This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

District of Columbia Articles of Incorporation for Domestic For-Profit Corporation

Description

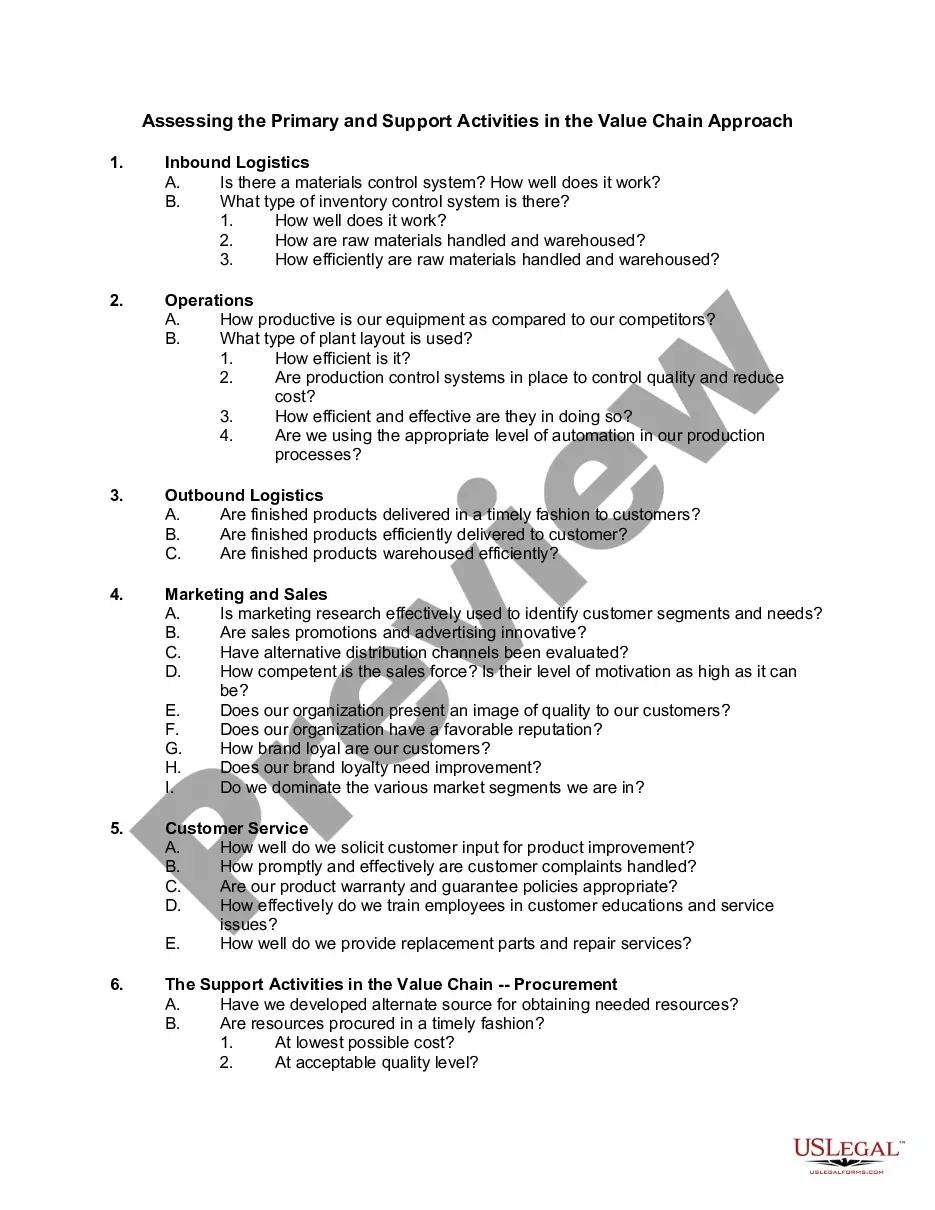

How to fill out District Of Columbia Articles Of Incorporation For Domestic For-Profit Corporation?

The more documents you need to make - the more worried you get. You can get thousands of District of Columbia Articles of Incorporation for Domestic For-Profit Corporation templates on the internet, still, you don't know those to rely on. Eliminate the headache to make getting samples easier employing US Legal Forms. Get professionally drafted forms that are published to meet state requirements.

If you currently have a US Legal Forms subscription, log in to the profile, and you'll see the Download key on the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation’s webpage.

If you have never used our website before, finish the registration process using these steps:

- Ensure the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation applies in the state you live.

- Re-check your choice by reading through the description or by using the Preview mode if they are provided for the chosen record.

- Click Buy Now to get started on the registration procedure and select a pricing program that fits your requirements.

- Provide the asked for details to create your profile and pay for your order with the PayPal or credit card.

- Pick a prefered file formatting and get your example.

Access every sample you download in the My Forms menu. Simply go there to fill in new copy of the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation. Even when having professionally drafted templates, it is still essential that you think about requesting the local attorney to double-check completed form to be sure that your record is accurately completed. Do more for less with US Legal Forms!

Form popularity

FAQ

Filing articles of organization in Washington, DC, involves several simple steps. Begin by accessing the DCRA's online filing system where you can fill out and submit your articles of incorporation directly. If you prefer, you can also mail your completed forms along with the requisite fees. Ensure you have all necessary information ready to facilitate the creation of your District of Columbia Articles of Incorporation for Domestic For-Profit Corporation.

To file articles of organization for a Limited Liability Company (LLC) in the District of Columbia, start by visiting the DCRA website. You will need to prepare the required documents, including your LLC's name and purpose. Use the online filing system for a quicker process, or submit your forms by mail. This step is crucial in establishing your District of Columbia Articles of Incorporation for Domestic For-Profit Corporation.

You can file articles of organization for a Domestic For-Profit Corporation in the District of Columbia either online or by mail. The online method offers a convenient and fast option through the Department of Consumer and Regulatory Affairs (DCRA) portal. Alternatively, you can complete the necessary forms and send them via postal mail to the DCRA. Both methods ensure that your District of Columbia Articles of Incorporation for Domestic For-Profit Corporation are processed efficiently.

Serving a corporation in Washington, DC requires following specific legal procedures. You can serve the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation by delivering legal documents to the corporation's registered agent or an officer. It's crucial to adhere to established guidelines to ensure that the service is valid and recognized by the court. Utilizing resources available through UsLegalForms can help ensure proper compliance during the service process.

To file Articles of Organization in Washington, DC, you must complete the appropriate form for your business structure. If you are forming a corporation, you will use the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation. Ensure you have all necessary information ready, including your business's name, registered agent, and purpose. Using UsLegalForms can facilitate this filing by providing step-by-step instructions and necessary documentation.

Setting up an S Corporation in Washington, DC involves forming a corporation first by filing the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation. After establishing your corporation, you'll need to file Form 2553 with the IRS to elect S Corporation status. This election allows your corporation to benefit from pass-through taxation, which means your business income will only be taxed at the individual level. Consulting resources like UsLegalForms can help navigate this process smoothly.

The registration time for a business in Washington, DC can vary based on the type of entity and the volume of applications received. Typically, if you file the District of Columbia Articles of Incorporation for Domestic For-Profit Corporation online, you may receive approval within a few business days. However, paper filings might take longer due to processing delays. To expedite your registration, consider using online services from platforms like UsLegalForms.

A domestic for-profit corporation refers to a business entity that exists to generate profit and is registered under local laws in a specific jurisdiction, like the District of Columbia. By securing District of Columbia Articles of Incorporation for Domestic For-Profit Corporation, you establish the legal foundation for your profit-seeking endeavors. This designation helps in clarifying your business's intentions and responsibilities.

The primary difference is structural. A domestic for-profit corporation is a distinct legal entity that offers shareholders limited liability, whereas an LLC or limited liability company combines features of a corporation and a partnership. While both can file for District of Columbia Articles of Incorporation for Domestic For-Profit Corporation, an LLC provides more flexibility in management and tax treatment.

An example of a domestic company could be a restaurant or a retail store that is incorporated in the District of Columbia. By acquiring District of Columbia Articles of Incorporation for Domestic For-Profit Corporation, such companies are legally recognized and can operate freely within the district's boundaries. Each domestic business showcases its commitment to the local economy.