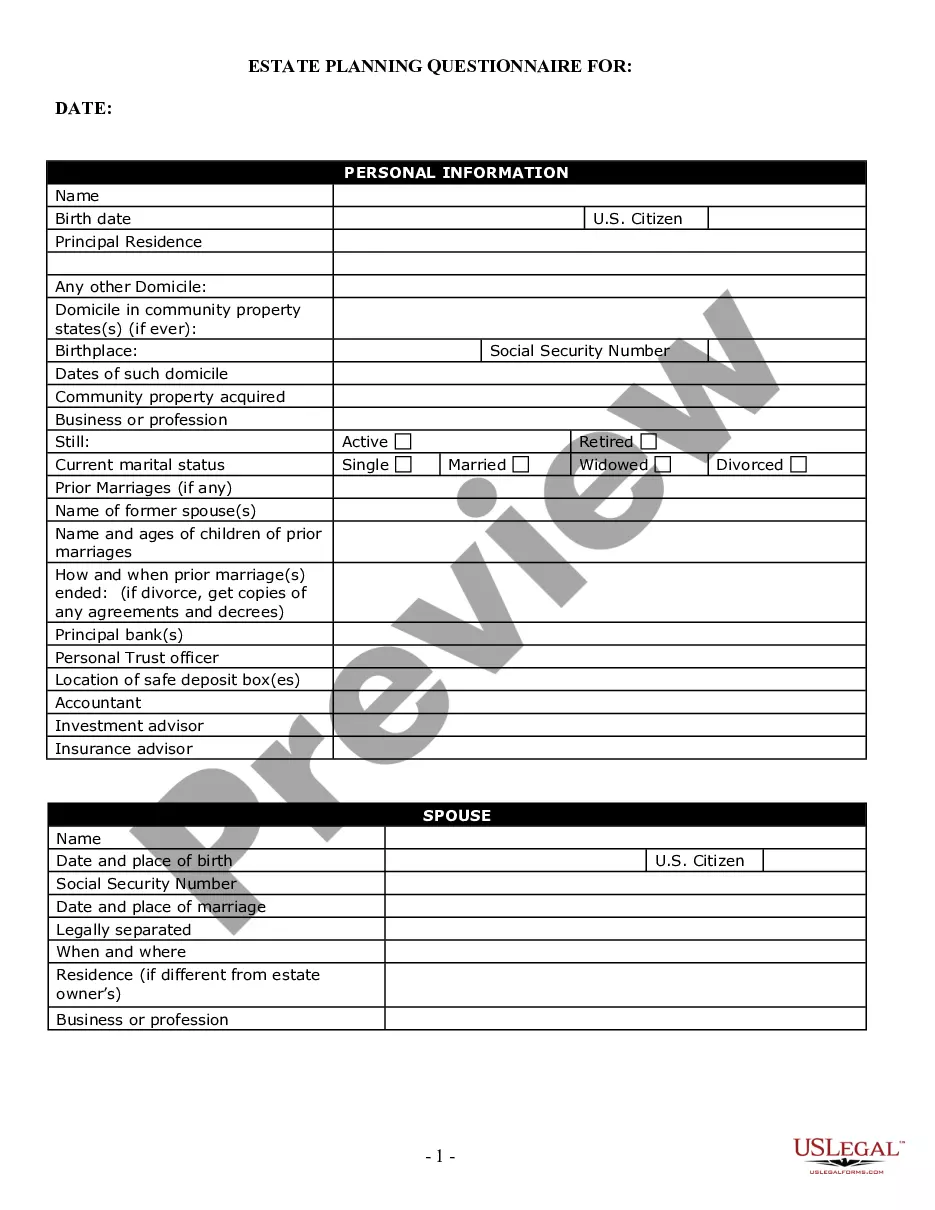

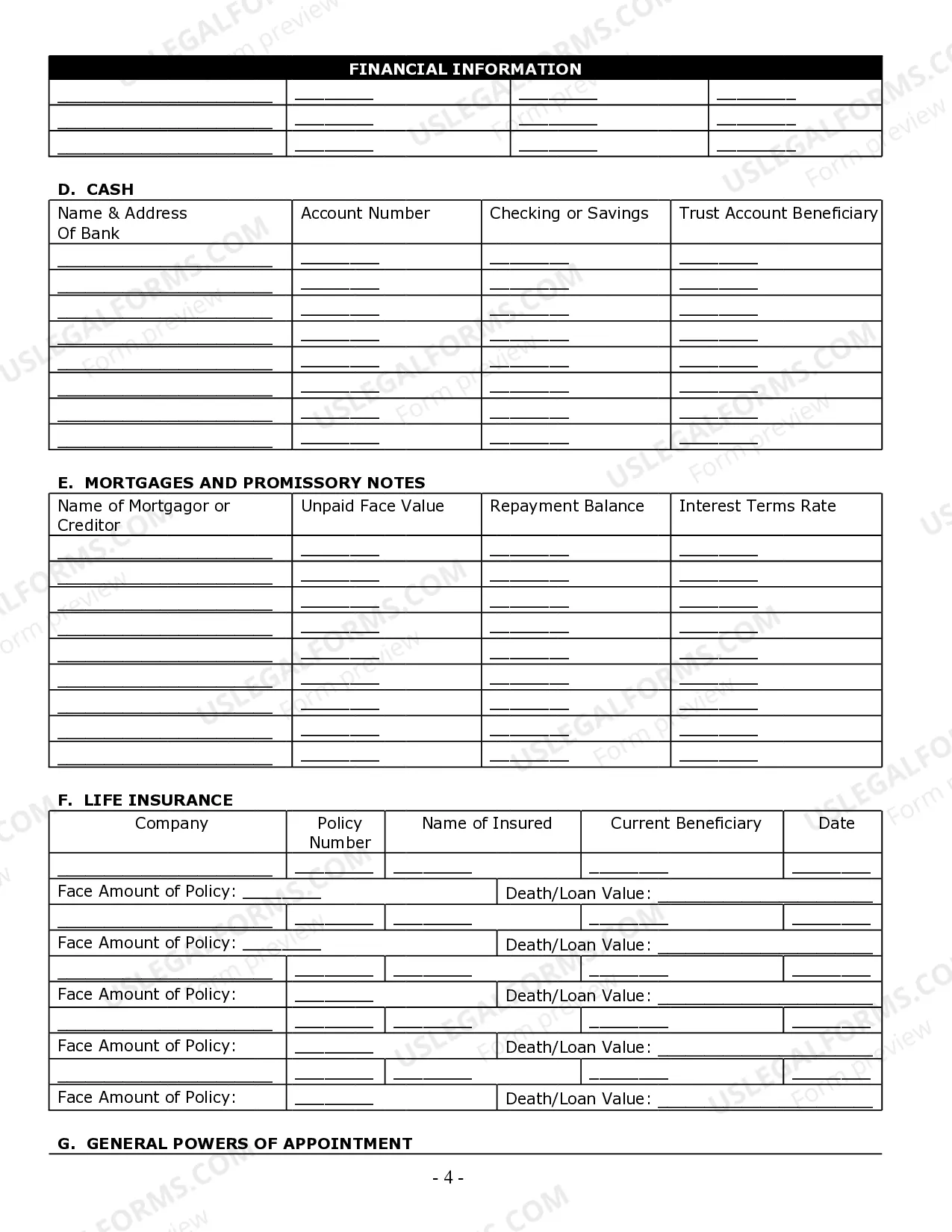

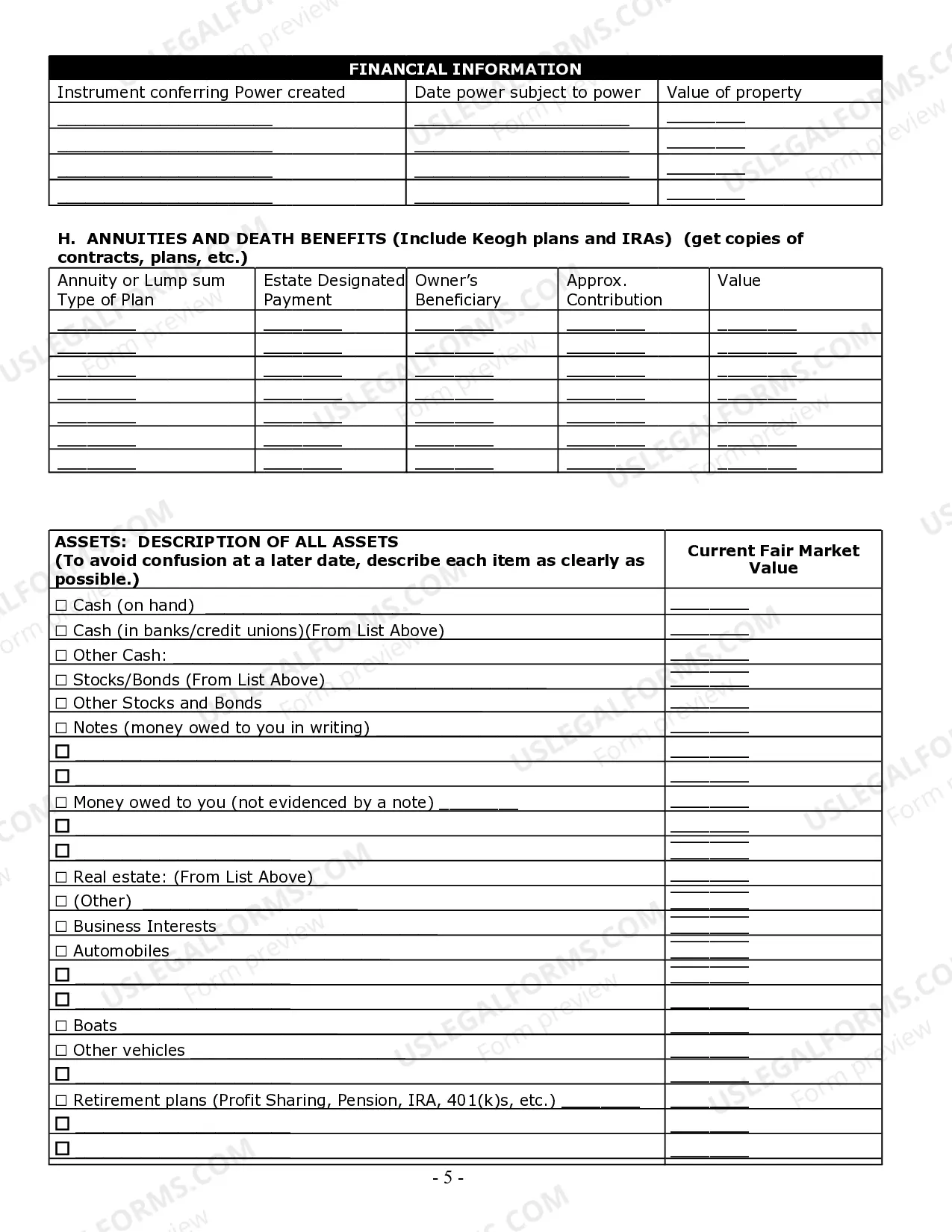

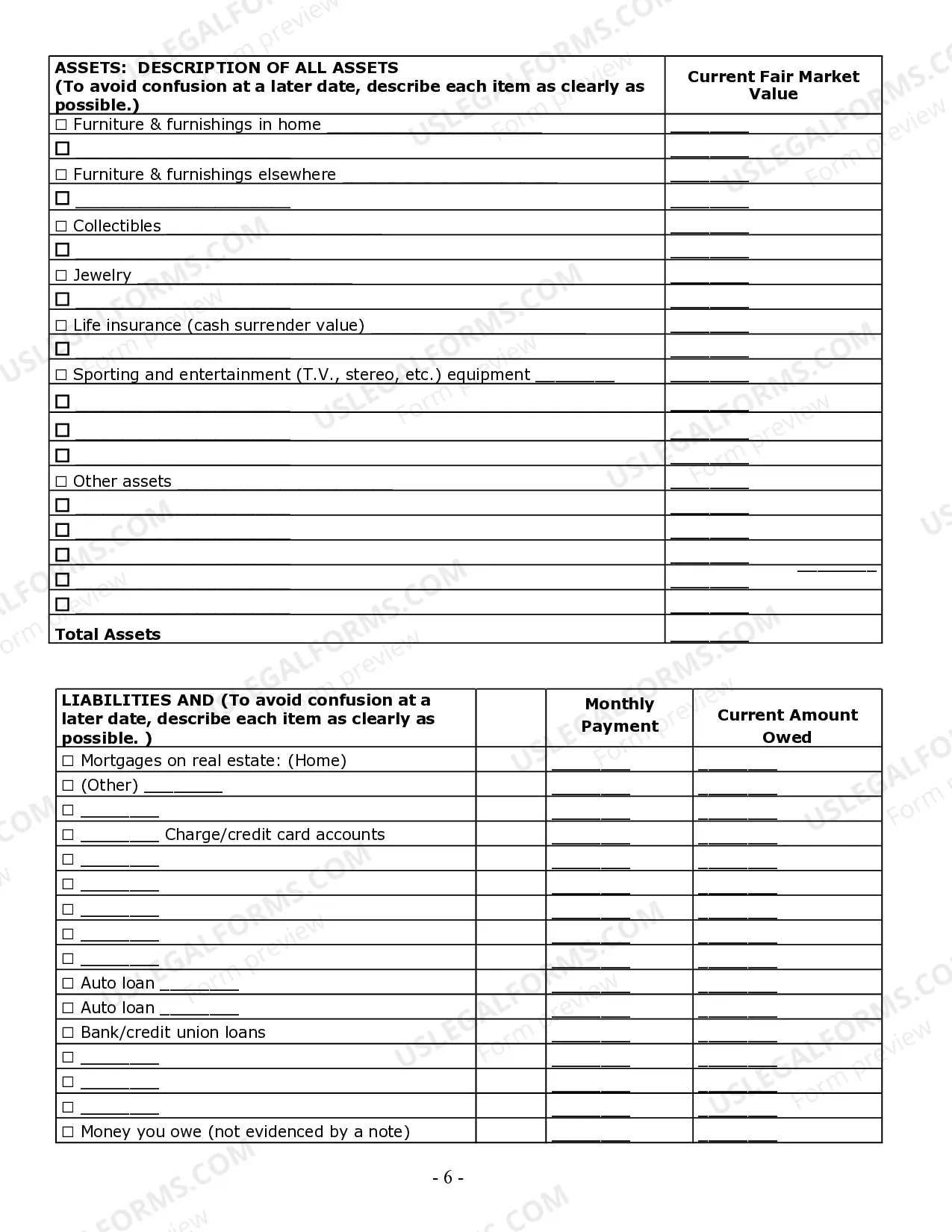

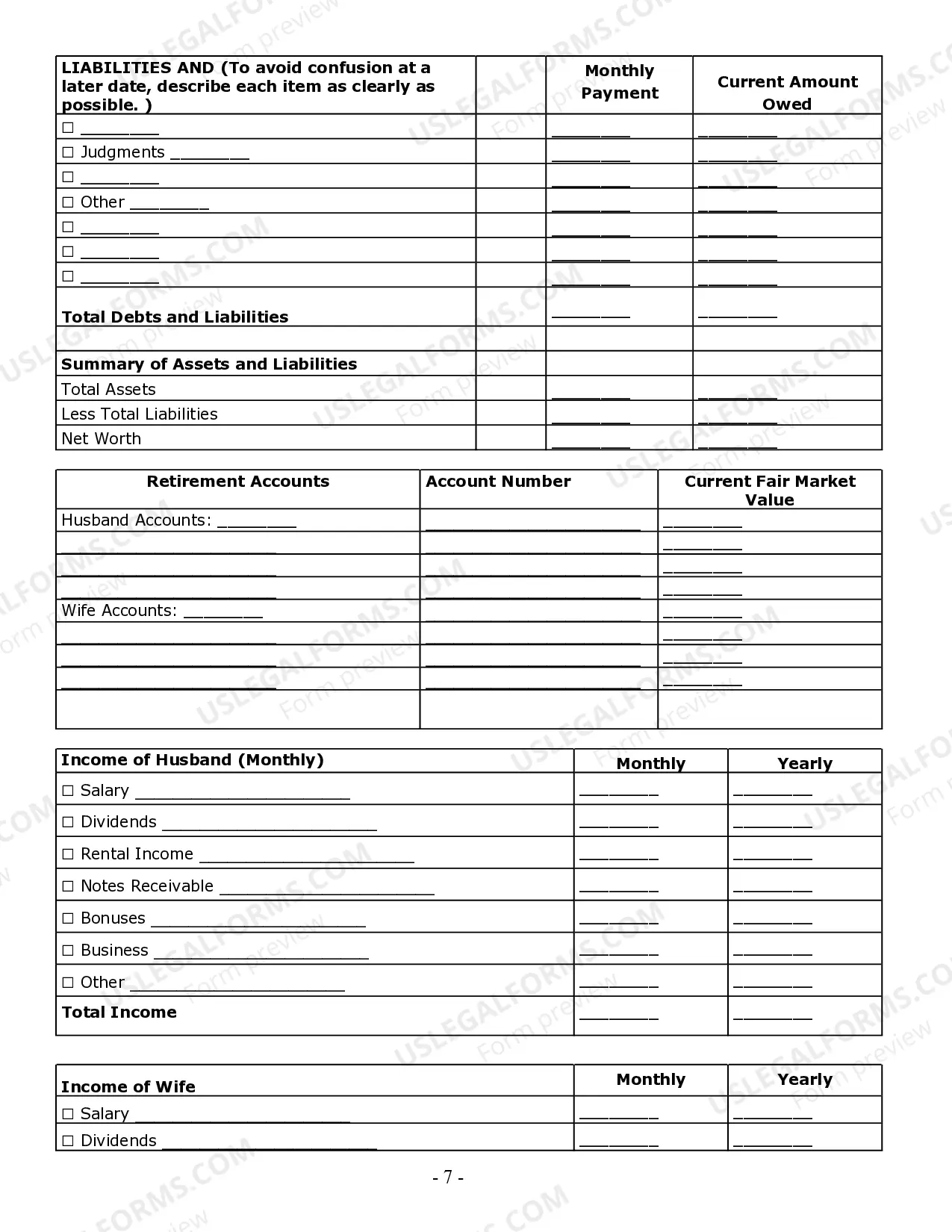

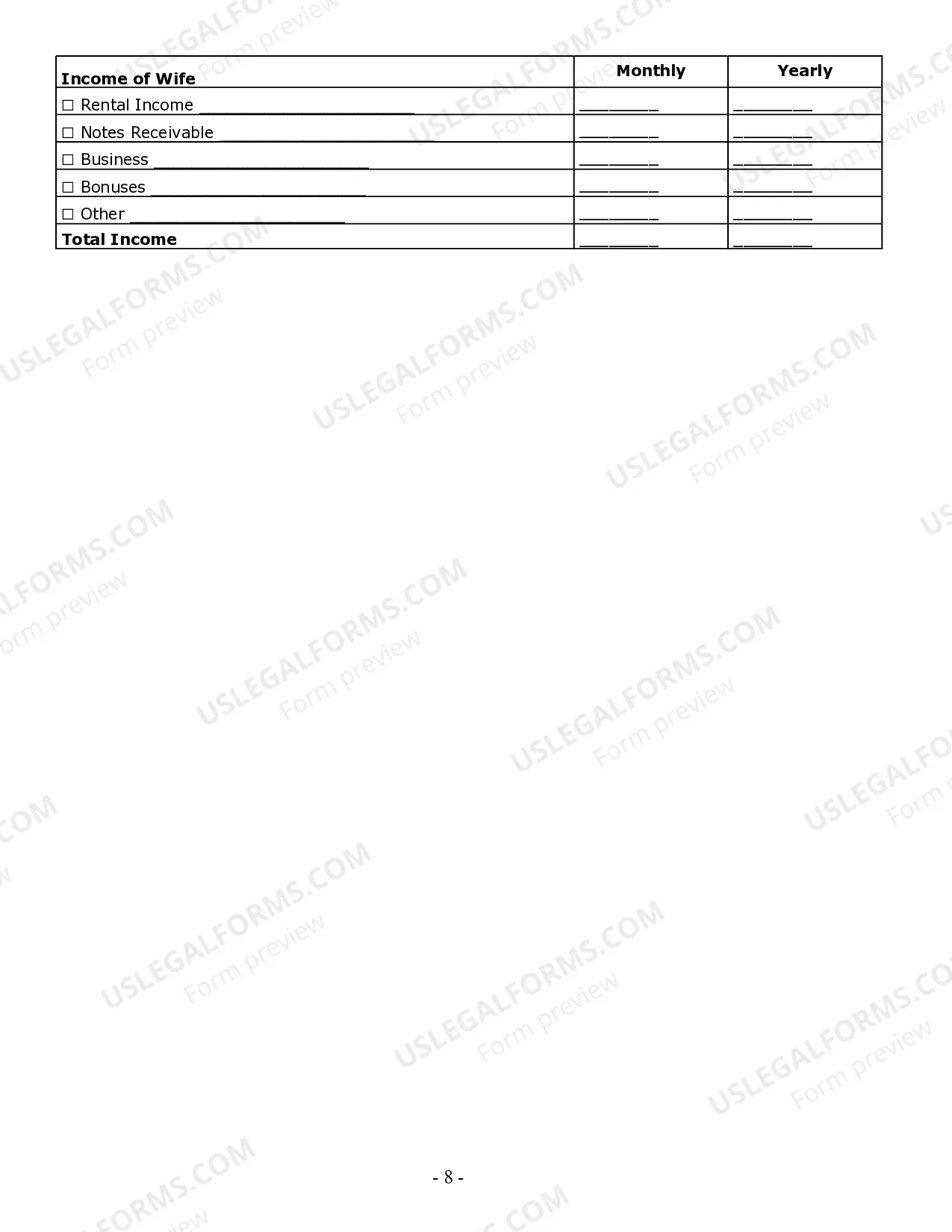

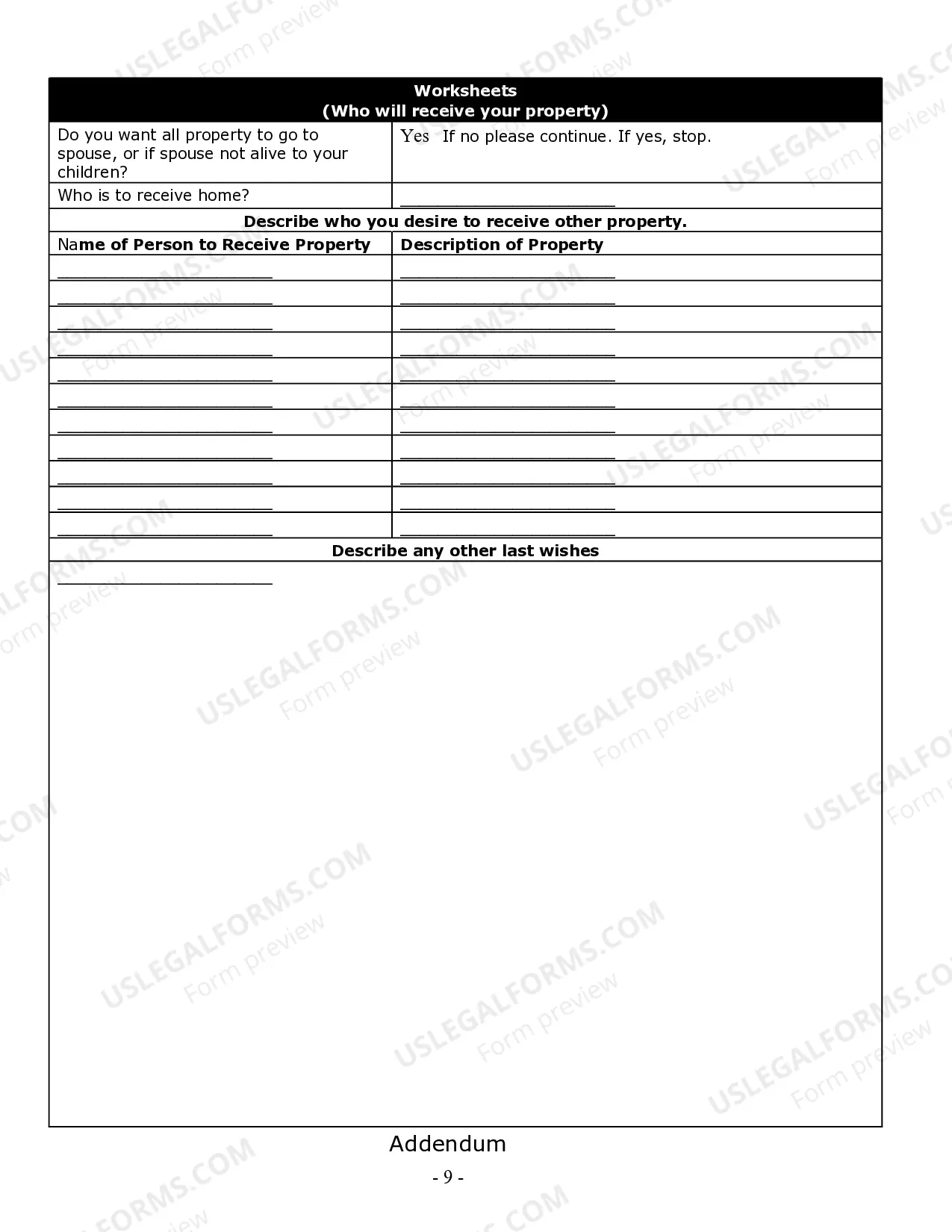

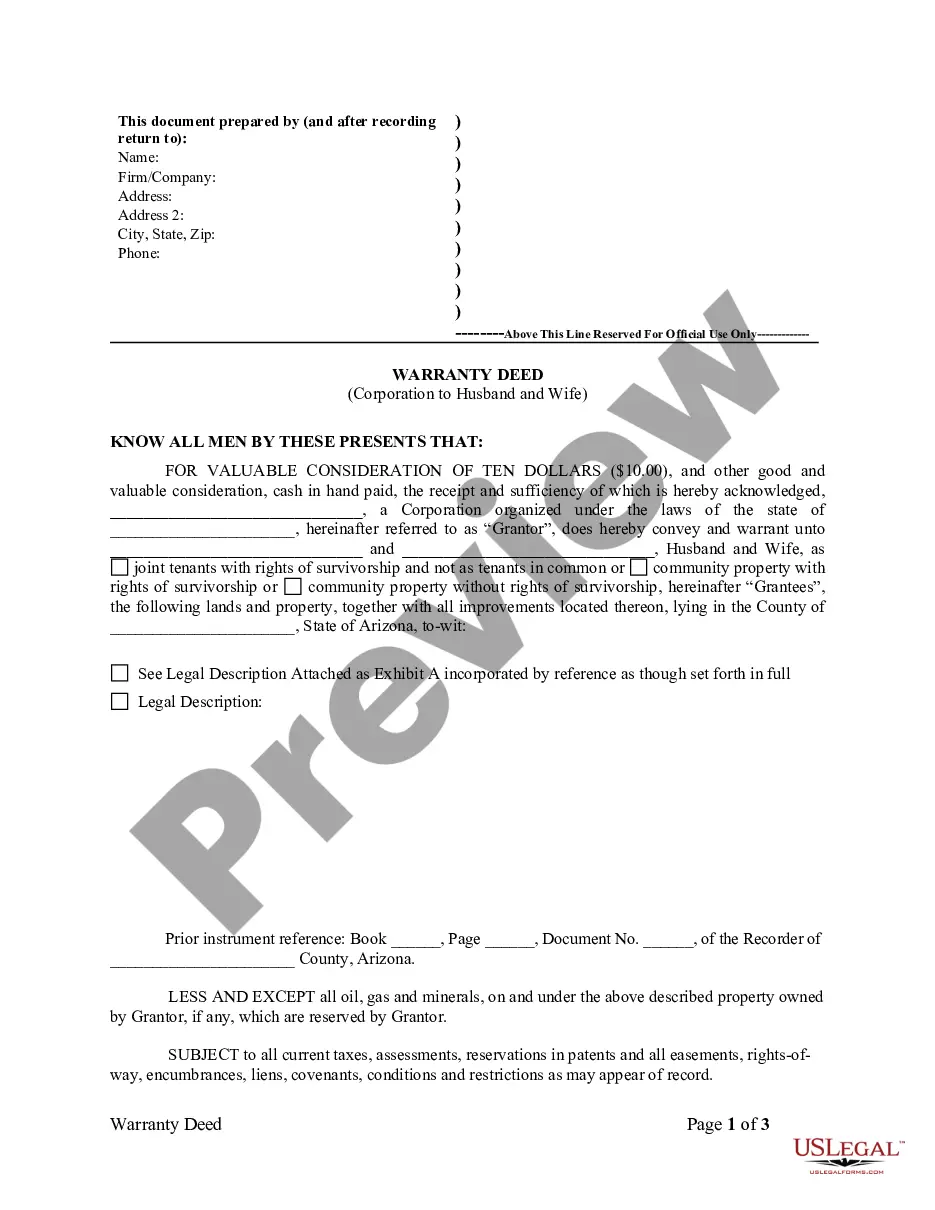

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Connecticut Estate Planning Questionnaire and Worksheets

Description

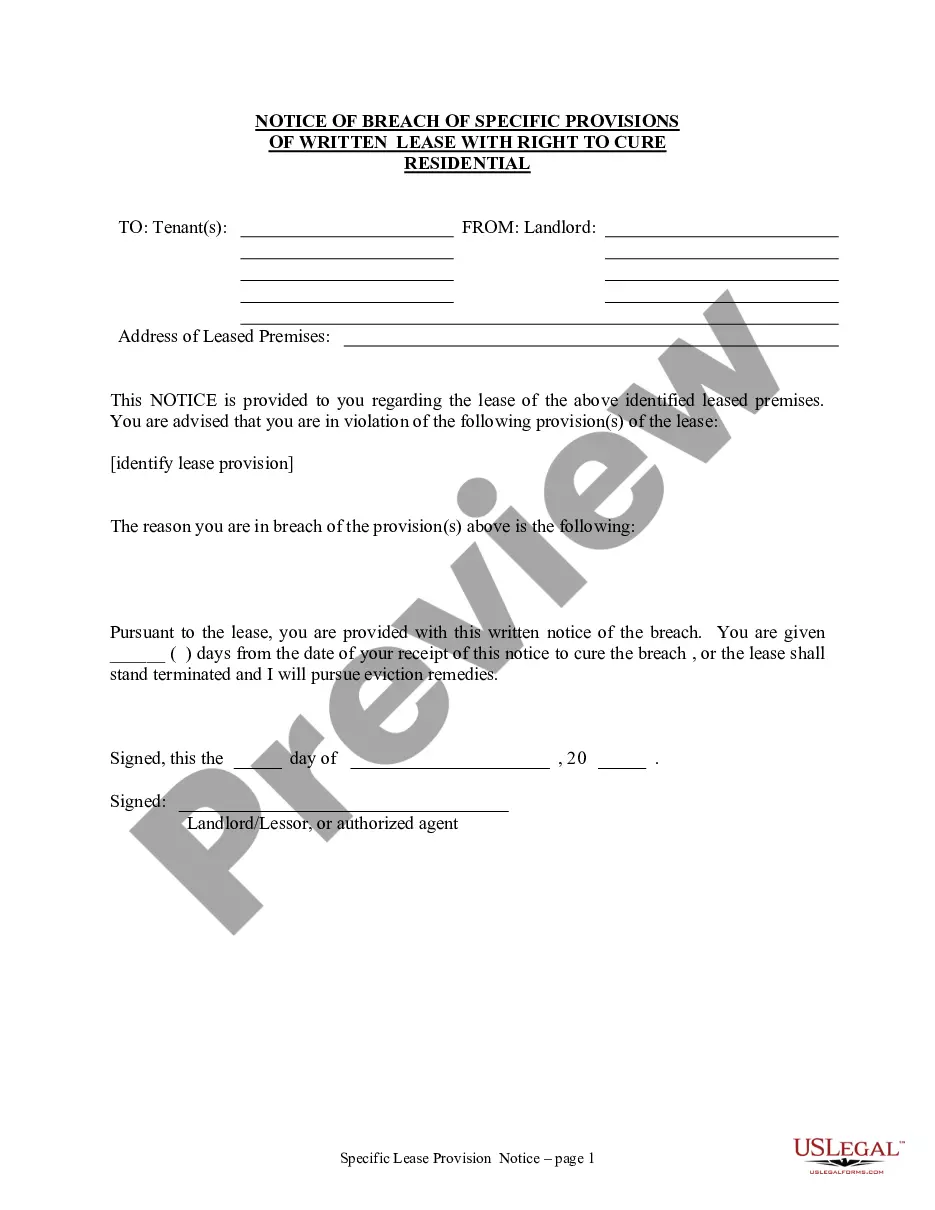

How to fill out Connecticut Estate Planning Questionnaire And Worksheets?

The larger quantity of documents you have to create - the more anxious you become.

You can locate numerous Connecticut Estate Planning Questionnaire and Worksheets templates on the internet, but you're unsure which ones to rely on.

Eliminate the difficulty of locating samples and make it much easier with US Legal Forms. Acquire expertly crafted forms designed to meet state requirements.

Enter the required information to create your account and settle your order using PayPal or credit card. Select a suitable document type and retrieve your copy. Access each document you download in the My documents section. Simply navigate there to prepare a new version of the Connecticut Estate Planning Questionnaire and Worksheets. Even with properly drafted forms, it is still crucial to consider consulting your local attorney to verify that the completed sample is accurately filled out. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the Connecticut Estate Planning Questionnaire and Worksheets’ page.

- If you haven't used our website before, complete the registration process following these steps.

- Ensure the Connecticut Estate Planning Questionnaire and Worksheets is applicable in your residing state.

- Verify your choice by reviewing the description or by utilizing the Preview feature if it is available for the chosen document.

- Click Buy Now to commence the registration process and choose a payment plan that suits your needs.

Form popularity

FAQ

The 5 and 5 rule refers to the same tax framework, enabling beneficiaries to withdraw the lesser of $5,000 or 5% of the trust assets annually without incurring taxes. This rule provides flexibility in accessing funds while preserving the estate’s overall integrity. When filling out the Connecticut Estate Planning Questionnaire and Worksheets, grasping this rule helps you create a balanced strategy for asset distribution that benefits your loved ones.

The 5 or 5 rule allows a trust beneficiary to withdraw up to $5,000 or 5% of the trust's assets each year without being taxed. This rule aims to give beneficiaries some access to their inheritance while maintaining the tax-deferred status of the trust. Understanding this rule is crucial when completing a Connecticut Estate Planning Questionnaire and Worksheets. It ensures you maximize your beneficiaries' benefits within the trust structure.

One common mistake is not properly funding the trust. Parents might create a trust but forget to transfer assets into it. This can lead to complications later on, as the trust may not serve its intended purpose. Using resources like the Connecticut Estate Planning Questionnaire and Worksheets can help you identify the right assets to include and ensure your trust functions as you planned.

The threshold for probate in Connecticut is currently set at $40,000 in total estate value. This means that estates valued below this amount may be eligible for simplified estate administration. It's important to note that other considerations, such as types of assets, might influence this process. The Connecticut Estate Planning Questionnaire and Worksheets offer valuable insights to help you navigate your estate planning easily.

Not all estates must go through probate in Connecticut. Estates valued below the $40,000 threshold generally do not require probate. However, if your estate includes certain assets, like real estate, it may complicate matters. To explore your options, the Connecticut Estate Planning Questionnaire and Worksheets can assist you in understanding the specifics.

In Connecticut, the probate process typically applies to estates valued at greater than $40,000. If your estate's value falls below this threshold, you might not have to go through probate. However, various factors can affect this, so consulting with an expert is advisable. Comprehensive tools such as the Connecticut Estate Planning Questionnaire and Worksheets can help clarify this process.

To avoid probate in Connecticut, you can utilize strategies such as establishing a living trust or joint ownership of assets. By transferring assets into a living trust, they bypass probate upon your passing. Additionally, using payable-on-death and transfer-on-death designations can streamline asset transfer to beneficiaries. For detailed guidance, consider utilizing the Connecticut Estate Planning Questionnaire and Worksheets available on US Legal Forms.

An estate planning questionnaire is a tool designed to gather essential information needed for effective estate planning. It prompts you to consider your assets, beneficiaries, and preferences for healthcare decisions. Completing a Connecticut Estate Planning Questionnaire and Worksheets helps you organize your thoughts and provides a solid foundation for creating your estate plan. This structured approach can save time and ensure that all critical aspects are addressed.

The 5 by 5 rule in estate planning refers to a specific provision in trust agreements. It allows beneficiaries to withdraw up to $5,000 per year from a trust without incurring tax penalties. Understanding this rule can be beneficial for both grantors and beneficiaries when structuring your estate plan. The Connecticut Estate Planning Questionnaire and Worksheets can clarify how to implement this rule in your estate strategy.

You can effectively handle your estate planning by following a structured approach. Begin by defining your goals and understanding state laws. Utilize templates and resources, such as the Connecticut Estate Planning Questionnaire and Worksheets, to create necessary documents like wills and trusts. Be sure to review your plan regularly to adapt to any changes in your life or laws.