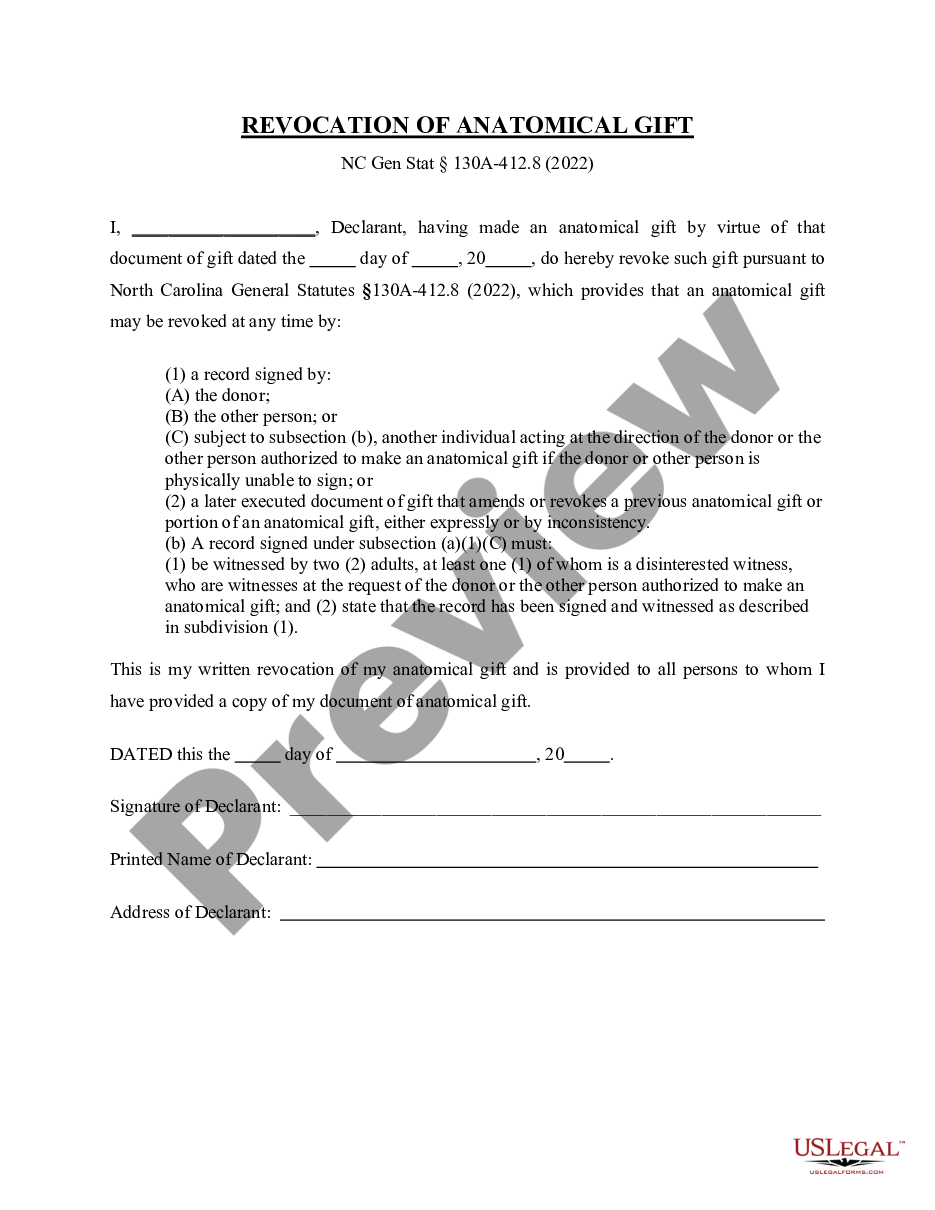

Connecticut Notice of Meeting of Members of LLC Limited Liability Company to increase number of members

Description

How to fill out Connecticut Notice Of Meeting Of Members Of LLC Limited Liability Company To Increase Number Of Members?

You are able to commit time online attempting to find the legal record web template that fits the federal and state requirements you want. US Legal Forms offers a huge number of legal varieties that are analyzed by experts. It is simple to obtain or print the Connecticut Notice of Meeting of Members of LLC Limited Liability Company to increase number of members from the support.

If you have a US Legal Forms accounts, it is possible to log in and click the Download switch. After that, it is possible to complete, change, print, or indicator the Connecticut Notice of Meeting of Members of LLC Limited Liability Company to increase number of members. Every single legal record web template you buy is your own property eternally. To acquire one more copy for any obtained form, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site for the first time, keep to the basic guidelines beneath:

- Initial, make certain you have chosen the right record web template for your region/metropolis of your choice. Read the form explanation to make sure you have selected the appropriate form. If offered, make use of the Review switch to check through the record web template also.

- If you would like get one more model from the form, make use of the Search field to discover the web template that meets your requirements and requirements.

- Upon having located the web template you desire, just click Buy now to carry on.

- Find the pricing program you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can utilize your bank card or PayPal accounts to fund the legal form.

- Find the format from the record and obtain it to the product.

- Make changes to the record if possible. You are able to complete, change and indicator and print Connecticut Notice of Meeting of Members of LLC Limited Liability Company to increase number of members.

Download and print a huge number of record themes making use of the US Legal Forms web site, which offers the largest selection of legal varieties. Use skilled and status-certain themes to handle your small business or specific needs.

Form popularity

FAQ

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

For investment companies like mutual funds, corporate indemnification of a director is not permitted under Section 17(h) of the Investment Company Act of 1940 (1940 Act) for willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his sic officeso called

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Starting an LLC in Connecticut Is EasySTEP 1: Name your Connecticut LLC.STEP 2: Choose a Registered Agent in Connecticut.STEP 3: File the Connecticut LLC Certificate of Organization.STEP 4: Create a Connecticut LLC Operating Agreement.STEP 5: Get a Connecticut LLC EIN.

As a licensed professional in Connecticut you can structure your business as a Connecticut professional limited liability company (PLLC).

The eponymous characteristic of the limited liability company (LLC) is that the LLC, as a separate legal entity, is liable for its obligations to others and that no other person, whether as owner or agent, is vicariously liable for those same obligations.

Prepare an Operating AgreementAn LLC operating agreement is not required in Connecticut, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Many LLC Acts have a provision dealing with indemnification. Some have a general statement that an LLC must indemnify members or managers for liabilities they incurred in the ordinary course of the business of the company.

Indemnification is a key protection for officers, directors and key employees, and the scope of an LLC's or corporation's indemnity provisions demands close attention. In an LLC, indemnification is completely discretionary and the scope of indemnification, if any, can be defined in the LLC's Operating Agreement.