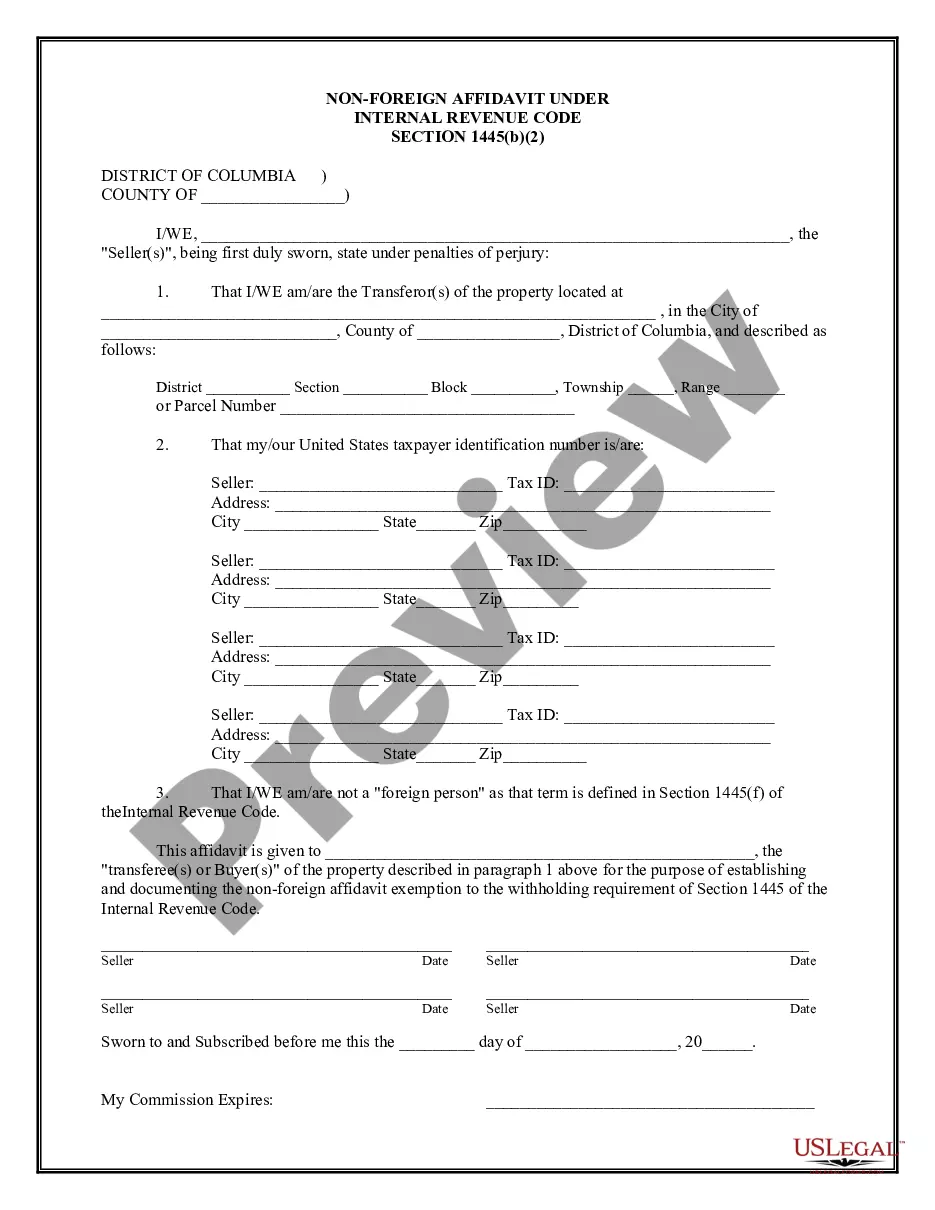

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

District of Columbia Non-Foreign Affidavit Under IRC 1445

Description Non Foreign Affidavit District Of Columbia

How to fill out District Of Columbia Non-Foreign Affidavit Under IRC 1445?

The more papers you need to create - the more nervous you are. You can get a huge number of District of Columbia Non-Foreign Affidavit Under IRC 1445 templates on the web, however, you don't know those to rely on. Remove the hassle to make detecting exemplars far more convenient with US Legal Forms. Get accurately drafted documents that are written to meet state requirements.

If you already have a US Legal Forms subscription, log in to the profile, and you'll find the Download button on the District of Columbia Non-Foreign Affidavit Under IRC 1445’s web page.

If you’ve never used our platform before, complete the registration procedure using these steps:

- Ensure the District of Columbia Non-Foreign Affidavit Under IRC 1445 applies in your state.

- Double-check your option by reading the description or by using the Preview function if they are available for the selected record.

- Click on Buy Now to get started on the signing up process and select a rates plan that suits your expectations.

- Provide the requested details to make your profile and pay for your order with the PayPal or bank card.

- Choose a practical file formatting and obtain your sample.

Find every template you obtain in the My Forms menu. Simply go there to fill in new version of the District of Columbia Non-Foreign Affidavit Under IRC 1445. Even when preparing properly drafted templates, it is still crucial that you consider asking your local legal representative to re-check filled in sample to be sure that your record is correctly filled in. Do more for less with US Legal Forms!

Form popularity

FAQ

The 1445 form refers to the IRS form used for reporting transfers of real estate by foreign persons, as mandated by FIRPTA. When a property is sold, the buyer usually needs to ensure that the seller provides a District of Columbia Non-Foreign Affidavit Under IRC 1445 as part of this process. This form protects buyers from unexpected tax liabilities and confirms that the seller is not a foreign entity.

The FIRPTA affidavit, which includes the District of Columbia Non-Foreign Affidavit Under IRC 1445, is typically provided by the seller of the real estate property. In many cases, real estate agents or attorneys facilitate the process for their clients to ensure accuracy and compliance. Engaging a legal service like USLegalForms can simplify this process, ensuring that the affidavit is correctly prepared and submitted.

foreign status affidavit is a document that certifies an individual or entity does not meet the criteria of a foreign person under U.S. tax law. This affidavit is particularly important for transactions involving real estate, as it helps ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA). By obtaining a District of Columbia NonForeign Affidavit Under IRC 1445, parties can avoid withholding taxes that typically apply to foreign sellers.

A foreign person under the Foreign Investment in Real Property Tax Act (FIRPTA) is generally defined as a non-resident alien or a foreign corporation, partnership, trust, or estate. Specifically, if you are not a U.S. citizen or green card holder, you fall under this definition. Understanding whether you qualify as a foreign person is crucial when executing a District of Columbia Non-Foreign Affidavit Under IRC 1445. Engaging with platforms like US Legal Forms can help clarify your status and ensure compliance with FIRPTA regulations.

The affidavit of non-foreign status is a legal document confirming that the seller of property is not a foreign individual, as defined by U.S. tax regulations. This affidavit is vital for avoiding withholding tax under IRC section 1445. Specifically, the District of Columbia Non-Foreign Affidavit Under IRC 1445 serves this purpose, streamlining real estate transactions by providing necessary proof. If you need templates or assistance, USLegalForms can help you navigate the process effectively.

Yes, a FIRPTA affidavit, including the District of Columbia Non-Foreign Affidavit Under IRC 1445, typically needs to be notarized. Notarization provides an extra layer of verification that the information presented is true and accurate. This process safeguards all parties involved in the transaction, affirming that the seller is not a foreign entity. For clear guidelines on notarization requirements, check USLegalForms.

To fill out form 8288 B for the District of Columbia Non-Foreign Affidavit Under IRC 1445, start by providing your personal information, including your name and address. Next, specify details about the property being transferred, such as the address and the seller's information. It's essential to sign and date the form at the end to validate it. If you need assistance, USLegalForms offers resources to help you complete the form correctly.

To avoid FIRPTA withholding, you can submit a District of Columbia Non-Foreign Affidavit Under IRC 1445 if you qualify as a U.S. person. This affidavit verifies your non-foreign status, eliminating the need for withholding. Ensure that all paperwork is correctly filled out to prevent issues. US Legal Forms provides resources and templates to help you easily navigate this process.

To navigate around FIRPTA, sellers often use the District of Columbia Non-Foreign Affidavit Under IRC 1445. This affidavit helps establish that the seller is not a foreign person, thus exempting them from withholding taxes. It’s essential to properly complete and submit this document to avoid complications during the sale process. Using platforms like US Legal Forms can guide you in preparing this affidavit accurately.