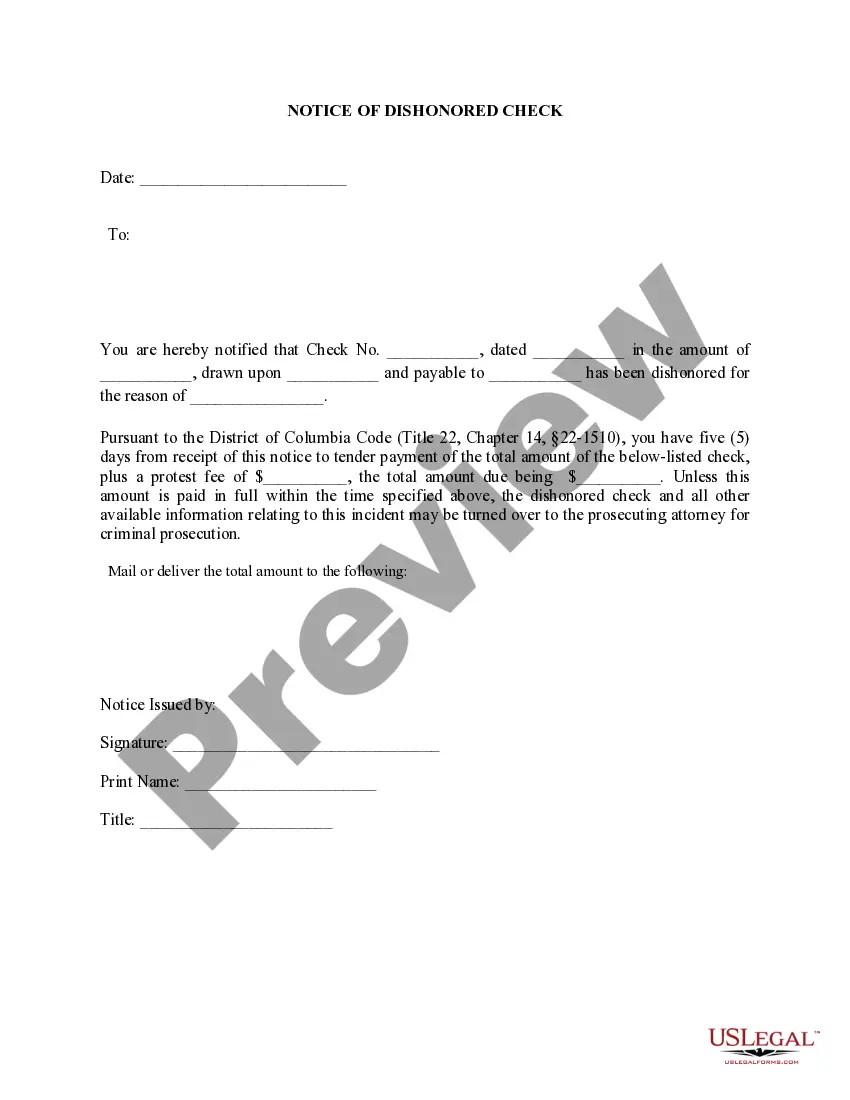

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Bounced Check Definition

Description

How to fill out District Of Columbia Notice Of Dishonored Check - Criminal - Keywords: Bad Check, Bounced Check?

The more paperwork you should make - the more stressed you become. You can get thousands of District of Columbia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check templates on the web, however, you don't know which of them to have confidence in. Eliminate the headache and make detecting samples far more convenient using US Legal Forms. Get expertly drafted forms that are composed to go with the state demands.

If you already possess a US Legal Forms subscription, log in to the profile, and you'll find the Download key on the District of Columbia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check’s webpage.

If you have never tried our service earlier, complete the sign up process with the following steps:

- Make sure the District of Columbia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check applies in your state.

- Double-check your option by reading the description or by using the Preview mode if they’re available for the chosen file.

- Simply click Buy Now to get started on the registration procedure and select a rates plan that suits your expectations.

- Provide the asked for information to create your profile and pay for the order with the PayPal or bank card.

- Choose a prefered document type and get your copy.

Access each file you download in the My Forms menu. Simply go there to fill in new version of the District of Columbia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check. Even when using professionally drafted forms, it is still vital that you consider asking your local legal professional to double-check filled out sample to ensure that your document is accurately completed. Do more for less with US Legal Forms!