Connecticut Stipulation of Ownership of Mineral Interest is a legal document that establishes the ownership rights and interests in mineral deposits located on specific lands within the state of Connecticut. It is a crucial agreement that outlines the rights, obligations, and responsibilities of parties involved in the mineral ownership. This stipulation is applicable when parties have differing claims to the mineral interest on specific lands in Connecticut, and it aims to bring clarity and resolution to any disputes or uncertainties surrounding mineral ownership. It ensures that all parties involved are aware of their respective rights and responsibilities, facilitating the smooth and efficient management of mineral resources. Keywords: Connecticut Stipulation of Ownership, Mineral Interest, Specific Lands, Mineral Ownership, Legal Document, Ownership Rights, Mineral Deposits, Disputes, Responsibilities, Rights. Different types of Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands may include: 1. Connecticut Stipulation of Ownership of Oil and Gas Mineral Interest: This variation specifically deals with the ownership rights and interests in oil and gas deposits located on specific lands in Connecticut. It outlines the terms and conditions related to the exploration, extraction, and exploitation of oil and gas resources. 2. Connecticut Stipulation of Ownership of Coal Mineral Interest: This type of stipulation focuses on the ownership rights and interests in coal deposits found on specific lands in Connecticut. It establishes the rights and responsibilities of the parties involved in the extraction, transportation, and utilization of coal resources. 3. Connecticut Stipulation of Ownership of Metallic Mineral Interest: This stipulation addresses the ownership rights and interests in metallic mineral deposits located on specific lands in Connecticut. It outlines the terms and conditions related to the exploration, extraction, processing, and marketing of metallic minerals like gold, silver, copper, etc. 4. Connecticut Stipulation of Ownership of Non-metallic Mineral Interest: This variation deals with the ownership rights and interests in non-metallic mineral deposits such as sand, gravel, limestone, etc., found on specific lands in Connecticut. It establishes the rights and obligations of the parties involved in the extraction, processing, and sale of non-metallic minerals. These different types of stipulations cater to the specific requirements and characteristics of different types of minerals, ensuring that the parties involved are aware of the rights, obligations, and restrictions related to their particular mineral interest.

Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

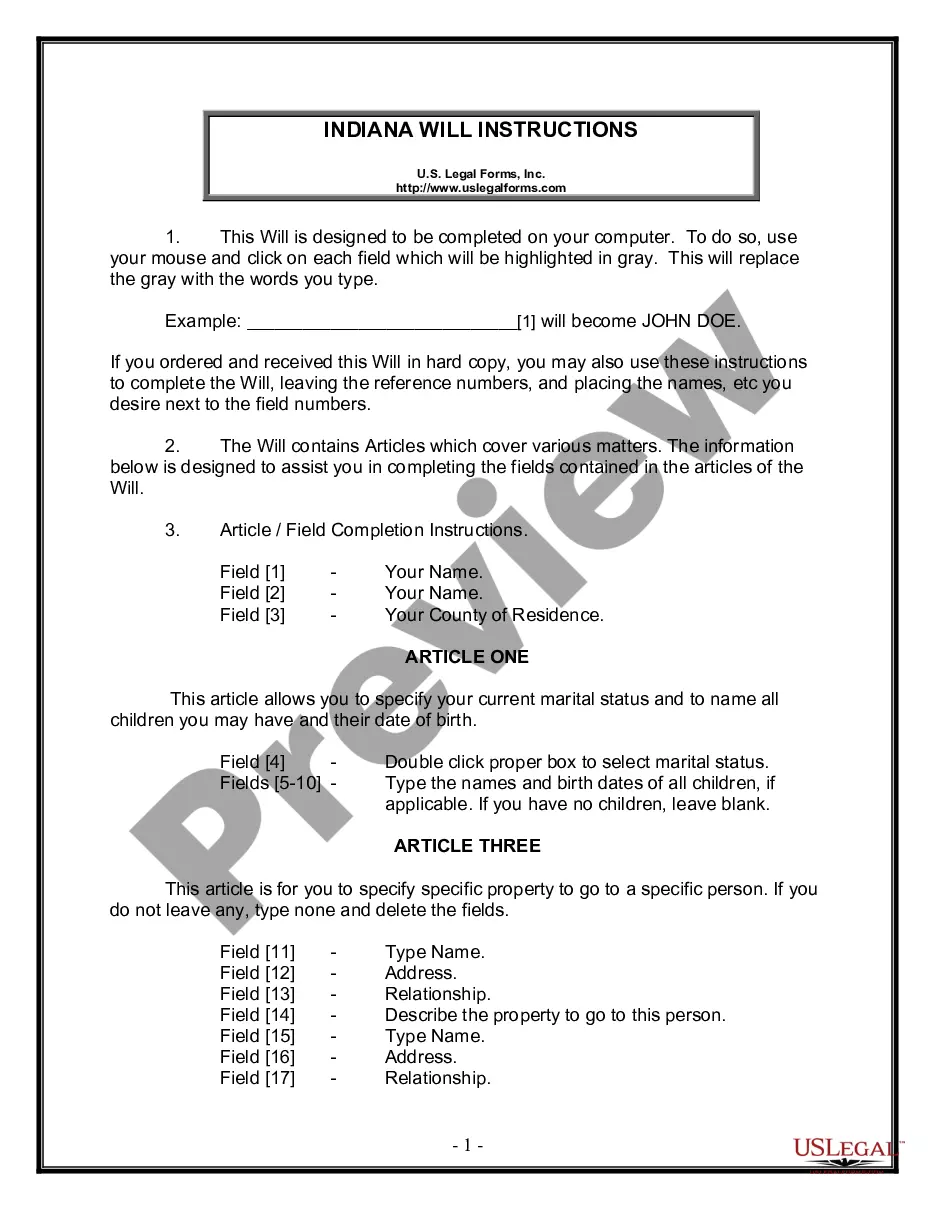

How to fill out Connecticut Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

US Legal Forms - one of many largest libraries of authorized kinds in the USA - provides a wide array of authorized file layouts you can download or produce. While using site, you can get a large number of kinds for business and personal purposes, categorized by groups, claims, or keywords and phrases.You will find the most up-to-date variations of kinds much like the Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands in seconds.

If you already possess a subscription, log in and download Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands through the US Legal Forms library. The Obtain option will appear on each and every develop you see. You get access to all in the past delivered electronically kinds within the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, listed below are easy instructions to help you get started off:

- Be sure to have picked out the best develop to your metropolis/state. Go through the Review option to check the form`s information. Look at the develop explanation to ensure that you have chosen the appropriate develop.

- When the develop does not match your demands, use the Lookup industry near the top of the screen to get the the one that does.

- When you are pleased with the form, verify your decision by clicking on the Get now option. Then, pick the costs prepare you want and give your accreditations to sign up on an accounts.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal accounts to complete the transaction.

- Find the file format and download the form on your gadget.

- Make modifications. Complete, edit and produce and indication the delivered electronically Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands.

Each format you added to your money does not have an expiry date and it is your own forever. So, if you wish to download or produce an additional copy, just proceed to the My Forms segment and then click about the develop you need.

Gain access to the Connecticut Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands with US Legal Forms, one of the most comprehensive library of authorized file layouts. Use a large number of professional and express-particular layouts that fulfill your business or personal requires and demands.

Form popularity

FAQ

(a) All conveyances of land shall be: (1) In writing; (2) if the grantor is a natural person, subscribed, with or without a seal, by the grantor with his own hand or with his mark with his name annexed to it or by his agent authorized for that purpose by a power executed, acknowledged and witnessed in the manner ...

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Mineral rights represent the ownership rights to exploit an area for the underground resources it harbours. This includes any oil and gas minerals that might be present. The owner of the mineral rights can explore and exploit the mineral resources present on the property.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.

The Marketable Record Title Act (the ?MRTA?) has been an integral part of Connecticut property law for 40 years. The existence of the MRTA helps to facilitate real estate transactions by providing purchasers, attorneys, title insurers, and lenders with a level of certainty regarding the status of land titles.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.