Connecticut Self-Employed Masseuse Services Contract

Description

How to fill out Self-Employed Masseuse Services Contract?

If you desire to complete, acquire, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Take advantage of the website's simple and user-friendly search to locate the documents you require. Different templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Connecticut Self-Employed Masseuse Services Contract in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you acquired within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, as well as print the Connecticut Self-Employed Masseuse Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Connecticut Self-Employed Masseuse Services Contract.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have selected the form appropriate for your city/state.

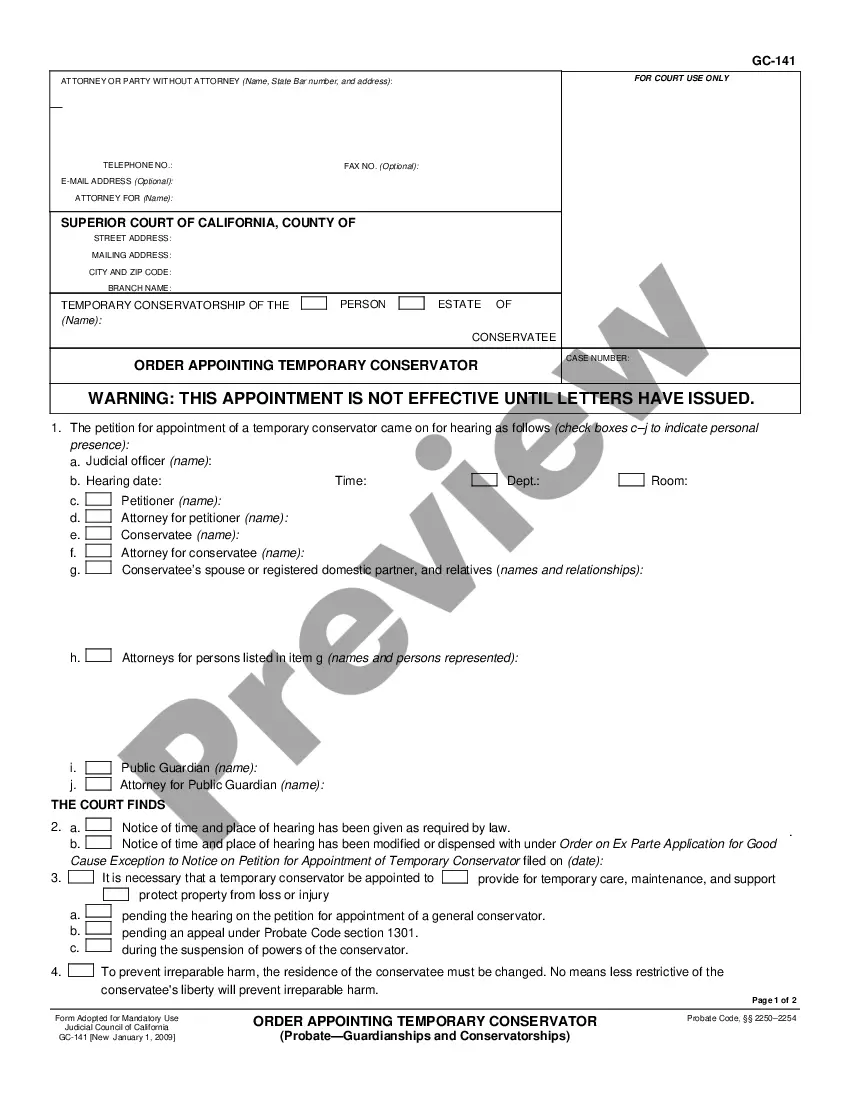

- Step 2. Use the Preview option to review the contents of the form. Be sure to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal form template.

- Step 4. After locating the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Connecticut Self-Employed Masseuse Services Contract.

Form popularity

FAQ

However, in the corporate massage world, most service providers hire massage therapists as independent contractors, not employees. If your onsite massage company is one of the many that does not classify their California massage therapists as employees, your program may be at risk.

As a massage therapist, you'll also be able to deduct a variety of other ongoing costs, including:renting an office, studio, or spa space.associated costs with the space, like electricity and water bills.cost of supplies like massage oils, lotions, and aromatherapy.legal costs, accounting fees, and tax preparation fees.More items...?

Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

Massage therapists who work for themselves typically sign an independent contractor agreement with the company where they'll be providing services. A contractor agreement states specific agreed-upon terms between the massage therapist and company, such as those affecting liability and confidentiality.

Profession: An occupation that requires extensive education or specialized training; the members of a particular profession. The practice of massage involves skill and it can be an occupation, so it clearly meets the definition of a trade. A profession requires extensive education or specialized training.

Generally, massage therapists are independent contractors if they are used on a temporary basis, utilize their own equipment and supplies and are paid a set amount for a job.

How AB 5 might affect licensed massage therapists isn't determined yet, as massage therapy is not specifically mentioned as an exempt profession in the bill. However, many professions will be exempt, including some health care occupations.

Connecticut As long as you are a licensed massage therapist, massage therapy is not taxed in Connecticut. Although, massage therapy administered by someone other than a licensed massage therapist has been taxed since 1991.

Connecticut law imposes a 6.35% sales tax on all retail sales and certain business and professional services (CGS § 12-408). Business and professional services in Connecticut are presumed to be exempt from the state's sales tax unless specifically identified as taxable by state law.