District of Columbia Accounts Receivable - Guaranty

Description

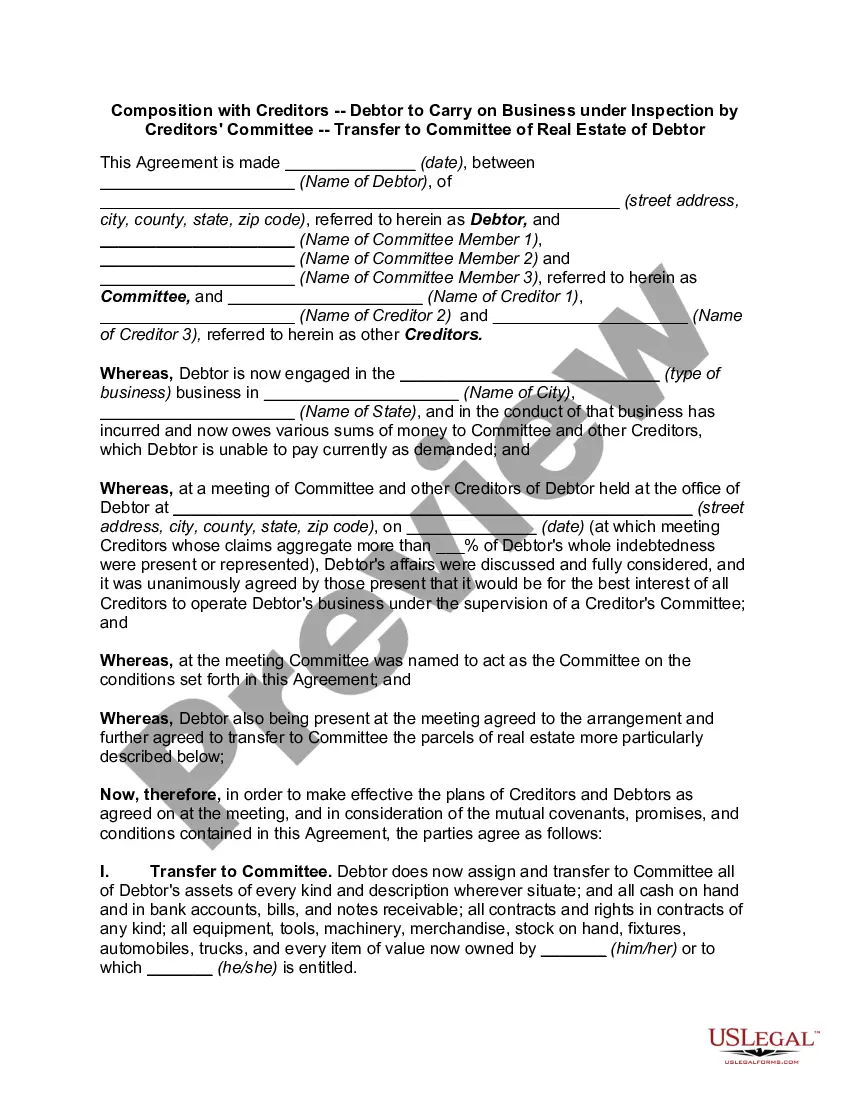

How to fill out Accounts Receivable - Guaranty?

If you need to completely download or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the District of Columbia Accounts Receivable - Guaranty with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the District of Columbia Accounts Receivable - Guaranty. You can also access forms you previously downloaded from the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Utilize the Review option to examine the form's details. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format. Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and input your information to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify and print or sign the District of Columbia Accounts Receivable - Guaranty.

- Every legal document format you acquire is yours permanently.

- You have access to every form you downloaded in your account.

- Click the My documents section and choose a form to print or download again.

- Complete, download, and print the District of Columbia Accounts Receivable - Guaranty with US Legal Forms.

- There are numerous professional and state-specific forms available for your personal business or personal needs.

Form popularity

FAQ

Accounts receivable coverage protects businesses against losses resulting from the inability to collect payments from clients. This coverage typically includes protection against theft, fire, or other disasters that may impact the business’s ability to collect its accounts receivable. With the District of Columbia Accounts Receivable - Guaranty, businesses can have peace of mind knowing they have support in managing potential financial setbacks. Using platforms like uslegalforms can streamline the process of obtaining this essential coverage.

The District of Columbia Life and Health Insurance Guaranty Association protects policyholders when an insurance company becomes insolvent. This association ensures that individuals and businesses can recover certain benefits and claims under their policies. By providing this safety net, the District of Columbia Accounts Receivable - Guaranty helps maintain consumer confidence in the insurance market. It serves as a crucial resource for residents looking for security in their insurance investments.

Yes, you can sue the DC government under specific circumstances, as it operates under the legal framework of the District of Columbia Accounts Receivable - Guaranty. However, there are certain limitations and procedures you must follow, such as filing a notice of claim. It’s advisable to consult with a legal professional who understands this area of law to navigate the complexities effectively. Platforms like uslegalforms can assist you in preparing the necessary documentation for your claim.

To reach the District of Columbia Department of Revenue, you can visit their official website for contact information, or call their main office directly. They provide essential services related to the District of Columbia Accounts Receivable - Guaranty, including assistance with tax inquiries and payment plans. Additionally, their customer service representatives are available to guide you through any specific issues you may encounter. Make sure to have your information ready for a smoother experience.

Yes, Harris and Harris is known to collect debts in the District of Columbia. They often work on behalf of various clients to recover overdue accounts. If you find yourself dealing with them, it is essential to understand your rights and options regarding District of Columbia Accounts Receivable - Guaranty. For assistance in managing these situations, uslegalforms can offer resources tailored to your needs.

While it may be challenging to eliminate debt collectors without payment, you can exercise your rights by disputing any incorrect charges. Send a written request to validate the debt, and if they cannot prove it, they must stop contacting you. Additionally, understanding your rights regarding District of Columbia Accounts Receivable - Guaranty can empower you in these situations. Uslegalforms provides valuable information to help you navigate these complexities.

To effectively manage overdue accounts receivable, start by sending reminders and clear communication to your clients. Establish a structured follow-up process to address any delays in payment. If issues persist, consider utilizing professional services to assist you, as they can streamline the collection process under the District of Columbia Accounts Receivable - Guaranty framework. Uslegalforms offers various tools that can help you organize and track your receivables.

In the District of Columbia, the dormancy period for unclaimed property is generally three years. After this time, the property may be considered abandoned and turned over to the state. It is important to keep track of your accounts to avoid losing them to unclaimed status. For guidance on managing your District of Columbia Accounts Receivable - Guaranty, uslegalforms can provide helpful templates.

Yes, you can refuse to deal with debt collectors. Under the Fair Debt Collection Practices Act, you have the right to request that a collector cease communication with you. However, this does not eliminate the debt itself. For assistance in navigating your rights related to District of Columbia Accounts Receivable - Guaranty, consider using resources from uslegalforms.