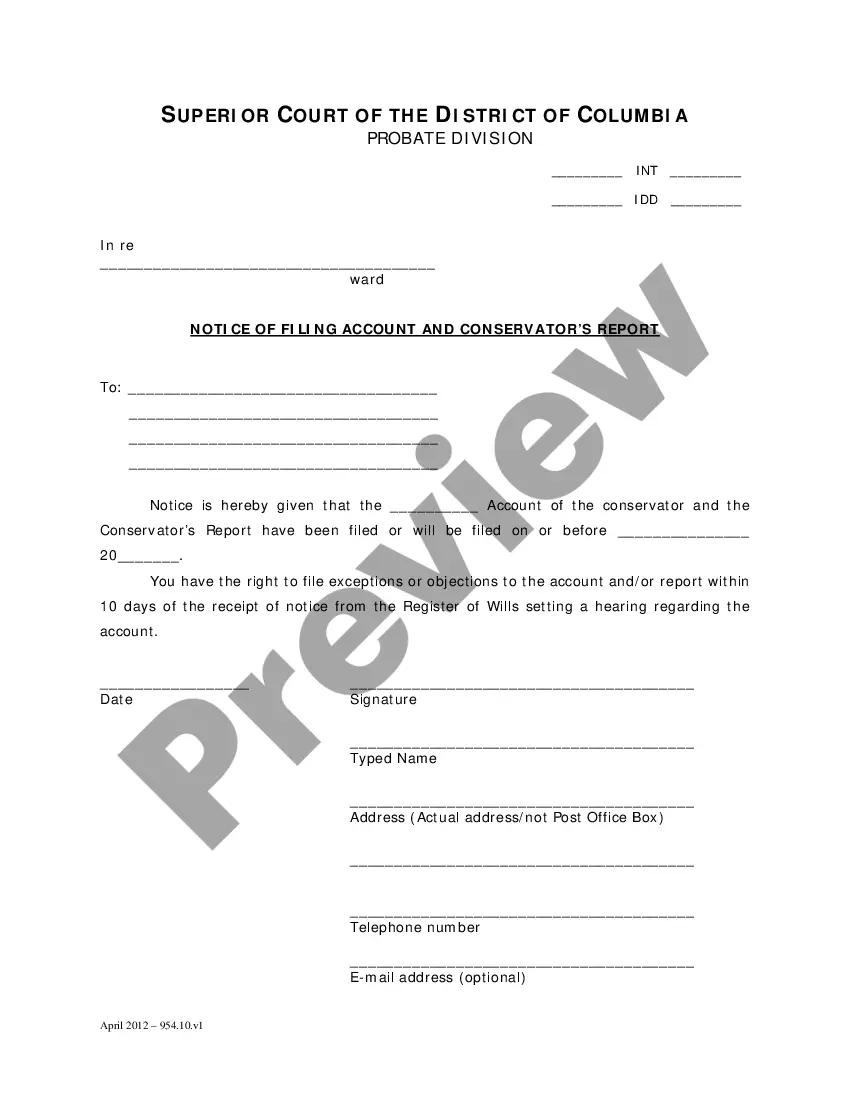

District of Columbia Notice To Interested Persons of Filing An Account is a document that is filled out by an individual or entity who wishes to open a fiduciary account in the District of Columbia. The notice is sent to all interested persons, including the proposed fiduciary, their attorney, the beneficiary, and any other persons who may be affected by the account. The notice includes information about the proposed fiduciary, the nature of the account, the amount of money being deposited, the type of account, and the proposed terms and conditions of the account. There are two types of District of Columbia Notice To Interested Persons of Filing An Account: an initial notice and an amended notice. An initial notice is sent when a fiduciary account is being opened for the first time. An amended notice is sent when the fiduciary wishes to change the terms of the existing account. Both notices must be served to all interested persons before the account can be opened.

District of Columbia Notice To Interested Persons of Filing An Account

Description

How to fill out District Of Columbia Notice To Interested Persons Of Filing An Account?

Handling legal documentation necessitates focus, precision, and the use of well-prepared templates. US Legal Forms has been assisting individuals across the nation in achieving this for 25 years, so when you select your District of Columbia Notice To Interested Persons of Filing An Account template from our platform, you can be assured it complies with federal and state regulations.

Utilizing our service is simple and efficient. To acquire the required paperwork, all you’ll require is an account with an active subscription. Here’s a brief guide for you to get your District of Columbia Notice To Interested Persons of Filing An Account within minutes.

All documents are designed for multiple uses, such as the District of Columbia Notice To Interested Persons of Filing An Account shown on this page. If you require them again, you can complete them without an additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents quickly and in complete legal alignment!

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official template if the one initially opened doesn’t fit your circumstances or state guidelines (the tab for that is on the upper page corner).

- Log in to your account and download the District of Columbia Notice To Interested Persons of Filing An Account in your preferred format. If it’s your first visit to our service, click Buy now to proceed.

- Create an account, select your subscription tier, and make your payment using your credit card or PayPal account.

- Decide the format you wish to receive your document in and click Download. Print the form or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Indeed, registering a will in DC is required to ensure it is legally recognized. This involves submitting the will to the Probate Division of the Superior Court. After registration, a District of Columbia Notice To Interested Persons of Filing An Account is provided to alert interested parties. This process helps avoid disputes and ensures that the estate is handled as per the deceased's instructions.

Inheritance laws in the District of Columbia dictate how assets are distributed when someone passes away. If a person dies intestate (without a will), the estate is divided among surviving family members according to established statutes. In instances where a will is present, the District of Columbia Notice To Interested Persons of Filing An Account outlines how the estate should be managed according to the deceased's wishes. Understanding these laws can help you navigate the complexities of estate planning effectively.

To be valid in Washington, DC, a will must be in writing, signed by the testator, and witnessed by at least two individuals. These witnesses should not be beneficiaries to avoid any conflicts of interest. Additionally, it’s beneficial to ensure that your will is stored properly so that it can be located easily after your passing, leading to a proper District of Columbia Notice To Interested Persons of Filing An Account. Ensuring these requirements are met will prevent complications in the probate process.

Yes, it is necessary to register your will with the appropriate court to make it legally enforceable. In the District of Columbia, this means filing your will with the Probate Division. After filing, the court will issue a District of Columbia Notice To Interested Persons of Filing An Account, notifying interested parties. This step is crucial for ensuring that your estate is settled according to your wishes.

To register a will in Washington, DC, you must file it with the Probate Division of the Superior Court. This process includes submitting the original will along with a Petition for probate. Once filed, the court will publish a District of Columbia Notice To Interested Persons of Filing An Account to inform heirs and beneficiaries. By following these steps, you ensure that your will is recognized and that your wishes are honored.

The primary purpose of a letter of administration is to grant legal authority to a personal representative to oversee and manage a deceased person's estate when there is no will. This document facilitates necessary actions such as paying bills, settling debts, and distributing assets to heirs. Knowing about the District of Columbia Notice To Interested Persons of Filing An Account can further clarify the responsibilities that arise during this important process.

Once a letter of administration is granted, the appointed personal representative gains the authority to collect and manage the deceased's assets. This representative is responsible for notifying interested parties, settling debts, and distributing the remaining assets according to DC laws. Understanding the significance of the District of Columbia Notice To Interested Persons of Filing An Account is crucial for all involved parties to ensure compliance with estate administration procedures.

Yes, if a person had a will at the time of their death, it must be filed with the probate court in DC. This process is necessary to initiate probate proceedings and ensure that the deceased's wishes are followed. Additionally, the District of Columbia Notice To Interested Persons of Filing An Account can provide insights into the filing process and what interested parties need to know.

A letter of administration in DC serves as a formal appointment of a personal representative authorized to handle the estate of a deceased individual without a will. This document ensures that the representative can legally act on behalf of the estate, including settling debts and distributing assets to heirs. By reviewing the District of Columbia Notice To Interested Persons of Filing An Account, you can better understand the responsibilities that come with this important duty.

DC letters of administration are legal documents issued by the court that grant authority to a person to manage the estate of someone who has passed away without a will. These letters are essential for the personal representative to perform duties such as paying debts and distributing assets. If you're navigating this process, the District of Columbia Notice To Interested Persons of Filing An Account can guide you in fulfilling your responsibilities.