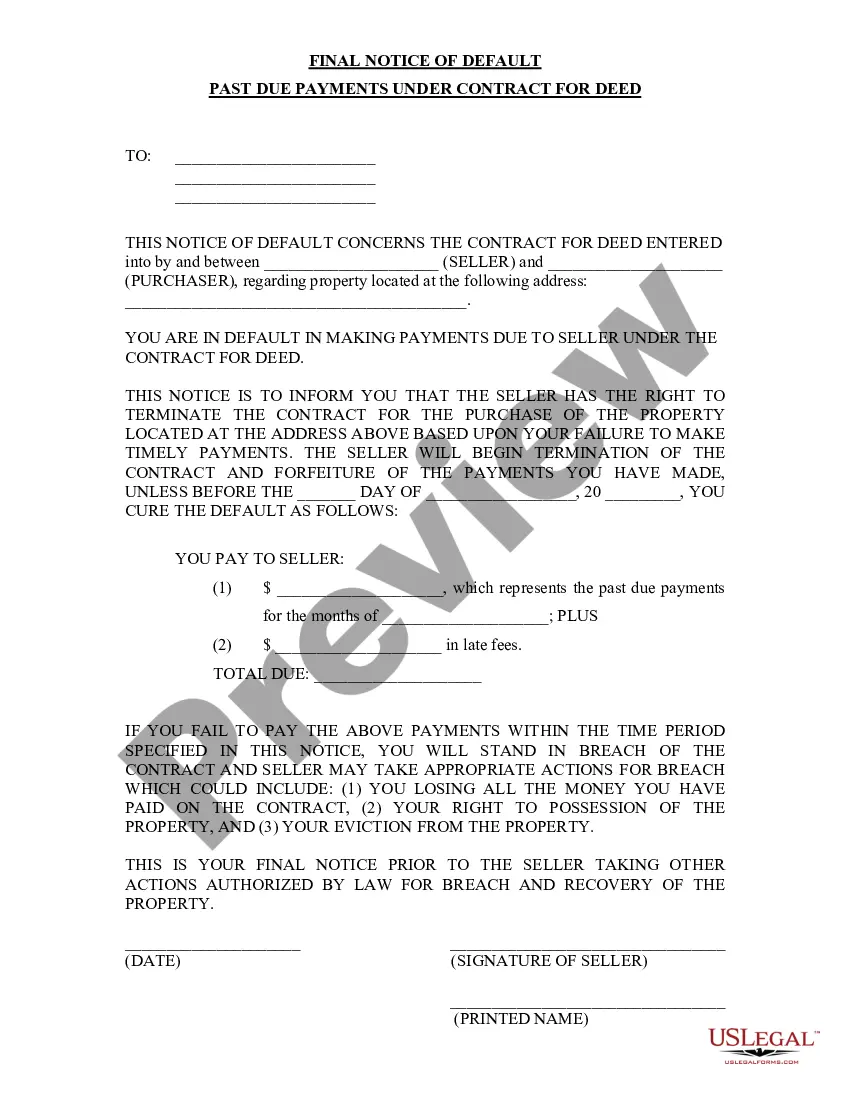

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out District Of Columbia Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable District of Columbia Final Notice of Default for Late Payments associated with Contract for Deed.

Our court-acceptable forms are crafted and frequently updated by experienced attorneys.

Ours is the most comprehensive Forms catalog on the internet and provides economical and precise samples for clients and legal professionals, as well as small to medium-sized businesses.

Press Buy Now if the document is what you seek. Create your account and complete payment via PayPal or credit/debit card. Download the form to your device and feel free to reuse it several times. Use the Search tool if you want to find another document template. US Legal Forms provides an extensive array of legal and tax forms and bundles for both business and personal requirements, including the District of Columbia Final Notice of Default for Late Payments associated with Contract for Deed. Over three million users have successfully employed our platform. Choose your subscription plan and obtain high-quality documents in just a few clicks.

- Templates are sorted into state-specific groups and many can be viewed before downloading.

- To obtain samples, users need to have a subscription and to Log In to their account.

- Press Download next to any template you wish and locate it in My documents.

- For individuals without a subscription, follow these steps to effortlessly find and download the District of Columbia Final Notice of Default for Late Payments related to Contract for Deed.

- Ensure to check that you acquire the correct form pertaining to the state it's intended for.

- Examine the form by reviewing the description and using the Preview functionality.

Form popularity

FAQ

A request for notice of default allows interested parties, such as investors or other creditors, to be notified when a borrower defaults on payments. In the context of the District of Columbia Final Notice of Default for Past Due Payments under a Contract for Deed, this request can provide important information regarding the status of an asset. Understanding this process can be beneficial for anyone interested in maintaining awareness of property health. If you're considering making such a request, obtaining professional assistance can streamline the process.

A default notice is a serious matter as it indicates a breach of your payment agreement within your Contract for Deed. The District of Columbia Final Notice of Default for Past Due Payments serves as a critical warning, signaling that failure to act could lead to severe outcomes such as foreclosure or legal disputes. It's essential to take this notice seriously and seek expert advice to explore your options for resolution. Addressing this quickly can help you avoid escalation and protect your home.

A written notice of default is a formal document that informs you of your overdue payments under your Contract for Deed. This notification, specifically a District of Columbia Final Notice of Default for Past Due Payments, outlines the steps necessary to rectify the situation. It typically includes information about the amount owed, deadlines for payments, and potential consequences if the default is not resolved. Understanding this document can help you make informed decisions moving forward.

Receiving a District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed marks a significant step in the collection process. This notice signals that you have fallen behind on your payments, and it serves as a formal warning. It is crucial to respond promptly, as ignoring this notice can lead to further legal actions, including potential foreclosure. Seek guidance to understand your options, which may include negotiating with your lender.

The 777 rule refers to a guideline that prohibits debt collectors from contacting individuals in certain circumstances. Specifically, if you inform a collector that you are represented by an attorney, they must cease communications with you directly. Understanding your rights under this rule is vital when managing issues related to the District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed.

The statute of limitations on debt collection in Washington D.C. is three years, similar to many states. This limitation applies to lawsuits aimed at recovering unpaid debts, including those related to the District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed. It’s important to be aware of this timeline to protect your rights.

Washington D.C. operates primarily as a tax lien jurisdiction rather than a tax deed state. This means that when property taxes are owed, a lien is placed on the property rather than immediate auctioning off of the deed. Knowing how this works can help you understand the implications if you receive a District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed.

In Washington D.C., the statute of limitations for debt collection is generally three years. This means creditors have three years to initiate legal action to recover debts before the right to sue expires. Understanding this timeframe is essential when dealing with past dues related to the District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed.

To file a notice of default, you typically need to prepare the document and have it properly documented. Then, you must submit it to the appropriate local office, such as the Recorder of Deeds in Washington D.C. Utilizing platforms like USLegalForms can simplify this process, providing templates and guidance for filing a District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed.

A recorded notice of default is a formal document that indicates a borrower has failed to meet their payment obligations. Specifically, in the context of the District of Columbia Final Notice of Default for Past Due Payments in connection with Contract for Deed, this document serves to inform all interested parties that the property may be at risk of foreclosure if the debt remains unpaid. Understanding this process is crucial for both borrowers and lenders to navigate potential risks and remedies.