Dear [Name of Credit Bureau], I am writing to inform you that I have been appointed as the estate administrator for the District of Columbia for the estate of [Deceased Person's Full Name]. I am reaching out to discuss the status of the deceased's credit profile and to request necessary actions on your part. As the estate administrator, it is my responsibility to handle all financial matters pertaining to the deceased individual. Therefore, it is crucial for me to obtain accurate information regarding their outstanding debts, credit accounts, and any relevant financial obligations. This information is necessary for the proper settlement of the estate. I kindly request you to provide me with a copy of the deceased's credit report, including all open credit accounts, outstanding balances, and any related information. It is important for me to review and verify the accuracy of this information to ensure a fair and transparent estate settlement process. Furthermore, I request your assistance in updating the status of the deceased's credit profile to reflect their passing and prevent any fraudulent activity. This can be accomplished by closing or freezing all active credit accounts associated with the deceased individual, as well as updating their credit report to indicate that the accounts are now the responsibility of the estate. Please note that under the laws of the District of Columbia, the estate is responsible for settling any outstanding debts using the available assets. Therefore, any communication or collection efforts regarding the deceased's debts should be directed to the estate administrator, rather than to their surviving family members. In conclusion, I kindly request your cooperation in providing me with the necessary information and taking appropriate actions to ensure the accuracy and integrity of the deceased's credit profile. Your prompt attention to this matter will greatly assist in the efficient settlement of the estate. Thank you for your understanding and cooperation. Should you require any additional information or documentation, please do not hesitate to contact me. Sincerely, [Your Name] Estate Administrator for the District of Columbia Keywords: District of Columbia, estate administrator, credit bureau, letter, deceased individual, estate settlement, outstanding debts, credit accounts, credit report, open credit accounts, updating credit profile, fraudulent activity, freezing credit accounts, settling debts, District of Columbia laws

District of Columbia Sample Letter to Credit Bureau - Estate Administrator

Description

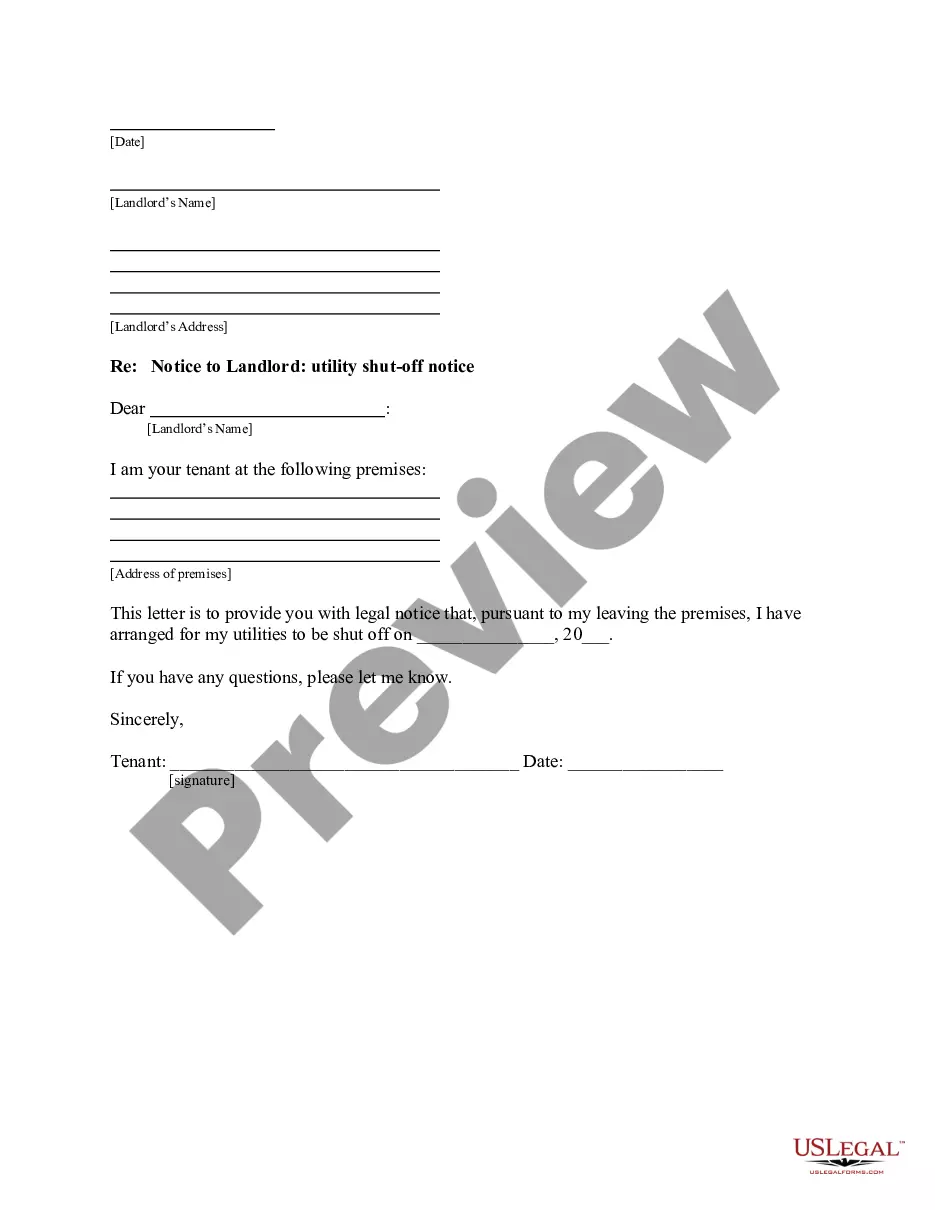

How to fill out Sample Letter To Credit Bureau - Estate Administrator?

If you have to complete, download, or print out authorized file templates, use US Legal Forms, the greatest assortment of authorized kinds, which can be found online. Take advantage of the site`s simple and practical look for to obtain the files you require. Numerous templates for enterprise and person functions are sorted by classes and claims, or keywords. Use US Legal Forms to obtain the District of Columbia Sample Letter to Credit Bureau - Estate Administrator in a number of click throughs.

In case you are previously a US Legal Forms client, log in to your bank account and click on the Acquire option to obtain the District of Columbia Sample Letter to Credit Bureau - Estate Administrator. You can even access kinds you earlier saved in the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for that proper town/region.

- Step 2. Use the Review choice to look over the form`s content material. Don`t overlook to read through the information.

- Step 3. In case you are not happy together with the kind, make use of the Search area towards the top of the display screen to discover other models from the authorized kind format.

- Step 4. Upon having discovered the form you require, select the Get now option. Choose the pricing plan you like and add your qualifications to sign up for an bank account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the structure from the authorized kind and download it on your own system.

- Step 7. Full, change and print out or sign the District of Columbia Sample Letter to Credit Bureau - Estate Administrator.

Each and every authorized file format you purchase is your own for a long time. You may have acces to each and every kind you saved within your acccount. Select the My Forms section and pick a kind to print out or download again.

Contend and download, and print out the District of Columbia Sample Letter to Credit Bureau - Estate Administrator with US Legal Forms. There are many specialist and state-particular kinds you can use to your enterprise or person demands.

Form popularity

FAQ

Ing to the Code of the District of Columbia § 20-351, only estates with a value of $40,000 or less will qualify for this shortened form of probate. As such, petitioners must include a list of the decedent's assets when filing their paperwork with the court.

A Letter of Testamentary?sometimes called a "Letter of Administration" or "Letter of Representation"?is a document granted by a local court. The document simply states that you are the legal executor for a particular estate and that you have the ability to act as such.

Is Probate Required in Washington, DC? Probate is required in many cases in the District of Columbia. If the property value is under $40,000, you can settle under small estate administration.

In the District of Columbia, an executor or administrator is referred to as a personal representative, who is the person appointed by the court to be responsible for administering the deceased person's estate.

Avoid probate with a trust With a living trust, the creator of such trust no longer ?owns? the assets in it, but a trustee does and therefore, at the moment of death this partial or full estate does not apply for probate, since ownership is no longer with the decedent.

Probate is a legal process that takes place after someone's death. It usually involves proving that the deceased's will is valid, identifying the deceased person's property and having it appraised, paying outstanding debts and taxes, and distributing the property per the will or state law.

The difference is the way in which they have been appointed. An Executor is nominated within the Will of a deceased person. If there is no Will, an Administrator is appointed by a Court to manage or administer a decedent's estate. A New York City estate planning lawyer can help explain their different roles.

DC law requires that all original wills must be filed with the Register of Wills Office. Regardless of whether there are assets that are passing through the probate administration, the law does require that original wills must be filed.

Similar to a grant of probate, the letters of administration is a grant of representation issued by the court allowing the named individual to administer the estate. The main difference here is that no specific person will have been appointed to manage the estate, because there is no valid will.

To become a personal representative in DC, a person must be appointed by the court. That requires filling out certain pleadings, one of which is the petition to open the estate proceedings and to be appointed as the representative.