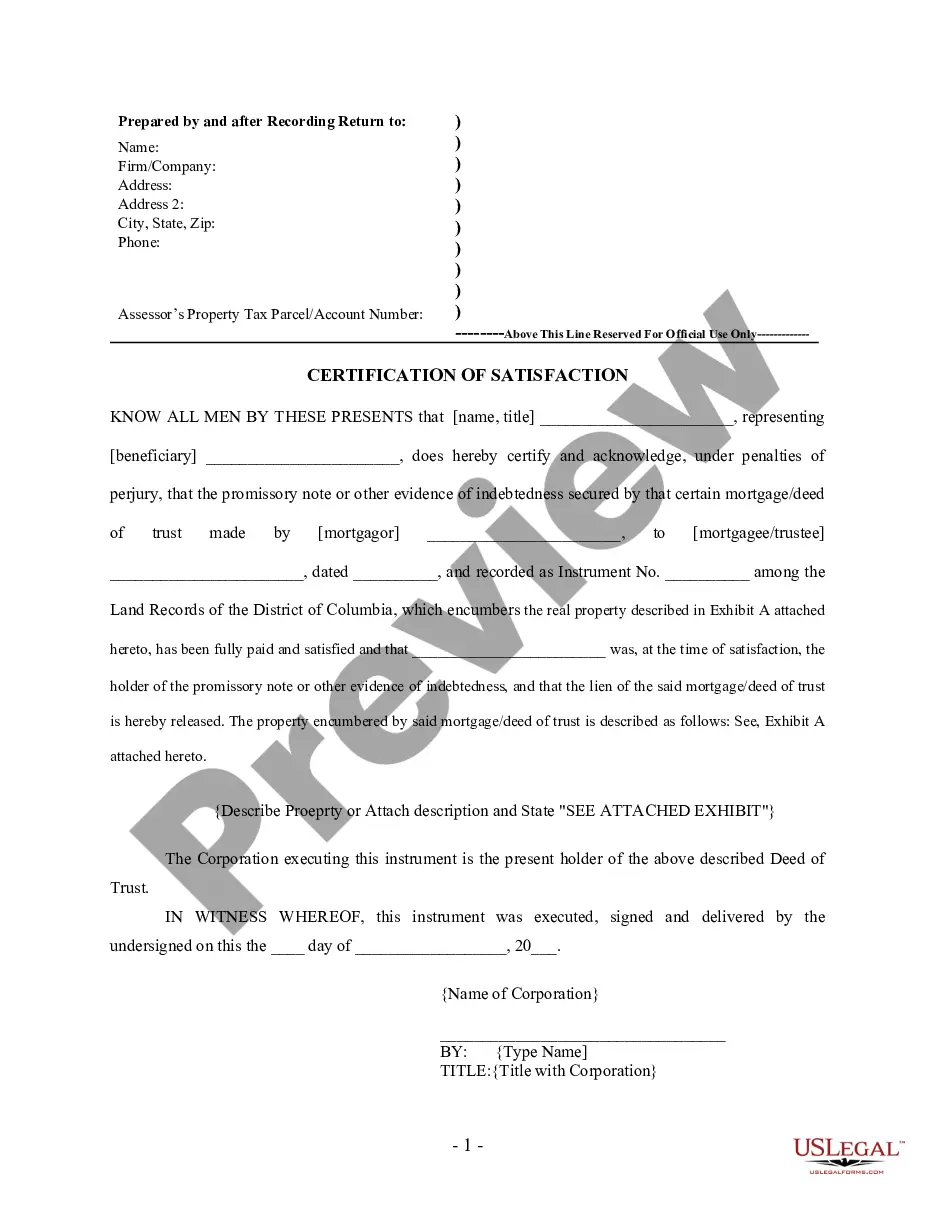

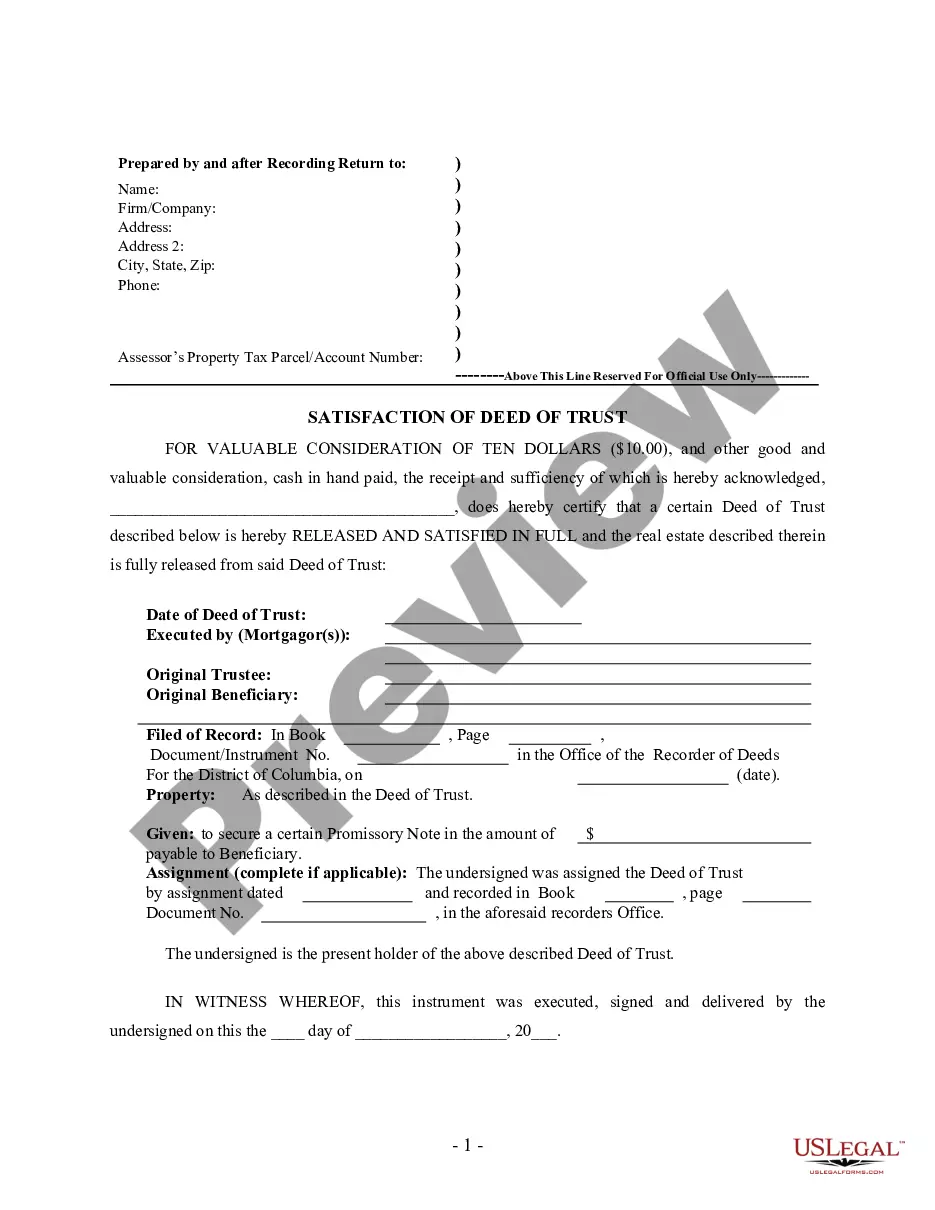

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the District of Columbia by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation

Description

How to fill out District Of Columbia Satisfaction, Release Or Cancellation Of Deed Of Trust By Corporation?

The greater number of documents you have to create - the more worried you are. You can get thousands of District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation blanks on the web, nevertheless, you don't know which of them to trust. Eliminate the headache and make finding exemplars easier using US Legal Forms. Get professionally drafted forms that are created to satisfy state specifications.

If you currently have a US Legal Forms subscribing, log in to the profile, and you'll see the Download button on the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation’s page.

If you have never tried our service before, finish the sign up procedure with the following guidelines:

- Ensure the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation applies in the state you live.

- Double-check your option by reading through the description or by using the Preview functionality if they are provided for the chosen document.

- Click Buy Now to get started on the registration process and select a costs plan that meets your expectations.

- Provide the asked for data to make your profile and pay for the order with the PayPal or credit card.

- Pick a prefered file type and take your example.

Find each document you obtain in the My Forms menu. Simply go there to prepare fresh version of your District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation. Even when preparing professionally drafted templates, it’s nevertheless important that you consider asking your local lawyer to re-check filled out sample to ensure that your record is accurately completed. Do more for less with US Legal Forms!

Form popularity

FAQ

To remove someone from a deed of trust, you must obtain their consent and file a formal document, often called a deed of release. This legally transfers removal and ensures all parties are aware of the changes. In the District of Columbia, following the appropriate legal steps is crucial for a valid outcome. Using US Legal Forms can provide the necessary documentation and guidance to navigate this procedure effectively.

While you can technically remove a name from a deed without a lawyer, it is highly recommended to seek legal assistance for clarity and compliance. A lawyer can help ensure that the removal process adheres to local laws and regulations in the District of Columbia. They can also assist with drafting the necessary documents to prevent future disputes. Engaging with US Legal Forms can simplify this process by providing guidance and templates tailored to your needs.

Yes, you can sell a house that has a deed of trust. However, the proceeds from the sale often go toward paying off the outstanding balance of the mortgage secured by the deed of trust. This ensures that all parties involved are satisfied, including the lender. It's advisable to consult with a professional to ensure the process aligns with the requirements for the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation.

One disadvantage of a deed of trust is that, unlike a traditional mortgage, the lender can initiate foreclosure without going through court proceedings. This can lead to a quicker loss of property in case of default. It's essential for borrowers to understand these risks and explore alternatives. Engaging with resources like uslegalforms can provide you with guidance on the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation.

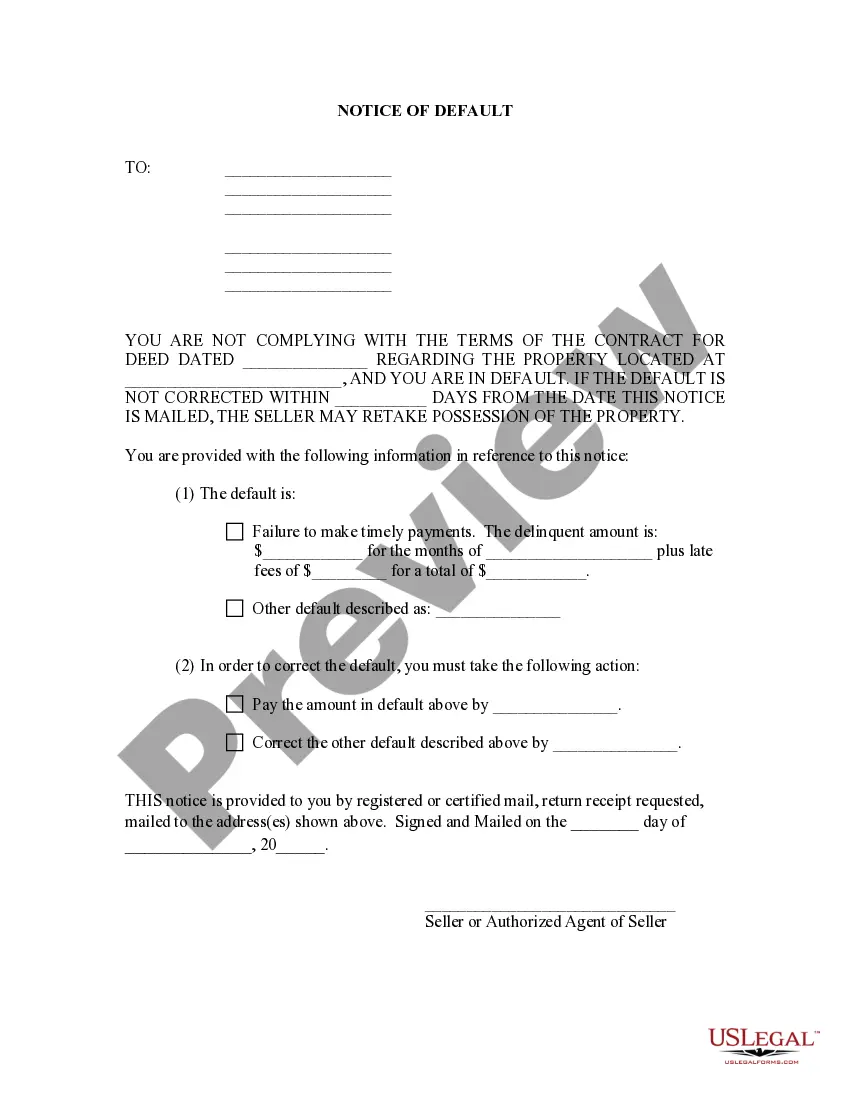

If you default on a note secured by a deed of trust, the lender has the right to initiate a foreclosure process to recover their investment. This action can result in losing the property and significantly impacting your credit. It's vital to communicate with your lender upon facing financial difficulties, as there may be options to avoid foreclosure. This scenario highlights the importance of understanding the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation.

After the final payment on a trust deed is made, the lender is responsible for providing a satisfaction of the deed. This document must then be filed with the local recorder to complete the release process. Without this step, the lien may still appear active, which could complicate future transactions involving the property. Therefore, it's essential to understand how this relates to District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation.

When the debt secured by a deed of trust is satisfied, the lender must issue a satisfaction of the deed. This document is essential because it indicates that the borrower has fulfilled their obligation and that the lien is no longer in effect. The borrower should then file this satisfaction with the local registry to formally release the deed. This is particularly important in the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation.

The release of a deed of trust occurs when the debt attached to the property is satisfied. This process typically involves filing a satisfaction document in the appropriate local registry. Upon completing this process, the lender officially marks the deed of trust as released, freeing the property from the lien. In the context of District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation, this process is crucial for both parties.

A quitclaim deed in the District of Columbia allows a person to transfer their interest in a property to another party quickly and easily. It does not guarantee that the person transferring the property has a good title. It's often used in situations such as transferring property between family members. When dealing with the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation, understanding quitclaim deeds can be essential.

To remove a deed of trust from your property, you typically need to obtain a release from the lender, which is often filed with the county records office. If your property is in Washington, D.C., and you qualify for a District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Corporation, consider using US Legal Forms to navigate the process smoothly. They offer the necessary forms and guidance to help you handle this property matter effectively.