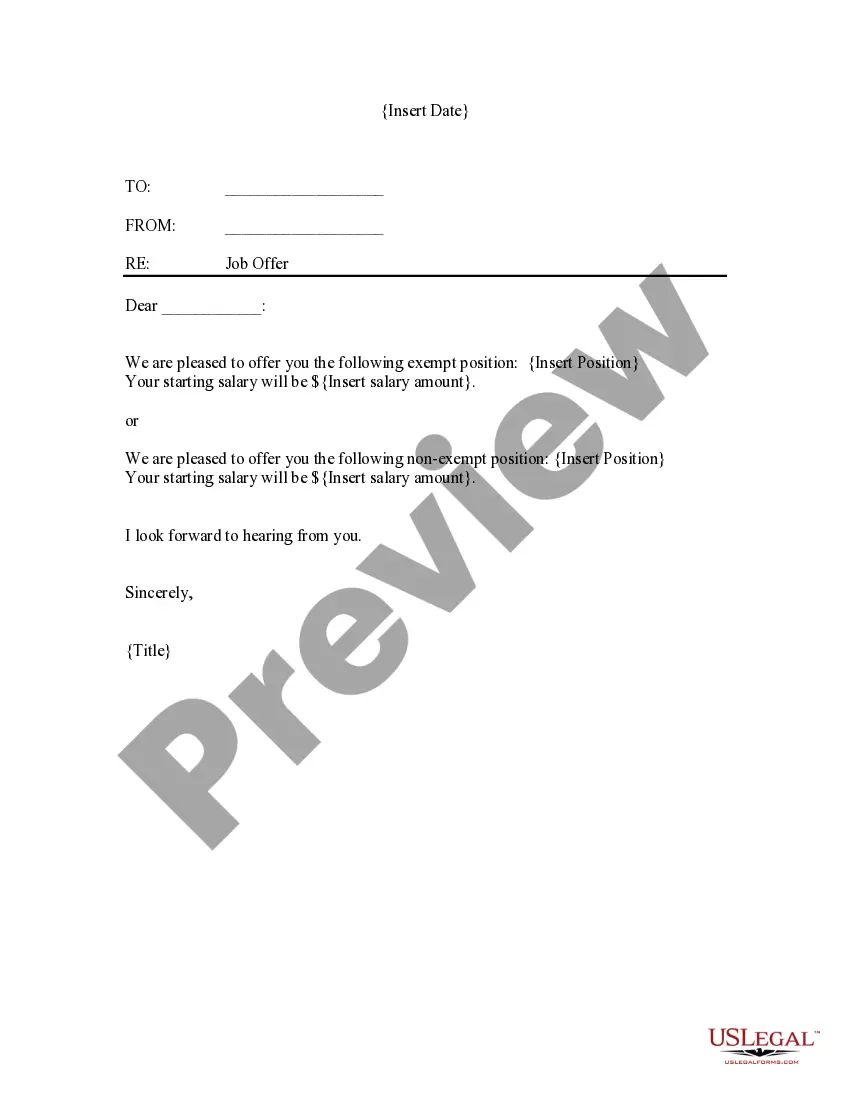

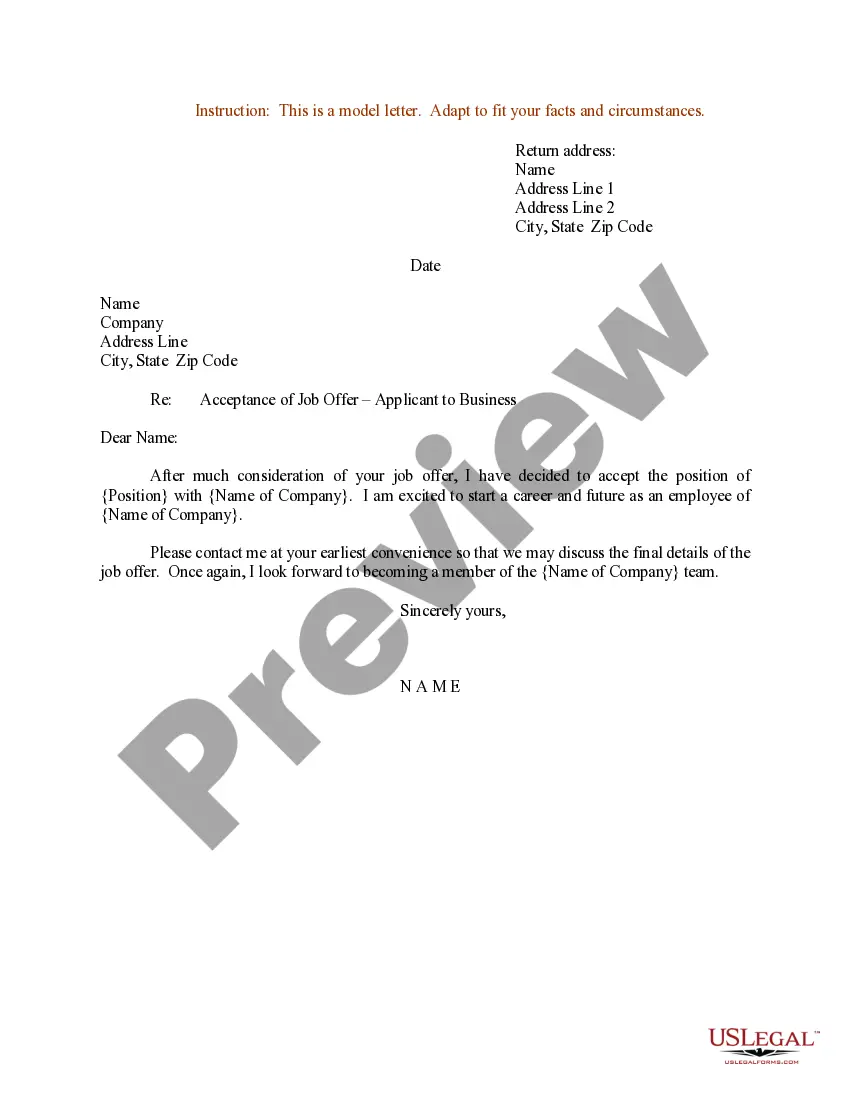

District of Columbia Job Acceptance Leter for Sole Trader

Description

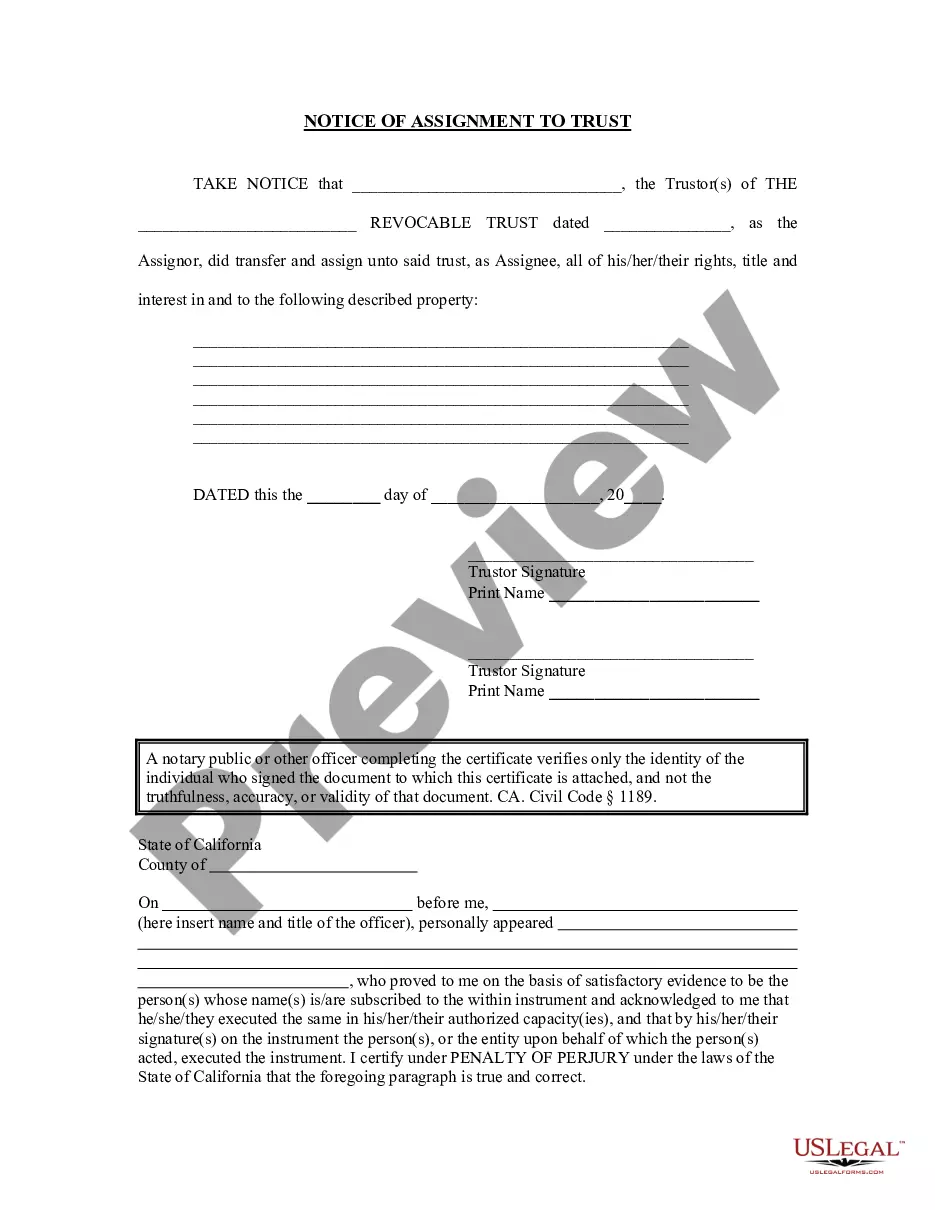

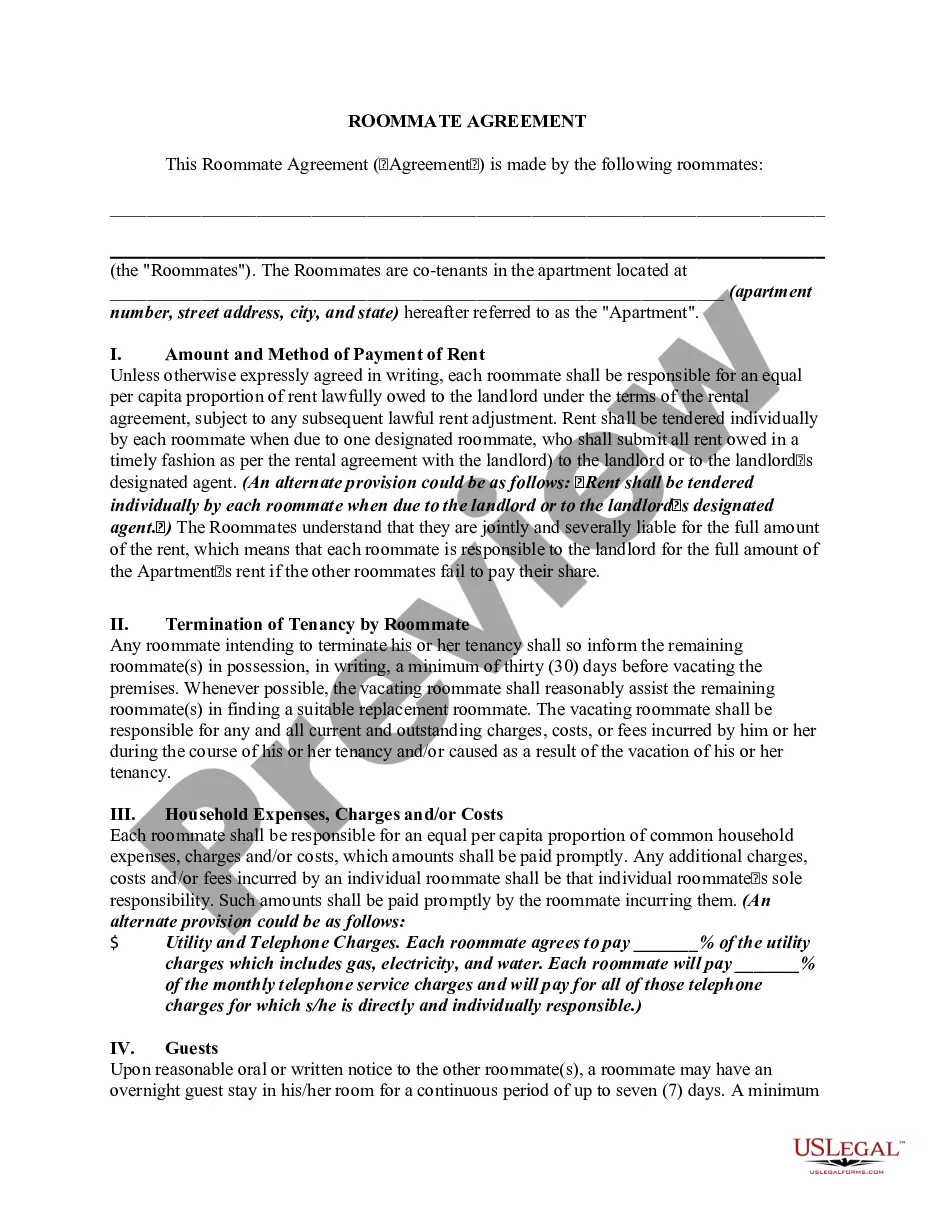

How to fill out Job Acceptance Leter For Sole Trader?

US Legal Forms - one of the largest libraries of authentic forms in the United States - provides a vast selection of legitimate document templates that you can download or print.

Through the website, you can find thousands of forms for business and personal needs, categorized by categories, states, or keywords. You can obtain the latest versions of forms such as the District of Columbia Job Acceptance Letter for Sole Trader in a matter of minutes.

If you currently hold a monthly subscription, Log In and download the District of Columbia Job Acceptance Letter for Sole Trader from the US Legal Forms library. The Download button will be visible on each form you examine. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the purchase. Use your credit card or PayPal account to complete the payment.

Select the format and download the form onto your device. Make adjustments. Fill out, edit, and print and sign the downloaded District of Columbia Job Acceptance Letter for Sole Trader. Each format you add to your account has no expiration date, making it yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the District of Columbia Job Acceptance Letter for Sole Trader with US Legal Forms, the most extensive collection of legitimate document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Make sure you have chosen the correct form for your city/county.

- Click on the Review button to examine the form's details.

- Check the form description to confirm you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Forming a Sole ProprietorshipNo formal action is required to form a sole proprietorship. If you are the only owner, this status automatically comes from your business activities. In fact, you may already own one without knowing it. If you are a freelance graphic designer, for example, you are a sole proprietor.

Taxicab/Limo Drivers Any non-resident taxicab/limo driver who operates a motor vehicle for hire in the District must file a Form D-30. The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.

How to start a sole proprietorship: 7 steps to takeChoose a business name.Register your business name.Purchase a website domain name.Obtain a business license and other permits.File for an employer identification number (EIN)Open a business bank account.Get insurance coverage.

To establish a sole proprietorship in Washington D.C., here's everything you need to know.Choose a business name.File a trade name with the Department of Consumer and Regulatory Affairs.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Apply for a Basic Business LicenseObtain an Employer Identification Number (EIN) from the IRS.Register with the District of Columbia Office of Tax and Revenue.Make sure your DC business premise has a Certificate of Occupancy Permit (or Home Occupation Permit).Complete the Clean Hands Self Certification.More items...

You can start your business today as a sole proprietorship because you do not need to file registration documents. Sole proprietors are taxed only once, at the personal level. There is no taxation of a sole proprietorship's income at the entity level.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

Who does not have to file Form D-30? You do not have to file if Total gross income (Line 10) is $12,000 or less. You are an organization recognized as exempt from DC taxes.

Taxicab/Limo Drivers Any non-resident taxicab/limo driver who operates a motor vehicle for hire in the District must file a Form D-30. The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.