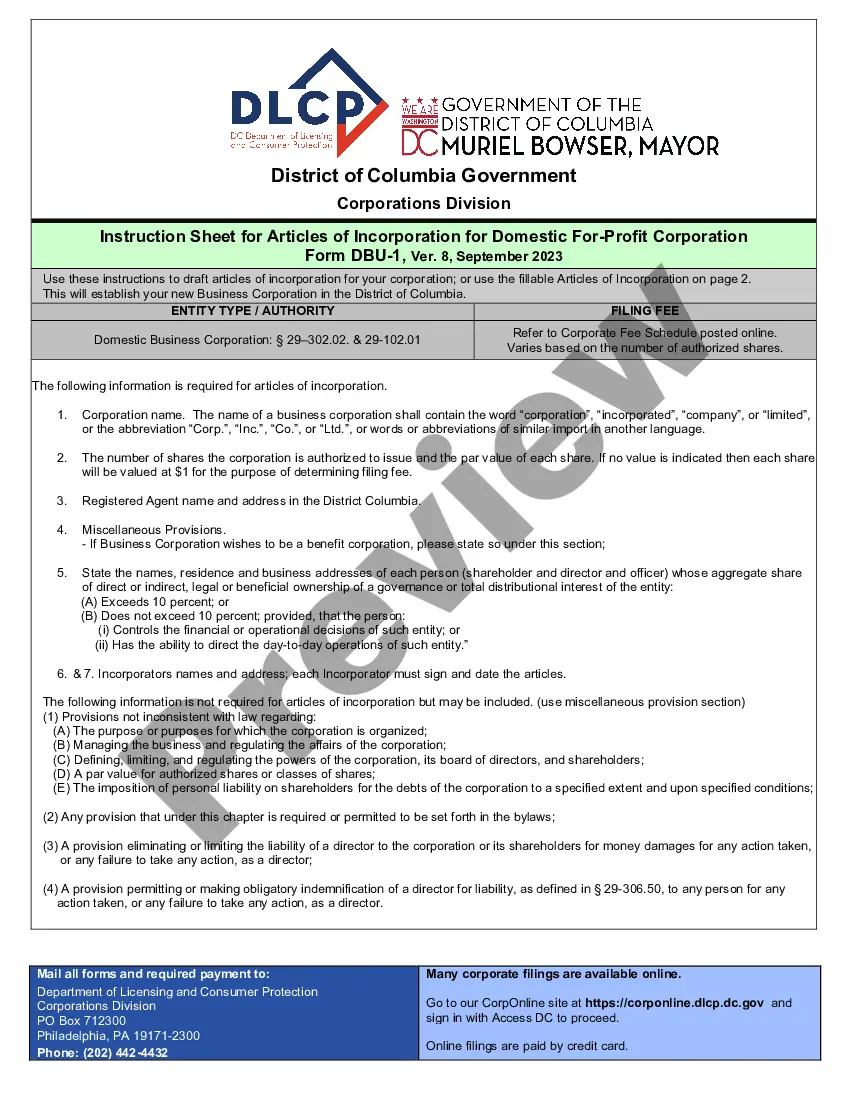

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation

Description

How to fill out District Of Columbia Articles Of Incorporation Certificate - Domestic Nonprofit Corporation?

The greater the number of documents you need to prepare, the more anxious you become.

You can discover numerous District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation templates online; however, you may not know which ones to trust.

Remove the stress and streamline your search for samples with US Legal Forms. Obtain professionally crafted documents tailored to meet state regulations.

Submit the required information to create your account and settle your payment via PayPal or credit card. Choose a preferred file format and download your sample. Access all the files you receive in the My documents section. Simply visit there to fill out a fresh copy of the District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation. Even with professionally prepared templates, it remains crucial to consider consulting a local lawyer to review your completed document to ensure it is accurately filled out. Achieve more for less with US Legal Forms!

- If you presently possess a US Legal Forms subscription, Log In to your account, and you will find the Download button on the District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation’s page.

- If this is your first time utilizing our platform, complete the sign-up process by following these steps.

- Ensure the District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation complies with your state's laws.

- Verify your selection by reviewing the description or utilizing the Preview mode if available for the chosen document.

- Click Buy Now to initiate the registration process and choose a pricing option that accommodates your requirements.

Form popularity

FAQ

Incorporating a nonprofit organization in DC involves several key steps. First, you must select a unique name for your organization and check its availability. Then, prepare your articles of incorporation, which will become your District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation upon approval. Finally, file the necessary documents with the DC Department of Consumer and Regulatory Affairs, and consider using resources from USLegalForms to navigate the requirements efficiently.

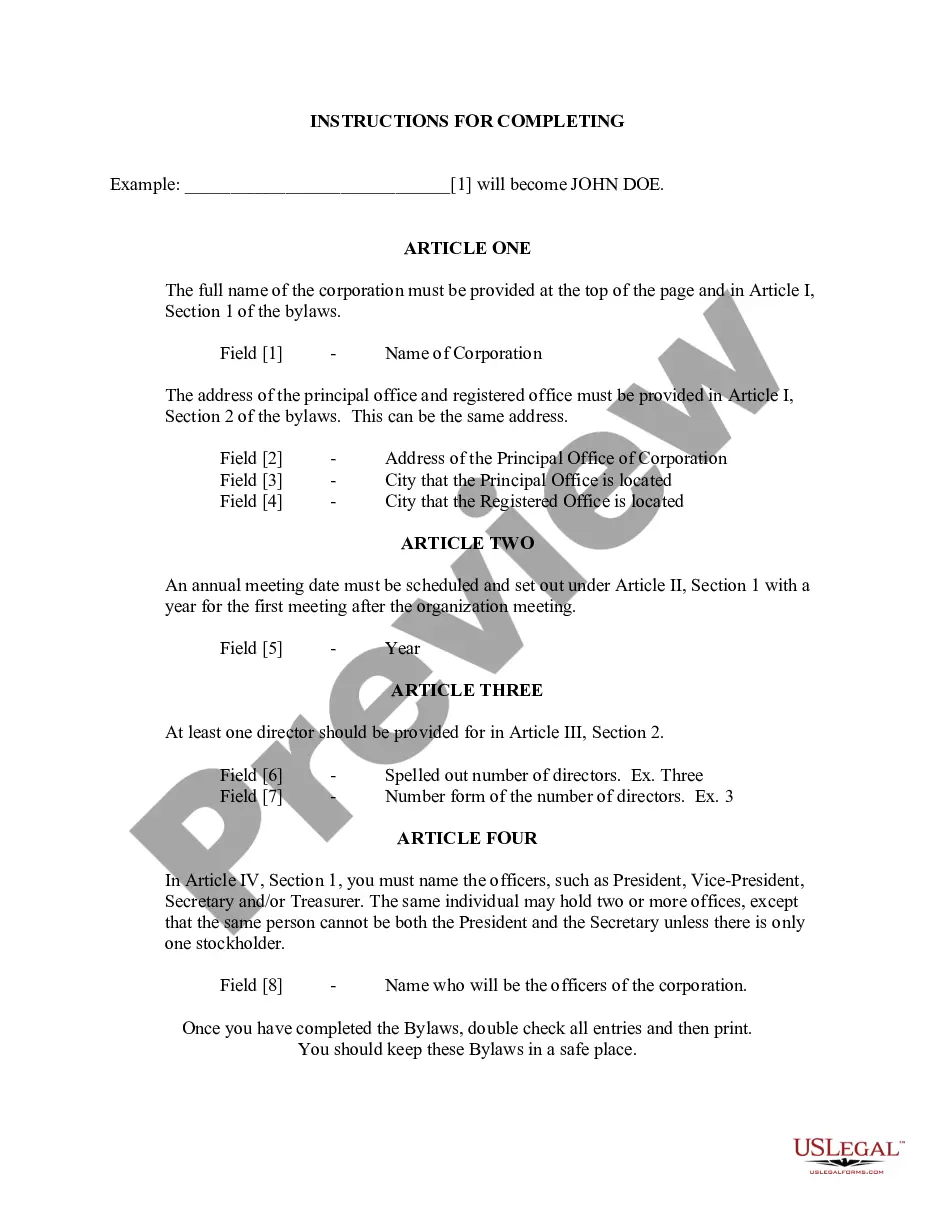

To write articles of incorporation for a non-profit organization, you'll need to clearly outline your organization's purpose, define its structure, and provide details about the governing body. Ensure you include all necessary elements that comply with District of Columbia regulations. Using the proper format and language is essential, as this document serves as your District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation. Leveraging platforms like USLegalForms can simplify this process by providing templates and guidance to help you create compliant articles.

A domestic nonprofit corporation is neither an AC Corporation nor an S Corporation. These designations relate to specific tax classifications for profit-making entities. Instead, a domestic nonprofit corporation aims to achieve a charitable purpose without distributing profits to shareholders. If you're looking to form such an organization, the District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation will guide you through the necessary steps.

The primary difference lies in their structure and purpose. A cooperative serves its members by providing services or resources and may distribute profits, while a nonprofit organization usually channels any excess revenue back into its mission. Both benefit communities in unique ways, and when establishing either in the District of Columbia, it is essential to reference the appropriate Articles of Incorporation Certificate.

A domestic nonprofit corporation focuses on activities that support a social mission and does not distribute profits to members. In contrast, a nonprofit cooperative corporation allows members to collaborate and share resources for mutual benefit, often involving some level of profit-sharing among participants. Both forms require specific documentation, including the District of Columbia Articles of Incorporation Certificate, but the operational frameworks and member benefits vary significantly.

The three main types of nonprofit corporations are public charities, private foundations, and social advocacy organizations. Public charities engage directly with the public and often provide services or support, while private foundations typically focus on grant-making. Social advocacy organizations work to influence public policy and raise awareness for specific causes. Understanding these categories can help you navigate the requirements of the District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation.

A domestic non-profit corporation is an organization formed under the laws of the District of Columbia that operates for a public or social benefit, rather than for profit. This type of corporation aims to serve the community or a specific cause, relying on donations, grants, and volunteers. Unlike traditional businesses, domestic non-profit corporations must adhere to strict guidelines and regulations as defined by the District of Columbia Articles of Incorporation Certificate.

To qualify as a 501c3 nonprofit organization, you must demonstrate that your organization serves a charitable purpose and operates within the legal framework set by the IRS. You also need to prepare articles of incorporation and conduct the necessary filing to obtain a District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation. Compliance with federal and local laws is critical to maintaining your tax-exempt status.

Yes, a 501c3 organization requires articles of incorporation to be recognized as a nonprofit corporation. These documents outline your organization’s purpose, management structure, and operational guidelines. Securing a District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation is essential for formal recognition and establishing a solid foundation for your nonprofit.

To establish a 501c3 organization, you typically need articles of incorporation, bylaws, and a conflict of interest policy. The articles of incorporation must align with IRS requirements for 501c3 status. Obtaining a District of Columbia Articles of Incorporation Certificate - Domestic Nonprofit Corporation ensures your organization meets local regulations and can operate legally.