Connecticut Subordination of Lien

Description

How to fill out Subordination Of Lien?

Are you presently in the place the place you need to have papers for possibly company or specific reasons virtually every working day? There are tons of lawful papers web templates available on the Internet, but finding types you can rely on is not simple. US Legal Forms offers 1000s of type web templates, such as the Connecticut Subordination of Lien, which can be created to meet federal and state specifications.

In case you are currently knowledgeable about US Legal Forms internet site and also have an account, basically log in. Next, you can obtain the Connecticut Subordination of Lien format.

Should you not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Find the type you want and make sure it is for your correct city/state.

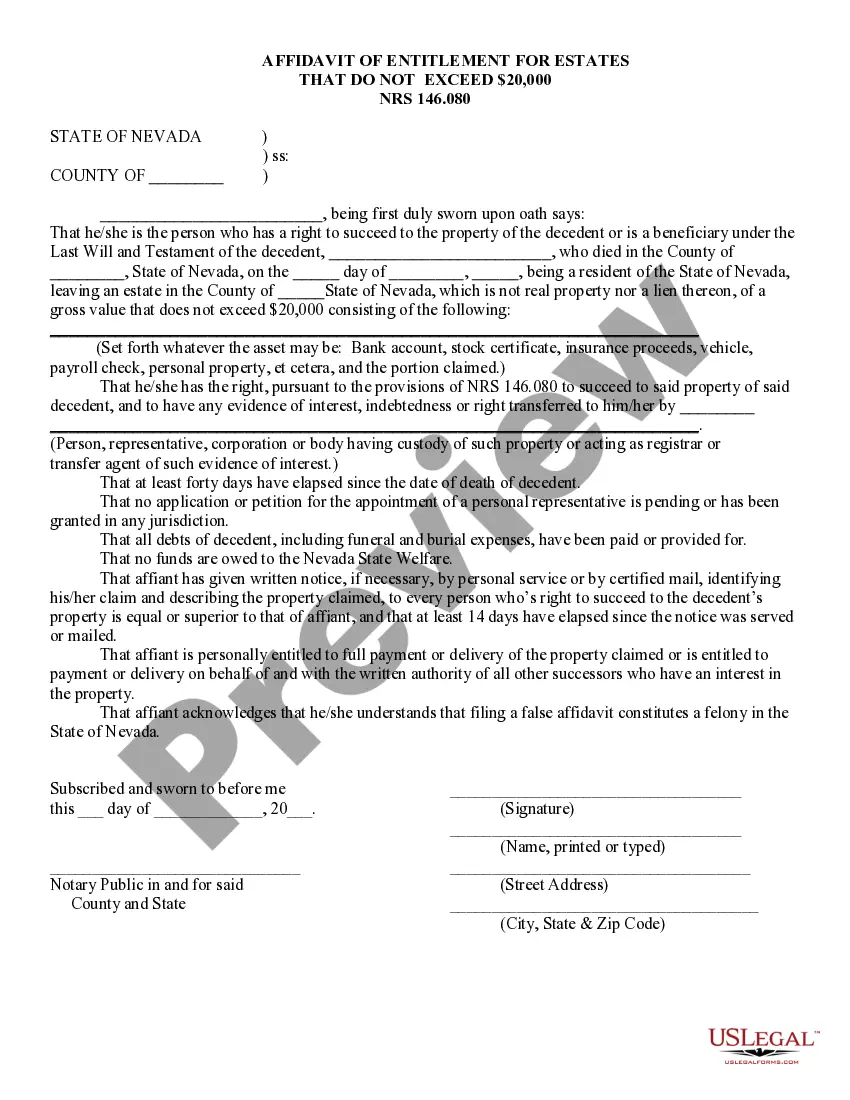

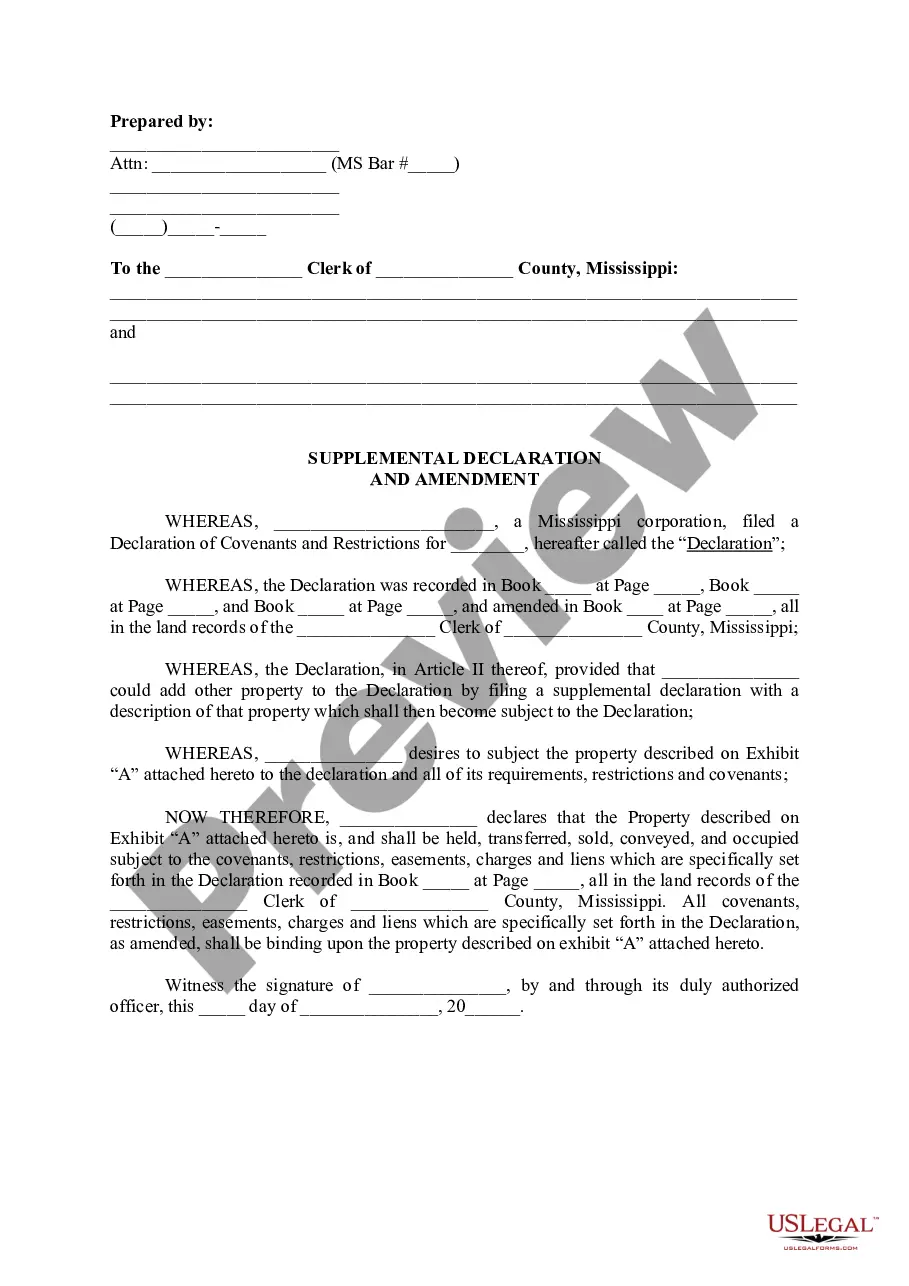

- Utilize the Review option to examine the shape.

- Look at the explanation to ensure that you have selected the right type.

- If the type is not what you are seeking, take advantage of the Lookup area to discover the type that meets your requirements and specifications.

- If you obtain the correct type, click on Acquire now.

- Opt for the rates strategy you would like, fill out the required information to make your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy document format and obtain your duplicate.

Get all the papers web templates you possess purchased in the My Forms food list. You may get a extra duplicate of Connecticut Subordination of Lien anytime, if needed. Just go through the necessary type to obtain or print the papers format.

Use US Legal Forms, the most substantial selection of lawful kinds, in order to save efforts and stay away from blunders. The services offers skillfully produced lawful papers web templates which can be used for a variety of reasons. Create an account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

Section 49-35 - Notice of intent. Liens of subcontractors and materialmen. The right of any person to claim a lien under this section shall not be affected by the failure of such affidavit to conform to the requirements of this section.

Connecticut requires that a Notice of Intent to lien be served for those who do not have a direct agreement with the owner for the work or materials/services provided. A Notice of intent to lien must be served after work has commenced but no later than 90 days after work has ceased. Connecticut faq - LienItNow lienitnow.com ? connecticut-faq lienitnow.com ? connecticut-faq

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

In Connecticut, all mechanics liens must be filed within 90 days of the date of last furnishing labor or materials. An action to enforce a Connecticut mechanics lien must be commenced within 1 year after recording lien.

4 steps to file a mechanics lien in Connecticut Prepare the lien form. First, make sure you are using a lien form that meets the statutory requirements in Connecticut. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner. How to File a Mechanics Lien in Connecticut | Step-by-Step Guide levelset.com ? blog ? how-to-file-mechanics... levelset.com ? blog ? how-to-file-mechanics...

The UCC-1 form, or Financing Statement, is a form you must file to place a lien on property or assets belonging to someone you have made a loan to. This creates a public record and serves as evidence in any legal dispute over liability.