Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub: A Comprehensive Overview Introduction: The Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub is a legally binding contract that outlines the terms and conditions between the partners involved in a fund hub project located in the state of Connecticut. This partnership agreement serves as a roadmap for the establishment, operation, and management of the fund hub, ensuring transparency, accountability, and equity among the participating parties. Types of Connecticut Amended Equity Fund Partnership Agreements: 1. General Partnership Agreement: This type of agreement is suitable when two or more equity fund partners join hands to form a partnership for the creation of a fund hub. This agreement outlines the roles and responsibilities, decision-making processes, profit-sharing methods, contributions, and distributions among the partners, ensuring a fair and balanced approach towards achieving the fund hub's objectives. 2. Limited Partnership Agreement: When there is a distinction between general partners who manage the fund hub and limited partners who solely contribute capital, a limited partnership agreement is necessary. This agreement clearly defines the rights, obligations, and restrictions of each partner category, allowing limited partners to passively invest in the fund hub while minimizing their liability. 3. Master Partnership Agreement: In case multiple fund hubs are intended to be established under a common umbrella, a master partnership agreement can be utilized. This agreement provides a framework for creating individual fund hubs while maintaining consistent guidelines and structures across all the partnerships. It ensures streamlined operations, standardized procedures, and coordinated efforts between the different fund hubs to achieve cost-efficiency and optimal management. Key Contents of Connecticut Amended Equity Fund Partnership Agreement: 1. Identification: The agreement begins with the legal names, addresses, and roles of all participating partners involved in the fund hub, ensuring clarity and authenticity. 2. Purpose and Objectives: This section outlines the specific goals, objectives, and desired outcomes of the fund hub project. It highlights the mission, strategy, and focus areas, setting the stage for the partners' collective efforts. 3. Capital Contributions and Profit Sharing: The agreement defines the capital contribution requirements for each partner, including initial investments, subsequent cash injections, or other eligible contributions. It also details the profit-sharing mechanism, allocation methods, and distribution protocols to ensure fairness and accountability. 4. Decision-Making Process: This section outlines the decision-making framework, voting rights, and procedures for making major or strategic decisions related to the fund hub. It ensures active participation and involvement of all partners while respecting the expertise and opinions of each party. 5. Governance and Management: The agreement describes the governance structure, roles, and responsibilities of the partners, including the appointment of managing partners, executive committees, or advisory boards. It establishes principles for day-to-day operations, reporting requirements, and financial management practices, ensuring effective management of the fund hub. 6. Term and Termination: This section specifies the initial term of the partnership and conditions for renewal or termination. It also outlines the protocols for an exit strategy, dissolution procedures, and distribution of assets in case of a partnership's termination. Conclusion: The Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub serves as the guiding document for partners involved in establishing and operating a fund hub. Its comprehensive nature ensures fairness, transparency, and compliance with respective legal frameworks. By defining roles, responsibilities, expectations, and operating procedures, this agreement enables effective collaboration, risk management, and opportunities for investment growth within the fund hub project.

Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub

Description

How to fill out Connecticut Amended Equity Fund Partnership Agreement For New Fund Hub?

If you wish to comprehensive, obtain, or print legitimate file web templates, use US Legal Forms, the most important assortment of legitimate types, which can be found on the web. Use the site`s easy and practical lookup to find the paperwork you need. Different web templates for business and individual uses are sorted by groups and claims, or keywords. Use US Legal Forms to find the Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub in a number of mouse clicks.

In case you are presently a US Legal Forms consumer, log in to the profile and click the Download button to obtain the Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub. Also you can access types you in the past delivered electronically from the My Forms tab of your own profile.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form for your right metropolis/country.

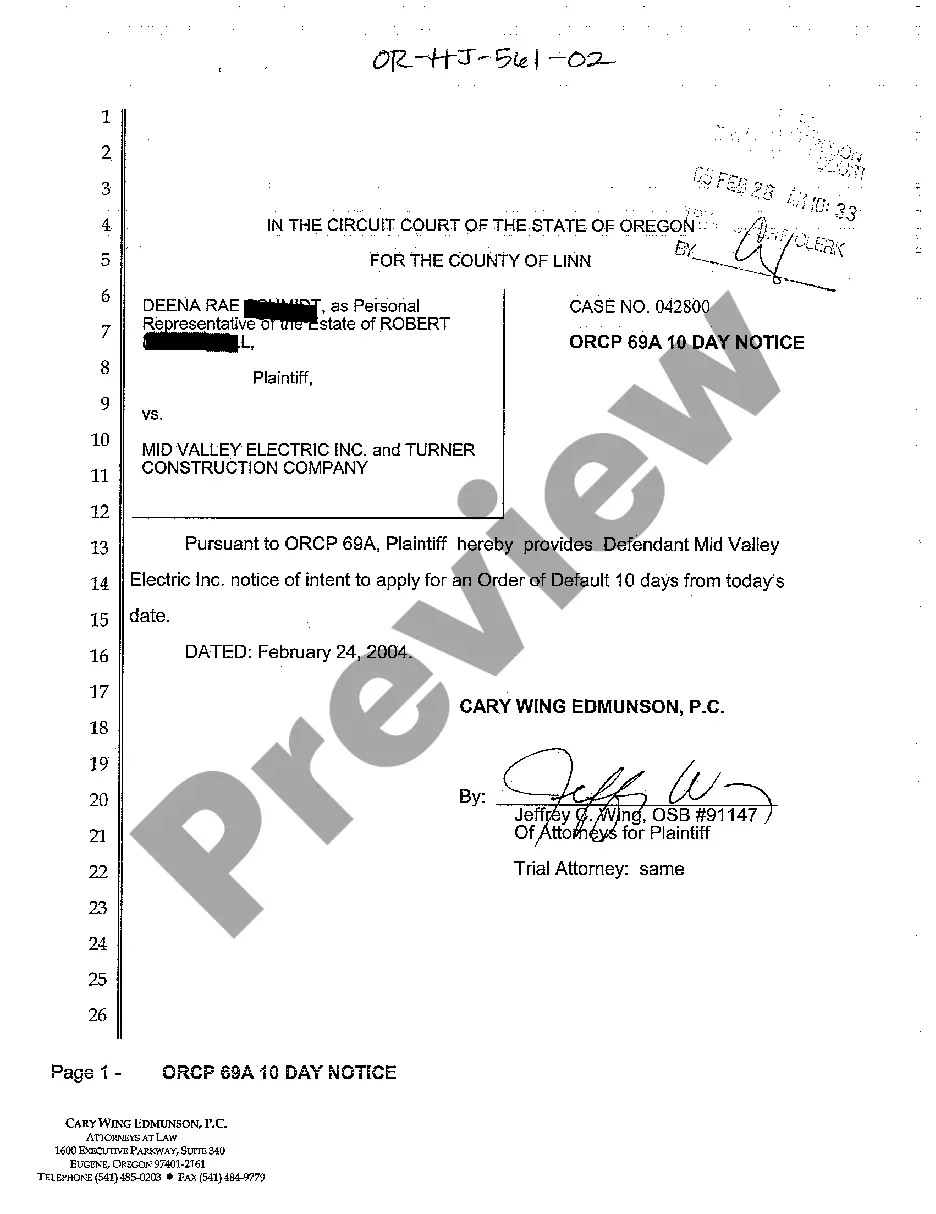

- Step 2. Make use of the Review solution to look through the form`s information. Do not forget about to read the information.

- Step 3. In case you are unhappy together with the kind, make use of the Lookup industry at the top of the display screen to find other types of the legitimate kind web template.

- Step 4. When you have discovered the form you need, click the Purchase now button. Pick the costs prepare you choose and add your references to register for the profile.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Choose the structure of the legitimate kind and obtain it on your gadget.

- Step 7. Full, edit and print or indication the Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub.

Each and every legitimate file web template you purchase is yours permanently. You possess acces to every kind you delivered electronically with your acccount. Select the My Forms area and select a kind to print or obtain once more.

Be competitive and obtain, and print the Connecticut Amended Equity Fund Partnership Agreement for New Fund Hub with US Legal Forms. There are millions of specialist and condition-specific types you may use to your business or individual demands.

Form popularity

FAQ

A Limited Partner (LP) Report is a critical document in venture capital (VC) that serves to keep Limited partners informed about the performance and activities of the VC fund in which they have invested. Transparency, clarity, and comprehensiveness are essential elements of these reports.

A limited partnership agreement helps protect your business into the future by outlining each partner's roles and responsibilities, as well as how they share in the business profits. You should use a limited partnership agreement if you want to form a limited partnership or formalize an existing limited partnership.

Hence LP generally would have investors such as Pension Funds, Labor Unions, Insurance companies, Universities Endowments, large wealthy families or Individuals, Foundations, etc.

The limited partnership agreement outlines the amount of risk each party takes along with the duration of the fund. Limited partners are liable for up to the full amount of money they invest, while general partners are fully liable to the market.

A typical investment strategy undertaken by private equity funds is to take a controlling interest in an operating company or business?the portfolio company?and engage actively in the management and direction of the company or business in order to increase its value.

form limited partnership agreement to be used in connection with the formation of a private equity fund structured as a limited partnership. This Standard Document can be adapted for other investment structures or other purposes when formation of limited partnerships is desired.