Connecticut Campaign Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Connecticut Campaign Worker Agreement - Self-Employed Independent Contractor?

Are you presently within a placement that you will need documents for both company or specific uses nearly every day? There are a lot of legal papers themes accessible on the Internet, but finding ones you can rely is not easy. US Legal Forms offers a huge number of form themes, much like the Connecticut Campaign Worker Agreement - Self-Employed Independent Contractor, which are composed in order to meet state and federal requirements.

When you are already familiar with US Legal Forms website and have a free account, basically log in. After that, it is possible to obtain the Connecticut Campaign Worker Agreement - Self-Employed Independent Contractor web template.

If you do not come with an account and want to begin using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is for the right metropolis/region.

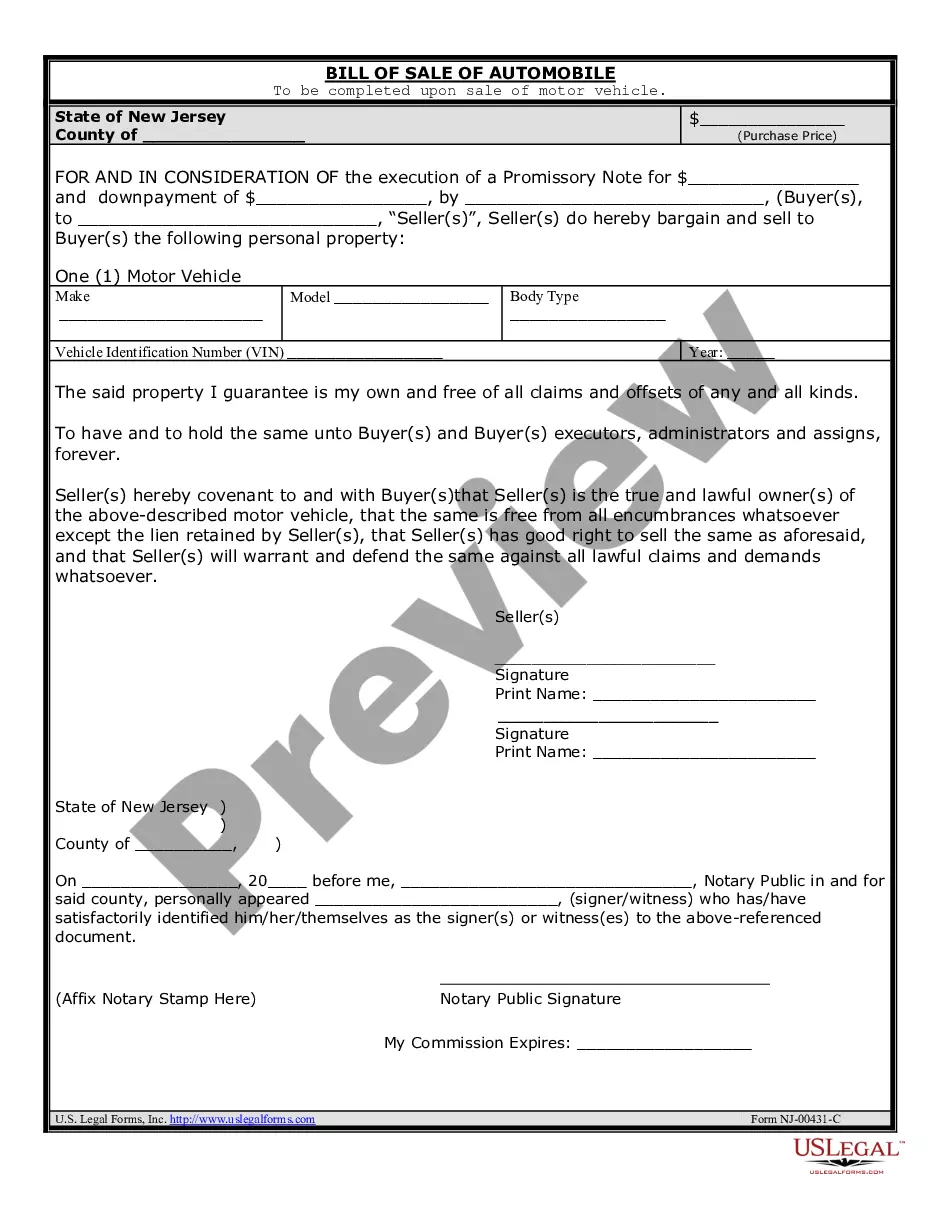

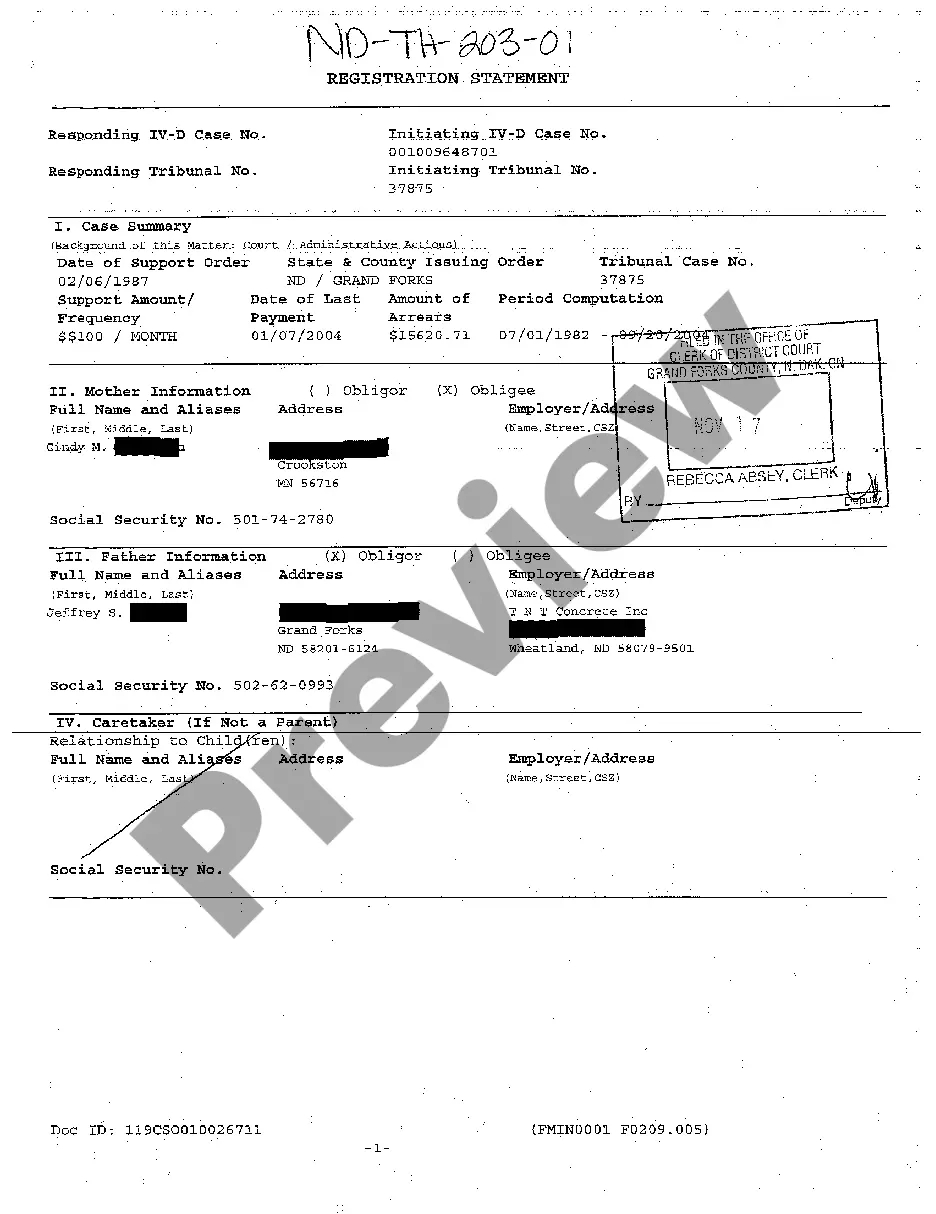

- Take advantage of the Review button to examine the form.

- Read the explanation to actually have selected the appropriate form.

- If the form is not what you`re trying to find, take advantage of the Lookup industry to discover the form that fits your needs and requirements.

- If you get the right form, just click Get now.

- Select the pricing plan you desire, fill in the specified information and facts to generate your bank account, and pay for an order using your PayPal or credit card.

- Select a convenient document structure and obtain your duplicate.

Discover every one of the papers themes you have bought in the My Forms food selection. You may get a additional duplicate of Connecticut Campaign Worker Agreement - Self-Employed Independent Contractor whenever, if necessary. Just select the necessary form to obtain or produce the papers web template.

Use US Legal Forms, the most extensive assortment of legal forms, to conserve time and steer clear of errors. The support offers professionally produced legal papers themes which can be used for a range of uses. Create a free account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

Such workers are exempt from coverage of most relevant federal employment laws, including the National Labor Relations Act (NLRA). That means, for example, an independent contractor generally does not have the right to form or join a union in the private sector.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Independent contractor's pay is usually specified in the contract agreement. However, employers can give a bonus to an independent contractor as long as you include the bonus clause in the contract and follow regulations around tax implications and applicable employment laws.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?