District of Columbia Guaranty of Promissory Note by Individual - Individual Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Individual Borrower?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad array of legal form templates you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

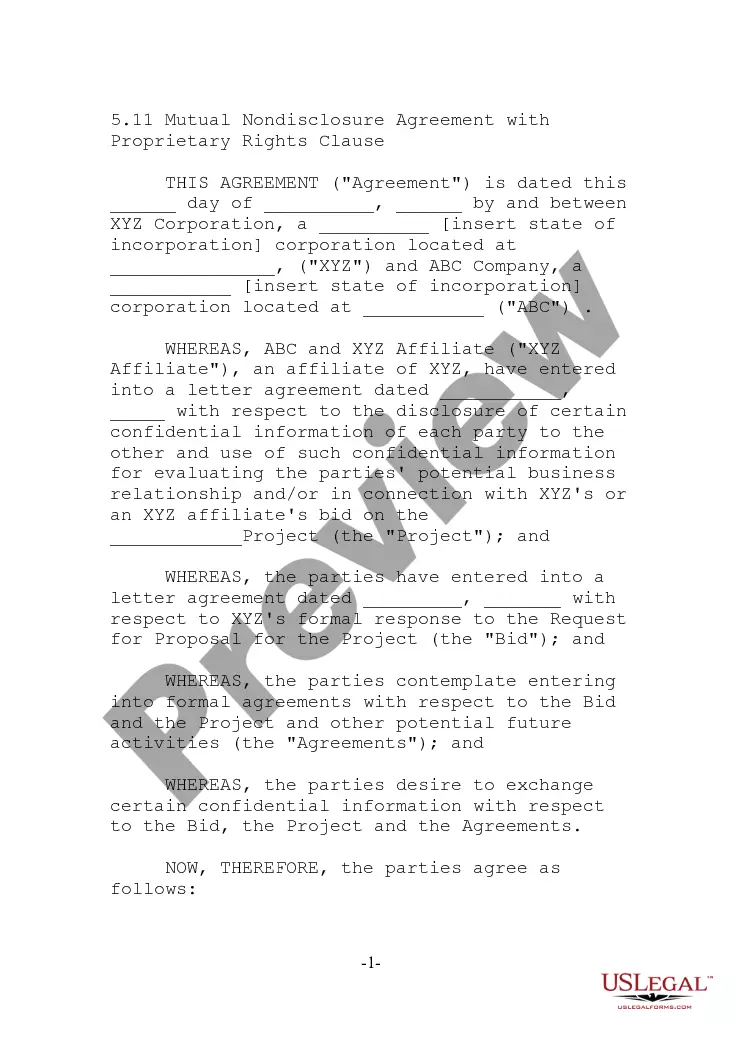

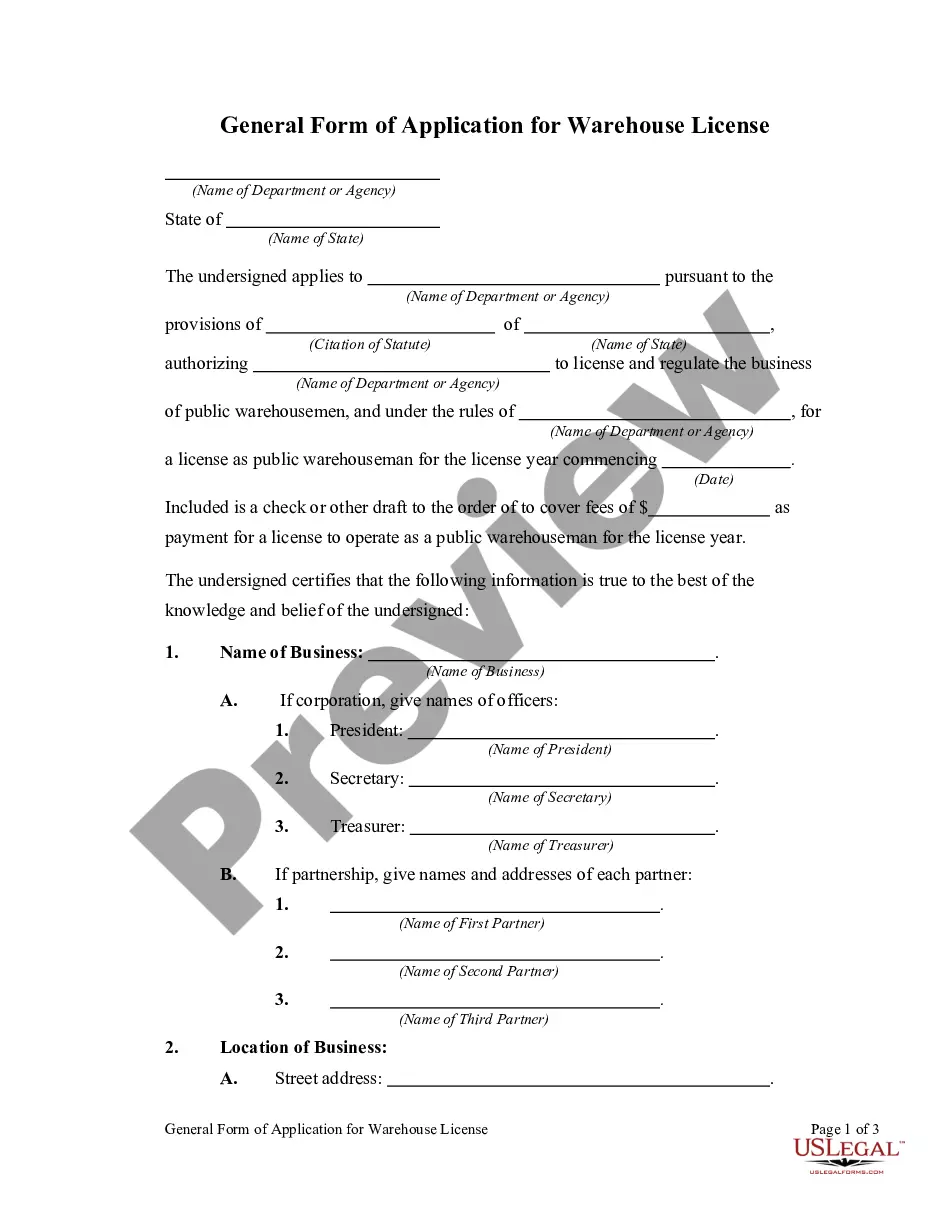

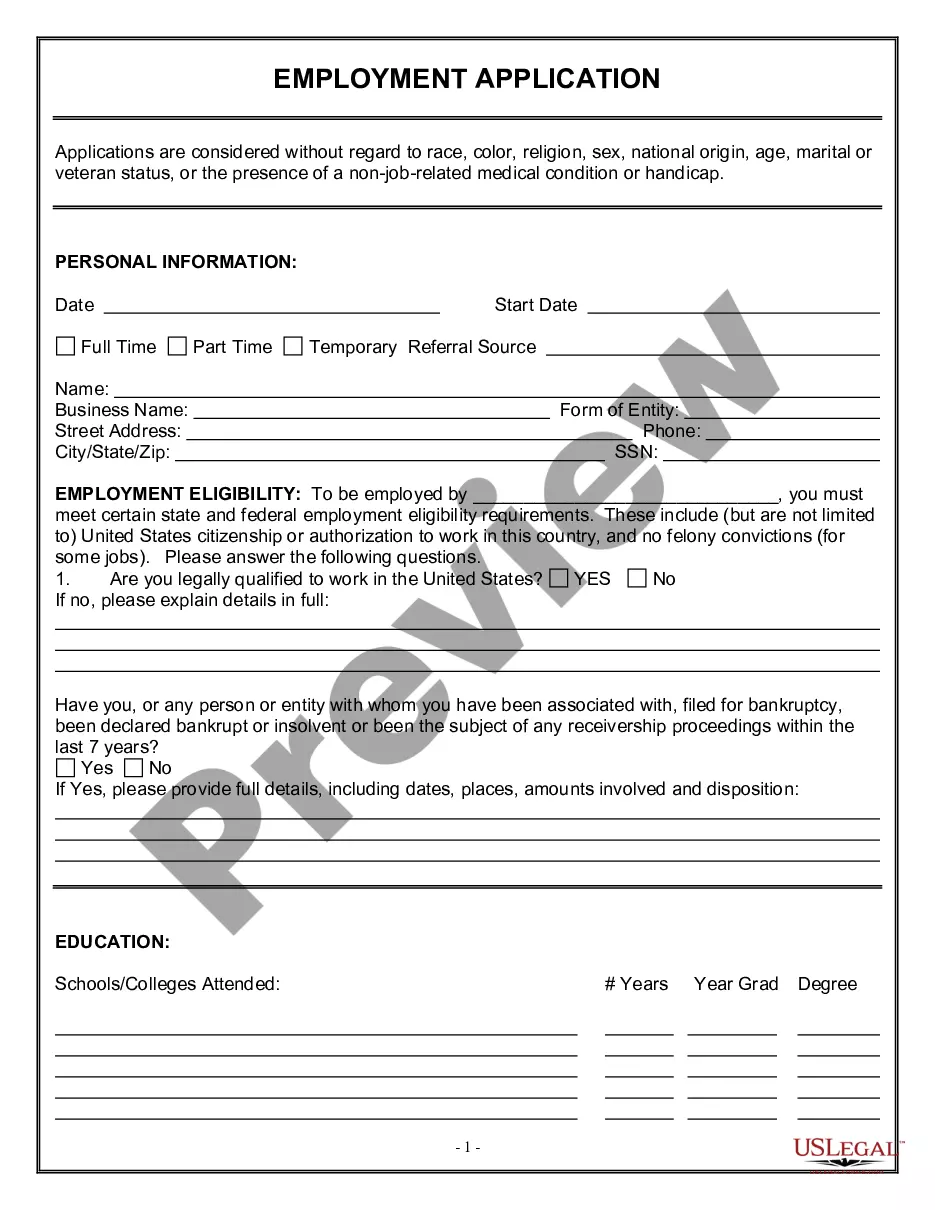

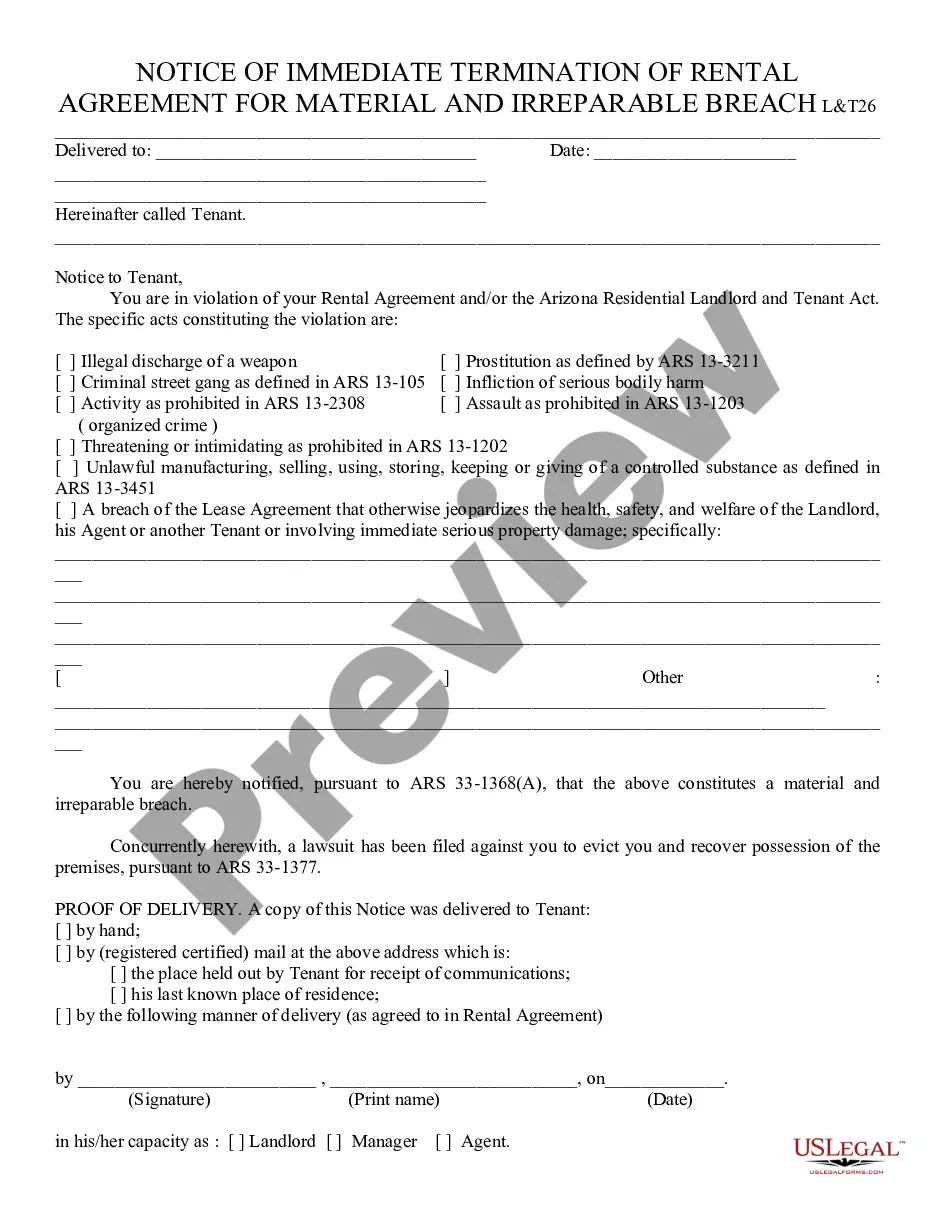

You will find the latest versions of forms like the District of Columbia Guaranty of Promissory Note by Individual - Individual Borrower in just moments.

Review the form summary to confirm that you have chosen the correct one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you currently possess a monthly subscription, Log In to acquire the District of Columbia Guaranty of Promissory Note by Individual - Individual Borrower from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms under the My documents tab in your account.

- To use US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to check the form's details.

Form popularity

FAQ

Article 3 of the Uniform Commercial Code applies only to negotiable instruments. Many promissory notes are negotiable instruments, but many are not, and non-negotiable promissory notes are completely outside the scope of UCC Article 3.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

An unconditional promise to pay a certain amount of money to a named party or the holder of the note, or to deposit that money as such persons direct. A promissory note must be in writing and signed by the maker of the promise.

As per section 32 of negotiable instrument act, in the absence of a contract to the contrary, the maker of a promissory note and the acceptor before the maturity of a bill of exchange are under the liability to pay the amount thereof at maturity.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Parties to Promissory Notes 1) The maker: This is basically the person who makes or executes a promissory note and pays the amount therein. 2) The payee: The person to whom a note is payable is the payee.