Connecticut Employee Agreement Incentive Compensation and Stock Bonus refers to the contractual arrangements and benefits provided to employees in Connecticut in regard to their compensation and stock ownership in a company. It is important for employers to have a detailed understanding of these agreements to attract and retain talented employees, while also complying with state laws and regulations. In Connecticut, there are several types of incentive compensation and stock bonus arrangements that companies may offer to their employees, such as: 1. Performance-Based Incentive Compensation: This type of agreement involves linking a portion of an employee's total compensation to their individual, team, or company performance. It encourages employees to achieve specific goals or targets, leading to increased productivity and profitability. Performance-based incentives can be in the form of bonuses, commissions, profit-sharing plans, or productivity bonuses. 2. Stock Options: Stock options provide employees the opportunity to purchase a specific number of company shares at a predetermined price, known as the exercise price or strike price. This agreement grants employees the right to buy shares in the future, typically after a vesting period. By offering stock options, companies can align the interests of employees with those of shareholders, promoting loyalty and long-term commitment. 3. Restricted Stock Units (RSS): RSS are a form of equity compensation where employees receive company shares as part of their compensation package. Unlike stock options, the shares are typically granted outright and subject to a vesting schedule. Once vested, employees can sell the shares or hold them, potentially benefiting from any increase in stock price. 4. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company stocks at a discounted price. This type of plan can enhance employee engagement and loyalty, as it gives them the opportunity to become partial owners of the company. Connecticut's employers must comply with state laws governing incentive compensation and stock bonus arrangements, including requirements related to disclosure, vesting periods, taxation, and reporting. It is crucial for employers to draft clear and comprehensive employee agreements that outline the terms and conditions of these arrangements, such as eligibility criteria, calculation methods, vesting schedules, and potential clawback provisions. By implementing well-designed and legally compliant incentive compensation and stock bonus programs, Connecticut employers can attract and motivate employees, foster a culture of ownership, and drive company performance and growth.

Connecticut Employee Agreement Incentive Compensation and Stock Bonus

Description

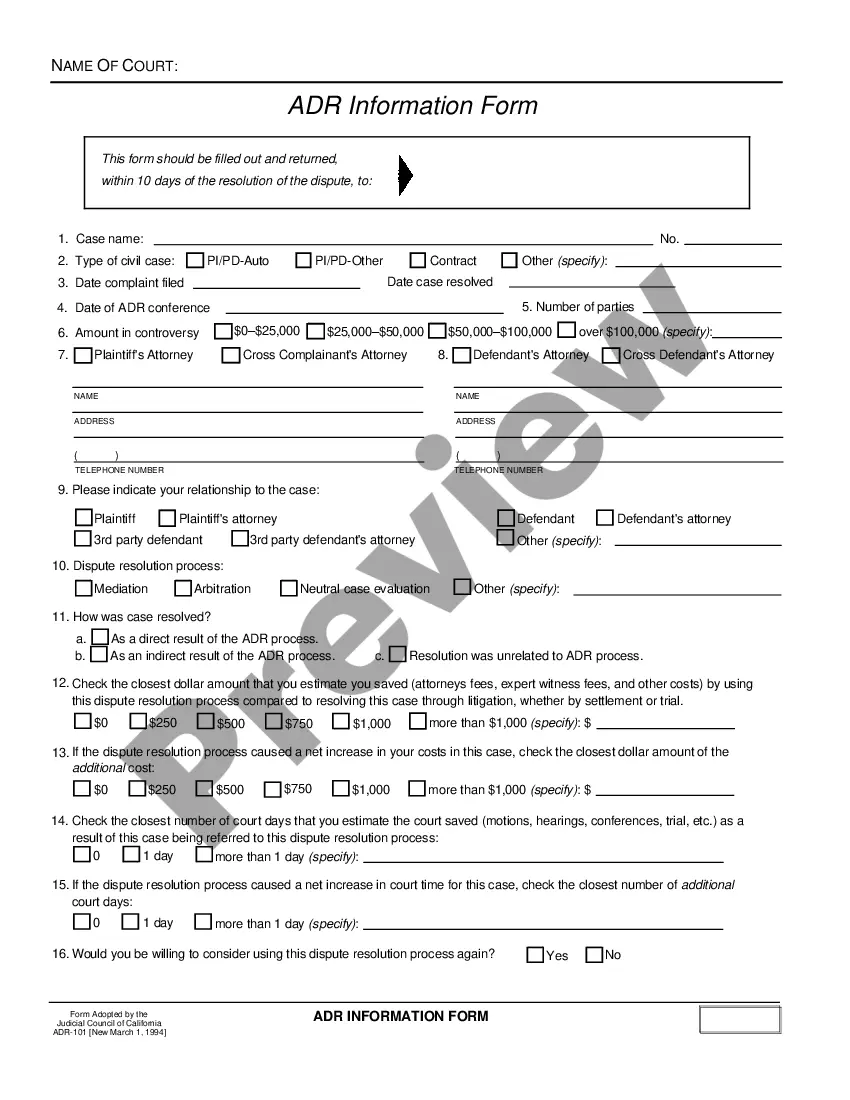

How to fill out Employee Agreement Incentive Compensation And Stock Bonus?

It is possible to invest several hours online looking for the authorized papers design that suits the federal and state requirements you want. US Legal Forms provides a large number of authorized types that happen to be analyzed by professionals. It is simple to acquire or printing the Connecticut Employee Agreement Incentive Compensation and Stock Bonus from my service.

If you have a US Legal Forms profile, it is possible to log in and click the Acquire switch. After that, it is possible to total, modify, printing, or sign the Connecticut Employee Agreement Incentive Compensation and Stock Bonus. Every authorized papers design you purchase is your own forever. To obtain one more duplicate of any acquired form, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms website for the first time, keep to the easy directions beneath:

- Initially, make sure that you have selected the right papers design for your county/town of your choice. See the form description to make sure you have selected the appropriate form. If offered, use the Preview switch to search through the papers design also.

- In order to locate one more variation in the form, use the Lookup area to discover the design that meets your needs and requirements.

- Upon having identified the design you desire, simply click Get now to carry on.

- Choose the costs program you desire, type your references, and register for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal profile to pay for the authorized form.

- Choose the structure in the papers and acquire it to the device.

- Make adjustments to the papers if possible. It is possible to total, modify and sign and printing Connecticut Employee Agreement Incentive Compensation and Stock Bonus.

Acquire and printing a large number of papers web templates while using US Legal Forms website, that offers the greatest variety of authorized types. Use expert and condition-particular web templates to take on your small business or person requirements.

Form popularity

FAQ

Any contractor who is not obligated by agreement to make payment or contribution on behalf of such persons to any such employee welfare fund shall pay to each mechanic, laborer or worker as part of such person's wages the amount of payment or contribution for such person's classification on each pay day.?

Each employer shall: (1) Advise his employees in writing, at the time of hiring, of the rate of remuneration, hours of employment and wage payment schedules, and (2) make available to his employees, either in writing or through a posted notice maintained in a place accessible to his employees, any employment practices ...

Commissions, bonuses or other forms of incentive compensation are considered earned compensation in Connecticut, just like salary or hourly wages. It is illegal for an employer not to pay compensation that you have earned, even if you have left the company, either voluntarily or involuntarily.

Under Labor Code 201, employers are liable to pay all wages owed (including bonuses) immediately following termination. If you quit, unpaid wages are owed either within 72 hours of your last day at work. If you give your employer 72 hours' notice, unpaid wages are owed on your last day.

Bonuses may be made to employees in a number of different ways from company stock and ownership, through their paychecks, or in cash. Any bonus, whether it's in cash or in kind, is seen as a of gratitude from the employer for a job well done.

Section 31-13a - Employer to furnish record of hours worked, wages earned and deductions.

Labor § 31-72. Civil action to collect wage claim, fringe benefit claim or arbitration award.

Bonuses are considered wages and are taxed the same way as other wages on your tax return. However, the IRS doesn't consider them regular wages. Instead, your bonus counts as supplemental wages and can be subject to different federal withholding rules than your regular wages when your get paid your bonus.