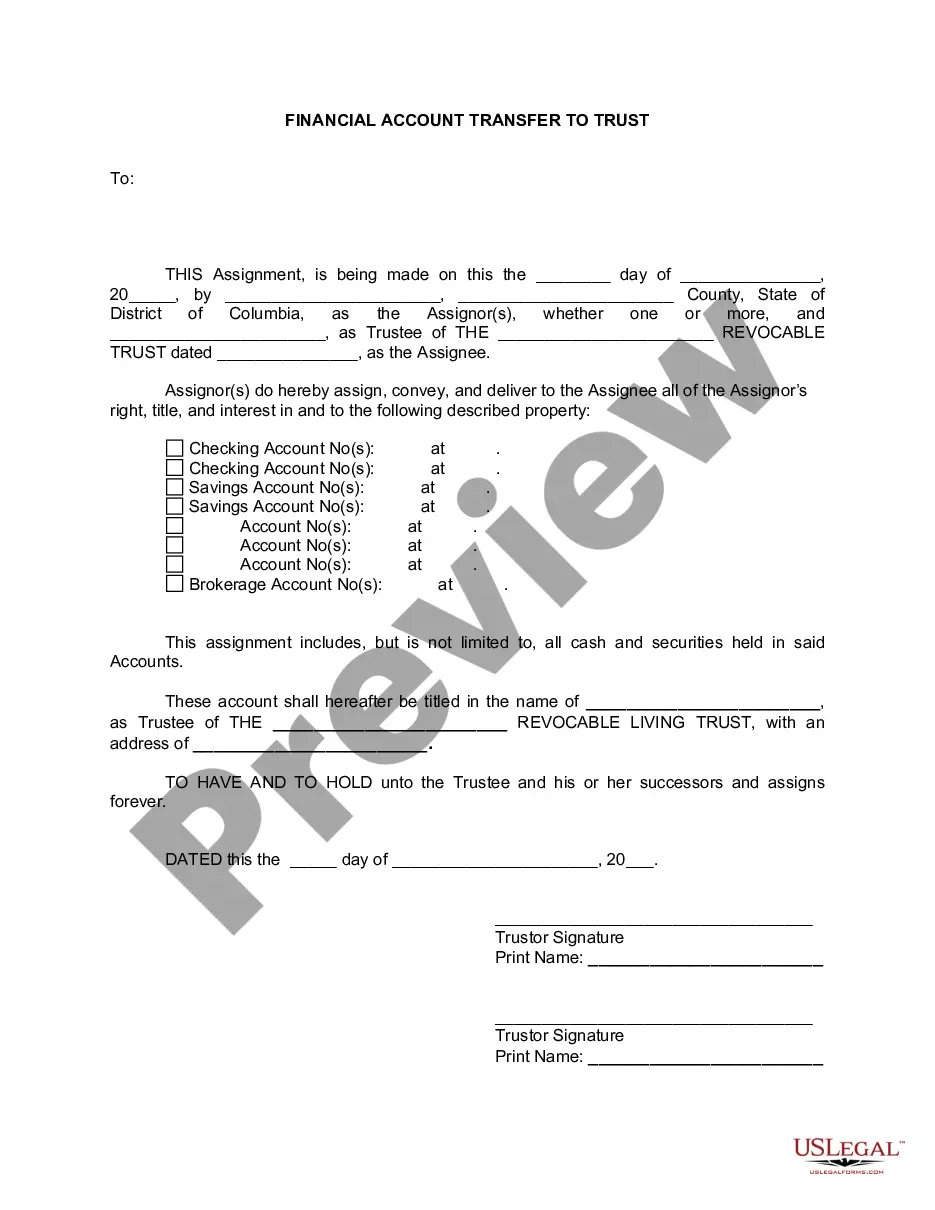

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

District of Columbia Financial Account Transfer to Living Trust

Description

How to fill out District Of Columbia Financial Account Transfer To Living Trust?

The larger the quantity of documents you have to produce - the more uneasy you become.

You can discover a vast array of District of Columbia Financial Account Transfer to Living Trust models online, but you are unsure which ones to trust.

Eliminate the frustration and simplify obtaining samples using US Legal Forms. Acquire professionally crafted papers that adhere to state regulations.

Access every file you obtain in the My documents menu. Simply navigate there to produce a new copy of your District of Columbia Financial Account Transfer to Living Trust. Even with professionally crafted templates, it’s still essential to consider consulting with a local attorney to review the completed form to ensure your document is accurately filled out. Do more with less using US Legal Forms!

- Ensure the District of Columbia Financial Account Transfer to Living Trust is applicable in your state.

- Verify your choice by reading the description or utilizing the Preview option if available for the selected document.

- Select Buy Now to initiate the registration process and opt for a pricing plan that suits your requirements.

- Provide the necessary information to create your account and pay for your order using your PayPal or credit card.

- Choose a convenient file format and download your sample.

Form popularity

FAQ

Several accounts may be best kept outside of a trust. For example, retirement accounts like 401(k)s and IRAs should typically remain in your name to maintain their tax advantages. Additionally, health savings accounts should also be excluded from the trust. It's crucial to understand how these distinctions impact the overall estate planning strategy, ensuring proper management without complications during a District of Columbia Financial Account Transfer to Living Trust.

To transfer your checking account to your living trust, start by contacting your bank for the necessary steps. Typically, you will need to provide your bank with the trust agreement, identification, and possibly other required forms. This process allows for a seamless District of Columbia Financial Account Transfer to Living Trust, ensuring that your checking account is governed by the decisions you've made regarding your trust.

Yes, you can certainly include your checking account in a trust. This action allows your assets to be managed according to the terms of your trust, ensuring a smoother transition of your finances to your beneficiaries upon your death. It's essential to reach out to your bank to understand their process for completing a District of Columbia Financial Account Transfer to Living Trust. Properly done, this transfer secures your assets while providing peace of mind.

Transferring your bank account to a living trust is straightforward. You should begin by visiting your bank or credit union to request their specific transfer policies. They may require the trust documentation and your identification. By facilitating the District of Columbia Financial Account Transfer to Living Trust this way, you ensure that your account is managed according to your trust’s terms, even after your passing.

To transfer your brokerage account to a living trust, you must first contact your brokerage firm to determine their specific requirements. Generally, you will need to provide the trust agreement, complete their transfer forms, and possibly include a copy of the trust’s tax identification number. Once they verify your documentation, they will help facilitate the District of Columbia Financial Account Transfer to Living Trust. This process ensures that your investments are protected according to your wishes.

One significant mistake parents often make when setting up a trust fund is failing to fund the trust adequately. Without the right assets, such as real estate or financial accounts, the trust won't serve its intended purpose of protecting assets for your beneficiaries. Additionally, neglecting to clearly outline the terms and conditions of the trust can lead to confusion and potential legal issues. Proper planning can ensure a smooth District of Columbia Financial Account Transfer to Living Trust, allowing you to secure your family's future.

One downside of putting assets in a trust is the loss of control over them while alive. Once assets are transferred, your parents may have limited access to them, depending on the trust's terms. Moreover, they may face periodic legal reviews to ensure compliance. Evaluating these aspects is essential when considering a District of Columbia Financial Account Transfer to Living Trust, and using platforms like US Legal Forms can help simplify this process.

Your parents should weigh the benefits and drawbacks before deciding whether to place their assets in a trust. A trust can provide protection and streamline the transfer of assets, especially in the District of Columbia. However, it may not be necessary for everyone. Assessing their specific circumstances can help determine if a District of Columbia Financial Account Transfer to Living Trust is the right choice.

One disadvantage of a family trust is the potential for misunderstanding among family members. If beneficiaries do not fully grasp the terms of the trust, conflicts may arise later. Additionally, setting up a family trust can involve legal fees and maintenance costs. It is important to consider these factors when planning a District of Columbia Financial Account Transfer to Living Trust.