Connecticut Clauses Relating to Accounting Matters are specific provisions included in various legal agreements that outline the accounting procedures and principles to be followed within the state of Connecticut. These clauses ensure transparency and accuracy in financial reporting, providing a framework for conducting business transactions and maintaining proper accounting standards. Below, different types of Connecticut Clauses Relating to Accounting Matters are described: 1. Connecticut Generally Accepted Accounting Principles (CT-GAAP) Clause: The CT-GAAP clause requires businesses and organizations operating within Connecticut to adhere to the Generally Accepted Accounting Principles specific to the state. It states that financial statements, including balance sheets, income statements, and cash flow statements, must be prepared in accordance with CT-GAAP. This clause ensures consistency and comparability of financial information across entities operating in Connecticut. 2. Tax Reporting Clause: The tax reporting clause focuses on accounting matters related to tax obligations within Connecticut. It outlines the specific tax laws and regulations businesses must comply with, such as sales tax, use tax, income tax, and payroll tax. This clause may require businesses to maintain accurate records, submit timely tax returns, and provide any necessary documentation required by the Connecticut Department of Revenue Services. 3. Audit and Review Clause: The audit and review clause establishes the requirement for financial statement audits and reviews conducted by independent certified public accountants (CPA's). It lays out the frequency and scope of such audits, ensuring that businesses operating in Connecticut undergo adequate scrutiny to maintain financial integrity. This clause may outline the selection process for CPA's, their qualifications, and the reporting requirements associated with audit findings. 4. Compliance with Connecticut Department of Banking (DOB) Standards Clause: This clause specifically applies to banks, financial institutions, and entities regulated by the Connecticut Department of Banking. It outlines the unique accounting standards, reporting requirements, and internal control procedures that these entities must adhere to. The clause ensures that financial institutions operating in Connecticut comply with state-specific regulations, safeguarding the interests of customers and maintaining the stability of the banking sector. 5. Disclosure and Transparency Clause: The disclosure and transparency clause emphasizes the importance of providing accurate and relevant financial information to stakeholders. It stipulates that businesses operating in Connecticut must make appropriate disclosures about their accounting policies, significant financial risks, and uncertainties. This clause ensures transparency, allowing stakeholders such as investors, creditors, and regulatory bodies to make informed decisions based on reliable financial data. In conclusion, Connecticut Clauses Relating to Accounting Matters encompass a range of provisions designed to regulate financial reporting and accounting practices within the state. The types of clauses mentioned above, including CT-GAAP, tax reporting, audit and review, compliance with DOB standards, and disclosure and transparency, provide a framework to maintain accounting standards, enhance transparency, and ensure compliance with state-specific regulations.

Connecticut Clauses Relating to Accounting Matters

Description

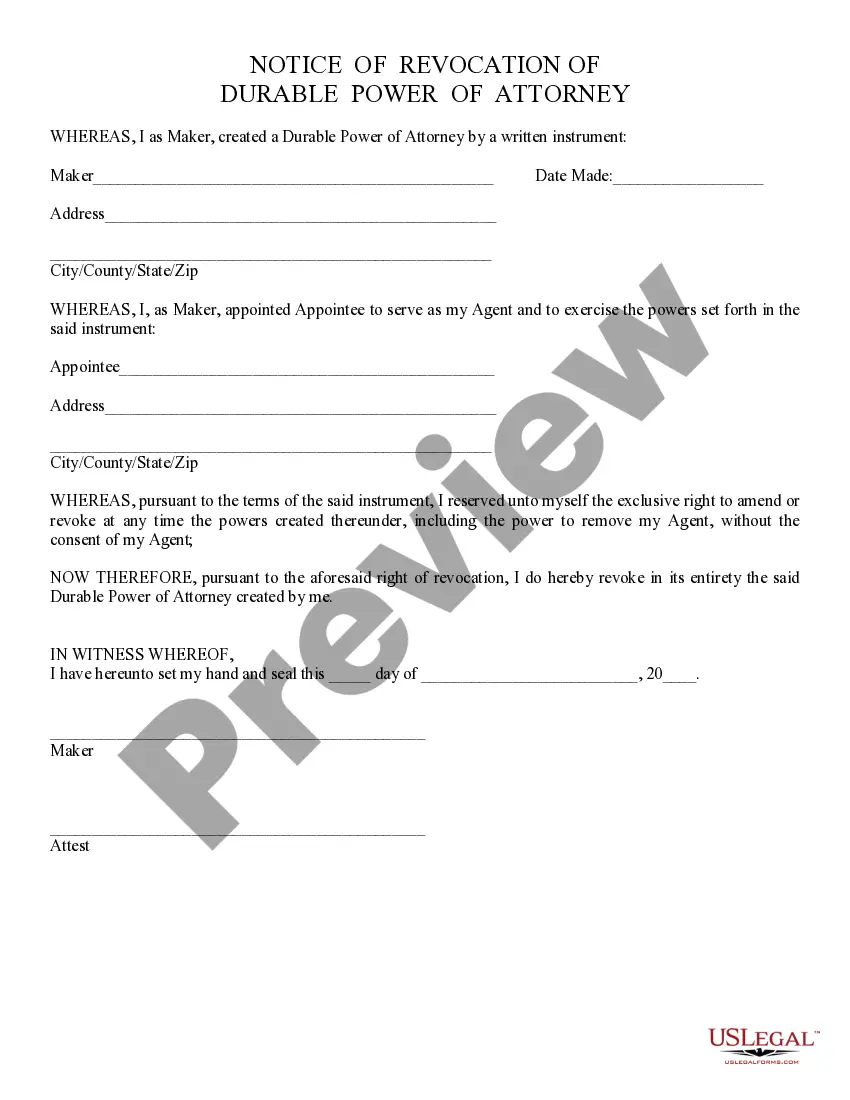

How to fill out Connecticut Clauses Relating To Accounting Matters?

You are able to invest time on-line searching for the lawful file design that meets the federal and state needs you need. US Legal Forms gives a large number of lawful kinds which are analyzed by specialists. You can easily obtain or print the Connecticut Clauses Relating to Accounting Matters from our service.

If you have a US Legal Forms accounts, it is possible to log in and click the Acquire key. Following that, it is possible to total, edit, print, or indicator the Connecticut Clauses Relating to Accounting Matters. Each lawful file design you acquire is the one you have eternally. To acquire one more copy associated with a bought develop, proceed to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms site the very first time, stick to the simple instructions beneath:

- First, make certain you have chosen the proper file design to the state/metropolis of your choice. Look at the develop explanation to ensure you have picked the right develop. If accessible, utilize the Review key to appear through the file design also.

- If you would like locate one more model from the develop, utilize the Lookup industry to find the design that suits you and needs.

- Once you have discovered the design you desire, click on Get now to move forward.

- Pick the prices plan you desire, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the transaction. You can use your charge card or PayPal accounts to cover the lawful develop.

- Pick the format from the file and obtain it to your product.

- Make changes to your file if possible. You are able to total, edit and indicator and print Connecticut Clauses Relating to Accounting Matters.

Acquire and print a large number of file templates using the US Legal Forms website, that offers the most important assortment of lawful kinds. Use specialist and express-particular templates to deal with your organization or person needs.