District of Columbia Commercial Lease - Short Form for Recording Notice of Lease

Description

How to fill out Commercial Lease - Short Form For Recording Notice Of Lease?

Selecting the correct legal document format can be challenging. Of course, there are numerous templates accessible online, but how can you obtain the legal type that you require? Utilize the US Legal Forms website. The platform offers a wide array of templates, including the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease, which you can use for both business and personal purposes.

All templates are reviewed by experts and comply with federal and state requirements.

If you are already registered, sign in to your account and click the Download button to acquire the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease. Use your account to review the legal documents you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

Choose the file format and download the legal document to your device. Finally, complete, revise, print, and sign the acquired District of Columbia Commercial Lease - Short Form for Recording Notice of Lease. US Legal Forms is the largest collection of legal documents where you can discover various file templates. Utilize the service to download professionally-crafted paperwork that adheres to state requirements.

- Initially, ensure you have chosen the correct form for your jurisdiction/state.

- You can review the form using the Preview button and examine the form description to confirm it is the appropriate one for you.

- If the form does not meet your criteria, utilize the Search field to locate the correct form.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and process your order using your PayPal account or credit card.

Form popularity

FAQ

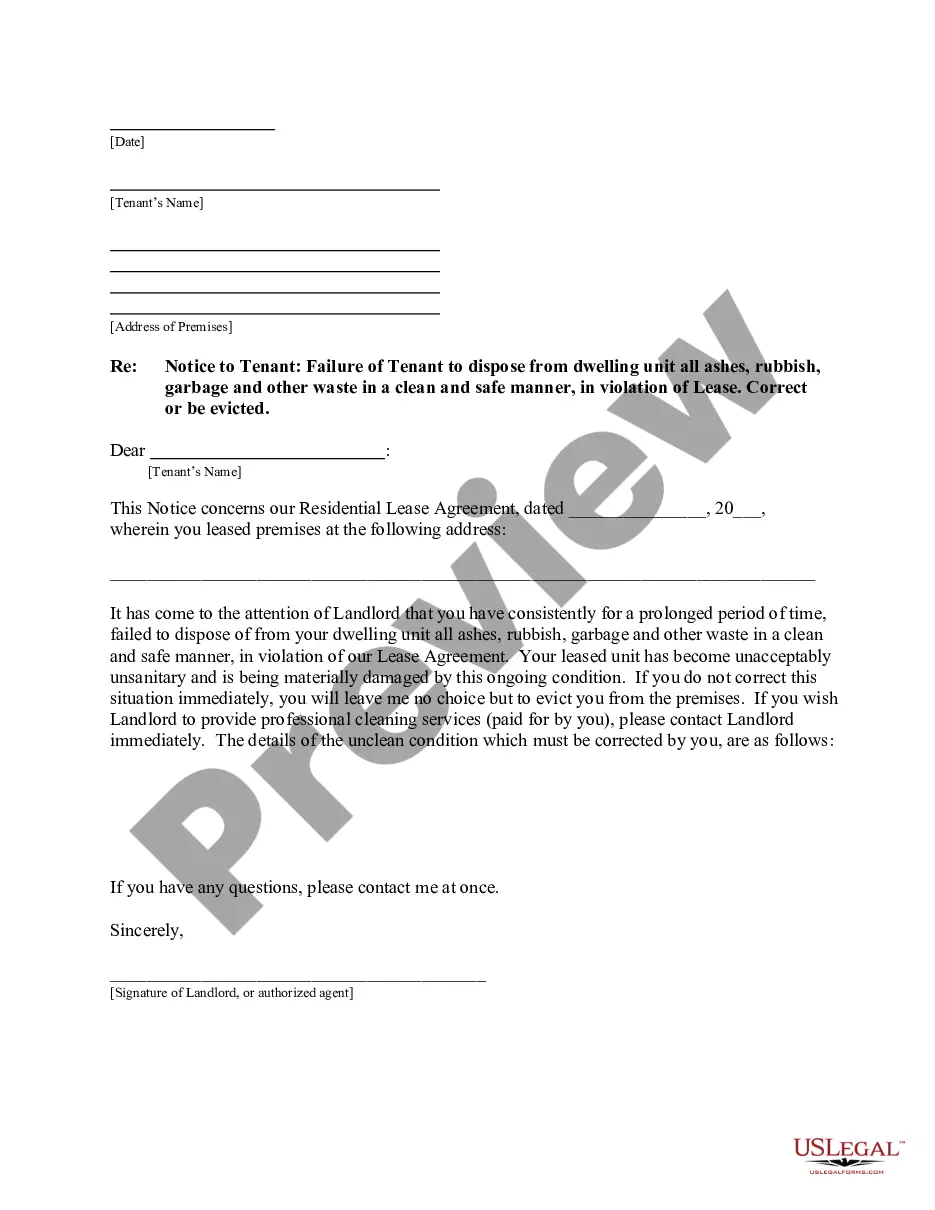

A lease transfer completely transfers all rights and responsibilities from the original tenant to a new tenant, ending the original tenant's lease obligations. In contrast, a sublease allows the original tenant to retain their lease while renting the property to another person. Understanding these differences is essential, especially when using documents like the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease to formalize your arrangements.

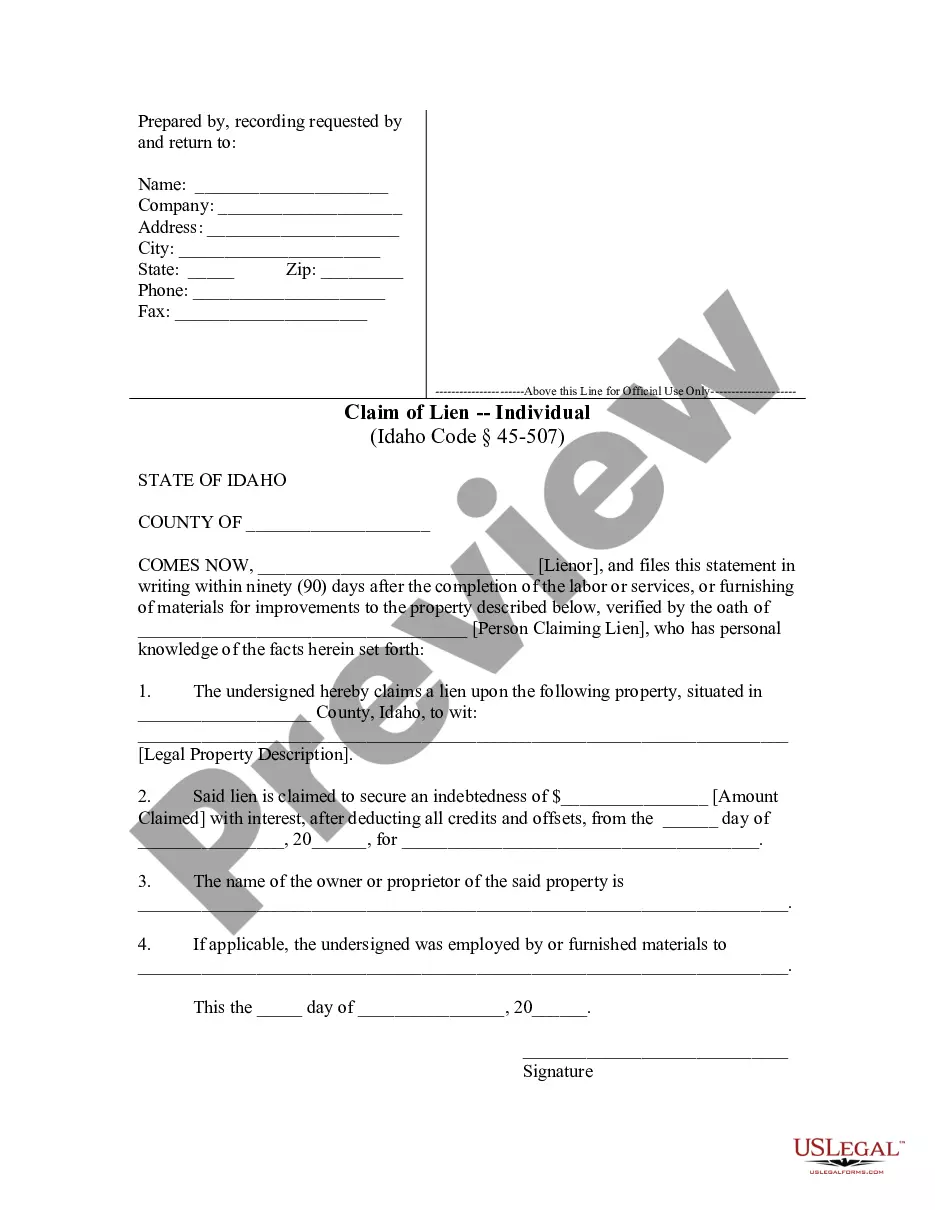

A short form of lease is a simplified document that outlines the critical terms and conditions of a lease agreement without extensive detail. This type of lease is particularly useful for landlords and tenants who need a quick and clear reference to the rental terms. When dealing with the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease, opting for a short form can enhance clarity and reduce confusion.

When writing a letter of intent for a commercial lease, include essential information such as your business name, proposed lease terms, and key conditions. This letter acts as a starting point for negotiations, establishing a mutual understanding between you and the landlord. A well-drafted letter can set the stage for a successful arrangement, particularly when aligned with the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease.

To request a lease transfer from your landlord, start by preparing a formal letter that outlines your reasons for the transfer. Be clear and respectful, and provide any necessary details about the prospective tenant. This direct approach can ease negotiations, especially when you reference the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease as part of your discussion.

The duration of a lease transfer can vary, often taking anywhere from a few days to several weeks, depending on landlord response and paperwork completion. After submitting a lease transfer request, you should remain in communication with your landlord to expedite the process. Utilizing the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease can also streamline this transition.

To record a memorandum of lease, you need to draft the memorandum and include key details like the parties involved, property description, and lease duration. After preparing this document, you must file it with the appropriate county office in the District of Columbia. This step ensures that others can see your rights regarding the property, particularly when using the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease.

A lease transfer works by allowing an existing tenant to assign their lease to another person, who will then take over the lease obligations. This process typically requires landlord approval and may involve filling out specific paperwork, such as the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease. By doing this, the new tenant effectively steps into the shoes of the original tenant.

A lease transfer form is a legal document that allows a tenant to transfer their rights and responsibilities under a lease to another party. This form is essential for ensuring that the landlord and new tenant understand the terms of the lease. When you prepare a District of Columbia Commercial Lease - Short Form for Recording Notice of Lease, you'll likely need this transfer form to formalize the process.

To record a lease agreement in Washington, DC, you must file it with the Recorder of Deeds. Ensure that all signatures are present and the document meets local guidelines. Utilizing the District of Columbia Commercial Lease - Short Form for Recording Notice of Lease available through uslegalforms can simplify this process to ensure your lease is properly recorded.

In Washington, DC, leases do not automatically convert to month-to-month agreements unless specifically stated in the lease contract. If you want flexibility after the term ends, ask for explicit language in your District of Columbia Commercial Lease - Short Form for Recording Notice of Lease that outlines this arrangement.