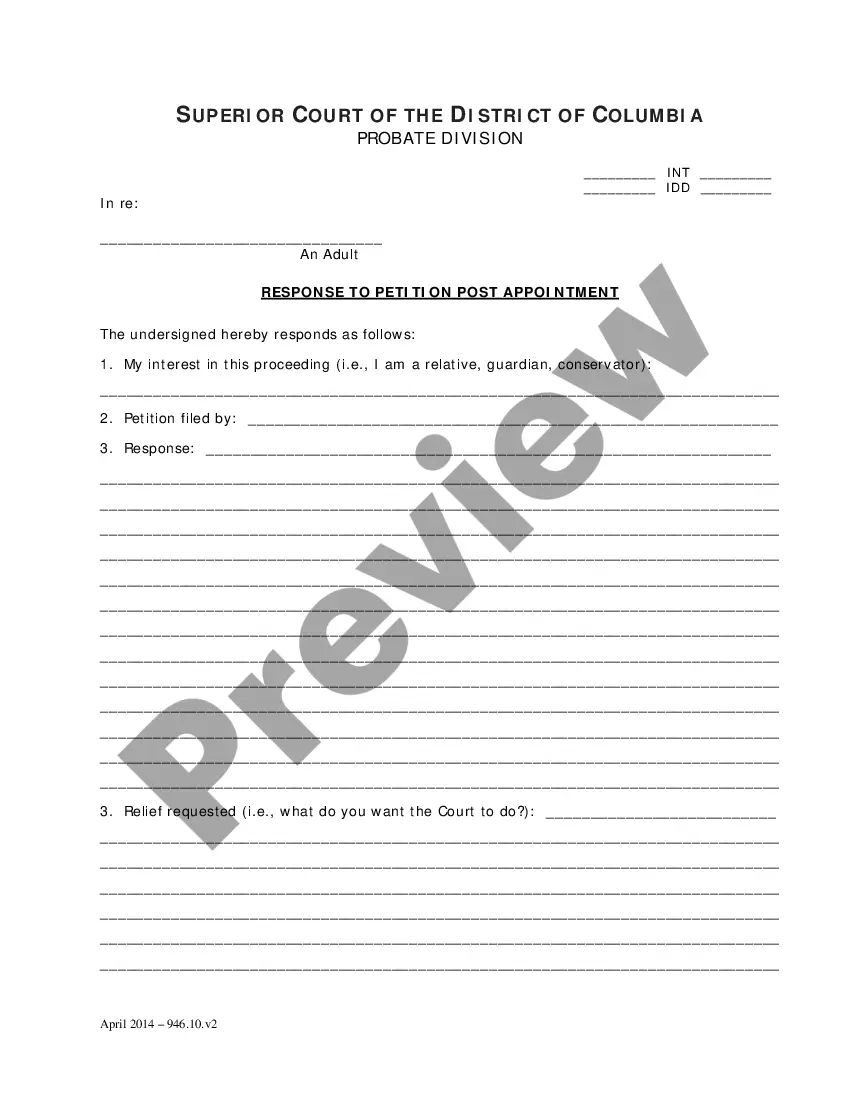

District of Columbia General Forms (Int)-Petition To Deposit Funds Into The Estate is a document used in the District of Columbia to initiate the process of depositing funds into the estate of a deceased person. This form is filed when a person wants to deposit funds into an estate which is in probate or is being administered by a fiduciary. The form includes the name of the deceased, the date of death, the names of the heirs, and the proposed amount to be deposited. The form also requires the petitioner to provide detailed information about the source of the funds, the purpose of the deposit, and the proposed distribution of the funds among the heirs. The District of Columbia General Forms (Int)-Petition To Deposit Funds Into The Estate comes in two versions: one for individuals filing the form on their own behalf and one for those filing on behalf of another person or entity.

District of Columbia General Forms (Int)-Petition To Deposit Funds Into The Estate is a document used in the District of Columbia to initiate the process of depositing funds into the estate of a deceased person. This form is filed when a person wants to deposit funds into an estate which is in probate or is being administered by a fiduciary. The form includes the name of the deceased, the date of death, the names of the heirs, and the proposed amount to be deposited. The form also requires the petitioner to provide detailed information about the source of the funds, the purpose of the deposit, and the proposed distribution of the funds among the heirs. The District of Columbia General Forms (Int)-Petition To Deposit Funds Into The Estate comes in two versions: one for individuals filing the form on their own behalf and one for those filing on behalf of another person or entity.