District of Columbia Financial Statement Form - Husband and Wife Joint

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Have you ever found yourself in a circumstance where you require documents for potentially business or personal purposes almost every day.

There is a plethora of legal document templates available on the internet, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the District of Columbia Financial Statement Form - Husband and Wife Joint, designed to fulfill both federal and state requirements.

Once you locate the right form, click on Get now.

Choose the pricing plan you wish, provide the necessary information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the District of Columbia Financial Statement Form - Husband and Wife Joint template.

- If you do not possess an account and wish to start using US Legal Forms, follow these procedures.

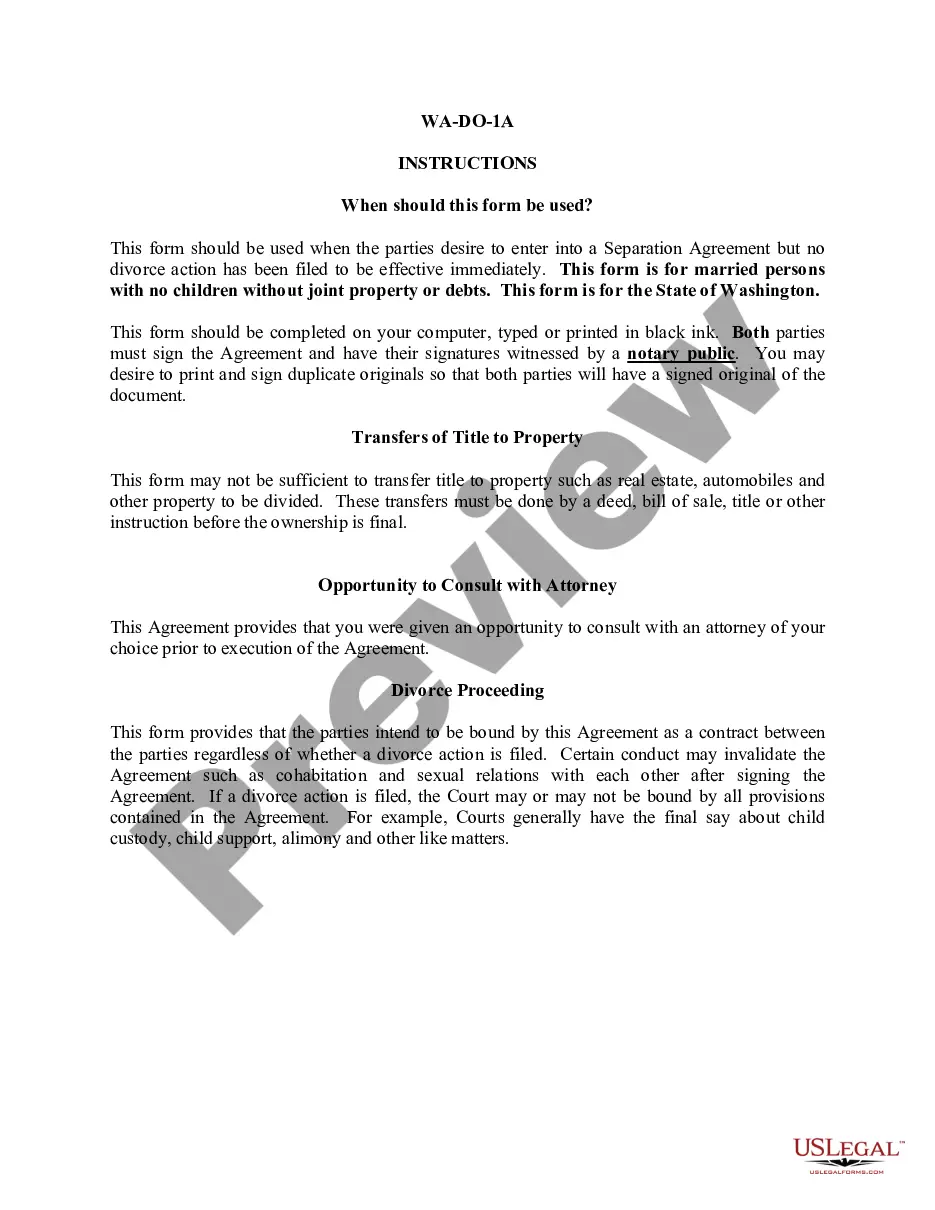

- Select the form you need and ensure it is appropriate for your specific city/region.

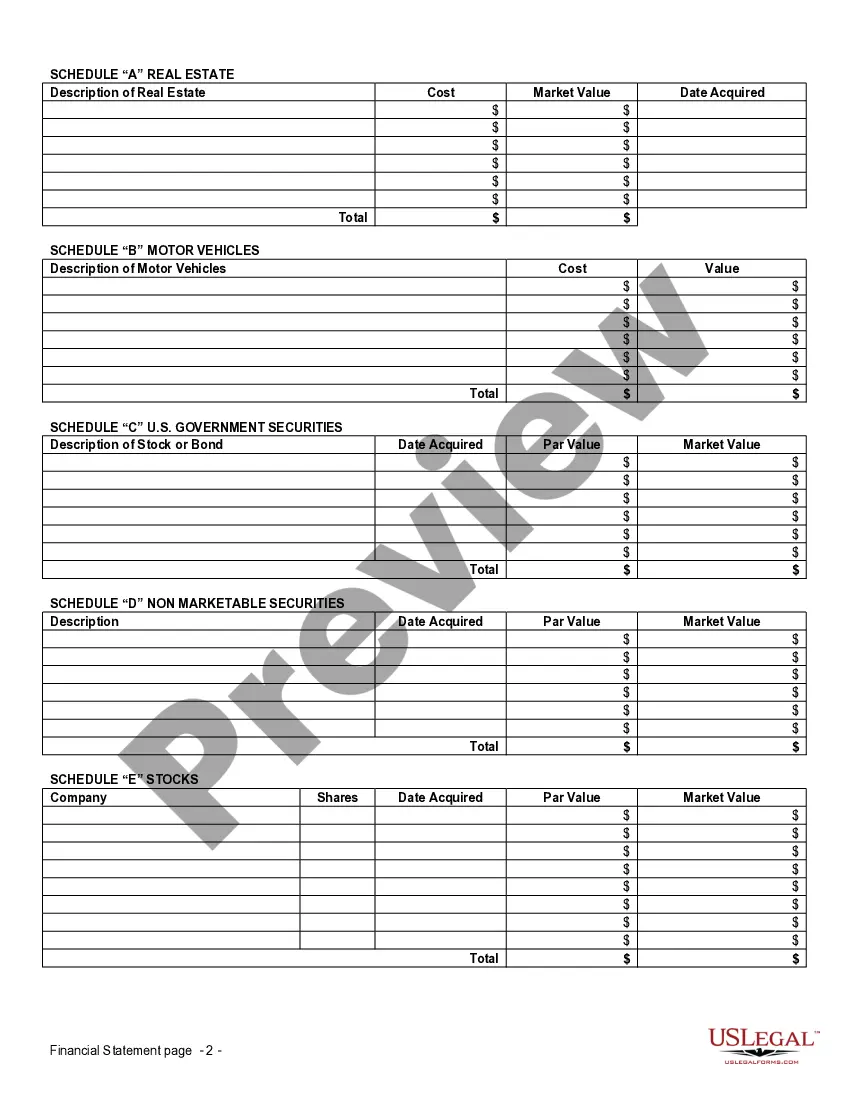

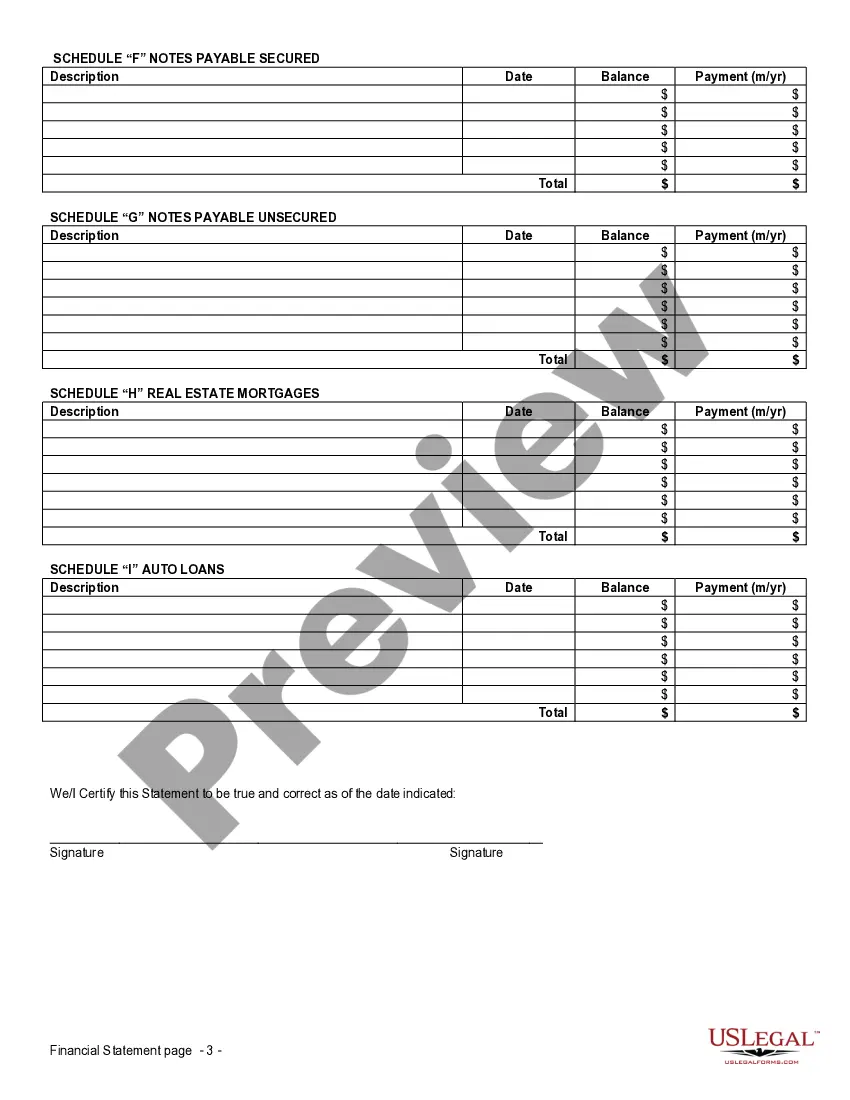

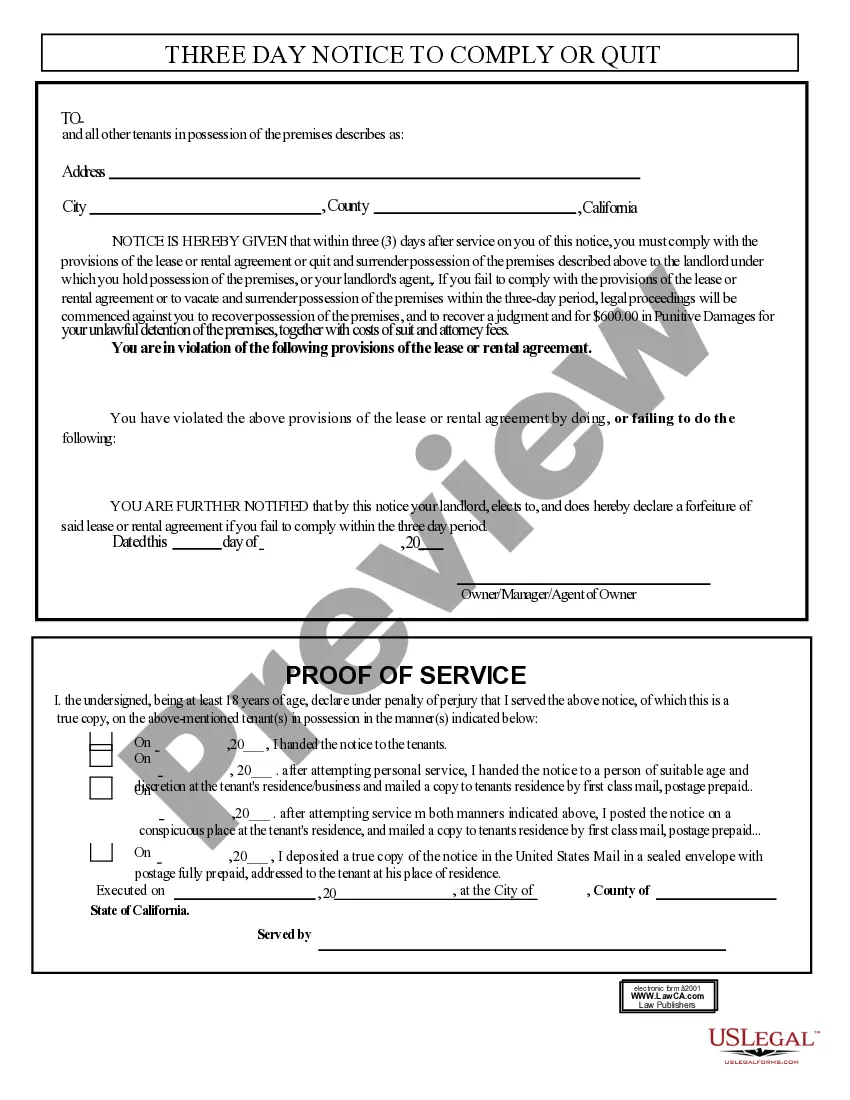

- Utilize the Preview option to review the document.

- Examine the description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Research section to find the form that suits your requirements.

Form popularity

FAQ

The District of Columbia has a progressive income tax system with several tax brackets based on your income level. As your earnings increase, so does your tax rate, allowing for a fair tax contribution based on your financial situation. When you complete the District of Columbia Financial Statement Form - Husband and Wife Joint, it is essential to be aware of these tax brackets to calculate your liability accurately.

The 183 day rule in Washington DC is a guideline that helps differentiate between residents and non-residents for tax purposes. Under this rule, if you spend more than half the year in the District, you are considered a resident. This clarification is often critical when filling out the District of Columbia Financial Statement Form - Husband and Wife Joint, impacting your tax rate and obligations.

The residency rule for Washington DC taxes focuses on where you live and how long you stay in the area. If you are domiciled in DC or maintain a physical presence for over 183 days in a year, you fall under this rule. For couples, understanding these guidelines can be enhanced through the District of Columbia Financial Statement Form - Husband and Wife Joint.

In Washington DC, spouses cannot file married filing separately on the same return. Each spouse must file their own tax return if they decide to file separately. Using the District of Columbia Financial Statement Form - Husband and Wife Joint can simplify the process and ensure you meet all requirements for joint filing.

The 183 day rule determines your residency status in Washington DC for tax purposes. If you spend 183 days or more in the District within a year, you are generally considered a resident. This rule is important when filing the District of Columbia Financial Statement Form - Husband and Wife Joint, as it can affect your tax obligations significantly.

To qualify as a resident of Washington DC, you must establish a physical presence in the city and maintain it for a significant portion of the year. Generally, living in the District for more than 183 days establishes residency. Utilizing the District of Columbia Financial Statement Form - Husband and Wife Joint can also assist in providing crucial documentation to support your residency claims.

Yes, the District of Columbia does allow itemized deductions on your tax return. If you choose to itemize, you can include various expenses such as medical costs, mortgage interest, and property taxes. Keep in mind that to maximize your benefits, reviewing the District of Columbia Financial Statement Form - Husband and Wife Joint will help you determine the best approach for your financial situation.

The District of Columbia requires residents to file tax returns if they meet certain income thresholds, which can vary based on filing status. Be sure to include necessary forms and documents, such as the District of Columbia Financial Statement Form - Husband and Wife Joint, to ensure full compliance with tax laws. Familiarizing yourself with these requirements can prevent missteps and benefit your overall financial health.

Yes, you can electronically file a District of Columbia tax return, which can simplify the filing process. This option often enables faster processing and quicker refunds. When filing, consider using the District of Columbia Financial Statement Form - Husband and Wife Joint, as it ensures that all essential information is streamlined and organized for submission.

No, both spouses are not required to file using Married Filing Separately. It is possible for one spouse to file jointly while the other files separately, allowing more flexibility in managing your tax situation. Utilizing the District of Columbia Financial Statement Form - Husband and Wife Joint can help present a clear picture of finances and guide your filing choices.