District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

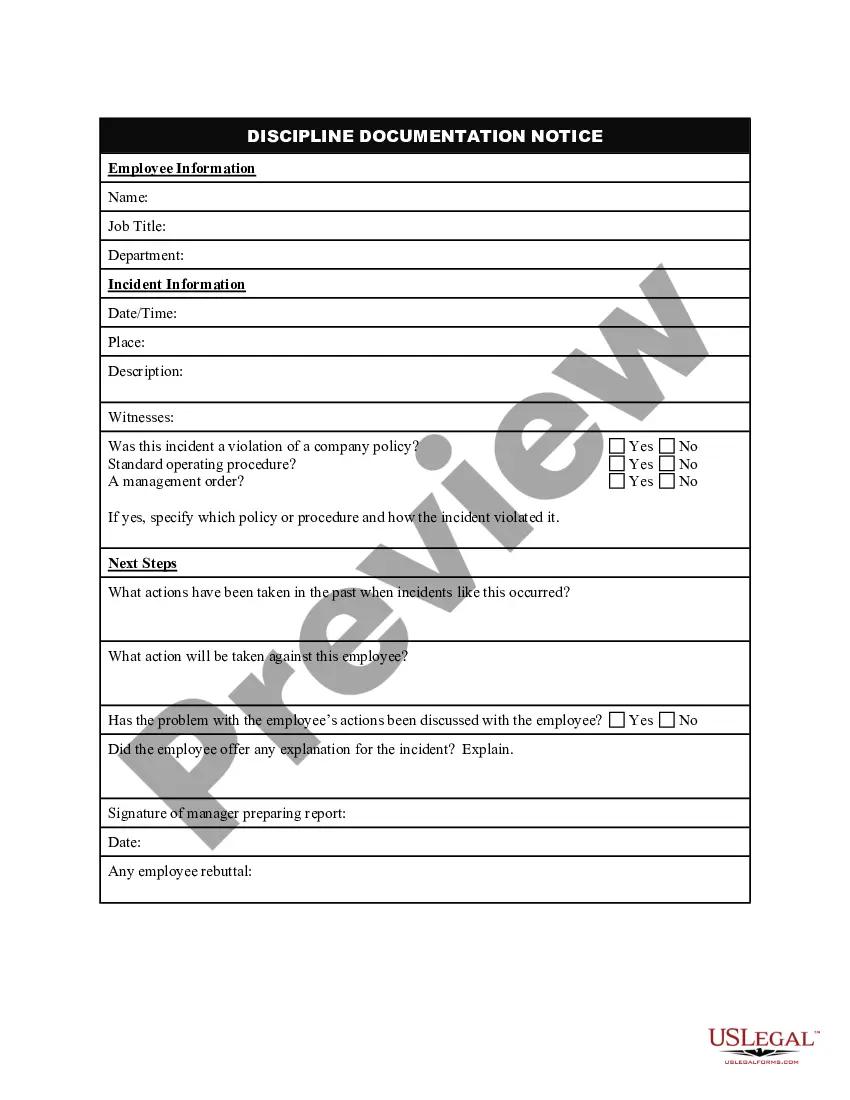

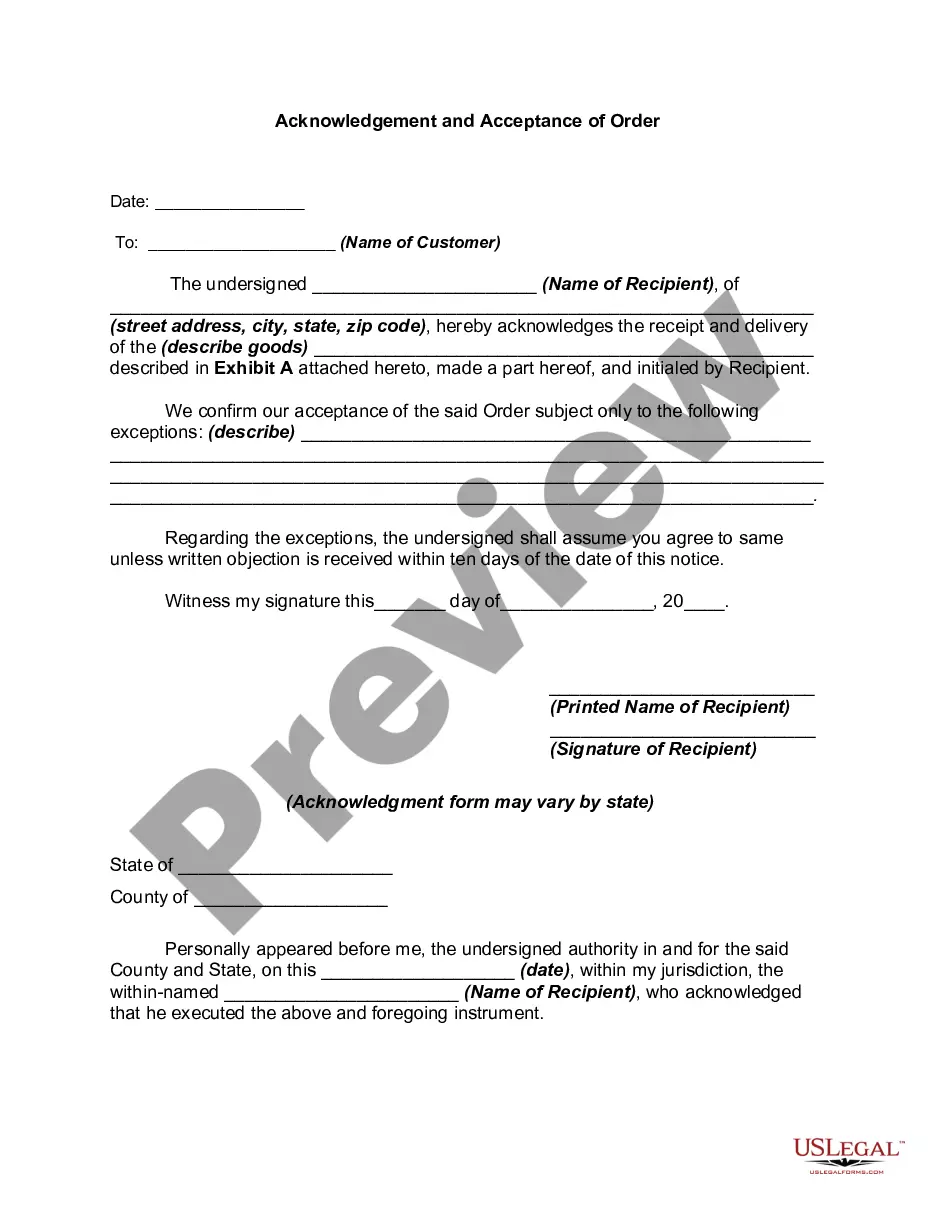

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can purchase or create.

By using the site, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You will find the most recent versions of documents such as the District of Columbia Reimbursement for Expenses - Resolution Form - Corporate Resolutions in just seconds.

Review the document details to confirm you have chosen the correct document.

If the document does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and retrieve the District of Columbia Reimbursement for Expenses - Resolution Form - Corporate Resolutions from your US Legal Forms library.

- The Download button will appear on every template you view.

- You have access to all previously downloaded documents in the My documents section of your account.

- If this is your first time using US Legal Forms, here are some simple instructions to get you started.

- Ensure you have selected the correct document for your region/area.

- Click the Review button to examine the document's details.

Form popularity

FAQ

The D 30 refers to the tax form that corporations must file in the District of Columbia for income tax purposes. It represents the annual tax return, which reports corporate earnings and helps calculate tax liabilities. Familiarizing yourself with the D 30 is essential for a seamless experience with the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, and uslegalforms offers invaluable assistance in understanding this process.

All corporations registered in the District of Columbia must file for franchise tax, regardless of their profit status. This requirement ensures that all businesses contribute to the district's economy. For more support on tax filings and the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, visit uslegalforms for extensive resources.

Any corporation that operates in D.C. is required to file corporate franchise tax. This includes domestic and foreign corporations doing business within the district. By understanding these requirements, you can effectively manage your responsibilities related to the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

DC Form D-30 must be filed by corporations that conduct business activities in the District of Columbia. This form is essential for corporate income tax obligations, ensuring compliance with local regulations. For a smoother filing process, refer to uslegalforms, which covers topics like the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions and helps you stay informed.

Certain entities, such as non-profit organizations, are often exempt from franchise tax in the District of Columbia. Understanding your entity's classification can save you from unnecessary tax obligations. For guidance on navigating these complexities, check out our resources related to the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions on uslegalforms.

You can mail your DC Form D 40B to the Office of Tax and Revenue in Washington, D.C. It is important to ensure that you address it correctly to avoid delays. For detailed instructions, you may visit the uslegalforms platform, which provides resources to assist with the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

Mail your DC tax form to the address specified on the form itself. Each tax form typically contains its specific mailing instructions. Make sure to include any relevant information from your District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to facilitate the review process.

You should mail your DC estimated tax payment to the address indicated on your estimated payment voucher. This is usually directed to the Office of Tax and Revenue. Including the relevant details of your District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions will help ensure your payment is processed correctly.

The filing requirements for the District of Columbia depend on your specific situation, such as whether you are an individual or business entity. Generally, you must file tax forms by the due date, alongside any applicable payments. Using the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help simplify this process.

The DC D-20 tax form is used by corporations operating within the District of Columbia to report income and calculate their tax liabilities. It's essential for compliance with local tax regulations. Incorporating the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can further assist in efficiently handling your corporate tax matters.