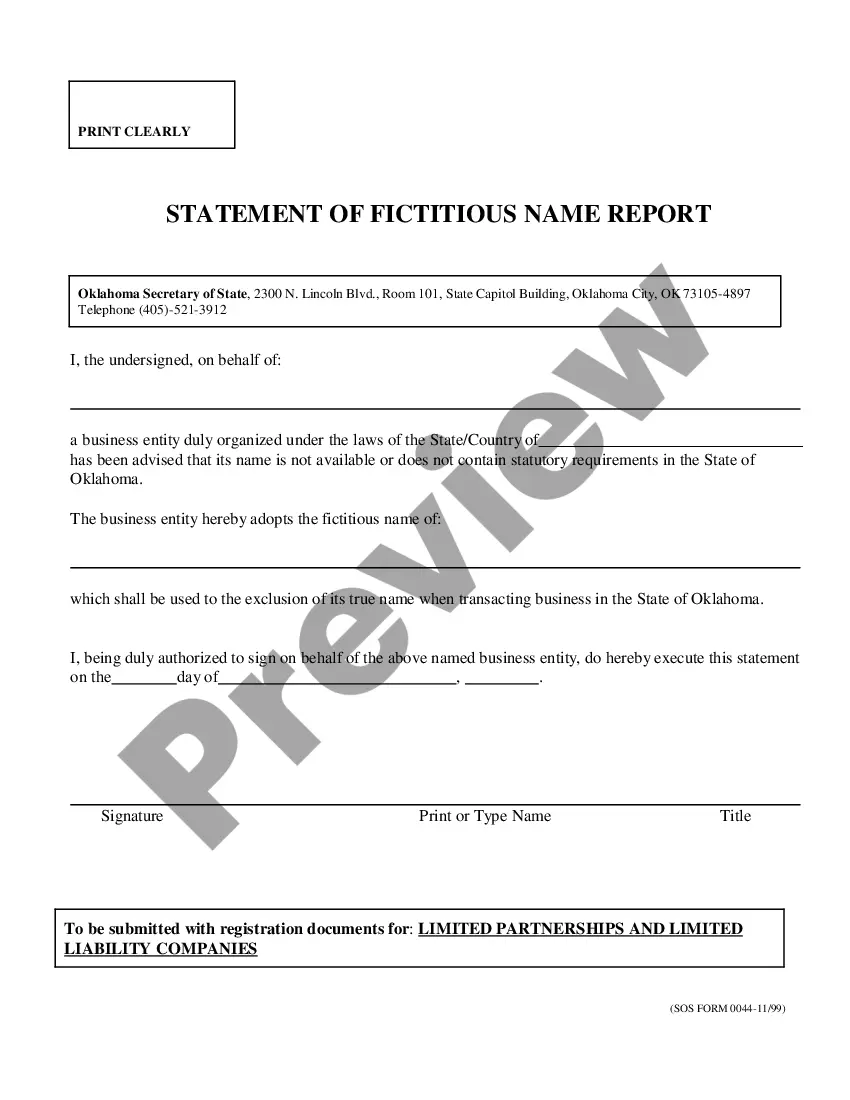

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions

Description

How to fill out District Of Columbia Notice To Debtor Of Non-Wage Garnishment And Exemptions?

The more documents you have to make - the more nervous you become. You can get thousands of District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions templates online, but you don't know which of them to rely on. Get rid of the headache to make finding exemplars more convenient with US Legal Forms. Get expertly drafted documents that are written to meet state requirements.

If you have a US Legal Forms subscription, log in to the account, and you'll find the Download option on the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions’s page.

If you have never used our service earlier, finish the signing up process using these directions:

- Ensure the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions applies in the state you live.

- Re-check your selection by reading the description or by using the Preview functionality if they are available for the selected document.

- Click Buy Now to get started on the registration process and choose a costs program that meets your expectations.

- Insert the asked for details to make your profile and pay for your order with the PayPal or bank card.

- Select a practical file type and acquire your copy.

Access every file you get in the My Forms menu. Simply go there to prepare new copy of the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions. Even when having professionally drafted forms, it is still crucial that you think about asking the local legal professional to re-check completed sample to make sure that your record is accurately completed. Do more for less with US Legal Forms!

Form popularity

FAQ

After receiving a writ of garnishment, it's crucial to address the matter promptly. You should review the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions to explore your options, including possible exemptions. Additionally, consider contacting a legal expert or using the US Legal Forms platform to help navigate your circumstances and seek potential relief options.

A writ of garnishment of wages is a legal order directing your employer to withhold a specific amount from your paycheck to satisfy a debt. This order is typically issued by a court following a lawsuit. The District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions provides detailed information about this process and your rights as a debtor.

If creditors can garnish your wages, a portion of your earnings will be automatically deducted to repay the debt. This process continues until the debt is settled or the court order is lifted. It is important to review the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions to identify any exemptions that may apply to protect part of your income.

Garnishment can have both positive and negative implications. On one hand, it allows creditors to recover debts owed to them, ensuring accountability. However, it can also create significant financial strain on you by reducing your available income. Therefore, understanding the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions is essential to navigate this situation effectively.

The District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions informs you when a creditor has initiated a legal process to collect a debt. This notice outlines your rights and obligations in the garnishment process. It is crucial to understand this notice to respond appropriately and protect your financial interests.

To fill out a challenge to garnishment form, first obtain the correct template specific to the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions. Clearly enter your personal information, case details, and the reasons for your challenge. Ensure you provide any supporting evidence, such as income statements or documentation of exemptions. Finally, submit the completed form to the appropriate court or agency as instructed.

To write a letter to stop wage garnishment, start by addressing the relevant creditor or institution managing the garnishment. Clearly state your intent to halt the garnishment, referring to the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions to outline your basis for the request. Include any pertinent details, such as your account number and any exemptions you wish to claim. For guidance and templates, explore resources available through uslegalforms to ensure your letter is effective.

When filling out a wage garnishment exemption form in the District of Columbia, it’s essential to identify your income sources and highlight what is legally protected. This may include necessary living expenses and certain types of income like Social Security. Be thorough in your explanations, as the details you provide will support your case for exemptions. Consider using uslegalforms to access easy-to-follow templates that simplify this process for you.

To successfully fill out a challenge to garnishment form in the District of Columbia, start by obtaining the correct form, often available through legal aid websites or the court. Clearly state your reasons for challenging the garnishment, and be specific about the exemptions you believe apply to your situation. Ensure all your information is accurate and complete, as mistakes can delay the process. If needed, uslegalforms offers resources to help guide you through this important step.

In the context of the District of Columbia Notice to Debtor of Non-Wage Garnishment and Exemptions, the right to claim exemptions allows debtors to protect certain assets from garnishment. This means that specific types of income or property, such as public benefits or essential household goods, may be exempt from being taken to satisfy a debt. Understanding these exemptions can help you retain necessary resources while addressing your financial obligations. It is crucial to be aware of what you can claim to ensure your financial stability.