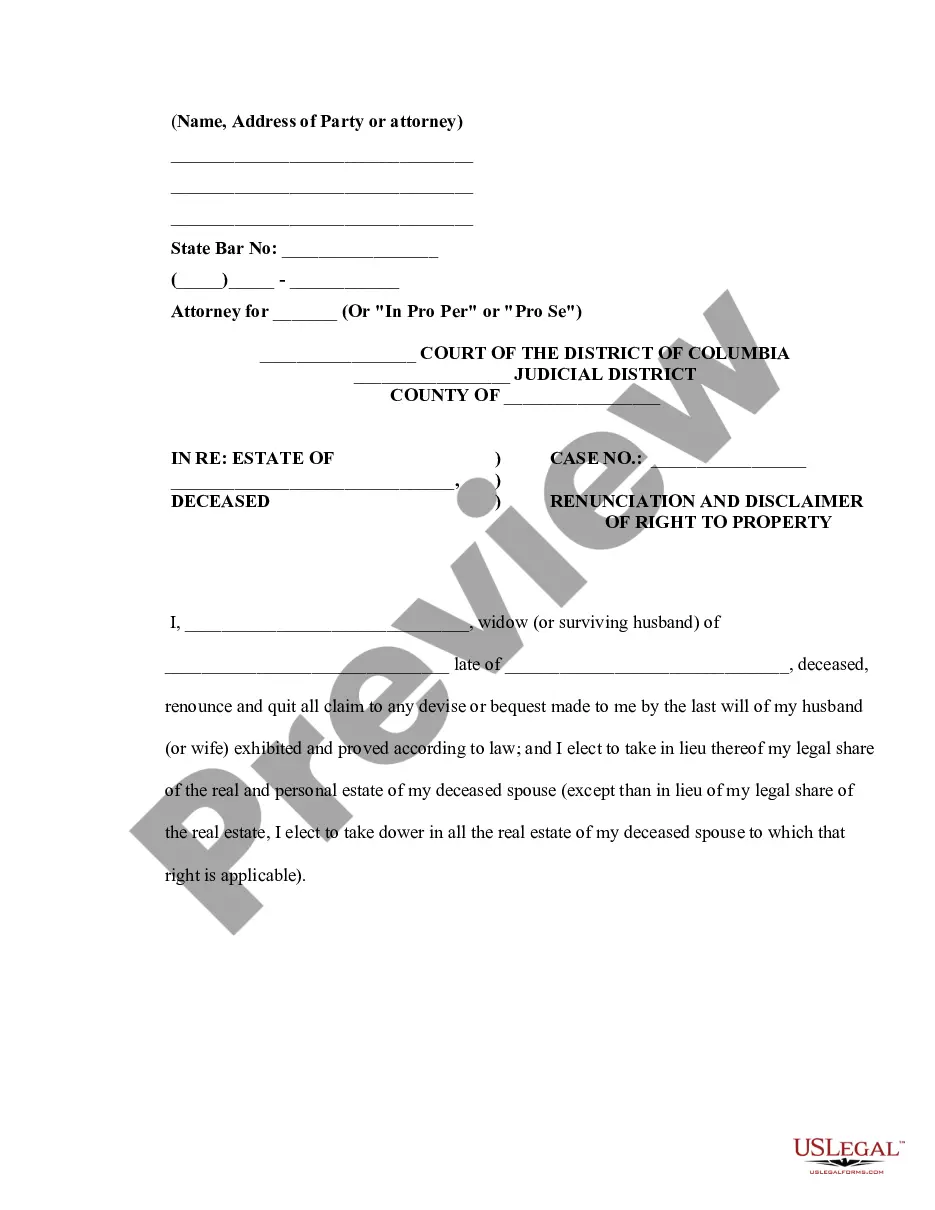

This form is a Renunciation and Disclaimer of Property acquired by a widow/widower due to the death of her/his spouse. The surviving spouse elects to take dower in all the real estate of her/his deceased spouse in lieu of her/his legal share of the real estate and personal estate of the deceased spouse. The form also contains a state specific acknowledgment and a certificate to verify delivery.

District of Columbia Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out District Of Columbia Renunciation And Disclaimer Of Property From Will By Testate?

The more papers you need to create - the more nervous you get. You can get thousands of District of Columbia Renunciation And Disclaimer of Property from Will by Testate templates on the web, however, you don't know which of them to have confidence in. Eliminate the hassle to make getting samples more straightforward employing US Legal Forms. Get accurately drafted forms that are created to satisfy state specifications.

If you already possess a US Legal Forms subscription, log in to the profile, and you'll find the Download button on the District of Columbia Renunciation And Disclaimer of Property from Will by Testate’s page.

If you’ve never used our platform earlier, finish the sign up procedure using these instructions:

- Ensure the District of Columbia Renunciation And Disclaimer of Property from Will by Testate is valid in the state you live.

- Re-check your selection by reading the description or by using the Preview functionality if they’re provided for the selected file.

- Click Buy Now to start the signing up process and select a pricing program that meets your preferences.

- Provide the asked for data to create your account and pay for the order with your PayPal or credit card.

- Choose a hassle-free file type and obtain your duplicate.

Find every file you download in the My Forms menu. Simply go there to produce a fresh copy of the District of Columbia Renunciation And Disclaimer of Property from Will by Testate. Even when using professionally drafted templates, it’s still important that you think about asking the local attorney to double-check filled in form to make certain that your record is accurately completed. Do more for less with US Legal Forms!

Form popularity

FAQ

In the District of Columbia, the time limit for disclaiming an inheritance typically stands at nine months from the date of the decedent’s death. Meeting this deadline is critical, as it ensures that the renunciation is valid and effective. To assist you in this matter, the District of Columbia Renunciation And Disclaimer of Property from Will by Testate serves as a guiding reference that outlines these important timelines.

When it comes to disallowing an inheritance with the IRS, you must file a disclaimer according to both state laws and federal tax guidelines. It's important to notify the IRS of your decision not to accept the property, as this can influence tax responsibilities. Always refer to the District of Columbia Renunciation And Disclaimer of Property from Will by Testate, which provides essential insights on how to navigate these processes smoothly.

Writing a disclaimer of inheritance in the District of Columbia involves drafting a straightforward document that expresses your decision not to accept the inheritance. You should include essential details such as your name, the name of the deceased, and a clear statement of your intention to renounce the inheritance. Utilizing the District of Columbia Renunciation And Disclaimer of Property from Will by Testate can provide you with a helpful framework to create your disclaimer effectively.

To disclaim an inherited property in the District of Columbia, you must provide a written renunciation to the relevant authorities, typically the executor of the estate. This disclaimer should clearly state your intention not to accept the property, adhering to the District of Columbia Renunciation And Disclaimer of Property from Will by Testate. It is essential to complete this process within the statutory time frame, which helps ensure that the property passes to the next beneficiary.

For a will to be valid in the District of Columbia, it must be in writing, signed by the testator, and witnessed by at least two disinterested individuals. Additionally, the testator must be of sound mind and at least 18 years old when creating the will. Understanding these criteria is vital because any invalidity affects heirs and the implications of the District of Columbia Renunciation And Disclaimer of Property from Will by Testate.

The Unclaimed Property Act in the District of Columbia governs how property that has been abandoned or unclaimed is handled by the state. Under this act, property, including unclaimed inheritances, may eventually revert to the government if not claimed within a specific time frame. Understanding this act can be beneficial if you are considering renouncing an inheritance and its implications.

In many cases, inheritance does not need to be declared unless it is part of a taxable estate. However, if you are involved in legal proceedings or certain financial transactions, revealing your inheritance may be necessary. The District of Columbia Renunciation And Disclaimer of Property from Will by Testate can impact how you declare or manage inherited assets.

A disclaimer in the DC Code refers to a legal declaration that a beneficiary is renouncing their right to inherit property. Specifically, under the District of Columbia Renunciation And Disclaimer of Property from Will by Testate, this allows individuals to refuse an inheritance for various reasons, such as financial planning or family dynamics. Understanding this procedure can be crucial for effective estate management.

When you file a disclaimer as per the District of Columbia Renunciation And Disclaimer of Property from Will by Testate, the property will not pass to you. Instead, it usually follows the rules of intestacy or goes to the next beneficiary named in the will. This process can help you avoid unwanted tax liabilities or legal entanglements associated with the inheritance.

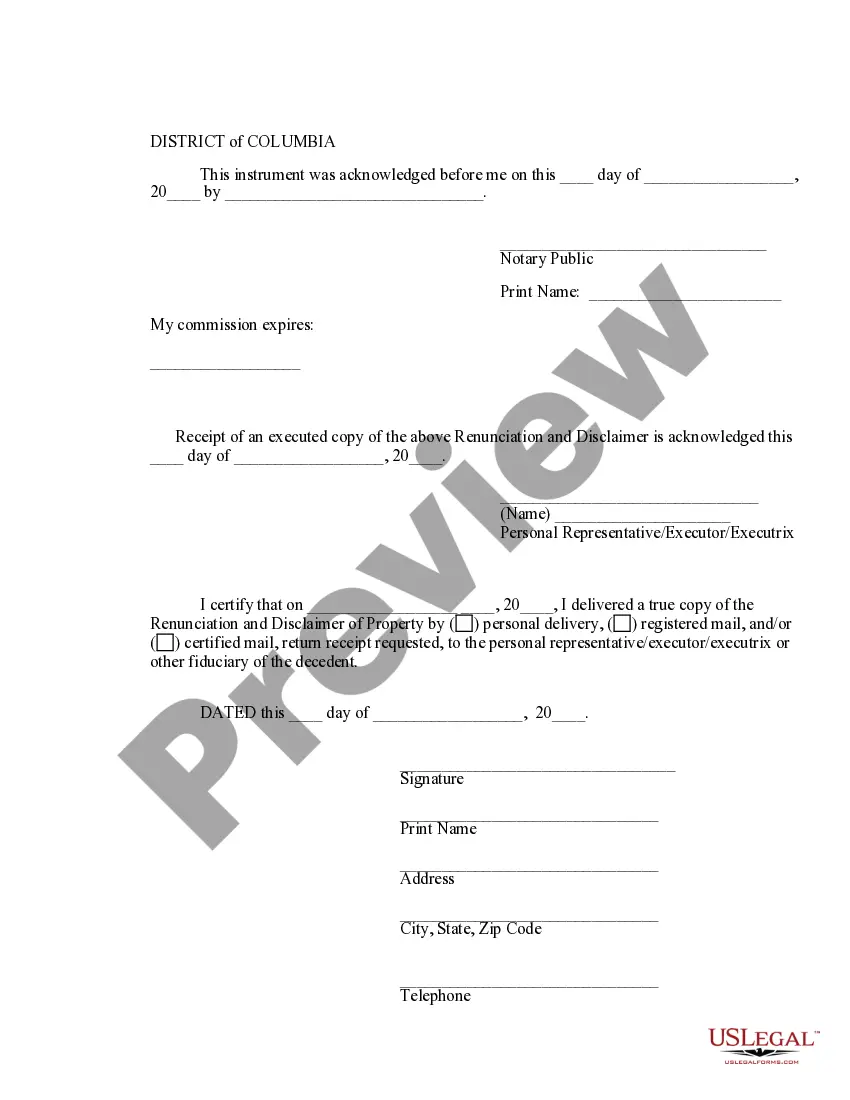

Yes, a disclaimer of inheritance under the District of Columbia Renunciation And Disclaimer of Property from Will by Testate typically must be executed in writing, and it is advisable to have it notarized. Notarization ensures that the document is valid and can protect you against future disputes. For proper guidance, consider using a service like uslegalforms to help you understand the requirements.