Connecticut Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Connecticut Drafting Agreement - Self-Employed Independent Contractor?

Have you been within a place in which you need to have files for sometimes company or personal functions nearly every time? There are a variety of lawful file templates available on the Internet, but finding ones you can trust is not effortless. US Legal Forms offers thousands of develop templates, just like the Connecticut Drafting Agreement - Self-Employed Independent Contractor, which are composed in order to meet federal and state demands.

If you are previously acquainted with US Legal Forms web site and also have a merchant account, simply log in. Afterward, it is possible to acquire the Connecticut Drafting Agreement - Self-Employed Independent Contractor web template.

Unless you offer an account and need to start using US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for the correct city/area.

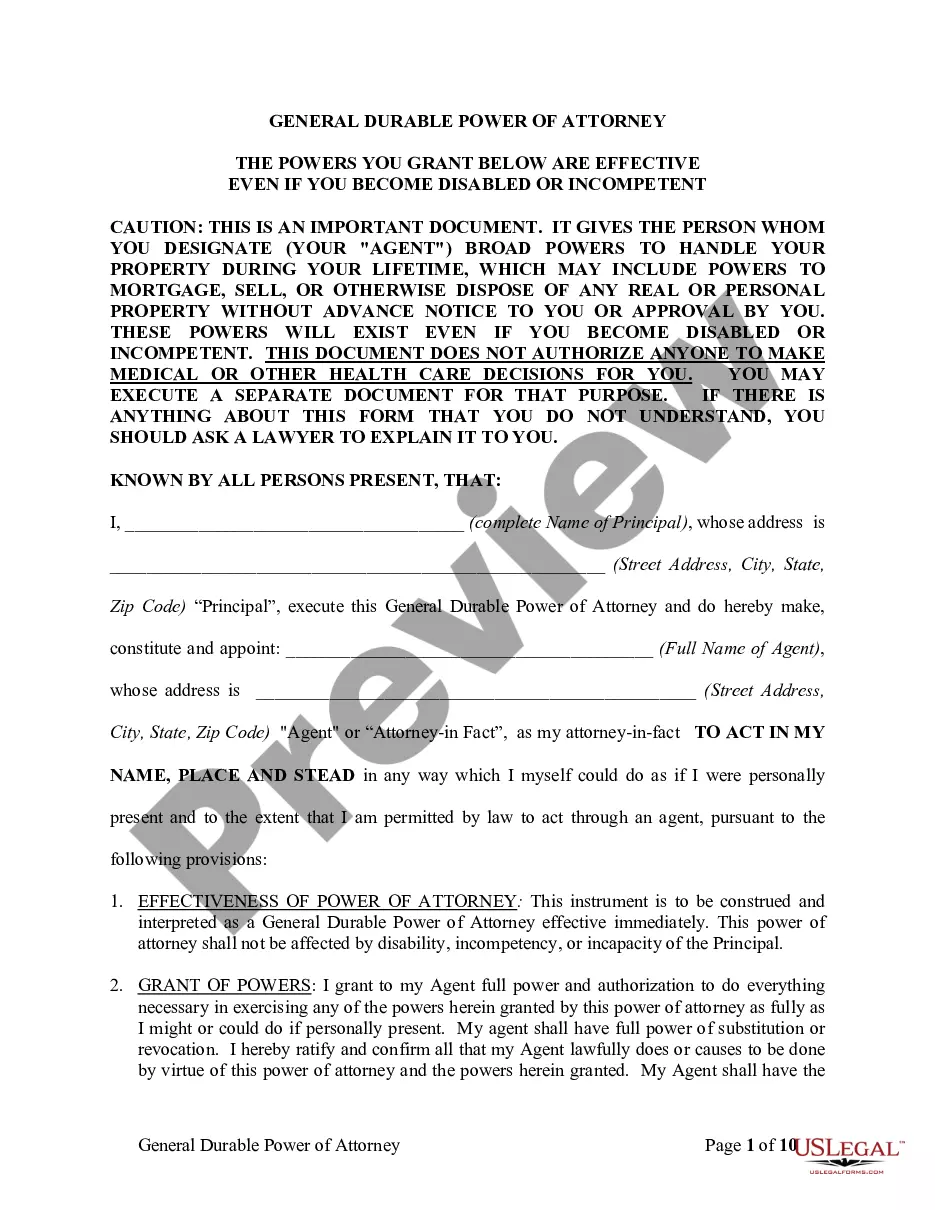

- Make use of the Review option to examine the shape.

- Browse the explanation to ensure that you have selected the proper develop.

- When the develop is not what you`re seeking, utilize the Look for field to obtain the develop that meets your requirements and demands.

- Once you obtain the correct develop, just click Get now.

- Choose the pricing program you need, complete the specified info to make your money, and purchase the order making use of your PayPal or charge card.

- Choose a handy data file format and acquire your copy.

Find each of the file templates you have bought in the My Forms food selection. You can obtain a extra copy of Connecticut Drafting Agreement - Self-Employed Independent Contractor any time, if possible. Just click on the essential develop to acquire or produce the file web template.

Use US Legal Forms, one of the most extensive assortment of lawful kinds, to save time as well as steer clear of mistakes. The support offers skillfully created lawful file templates that you can use for an array of functions. Produce a merchant account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.