This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

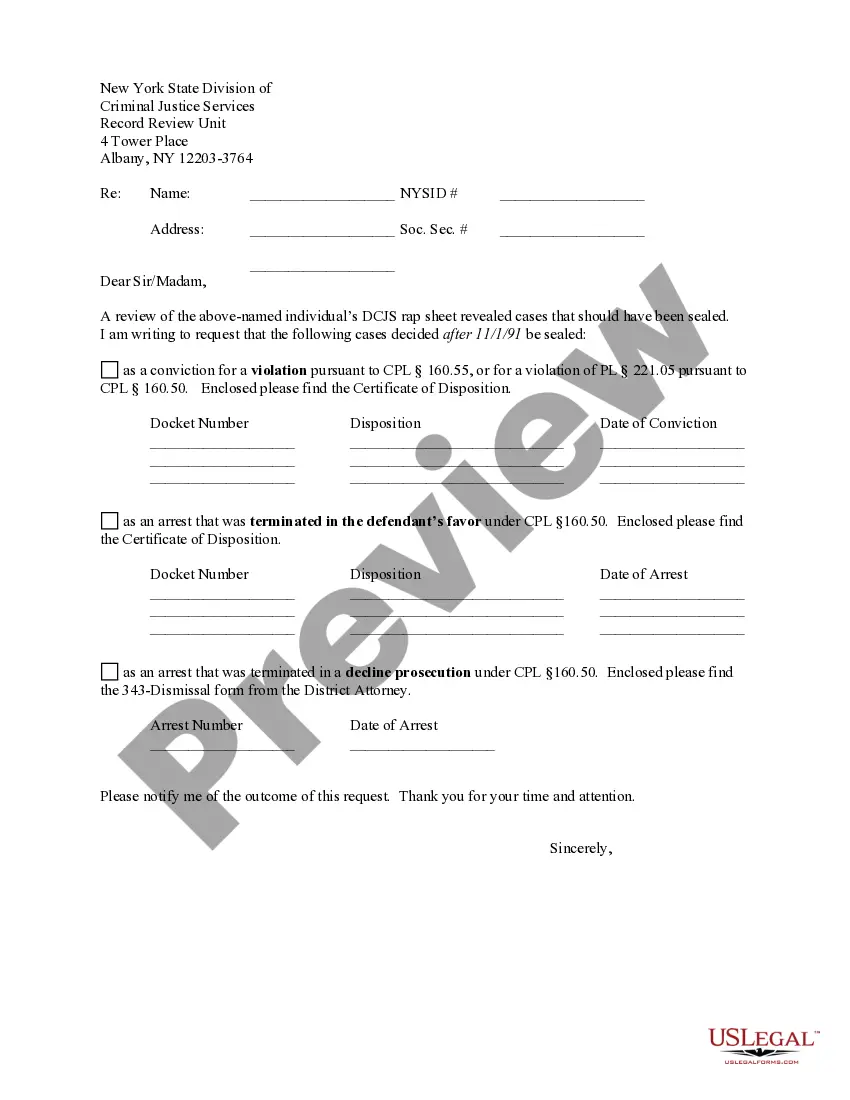

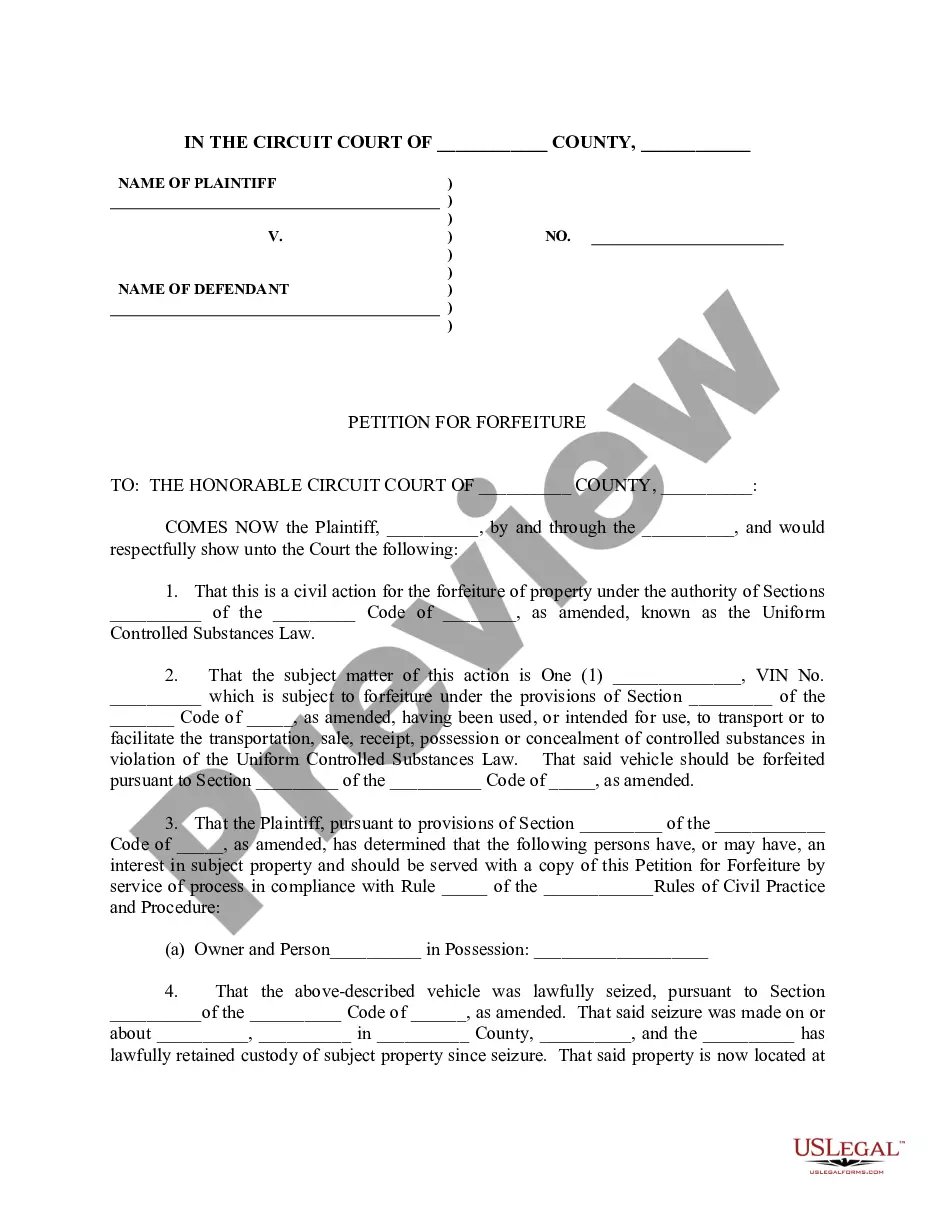

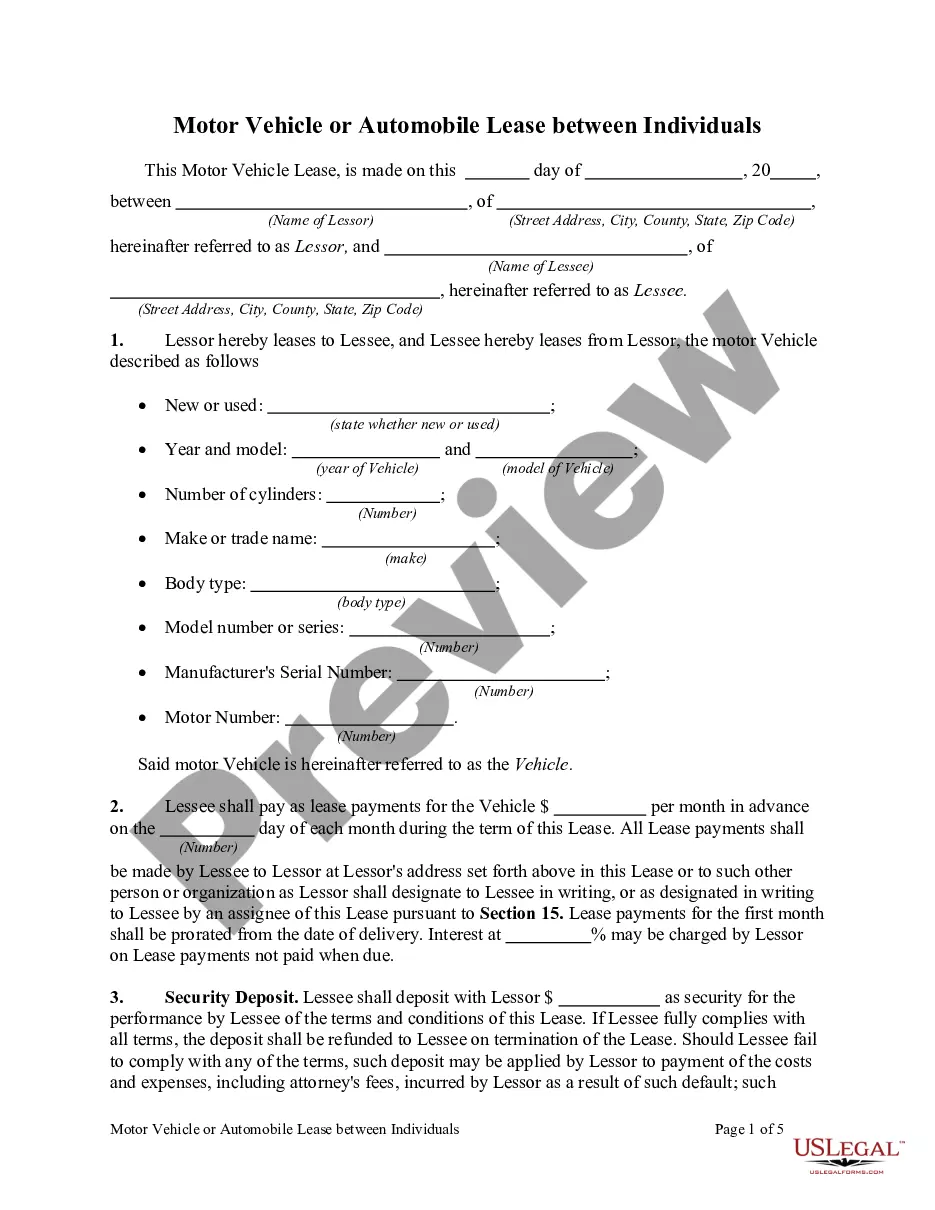

Connecticut Employee Stock Option Agreement

Description

How to fill out Employee Stock Option Agreement?

Finding the right lawful record template can be a struggle. Obviously, there are a variety of templates available online, but how can you obtain the lawful develop you want? Use the US Legal Forms site. The support delivers 1000s of templates, including the Connecticut Employee Stock Option Agreement, that you can use for business and personal needs. All of the types are checked out by specialists and meet federal and state needs.

If you are presently authorized, log in to your profile and click on the Download option to obtain the Connecticut Employee Stock Option Agreement. Make use of your profile to look with the lawful types you possess ordered earlier. Proceed to the My Forms tab of your respective profile and have yet another duplicate from the record you want.

If you are a new customer of US Legal Forms, listed here are basic guidelines that you should comply with:

- Initial, make certain you have selected the right develop for your city/state. You are able to examine the form utilizing the Preview option and browse the form outline to make certain it is the right one for you.

- If the develop fails to meet your preferences, make use of the Seach discipline to find the right develop.

- Once you are certain the form is suitable, go through the Purchase now option to obtain the develop.

- Select the prices program you desire and enter in the necessary information. Make your profile and buy your order with your PayPal profile or credit card.

- Select the submit structure and download the lawful record template to your device.

- Comprehensive, edit and printing and indicator the received Connecticut Employee Stock Option Agreement.

US Legal Forms is the most significant library of lawful types for which you can discover a variety of record templates. Use the company to download expertly-made paperwork that comply with condition needs.

Form popularity

FAQ

How Does an Employee Stock Ownership Plan (ESOP) Work? Employers decide the number of shares to be offered under ESOPs, their price, and the beneficiary employees. ESOPs are then granted to employees, and a grant date is provided.

Procedure to Issue ESOP A draft needs to be prepared of the ESOP ing to the companies,2013 and Rules. A board meeting notice along with the draft resolution that is to be passed in the board meeting is to be made. The notice of the board meeting is to be sent seven days before the meeting to all the directors.

How to Establish an ESOP Designing an ESOP and an ESOP Stock Purchase Transaction. Most companies will engage a qualified consultant to work with management to assess the feasibility of an ESOP for the particular company. ... Repurchase Liability Studies. ... Putting the ESOP in Place. ... Implemementing the ESOP. ... Conclusion.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

An employer and employee agree on ESOP terms on the grant date. Once the employee has fulfilled the conditions or the relevant time period has elapsed, these employee stock options are vested. At this time the employee can exercise them or put simply ? buy them.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.