Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

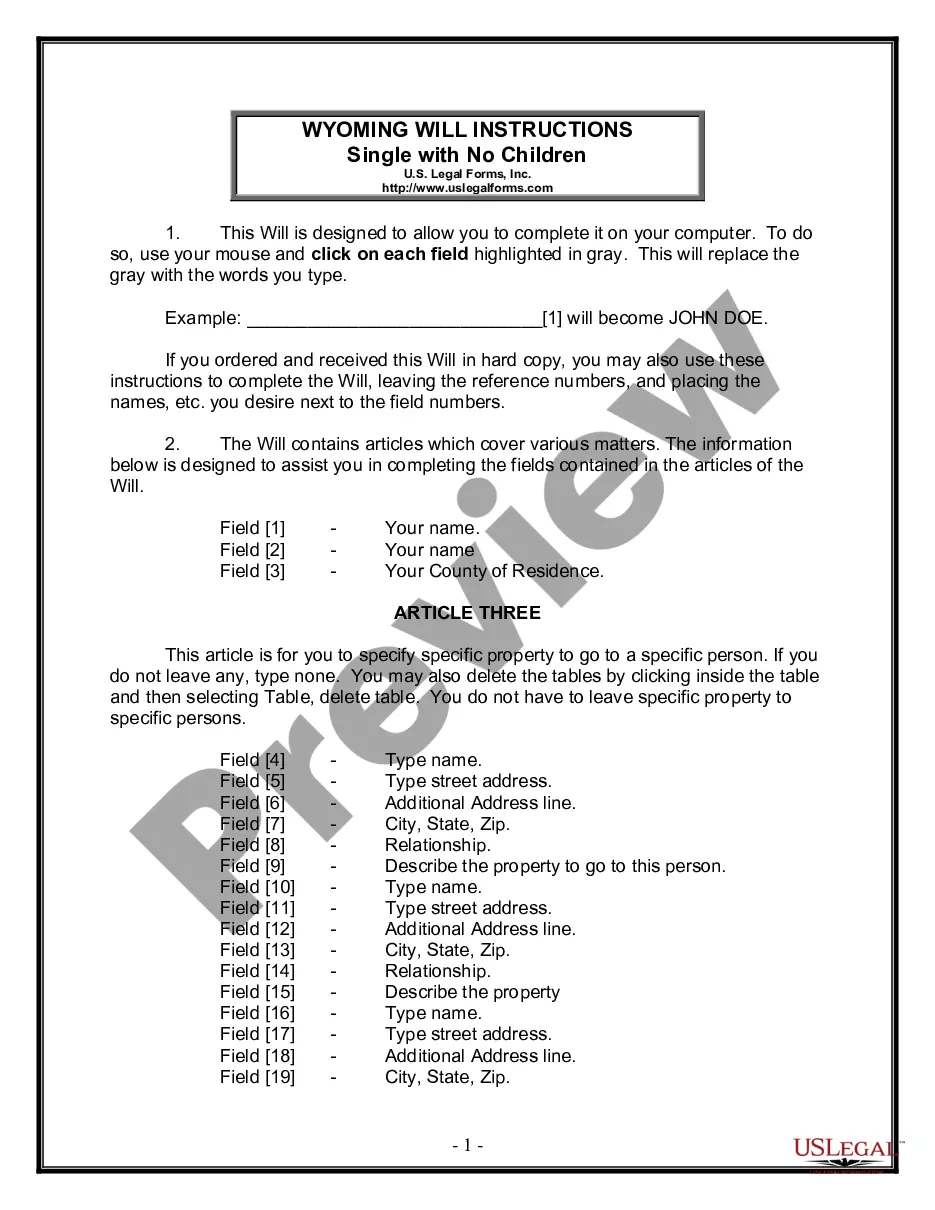

How to fill out District Of Columbia Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

The more paperwork you need to create - the more nervous you become. You can get a huge number of District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 blanks on the internet, still, you don't know those to trust. Get rid of the hassle and make detecting samples more straightforward with US Legal Forms. Get accurately drafted documents that are composed to satisfy state requirements.

If you already have a US Legal Forms subscription, log in to your account, and you'll find the Download button on the District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13’s webpage.

If you have never tried our platform before, complete the signing up process with the following instructions:

- Ensure the District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 is valid in your state.

- Re-check your option by reading the description or by using the Preview function if they are available for the selected file.

- Click Buy Now to begin the registration process and select a rates program that suits your requirements.

- Provide the requested details to create your account and pay for the order with the PayPal or bank card.

- Select a convenient file formatting and get your copy.

Access every file you obtain in the My Forms menu. Simply go there to fill in new version of the District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13. Even when preparing professionally drafted forms, it’s still vital that you consider asking the local legal professional to twice-check filled out form to make sure that your record is accurately filled out. Do more for less with US Legal Forms!

Form popularity

FAQ

Filing Chapter 7 requires specific paperwork to ensure you meet all legal requirements. Essential documents include a completed bankruptcy petition, schedules of assets and liabilities, and a statement of financial affairs. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 simplifies this process by providing you with all necessary forms and guidance. By organizing your paperwork effectively, you can navigate your filing with confidence.

Choosing between Chapter 7 and Chapter 13 depends on your financial situation and goals. Chapter 7 provides a quicker discharge of unsecured debts, while Chapter 13 allows you to keep your property by repaying debts over time. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 can help you understand the implications of each chapter, making your decision process easier. Be sure to consider your income, types of debts, and whether you own significant assets.

Filing Chapter 13 by yourself requires careful preparation and attention to detail. You need to complete the appropriate forms, outline a repayment plan, and submit them to the bankruptcy court. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 provides essential resources and guidance to help you navigate this process successfully.

To convert from Chapter 7 to Chapter 13, you must file a motion with the bankruptcy court. You will need to provide updated financial information and prepare a repayment plan. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 may assist you through this process, ensuring you meet all necessary requirements and deadlines.

Choosing between Chapter 7 and Chapter 13 depends on your financial situation. Chapter 7 typically allows for quicker debt discharge, while Chapter 13 involves a repayment plan over three to five years. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 can help clarify the benefits of each option and guide you in making the best choice for your needs.

Whether to file Chapter 7 or Chapter 13 depends on your financial situation and goals. Chapter 7 allows for quick debt relief but may result in asset liquidation, while Chapter 13 provides a repayment plan, allowing you to keep your assets. The District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 can help you understand these options better. Ultimately, reviewing your unique circumstances and consulting with a professional can clarify which option is best for you.

To convert a Chapter 7 bankruptcy to Chapter 13, you need to file a motion with the bankruptcy court. This involves submitting a conversion request along with the proper forms included in the District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13. While filling out these forms, you should also include a repayment plan that meets the court's requirements. Leveraging US Legal Forms can make this process more straightforward.

To file for Chapter 13 bankruptcy on your own, begin by gathering your financial documents, such as income statements and debts. Next, utilize the District of Columbia Bankruptcy Guide and Forms Package for Chapters 7 or 13 to complete the necessary paperwork. After filling out your forms, submit them to the appropriate court and attend the required hearing. This process can be complex, so consider using resources like US Legal Forms to ensure accuracy.