This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will

Description Will Testament With

How to fill out Last Testament With?

The more papers you need to create - the more anxious you become. You can get a huge number of Connecticut Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will templates on the web, nevertheless, you don't know which ones to rely on. Eliminate the hassle to make getting samples more straightforward using US Legal Forms. Get expertly drafted documents that are created to go with the state demands.

If you currently have a US Legal Forms subscription, log in to the profile, and you'll find the Download option on the Connecticut Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will’s webpage.

If you have never used our platform before, finish the sign up process with the following guidelines:

- Ensure the Connecticut Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will applies in the state you live.

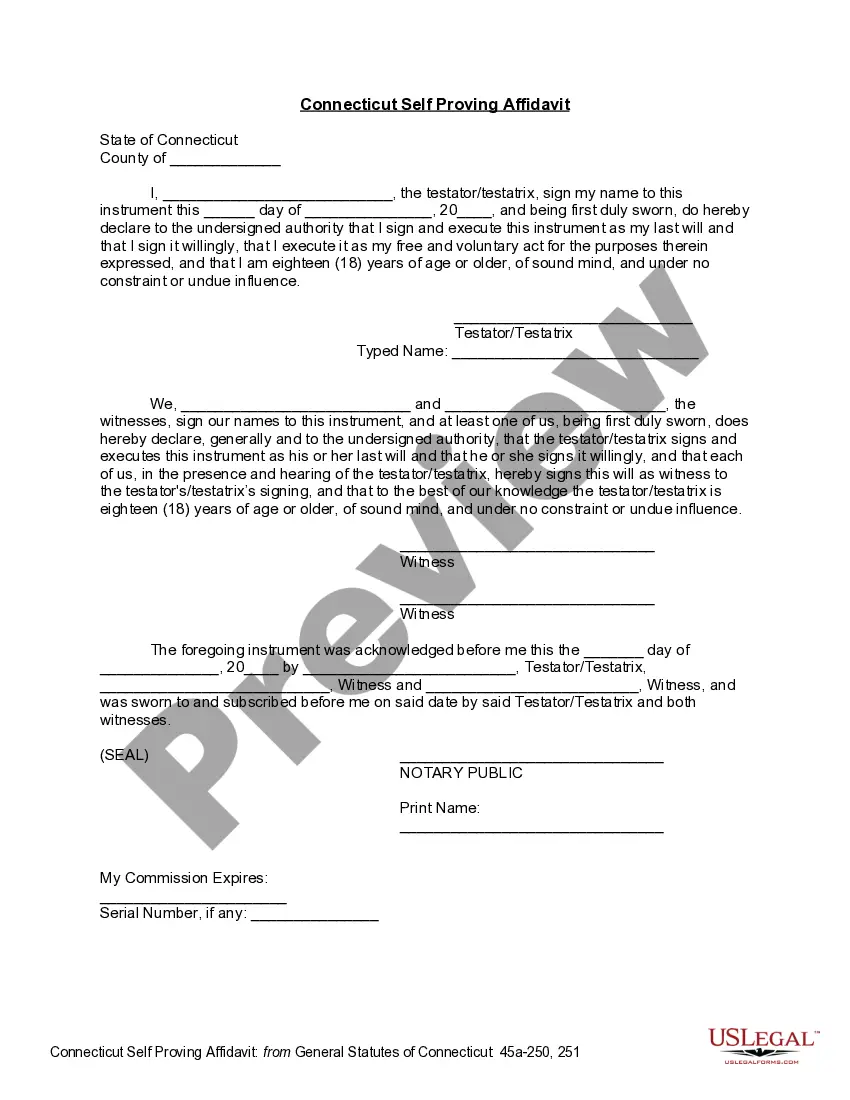

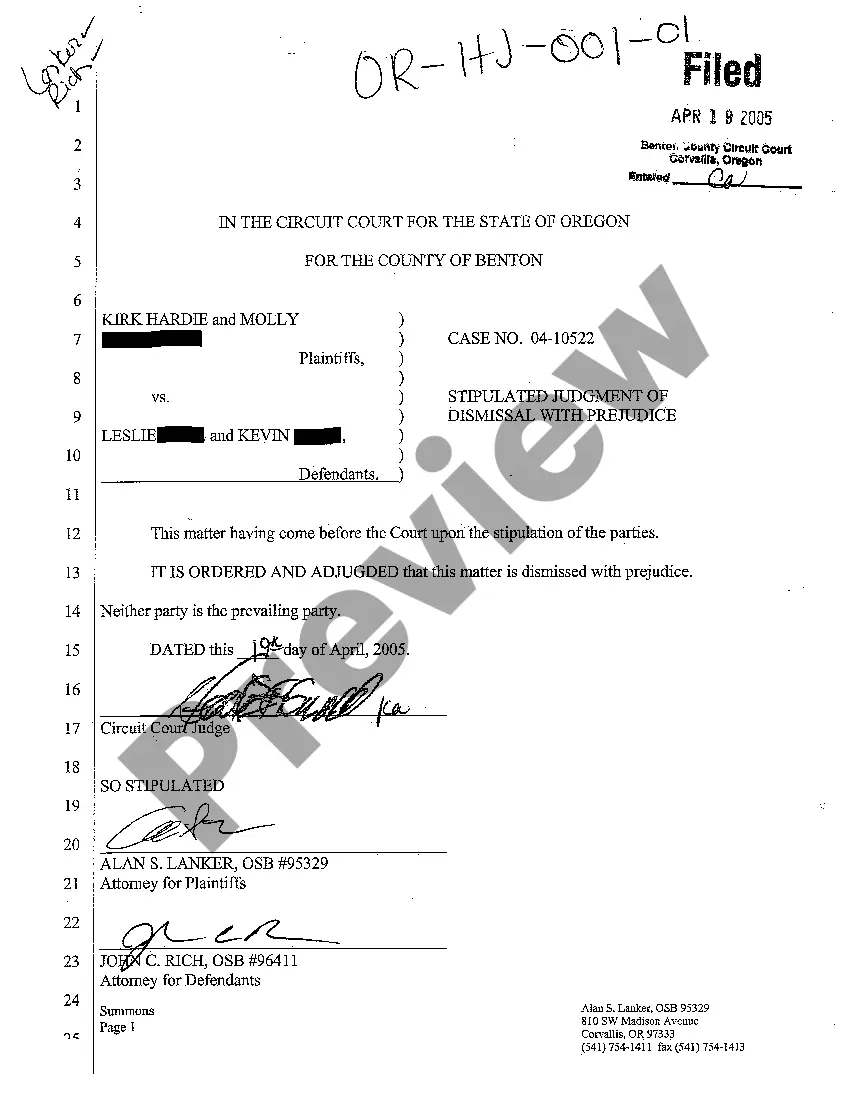

- Double-check your choice by reading through the description or by using the Preview functionality if they are available for the selected record.

- Click on Buy Now to start the signing up procedure and choose a rates plan that suits your needs.

- Insert the requested info to make your account and pay for the order with the PayPal or bank card.

- Select a practical file format and acquire your sample.

Access each document you obtain in the My Forms menu. Simply go there to produce a new version of the Connecticut Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will. Even when using professionally drafted web templates, it is still vital that you think about asking the local legal representative to re-check completed form to ensure that your record is accurately completed. Do much more for less with US Legal Forms!

Legal With Property Form popularity

Last Will Trust Other Form Names

Connecticut Last Will Testament FAQ

A significant drawback of a pour-over will is that it may not cover all your assets immediately. Any property acquired after the will is created could be subject to probate instead of being transferred into the trust automatically. This timing issue could lead to complications and confusion for your beneficiaries. An effective approach can be using a comprehensive estate planning platform, such as uslegalforms, to simplify this process.

One drawback of a pour-over will is that it typically requires probate, which can be a lengthy process. Your assets may spend additional time in the court system before they are transferred to the trust. This situation can delay how quickly your heirs receive their inheritance, making it vital to plan your estate carefully and utilize services like uslegalforms for efficient estate planning.

While placing your house in a trust can provide benefits, there are some drawbacks to consider. One issue is the potential for higher upfront costs and maintenance fees associated with managing the trust. Additionally, transferring ownership may complicate your home insurance and property taxes. Evaluating these factors is essential when deciding on your Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will.

You might choose a pour-over will for its ability to work seamlessly with a trust. This type of will provides clarity and reduces the risk of disputes about your estate after your death. By using a Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will, you help ensure that all assets are directed into the established trust, making them subject to your predefined estate plan. This approach offers peace of mind for many individuals.

over will serves as a safety net for your assets. When you create a Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will, any property not included in your trust at the time of your death pours over into the trust. This ensures that assets are still managed according to your wishes, even if they were overlooked during the estate planning process. It simplifies the transition of your estate to your trust.

In Connecticut, a trust can override a Last Will and Testament, especially when it comes to property distribution. When you create a Connecticut Last Will and Testament with All Property to Trust, called a Pour Over Will, the assets designated in the trust typically pass outside the will. This means that the trust's terms will govern how the assets are managed and distributed. Therefore, it is crucial to ensure that both documents are properly drafted and align with your overall estate planning goals.

Beneficiaries do hold a significant place in the context of trusts, but it’s essential to understand the specific terms laid out in the trust document. A Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will can guide asset transfer to your trust, but once assets are in the trust, they are managed according to the trust's rules. It is crucial to establish clear directives to ensure your intentions are honored. Understanding how your beneficiaries interact with your trust will help you create a well-structured estate plan.

There are several reasons to choose a trust over a will, particularly the ability to manage your assets during your lifetime and after your passing. A Connecticut Last Will and Testament with All Property to Trust called a Pour Over Will only takes effect after your death, while a trust can manage your assets and provide for your beneficiaries immediately. This means you can ensure your loved ones are cared for without the delays associated with probate. Additionally, a trust can help maintain privacy since it does not go through probate.