District of Columbia Bill of Sale - Quitclaim

Description

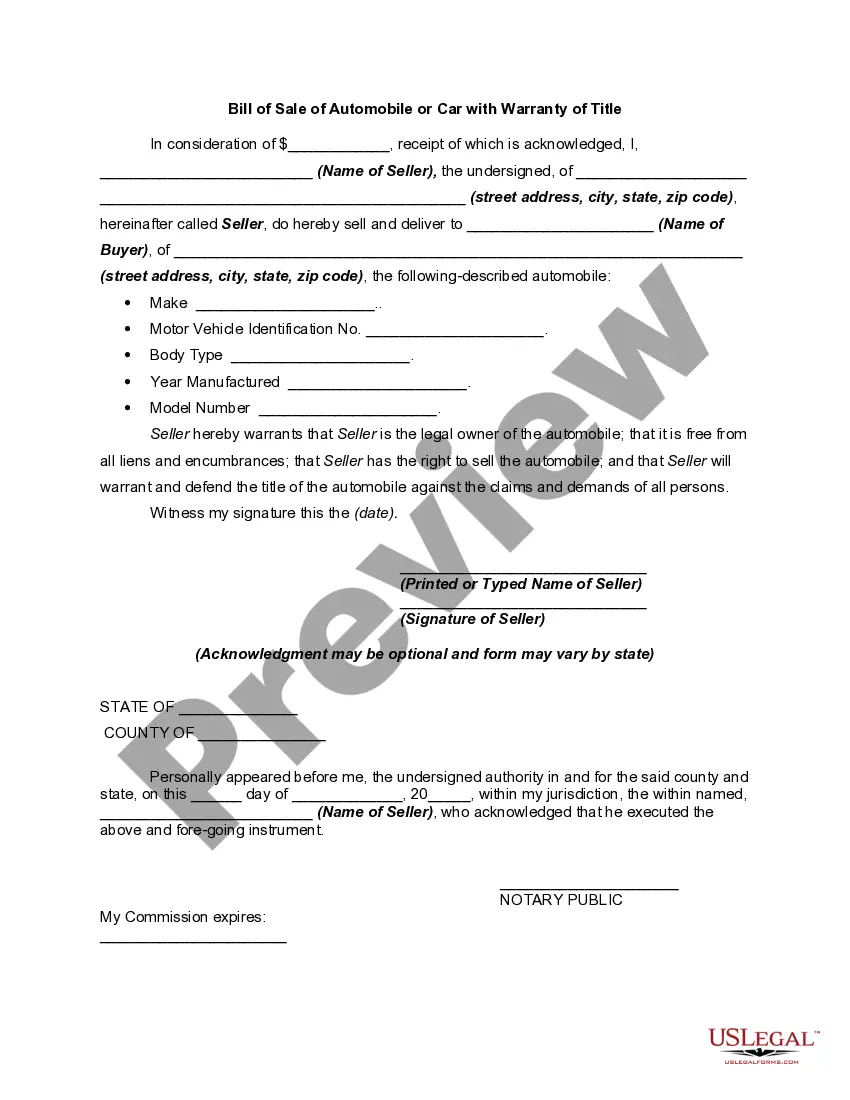

How to fill out Bill Of Sale - Quitclaim?

If you need to total, download, or print legal document templates, utilize US Legal Forms, the primary repository of legal forms that is accessible online.

Leverage the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose your preferred pricing plan and enter your credentials to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the District of Columbia Bill of Sale - Quitclaim with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the District of Columbia Bill of Sale - Quitclaim.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Generally, quitclaim deeds do not have to be reported to the IRS, as they typically do not trigger tax consequences. However, if the property is sold or if there is a significant change in ownership, it may need to be reported. Using the District of Columbia Bill of Sale - Quitclaim does not change this rule, but consulting with a tax advisor can provide clarity on your specific situation.

The main disadvantages of a quitclaim deed include a lack of warranties and potential exposure to claims against the property. Since the deed does not guarantee a clear title, you may inherit existing problems along with the property. Understanding these risks with the District of Columbia Bill of Sale - Quitclaim is vital for anyone considering this option.

Yes, you can prepare a quitclaim deed yourself, especially if you are familiar with the necessary legal requirements in the District of Columbia. However, using a service like US Legal Forms ensures that your document meets all legal standards and is correctly filed. Crafting a quitclaim deed independently may save you some costs, but it can be risky without proper guidance.

A quitclaim deed in the District of Columbia is a legal document that allows one party to transfer their interest in a property to another party without ensuring the property's title is clear. The District of Columbia Bill of Sale - Quitclaim simplifies the process of ownership transfer, making it a popular choice for fast transactions. However, it’s crucial to understand what you are taking on when you accept property through this method.

Individuals who want to transfer property ownership quickly and easily often benefit most from a quitclaim deed. This type of transfer is especially useful in situations like family transfers, divorce settlements, and settling estates. The District of Columbia Bill of Sale - Quitclaim provides a straightforward way to pass on property rights without extensive documentation.

Filling out a District of Columbia Bill of Sale - Quitclaim requires precise attention to detail. Start with the names and addresses of both the grantor and grantee, ensuring the property description is accurate. After including the necessary details, sign and date the document in front of a notary to ensure its legality, which can be conveniently facilitated through uslegalforms.

A District of Columbia Bill of Sale - Quitclaim can become invalid if it is not properly executed or if it lacks essential information. For example, if the document is not signed by the grantor or if there is no legal description of the property, it cannot hold up in court. Ensuring all required sections are filled out is crucial for its validity.

The dangers of a District of Columbia Bill of Sale - Quitclaim include the potential for undisclosed debts or claims against the property. If the grantor has financial obligations tied to the property, these can roll over to the new owner. This type of deed does not protect the buyer, making it essential to inspect any property thoroughly before proceeding.

One primary issue with a District of Columbia Bill of Sale - Quitclaim is the lack of warranty. Since the grantor does not guarantee the title, the buyer assumes all risks associated with any liens or encumbrances. Moreover, without proper due diligence, the grantee could unknowingly acquire problems that could affect their ownership.

A District of Columbia Bill of Sale - Quitclaim serves as a legal document to transfer property ownership without making any guarantees about the title. For instance, if a parent wishes to transfer their property to their child, they may use a quitclaim deed. This document will include the names of both parties involved and a clear description of the property being transferred.