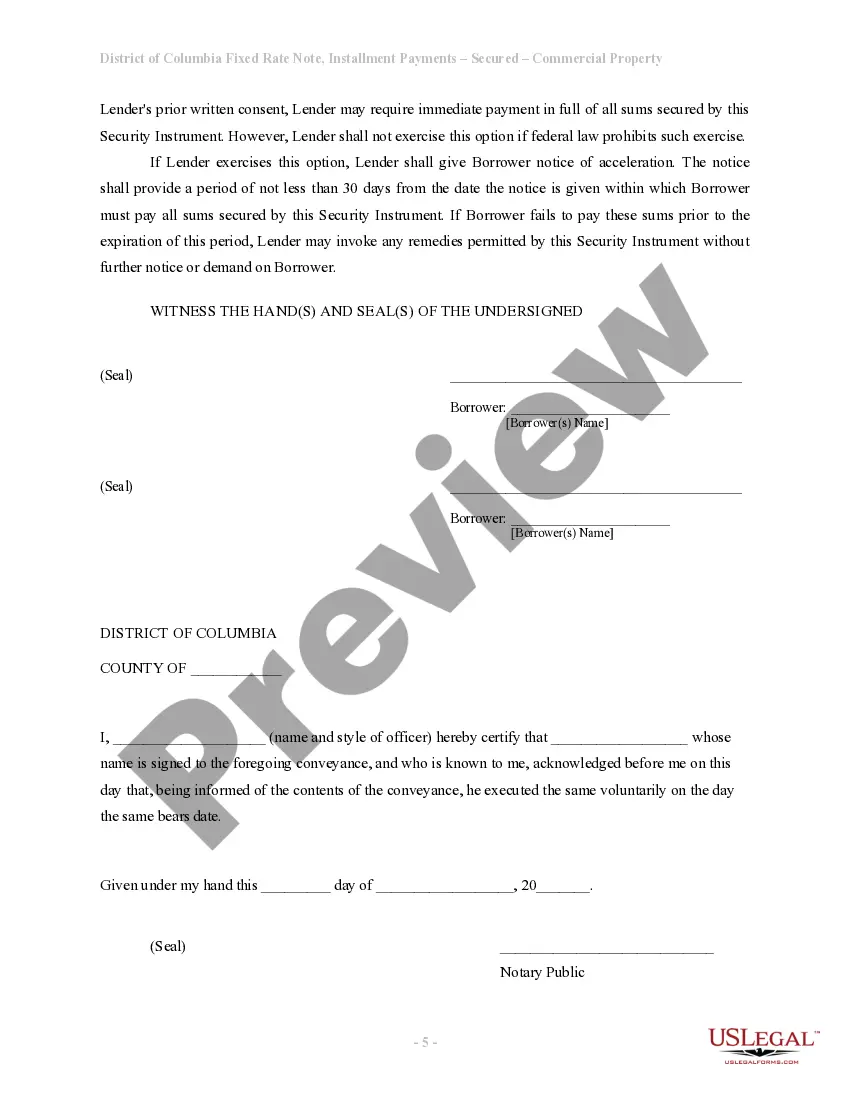

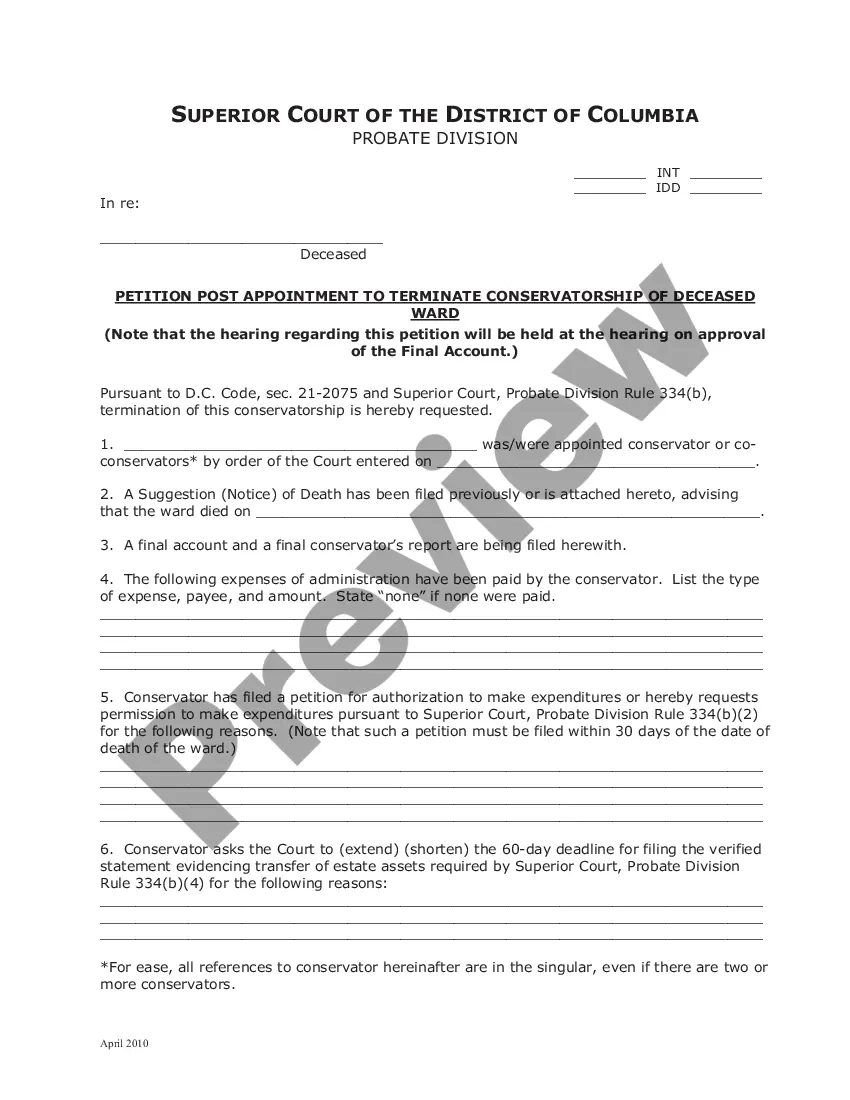

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out District Of Columbia Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

The greater number of papers you need to prepare - the more stressed you feel. You can find a huge number of District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate templates online, still, you don't know which ones to rely on. Get rid of the headache to make finding samples less complicated with US Legal Forms. Get expertly drafted documents that are created to satisfy state demands.

If you have a US Legal Forms subscribing, log in to your profile, and you'll see the Download option on the District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate’s web page.

If you’ve never applied our platform before, complete the sign up process using these guidelines:

- Check if the District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate applies in the state you live.

- Double-check your option by reading the description or by using the Preview mode if they are provided for the selected file.

- Click Buy Now to start the signing up process and choose a pricing program that fits your preferences.

- Insert the asked for details to create your profile and pay for the order with the PayPal or bank card.

- Choose a practical file formatting and get your duplicate.

Access each template you obtain in the My Forms menu. Simply go there to fill in new version of your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Even when having expertly drafted forms, it’s still essential that you consider requesting your local legal professional to double-check filled out sample to ensure that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

To report interest from a promissory note, you usually need to include it on your annual tax return. This is often done using Schedule B, where you list interest income, including that from your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Remember to maintain accurate records to substantiate your reported income.

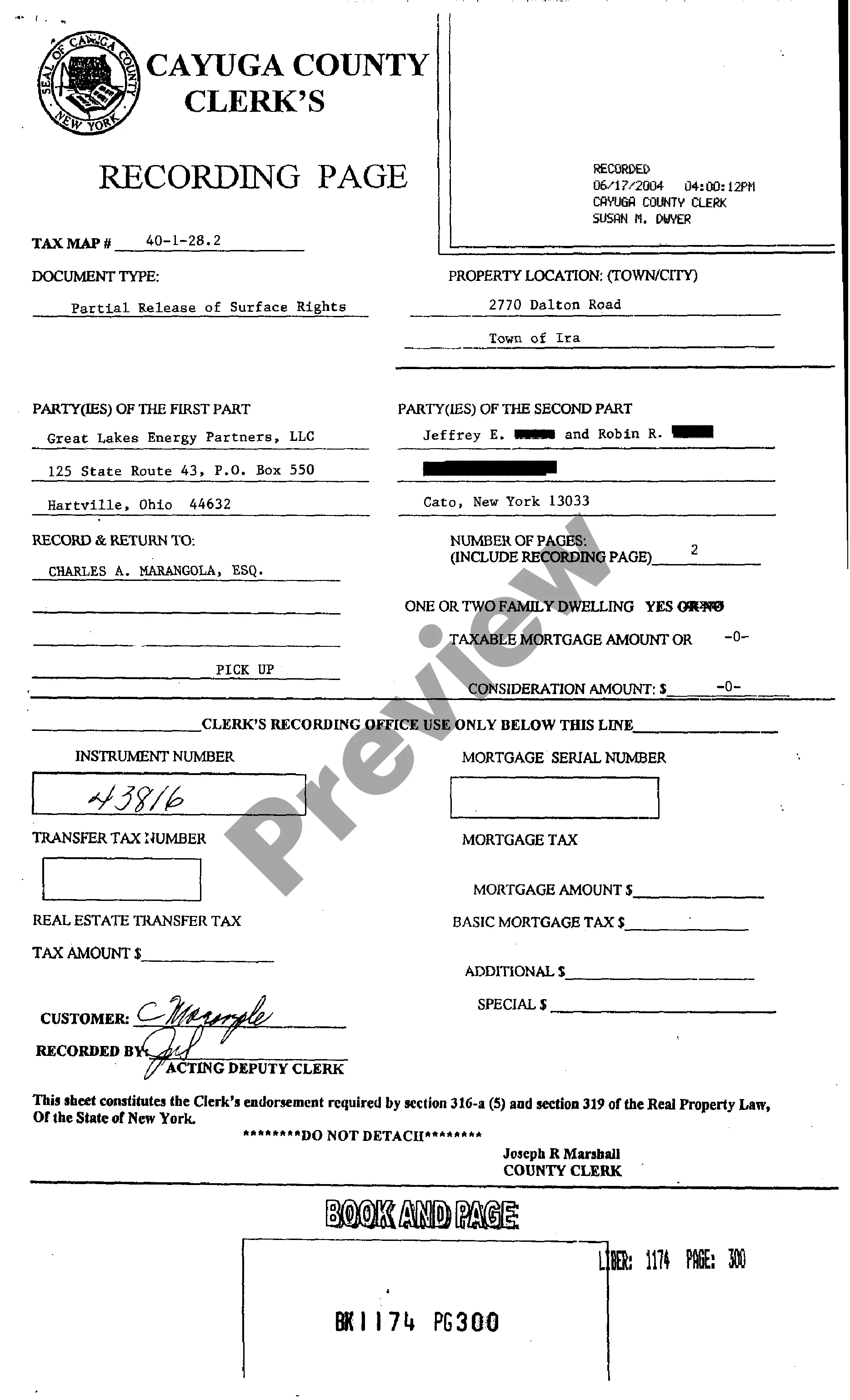

A promissory note does not typically need to be filed in a public registry; however, it is advisable to keep it in a secure location. In some cases, you may choose to record it with the appropriate local government office, especially if it's secured by real property. By using templates from US Legal Forms, you can create a District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate that meets your local standards.

Typically, you are not required to report interest earned if it is less than $10. However, being aware of your overall reporting obligations is important. If you receive interest from your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it’s prudent to keep track of all amounts for accurate future reference.

Yes, interest earned on a promissory note is generally considered taxable income. This means that when you receive interest payments from your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you must report this income on your tax return. Always consult a tax professional for tailored advice regarding your situation.

No, a promissory note is not a closing disclosure. Instead, the note serves as a promise to repay, while a closing disclosure provides details about all the final costs involved in a real estate transaction. However, if you are dealing with a District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you will likely encounter both documents in the closing process. Understanding each document's role helps in navigating real estate transactions.

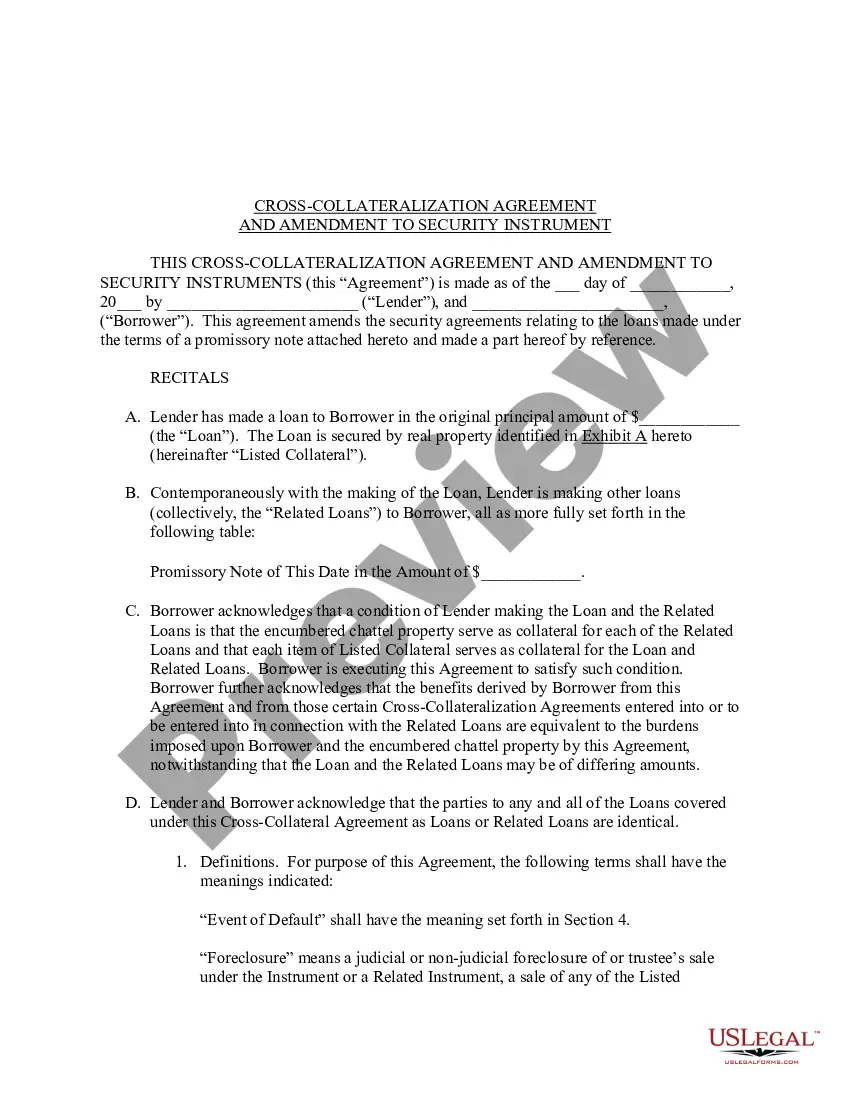

A lien is a legal claim against an asset, while a promissory note is a written promise to repay a debt. In the context of a District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the promissory note outlines the borrower's obligation, while the lien gives the lender security over the real estate involved. This differentiation is crucial in understanding borrower-lender relationships and the rights associated with each document.

One disadvantage of a promissory note, particularly in the case of the District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, is the risk of default. If the borrower fails to make payments, the lender may face difficulties in collecting the owed amount. Additionally, unless explicitly detailed, the terms can be unclear, which may lead to disputes. It's important for both parties to understand their obligations to avoid confusion.

To make a promissory note legally binding, several key elements must be present. First, include the names of the parties involved, the amount to be borrowed, and the specific repayment terms. Furthermore, both parties should sign the note, and it’s advisable to have it witnessed or notarized for added security. When structured correctly, your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate will stand firm in legal situations, ensuring all parties understand their obligations.

Securing a promissory note involves tying it to a specific asset or collateral, which can be particularly beneficial in real estate transactions. By including a security agreement that identifies the collateral upfront, you protect the lender's investment. Additionally, ensuring proper documentation and filing with local authorities enhances the security of your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, making it a wise choice for managing your financial agreements.

To secure a promissory note with real estate, you can take a few straightforward steps. First, include a clause in the promissory note that identifies the real estate as collateral. Next, file a deed of trust or mortgage with the appropriate local authority, which legally attaches the property to the note. This process ensures that your District of Columbia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is backed by a tangible asset, providing you with a layer of security.