Connecticut Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

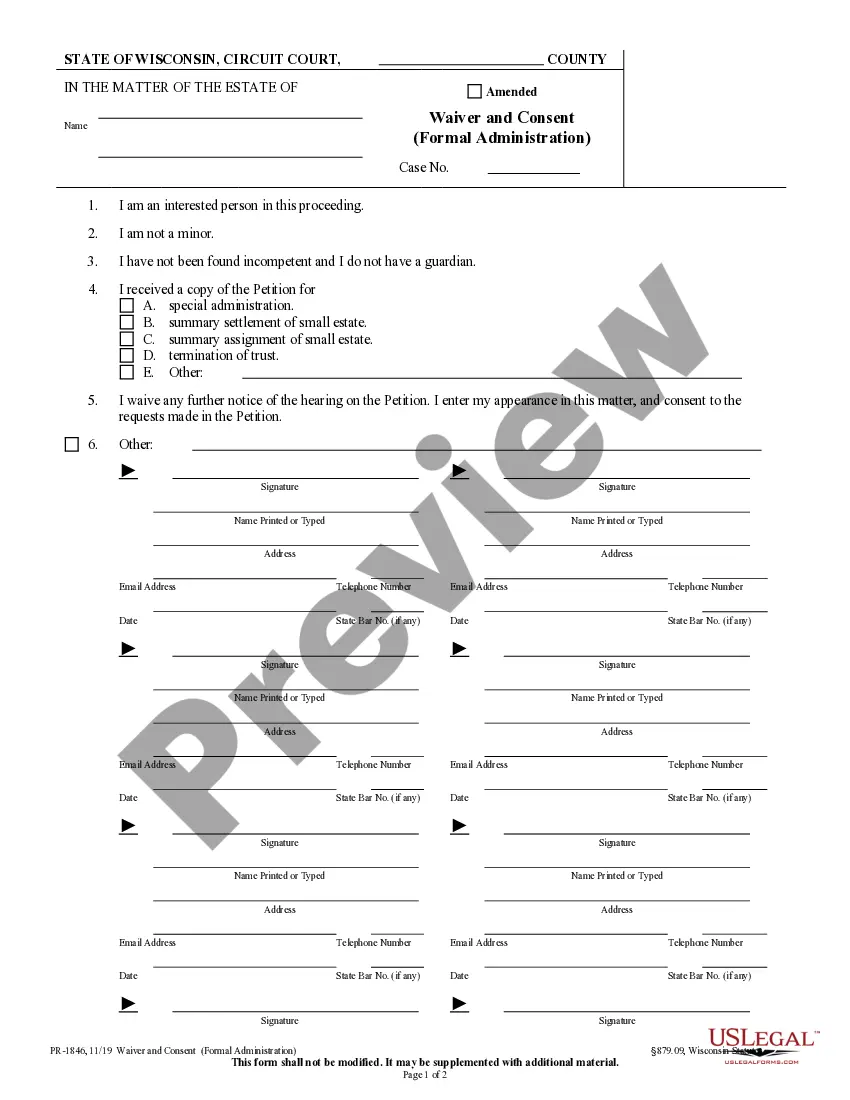

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

If you have to complete, down load, or print legitimate papers layouts, use US Legal Forms, the biggest collection of legitimate kinds, that can be found on-line. Use the site`s easy and handy lookup to discover the paperwork you will need. A variety of layouts for company and personal functions are sorted by classes and states, or keywords. Use US Legal Forms to discover the Connecticut Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes in just a few mouse clicks.

When you are currently a US Legal Forms customer, log in to the account and click the Acquire option to get the Connecticut Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. Also you can gain access to kinds you in the past acquired inside the My Forms tab of your respective account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the appropriate area/nation.

- Step 2. Utilize the Review solution to look through the form`s information. Do not overlook to read through the description.

- Step 3. When you are not satisfied with all the kind, use the Search field at the top of the screen to find other variations of your legitimate kind design.

- Step 4. Upon having located the shape you will need, go through the Get now option. Opt for the pricing program you favor and add your accreditations to register to have an account.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the structure of your legitimate kind and down load it on the product.

- Step 7. Full, change and print or signal the Connecticut Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

Each legitimate papers design you buy is your own for a long time. You possess acces to each kind you acquired in your acccount. Click on the My Forms area and choose a kind to print or down load once more.

Contend and down load, and print the Connecticut Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes with US Legal Forms. There are many professional and status-specific kinds you can utilize for the company or personal needs.

Form popularity

FAQ

An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Creditors have 150 days to file a claim in a Connecticut estate going through probate unless the Executor sends the creditor the letter described above. A creditor can't just ignore the Executor and march into any court other than the probate court and get a judgment for payment.

Executors who violate their duty may face legal action by beneficiaries or creditors, although they cannot be held accountable for a decline in asset value unless it resulted from their unreasonable actions.

Until a beneficiary's share is fully distributed, the fiduciary shall periodically account to each beneficiary by supplying a statement of the activities of the estate and of the fiduciary, specifying all receipts and disbursements and identifying all property belonging to the estate.