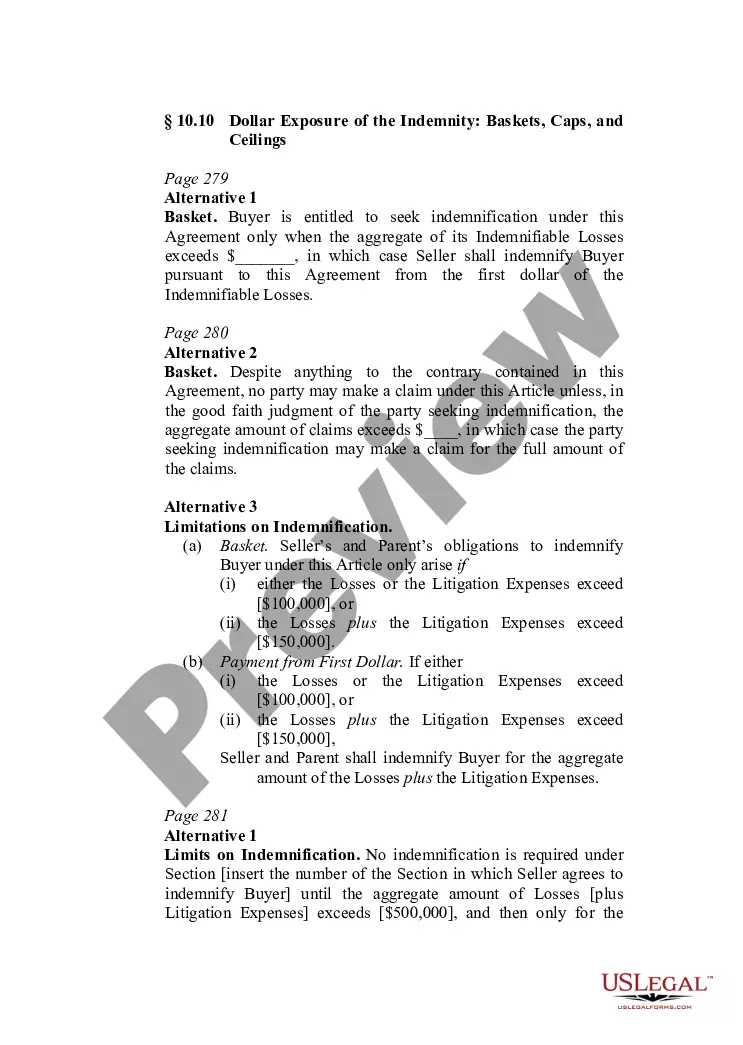

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Connecticut Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

US Legal Forms - one of many biggest libraries of authorized varieties in the USA - delivers a variety of authorized document themes you can obtain or produce. Making use of the website, you will get a huge number of varieties for enterprise and person functions, categorized by groups, states, or keywords and phrases.You can find the latest versions of varieties much like the Connecticut Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations in seconds.

If you have a membership, log in and obtain Connecticut Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations through the US Legal Forms catalogue. The Acquire button will show up on each and every form you view. You have accessibility to all formerly downloaded varieties within the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, listed below are simple instructions to help you get began:

- Make sure you have chosen the proper form for your personal town/county. Click the Review button to analyze the form`s information. Read the form outline to ensure that you have selected the correct form.

- In the event the form doesn`t match your specifications, make use of the Research field towards the top of the monitor to find the one that does.

- If you are pleased with the shape, confirm your choice by simply clicking the Buy now button. Then, opt for the costs plan you prefer and provide your credentials to sign up for the account.

- Procedure the financial transaction. Utilize your charge card or PayPal account to finish the financial transaction.

- Find the file format and obtain the shape on your own system.

- Make alterations. Fill up, change and produce and indication the downloaded Connecticut Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Every template you added to your account lacks an expiry day and is also your own eternally. So, if you want to obtain or produce one more backup, just check out the My Forms area and click about the form you will need.

Get access to the Connecticut Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations with US Legal Forms, the most extensive catalogue of authorized document themes. Use a huge number of skilled and express-certain themes that meet your organization or person requirements and specifications.

Form popularity

FAQ

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution. What Is a Letter of Indemnity (LOI)? Definition and Example - Investopedia investopedia.com ? terms ? letterofindemnity investopedia.com ? terms ? letterofindemnity

The purpose of an indemnity is to provide guaranteed compensation to a buyer on a dollar for dollar basis in circumstances in which a breach of warranty would not necessarily give rise to a claim for damages or to provide a specific remedy that might not otherwise be legally available.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement. Indemnity: What It Means in Insurance and the Law - Investopedia investopedia.com ? terms ? indemnity investopedia.com ? terms ? indemnity

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal. Indemnification Clause: Meaning & Samples (2022) - Contracts Counsel contractscounsel.com ? indemnification-clause contractscounsel.com ? indemnification-clause

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

In a business transaction, a letter of indemnity (LOI) is a contractual document guaranteeing that specific provisions will be met between two parties in the event of a mishap leading to financial loss or damage to goods. An LOI is drafted by third-party institutions such as banks or insurance companies. What is Letter of Indemnity?| Meaning, Sample, Importance & More dripcapital.com ? en-us ? resources ? blog dripcapital.com ? en-us ? resources ? blog