Connecticut Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

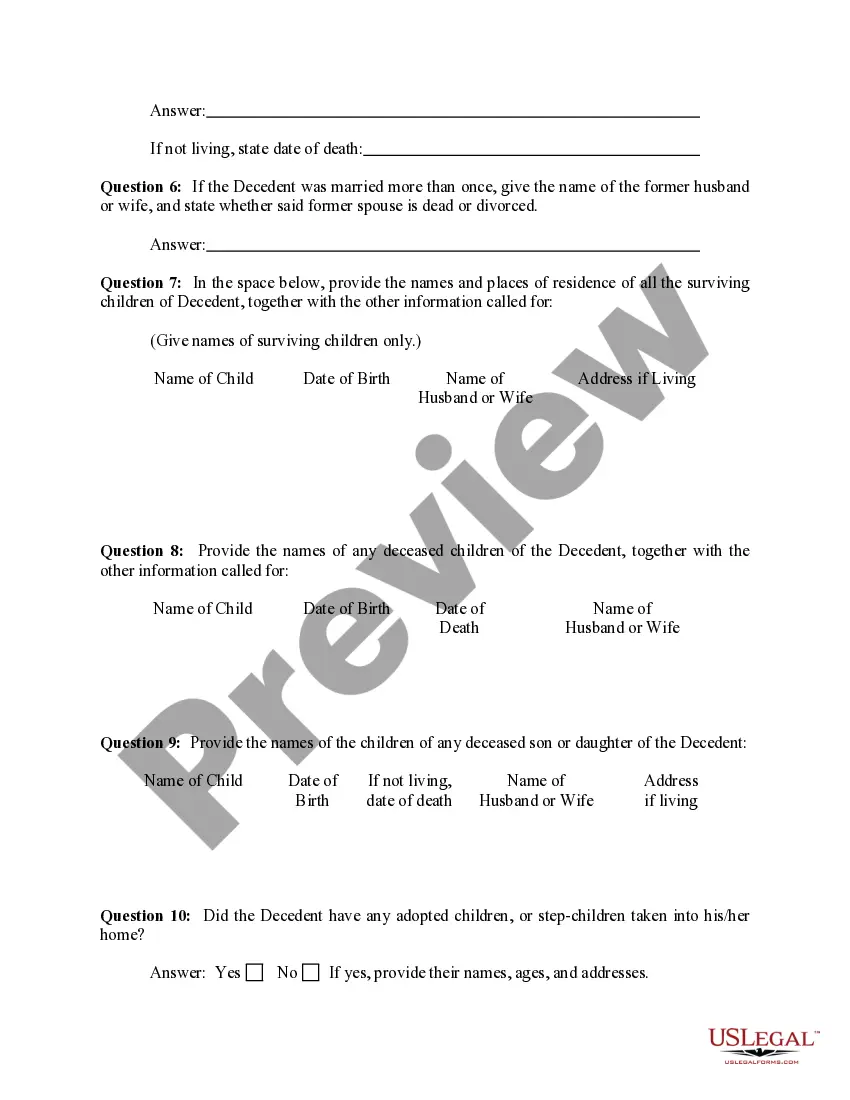

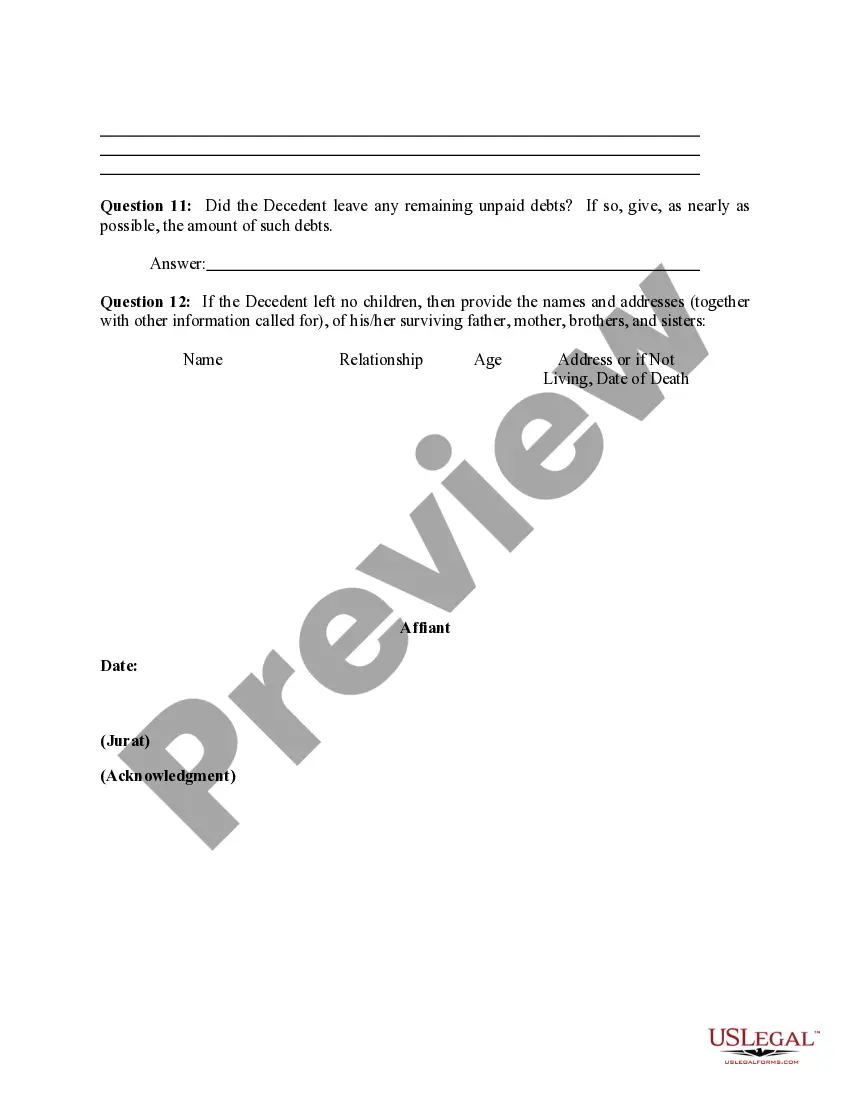

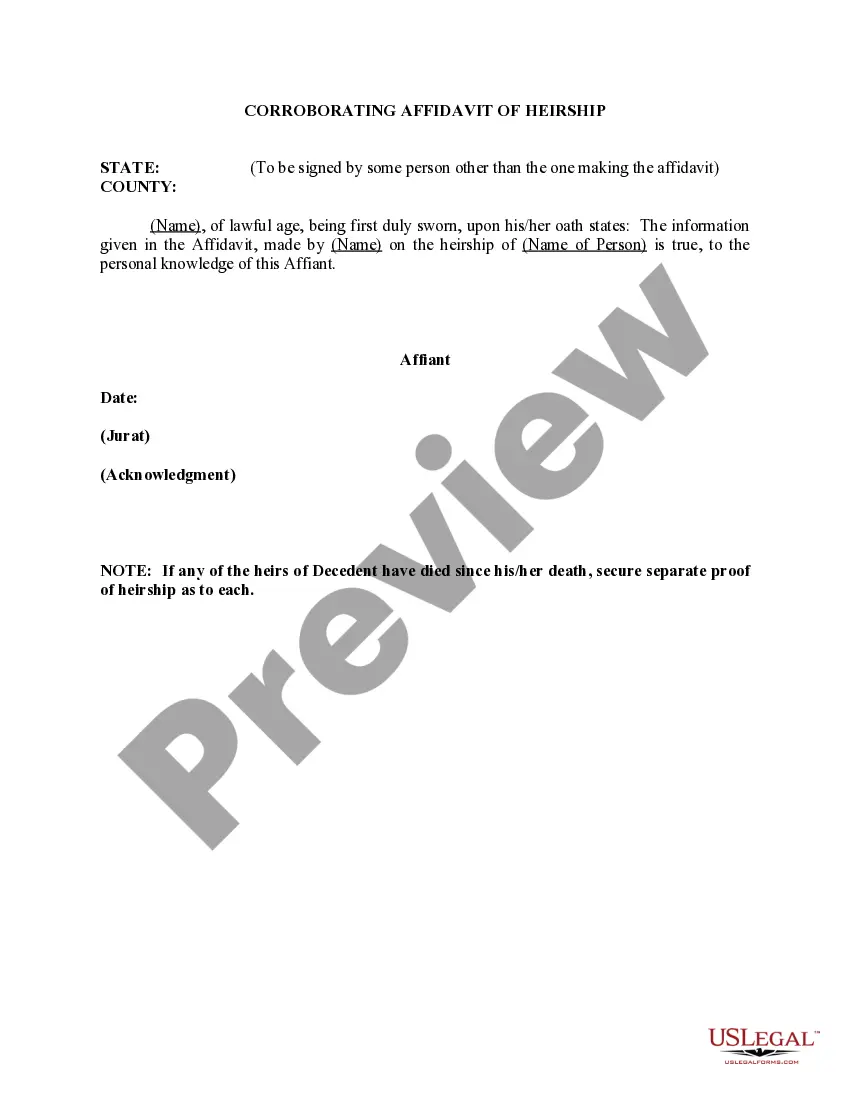

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

US Legal Forms - one of the most significant libraries of legal forms in the United States - delivers a wide range of legal document web templates you may acquire or produce. Utilizing the site, you can find a large number of forms for business and person functions, sorted by groups, claims, or key phrases.You will find the most up-to-date versions of forms just like the Connecticut Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in seconds.

If you currently have a monthly subscription, log in and acquire Connecticut Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) from your US Legal Forms collection. The Acquire option can look on each kind you view. You have access to all formerly acquired forms inside the My Forms tab of the bank account.

If you want to use US Legal Forms initially, allow me to share simple guidelines to get you started off:

- Make sure you have chosen the best kind for the town/region. Click the Review option to examine the form`s articles. Read the kind explanation to ensure that you have chosen the proper kind.

- In case the kind doesn`t fit your specifications, make use of the Lookup discipline on top of the display to find the one that does.

- In case you are happy with the shape, validate your selection by simply clicking the Acquire now option. Then, pick the prices plan you prefer and give your accreditations to register on an bank account.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal bank account to perform the financial transaction.

- Find the format and acquire the shape on the device.

- Make changes. Fill out, edit and produce and indicator the acquired Connecticut Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Each and every design you added to your bank account lacks an expiration particular date and it is your own permanently. So, in order to acquire or produce another copy, just proceed to the My Forms segment and click about the kind you want.

Gain access to the Connecticut Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) with US Legal Forms, by far the most extensive collection of legal document web templates. Use a large number of professional and status-particular web templates that satisfy your business or person demands and specifications.

Form popularity

FAQ

If at least one of your children is not also your spouse's child, your spouse will inherit half of your intestate property, and your children will inherit the other half of your intestate property. Your children must legally be your children in order for them to inherit under the laws of intestacy.

45a-365 in 1991. Repair to property of estate can constitute expense of settling the estate only if it is necessary to conserve the overall value of the estate or ordinary and necessary to preserve the property in question.

If the decedent's solely-owned assets include no real property and are valued at less than $40,000 ? which meets Connecticut's ?small estates limit? ? then the assets and property of the estate can be settled without full probate, under a much shorter and easier process.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

Pursuant to Conn. Gen. Stat. § 45a-257(a), if a testator fails to provide by will for the testator's surviving spouse who married the testator after the execution of the will, the surviving spouse shall receive the same share of the estate the surviving spouse would have received if the decedent left no will.

An affidavit of heirship can be used to establish the heirs of a deceased person when there is no probated will or estate. To use an affidavit of heirship for this purpose please follow the instructions below: The person signing the affidavit of heirship cannot be a person listed as an heir.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.