Connecticut Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Connecticut Electronics Assembly Agreement - Self-Employed Independent Contractor?

Have you been within a position where you need to have paperwork for either business or person uses virtually every day? There are plenty of authorized record themes accessible on the Internet, but locating ones you can trust isn`t effortless. US Legal Forms provides a huge number of kind themes, such as the Connecticut Electronics Assembly Agreement - Self-Employed Independent Contractor, that are published to meet state and federal requirements.

If you are already acquainted with US Legal Forms site and also have your account, just log in. Following that, it is possible to down load the Connecticut Electronics Assembly Agreement - Self-Employed Independent Contractor format.

Should you not come with an accounts and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is for the appropriate town/region.

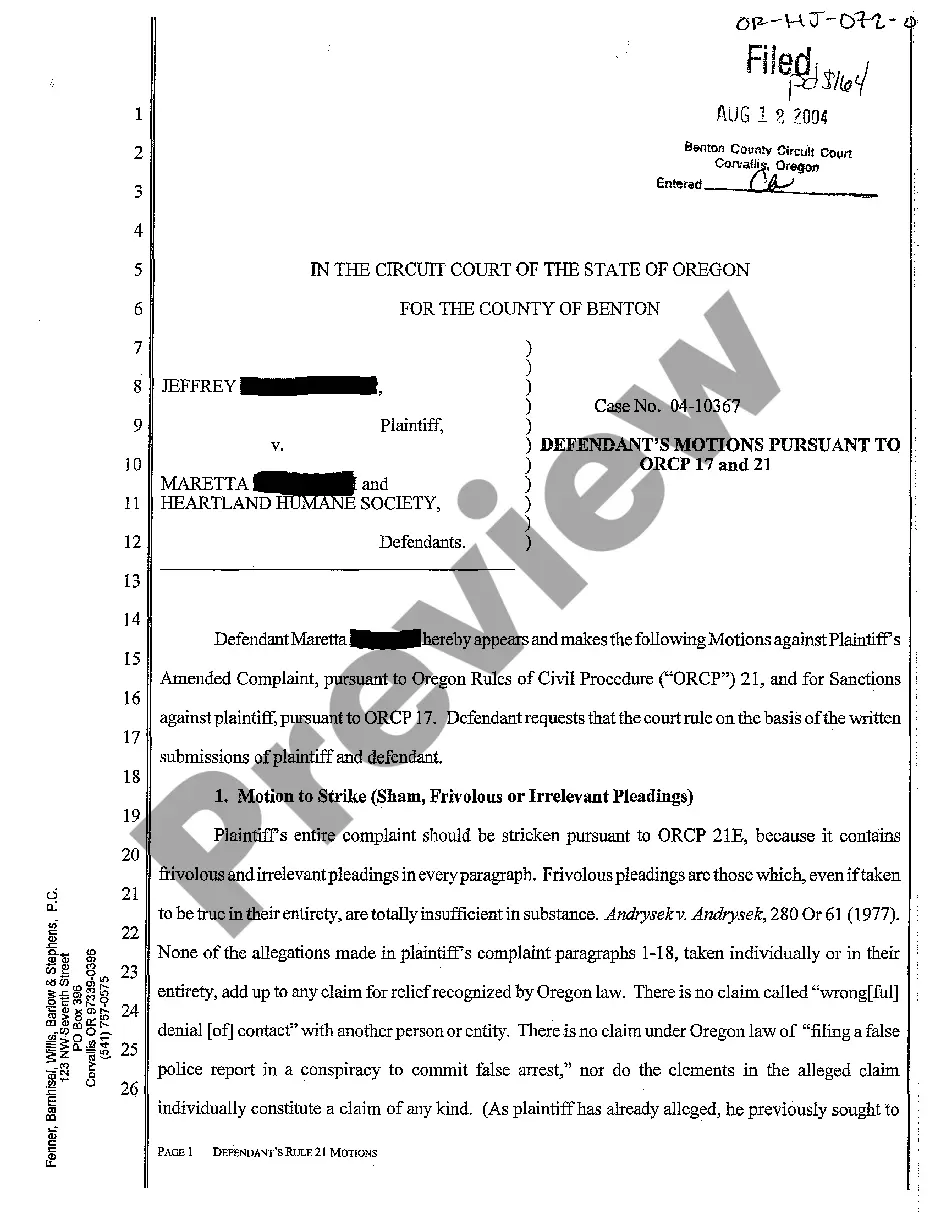

- Utilize the Review button to examine the shape.

- See the information to ensure that you have selected the appropriate kind.

- When the kind isn`t what you are searching for, make use of the Research field to discover the kind that fits your needs and requirements.

- When you discover the appropriate kind, just click Buy now.

- Select the costs strategy you desire, fill out the required details to produce your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Select a practical file structure and down load your duplicate.

Discover all the record themes you have purchased in the My Forms food list. You may get a extra duplicate of Connecticut Electronics Assembly Agreement - Self-Employed Independent Contractor whenever, if needed. Just click on the essential kind to down load or printing the record format.

Use US Legal Forms, one of the most extensive assortment of authorized varieties, in order to save efforts and avoid errors. The services provides professionally made authorized record themes which you can use for a range of uses. Create your account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.