This office lease form is a more detailed, more complicated subordination provision stating that subordination is conditioned on the landlord providing the tenant with a satisfactory non-disturbance agreement.

Connecticut Detailed Subordination Provision

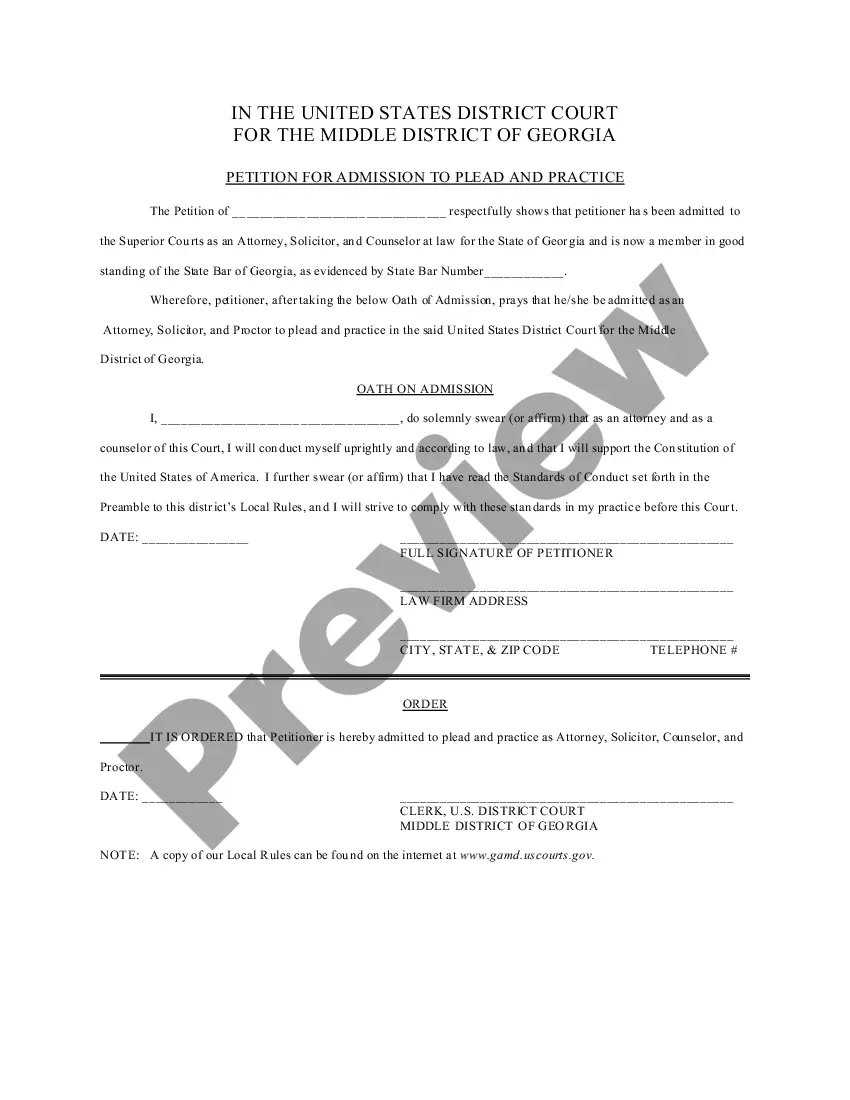

Description

How to fill out Detailed Subordination Provision?

If you want to full, obtain, or printing legal papers templates, use US Legal Forms, the largest selection of legal varieties, that can be found online. Take advantage of the site`s simple and practical research to get the documents you require. A variety of templates for company and person reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the Connecticut Detailed Subordination Provision within a handful of click throughs.

Should you be already a US Legal Forms customer, log in for your accounts and click the Download switch to get the Connecticut Detailed Subordination Provision. You can also accessibility varieties you in the past delivered electronically from the My Forms tab of your respective accounts.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the correct city/land.

- Step 2. Take advantage of the Review choice to look over the form`s content. Never overlook to read the explanation.

- Step 3. Should you be not satisfied using the develop, use the Lookup area towards the top of the screen to find other types from the legal develop web template.

- Step 4. When you have identified the form you require, click the Buy now switch. Pick the prices plan you like and add your accreditations to register to have an accounts.

- Step 5. Process the purchase. You can utilize your charge card or PayPal accounts to perform the purchase.

- Step 6. Choose the file format from the legal develop and obtain it on your gadget.

- Step 7. Total, revise and printing or indication the Connecticut Detailed Subordination Provision.

Every single legal papers web template you acquire is your own property eternally. You possess acces to every develop you delivered electronically with your acccount. Go through the My Forms area and decide on a develop to printing or obtain once again.

Contend and obtain, and printing the Connecticut Detailed Subordination Provision with US Legal Forms. There are thousands of specialist and status-specific varieties you can utilize for your company or person demands.

Form popularity

FAQ

Section 49-37 - Dissolution of mechanic's lien by substitution of bond. Joinder of actions on claim and bond.

(a) The mortgagee or a person authorized by law to release the mortgage shall execute and deliver a release to the extent of the satisfaction tendered before or against receipt of the release: (1) Upon the satisfaction of the mortgage; (2) upon a bona fide offer to satisfy the mortgage in ance with the terms of ...

What Is a Subordination Agreement? A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on their payments or declares bankruptcy.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

Ancient Mortgage - CGS 49-13a ? cites that a mortgage is invalid 20 years after a stated maturity date or 40 years after date of recording of mortgage if no due date is set forth in the mortgage. An affidavit must be recorded signed by owner of the property alleging these facts.

If Fraud is committed by either the granter or recipient, a deed will be declared invalid. As an example, a deed that's a forgery is totally ineffective. The exercise of Undue Influence additionally usually serves to invalidate a deed.

Section 49-2a - Interest on funds held in escrow for payment of taxes and insurance, Conn. Gen. Stat. § 49-2a | Casetext Search + Citator.