Connecticut Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder

Description

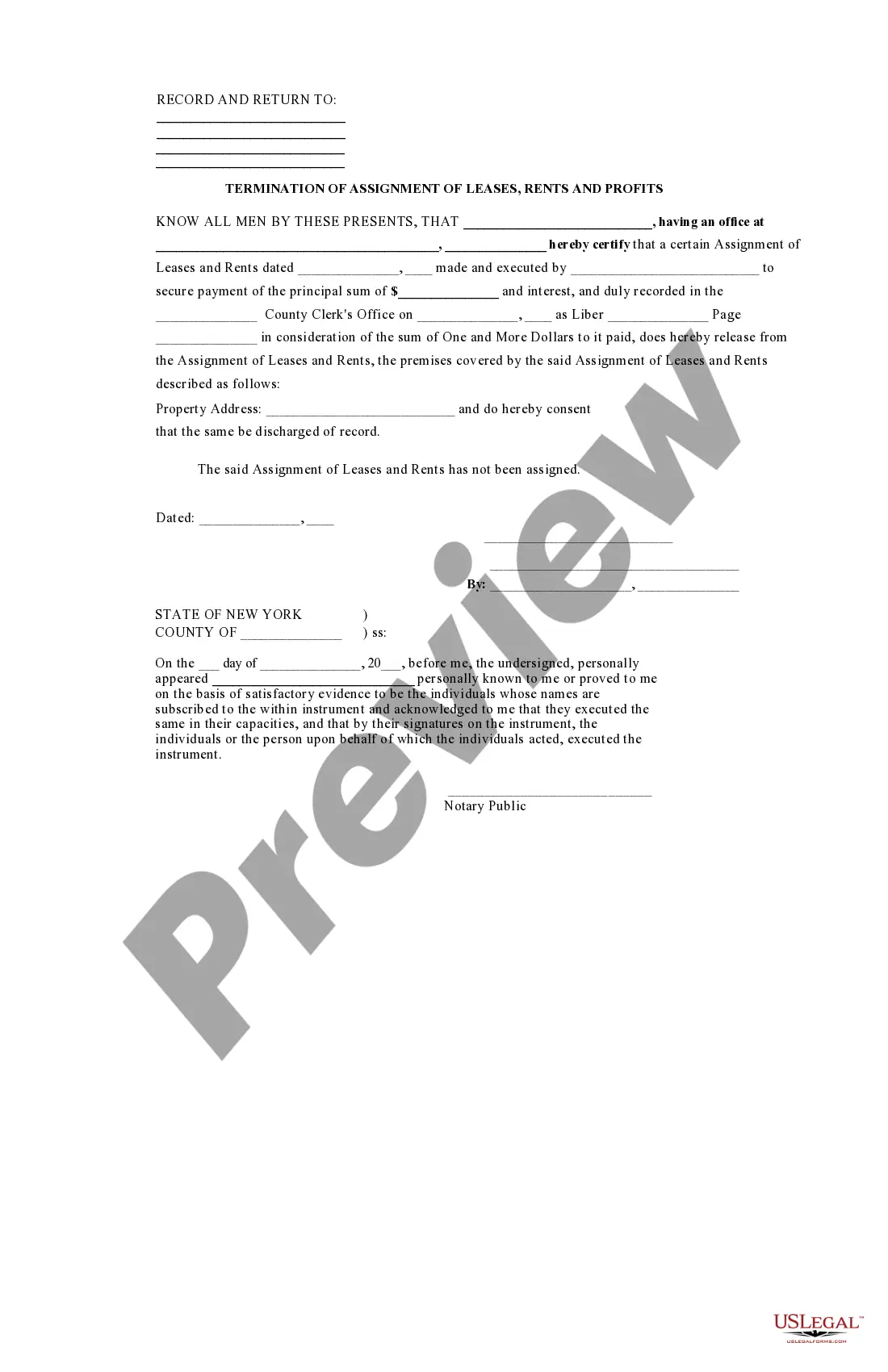

How to fill out Subordination Of Mortgage / Deed Of Trust To Oil And Gas Lease With Bonus And Royalty Payments To Go To Lessor Until Notice From Lienholder?

If you want to full, download, or print out legal papers layouts, use US Legal Forms, the biggest selection of legal types, which can be found online. Use the site`s basic and convenient lookup to find the documents you need. Various layouts for company and specific uses are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Connecticut Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder with a couple of clicks.

If you are presently a US Legal Forms buyer, log in to your profile and then click the Down load switch to find the Connecticut Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder. You may also entry types you in the past delivered electronically inside the My Forms tab of your own profile.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for the proper city/country.

- Step 2. Utilize the Review solution to look over the form`s content material. Don`t overlook to see the outline.

- Step 3. If you are not happy using the develop, utilize the Lookup area on top of the display screen to get other variations of your legal develop template.

- Step 4. Once you have found the shape you need, click the Buy now switch. Choose the prices prepare you prefer and add your references to register for an profile.

- Step 5. Procedure the deal. You should use your bank card or PayPal profile to perform the deal.

- Step 6. Find the structure of your legal develop and download it on the device.

- Step 7. Complete, revise and print out or signal the Connecticut Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder.

Each and every legal papers template you get is your own for a long time. You might have acces to every single develop you delivered electronically with your acccount. Click the My Forms area and choose a develop to print out or download yet again.

Remain competitive and download, and print out the Connecticut Subordination of Mortgage / Deed of Trust to Oil and Gas Lease with Bonus and Royalty Payments to Go to Lessor Until Notice from Lienholder with US Legal Forms. There are many specialist and express-certain types you may use for your personal company or specific requires.