This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Receipt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Receipt?

The larger quantity of documents you need to assemble - the more anxious you become.

You can find an extensive selection of District of Columbia Receipt templates online, but you can't discern which ones to rely on.

Eliminate the inconvenience and simplify your search for samples by utilizing US Legal Forms. Obtain professionally crafted documents designed to fulfill state regulations.

Locate each template you download in the My documents section. Simply navigate there to generate a new copy of the District of Columbia Receipt. Even with professionally prepared forms, it’s still advisable to consult your local attorney to verify that your document is completed correctly. Achieve more for less with US Legal Forms!

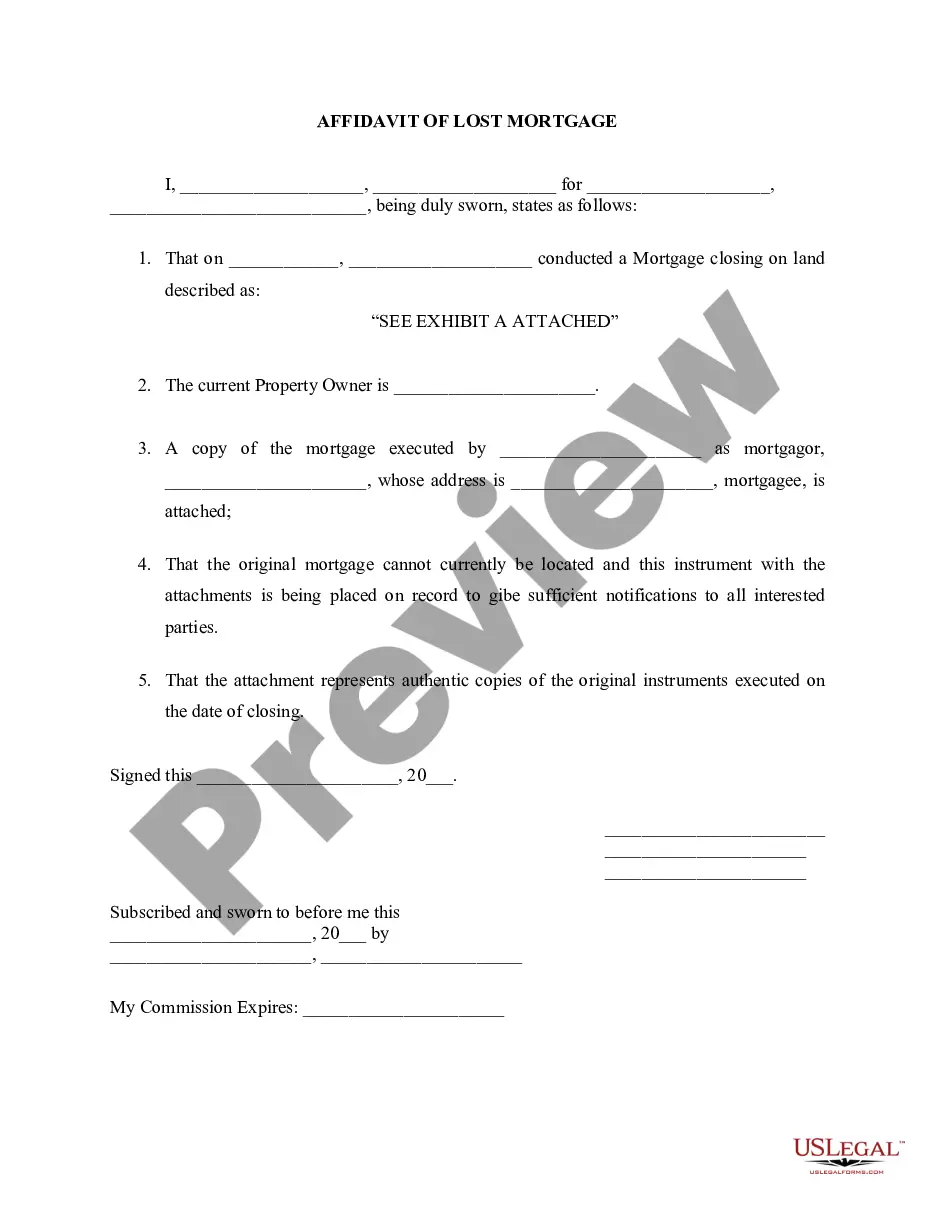

- Ensure the District of Columbia Receipt is applicable in your jurisdiction.

- Verify your choice by reading the details or using the Preview option if available for the chosen document.

- Click Buy Now to initiate the signup process and select a pricing plan that aligns with your preferences.

- Enter the required information to create your account and complete the payment with your PayPal or credit card.

- Select a suitable file format and receive your copy.

Form popularity

FAQ

After completing the DC D40B form, you need to send it to the Office of Tax and Revenue for the District of Columbia. Make sure to check the instructions included with your form to ensure you follow the correct submission process. Properly submitting your District of Columbia Receipt and related forms helps you avoid any penalties. If you're unsure about the submission or need additional guidance, our platform provides detailed information and support.

Filling out a receipt involves providing clear details about the transaction, including the date, amount, and description of services or goods provided. For a valid District of Columbia Receipt, include your name, address, and tax identification number. Additionally, ensure that your receipt aligns with local regulations to avoid any discrepancies in record-keeping. Our platform offers templates and examples that simplify the process and help you create an accurate receipt effortlessly.

The D 30 District of Columbia is a tax receipt form used for reporting various income and taxes owed in the District of Columbia. This form is essential for individuals and businesses to maintain compliance with local tax regulations. By completing the District of Columbia Receipt accurately, you ensure proper documentation of your financial activities and obligations. If you need assistance with the D 30, consider using our platform for easy access to the necessary forms and guidance.

A DC payment type refers to the specific methods available for making payments to the District of Columbia tax system. Common types include electronic transfers, credit card payments, and checks. Always ensure that you keep your District of Columbia Receipt when making payments to provide proof of your transactions.

You should mail your estimated tax payment to the address indicated on the tax payment voucher found on the District of Columbia Office of Tax and Revenue's website. Properly addressing your envelope will ensure timely processing. Don't forget to keep a copy of your District of Columbia Receipt once your payment goes through.

Yes, residents of DC are required to make estimated tax payments if they expect to owe a specific amount in taxes. These payments help prevent tax penalties at the end of the year. Be sure you track your payments and retain your District of Columbia Receipt for each transaction to ensure everything is accounted for.

To download your e-filing receipt, log into the platform where you submitted your tax return, and navigate to the section for e-filing history. Here, you should see an option to view or download your receipts. This District of Columbia Receipt confirmation serves as proof of your submission and is essential for your records.

To obtain your DC tax transcript, you can request it directly from the District of Columbia Office of Tax and Revenue. This process is straightforward and can typically be completed online or by mail. When filing your request, ensure you provide the necessary information to verify your identity. A District of Columbia Receipt will be sent to you once your request is processed.

Yes, you can file a DC tax extension online for personal income taxes through the Office of Tax and Revenue’s website. This extension gives you more time to prepare your documents without incurring penalties. Remember to keep your District of Columbia Receipt, as it serves as validation for your extension request.

District of Columbia tax encompasses various types of taxes, including income tax, business tax, and property tax. These taxes fund essential services in the district. When you file your taxes, be sure to include your District of Columbia Receipt to confirm your submissions.