Connecticut Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

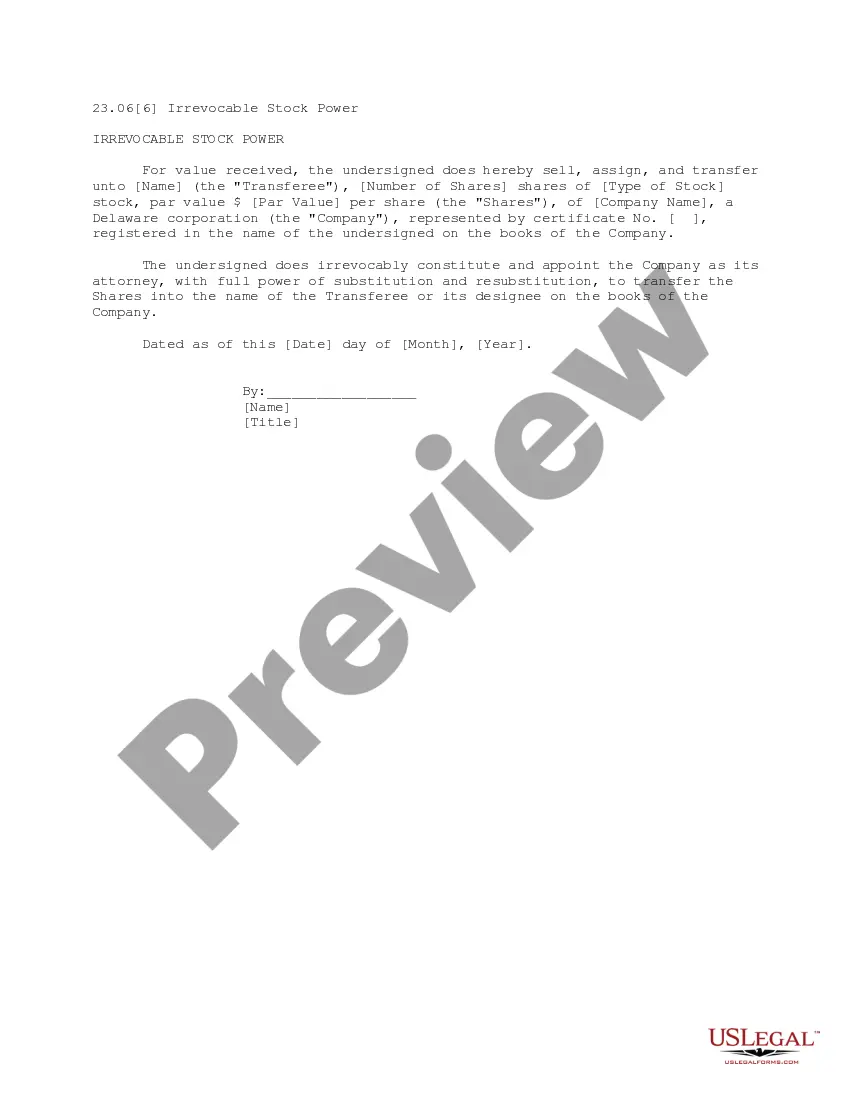

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

US Legal Forms - one of the biggest libraries of legitimate forms in the USA - gives a wide array of legitimate record templates you can obtain or produce. Utilizing the site, you can get a huge number of forms for business and individual purposes, categorized by groups, claims, or search phrases.You can get the most up-to-date types of forms much like the Connecticut Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner in seconds.

If you have a subscription, log in and obtain Connecticut Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner from your US Legal Forms local library. The Acquire switch will appear on every kind you view. You have accessibility to all formerly saved forms within the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, listed below are straightforward guidelines to help you get started:

- Ensure you have picked the right kind to your city/state. Go through the Preview switch to review the form`s content. Look at the kind outline to actually have selected the proper kind.

- If the kind does not suit your needs, take advantage of the Look for area on top of the monitor to get the one which does.

- If you are pleased with the form, confirm your choice by clicking on the Acquire now switch. Then, select the rates plan you favor and give your accreditations to sign up for an account.

- Approach the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Pick the formatting and obtain the form on the gadget.

- Make alterations. Load, edit and produce and indication the saved Connecticut Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner.

Every format you put into your money does not have an expiration particular date and is the one you have eternally. So, if you want to obtain or produce an additional duplicate, just check out the My Forms segment and click in the kind you will need.

Get access to the Connecticut Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner with US Legal Forms, probably the most substantial local library of legitimate record templates. Use a huge number of expert and status-certain templates that meet your business or individual requirements and needs.

Form popularity

FAQ

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest. ABC can convey a share of that net revenue interest as a royalty.