Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced A Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced is a legal document that grants a party the right to receive a percentage of the proceeds generated from the extraction and production of oil in Connecticut. In this type of assignment, the overriding royalty interest becomes effective once a certain threshold, known as payout, is reached. Payout refers to the point at which the total revenue from the oil production surpasses the costs incurred in extracting and operating the oil wells. The amount of royalty payout is directly linked to the volume of oil produced. The more oil extracted and sold, the higher the royalty payout will be. This arrangement provides an incentive for the party granting the overriding royalty interest, as they stand to benefit from increased production and sales. There are various types of Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, including: 1. Fixed Percentage Assignment: In this type, the overriding royalty interest is assigned based on a fixed percentage of the total revenue generated from the oil production. For example, if the assignment is for a 2% royalty interest, the assigned party will receive 2% of the total revenue produced from oil sales. 2. Sliding Scale Assignment: With a sliding scale assignment, the percentage of royalty interest may vary depending on the volume of oil produced. The higher the volume, the lower the percentage, and vice versa. This type of assignment allows for flexibility in royalty payments based on production levels. 3. Graduated Assignment: In a graduated assignment, the percentage of overriding royalty interest increases at specific production milestones. For instance, if an assignment has a graduated structure, it might state that if the oil production reaches 10,000 barrels per day, the assigned party's royalty interest will increase from 2% to 3%. 4. Time-Limited Assignment: This type of assignment sets a specific timeframe during which the overriding royalty interest will be in effect. After the designated period, the assignment may expire, or the terms may be renegotiated. This enables parties to evaluate the profitability of the arrangement based on actual oil production and adjust the terms accordingly. The Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced offers a mutually beneficial arrangement for both the assignor and the assigned party. It provides an opportunity for the assignor to secure necessary capital for oil production, while the assigned party has the potential to earn substantial returns based on the volume of oil produced. This type of assignment encourages investment and incentivizes increased oil production, benefiting the oil industry in Connecticut.

Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

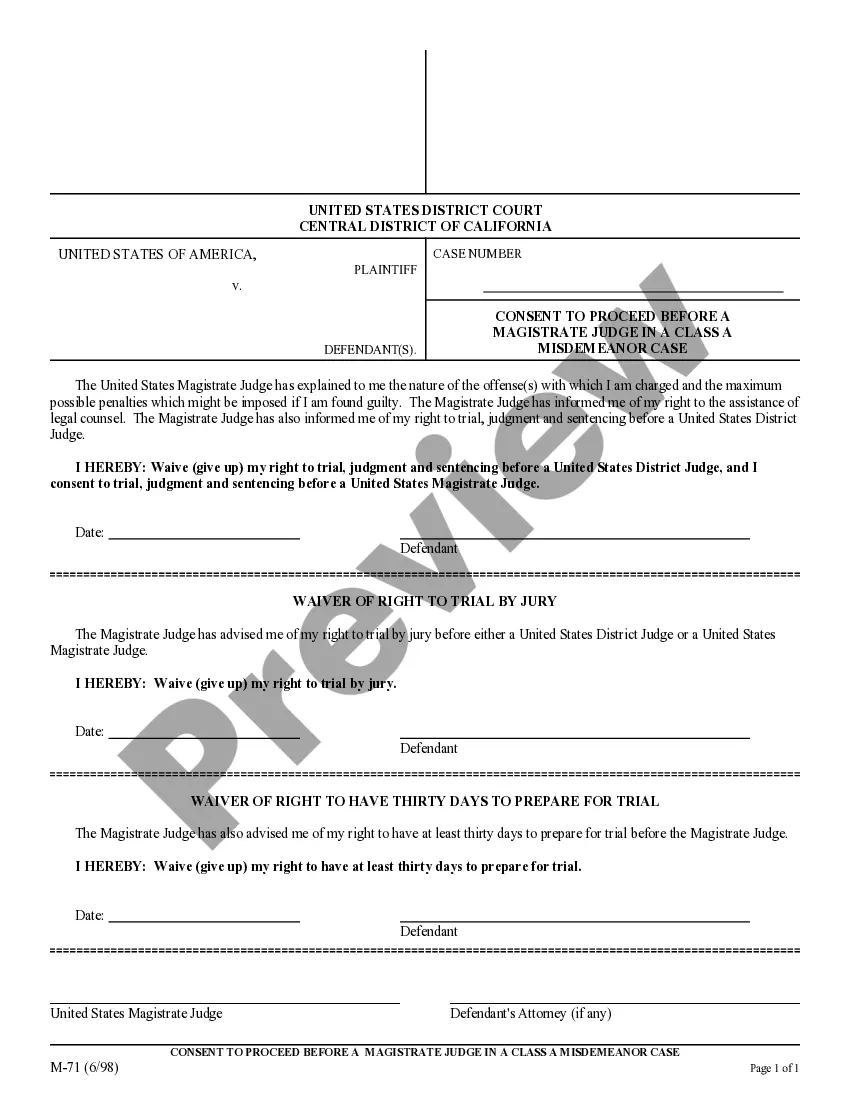

How to fill out Connecticut Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Are you inside a position that you need documents for both enterprise or specific reasons almost every day time? There are a variety of legitimate record web templates accessible on the Internet, but discovering kinds you can rely is not simple. US Legal Forms gives a large number of type web templates, just like the Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, that happen to be composed to satisfy state and federal requirements.

If you are previously informed about US Legal Forms site and also have a free account, basically log in. Following that, you can acquire the Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced template.

Unless you provide an account and need to start using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is to the appropriate town/region.

- Use the Preview switch to check the shape.

- Read the information to ensure that you have selected the appropriate type.

- In case the type is not what you are seeking, make use of the Look for area to obtain the type that suits you and requirements.

- When you get the appropriate type, click Buy now.

- Choose the costs strategy you desire, complete the required info to produce your bank account, and pay money for the transaction making use of your PayPal or credit card.

- Decide on a handy file structure and acquire your copy.

Find all of the record web templates you might have bought in the My Forms food list. You can obtain a further copy of Connecticut Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced anytime, if required. Just click on the required type to acquire or print out the record template.

Use US Legal Forms, the most comprehensive collection of legitimate kinds, to conserve some time and stay away from errors. The services gives skillfully manufactured legitimate record web templates that can be used for a variety of reasons. Create a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Subtract the royalty owners' percentage from the profits generated by the well. So, 100% ? 20% = 80% left from the 100% profits from the well. Multiply each investment by the percentage of profit: Joe, royalty owner ? 15% * 80% = 12% NRI.

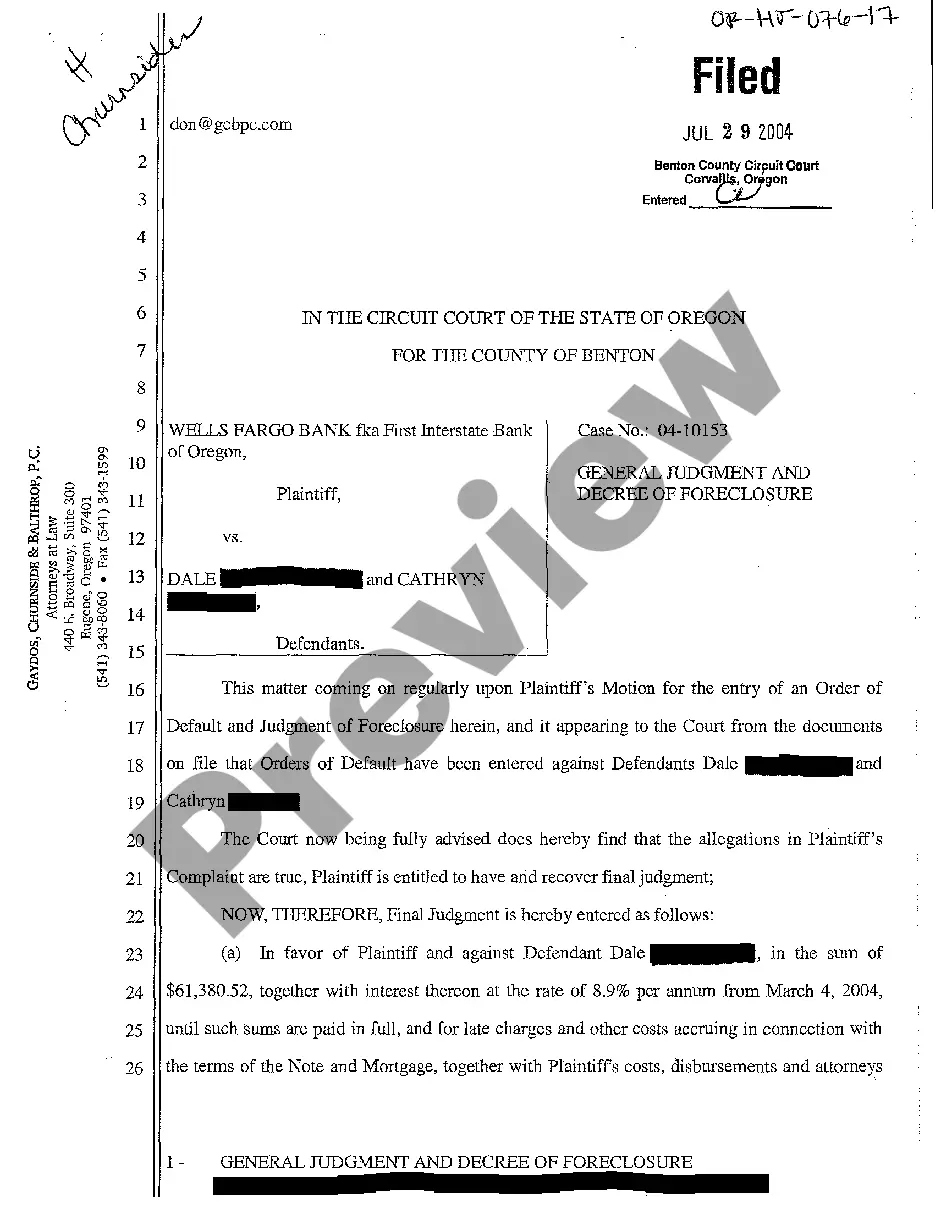

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

The oil and gas business; assignments are the documents used. to accomplish transfers of lease rights .1./ Although the. common form of assignment may appear to be a rather simple. document, the respective rights and obligations of the parties.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.