District of Columbia Minutes for Partnership

Description

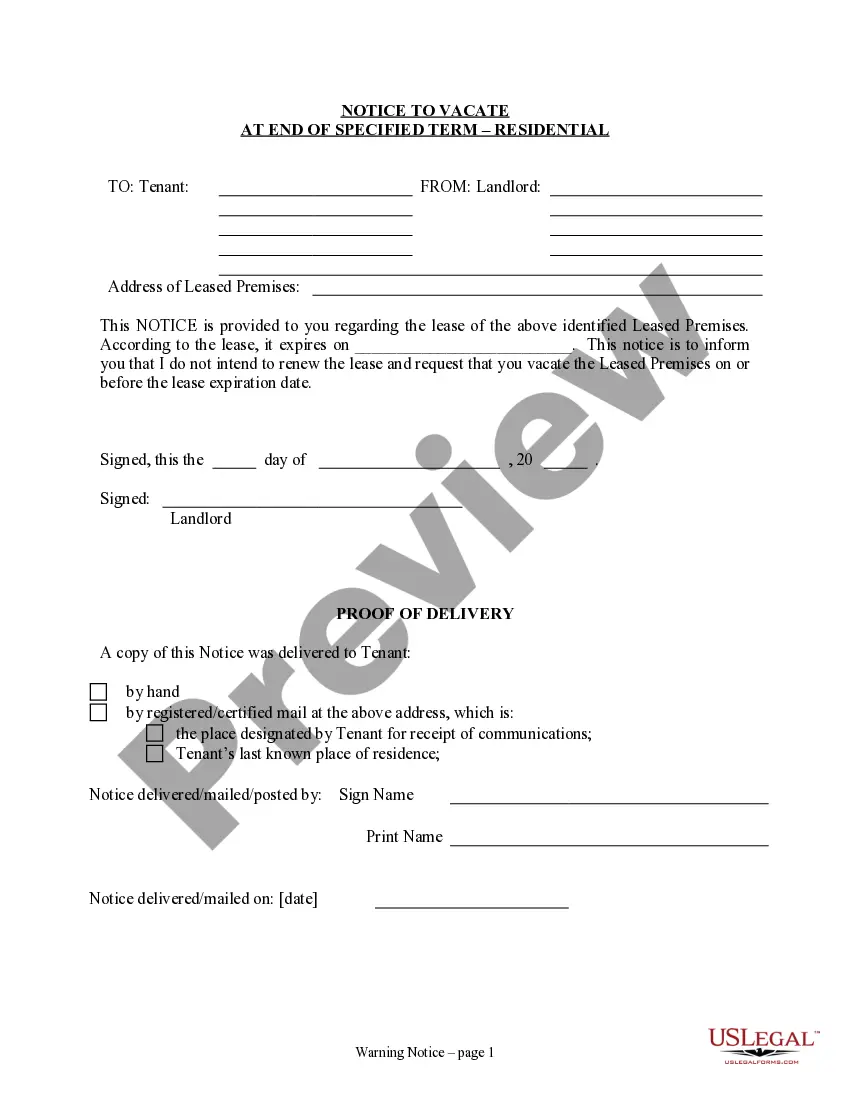

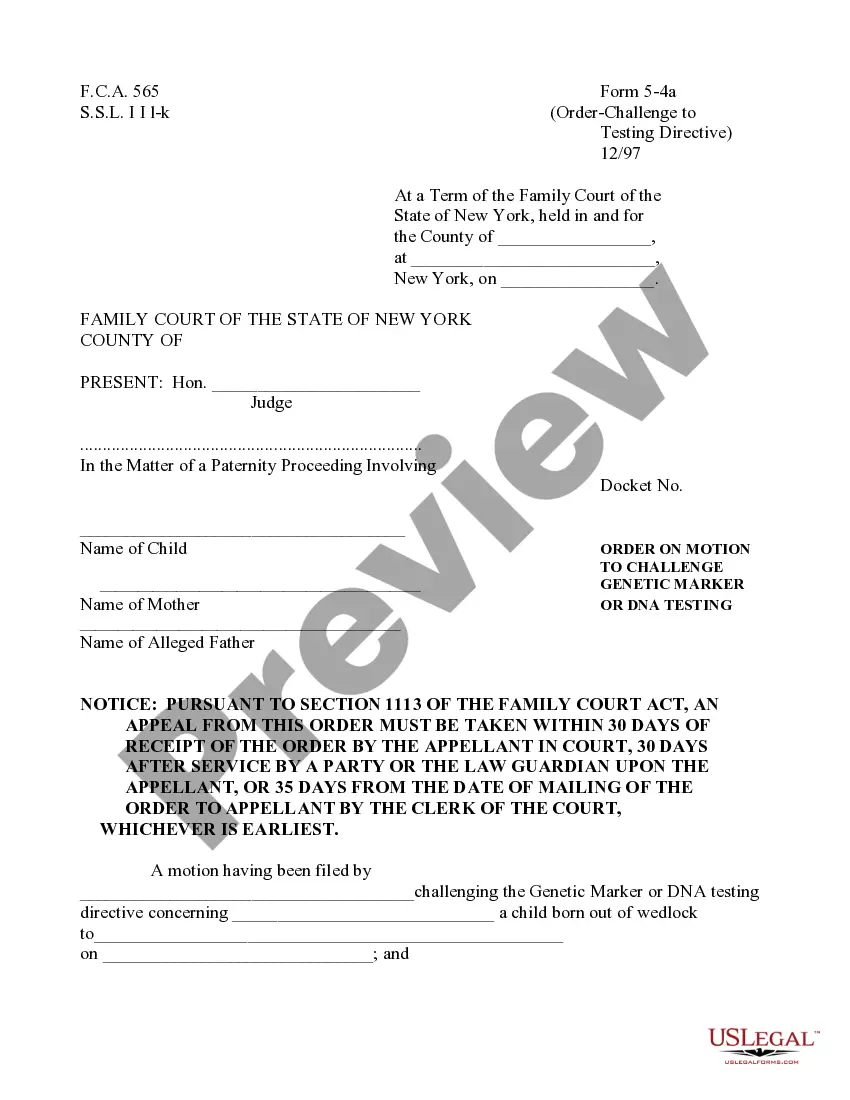

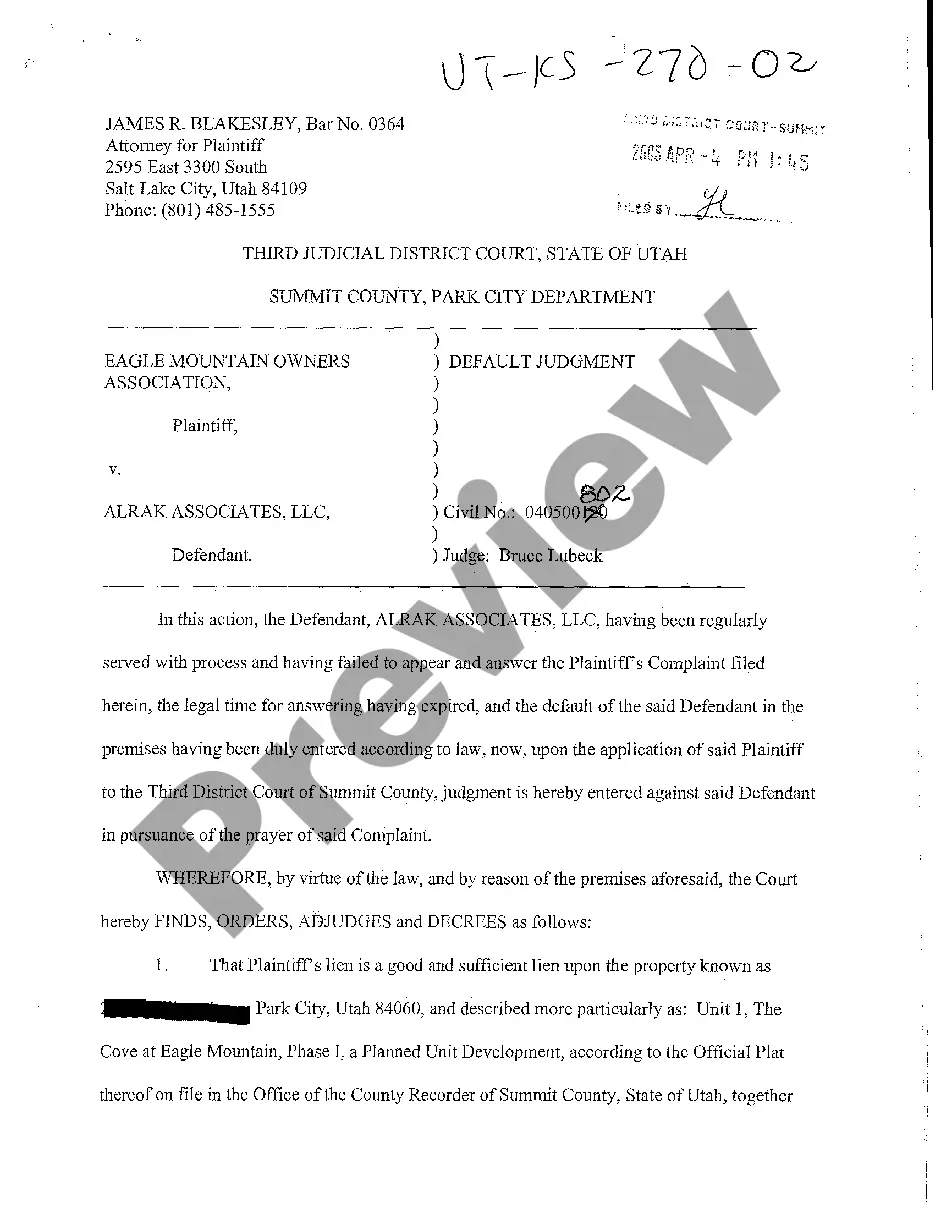

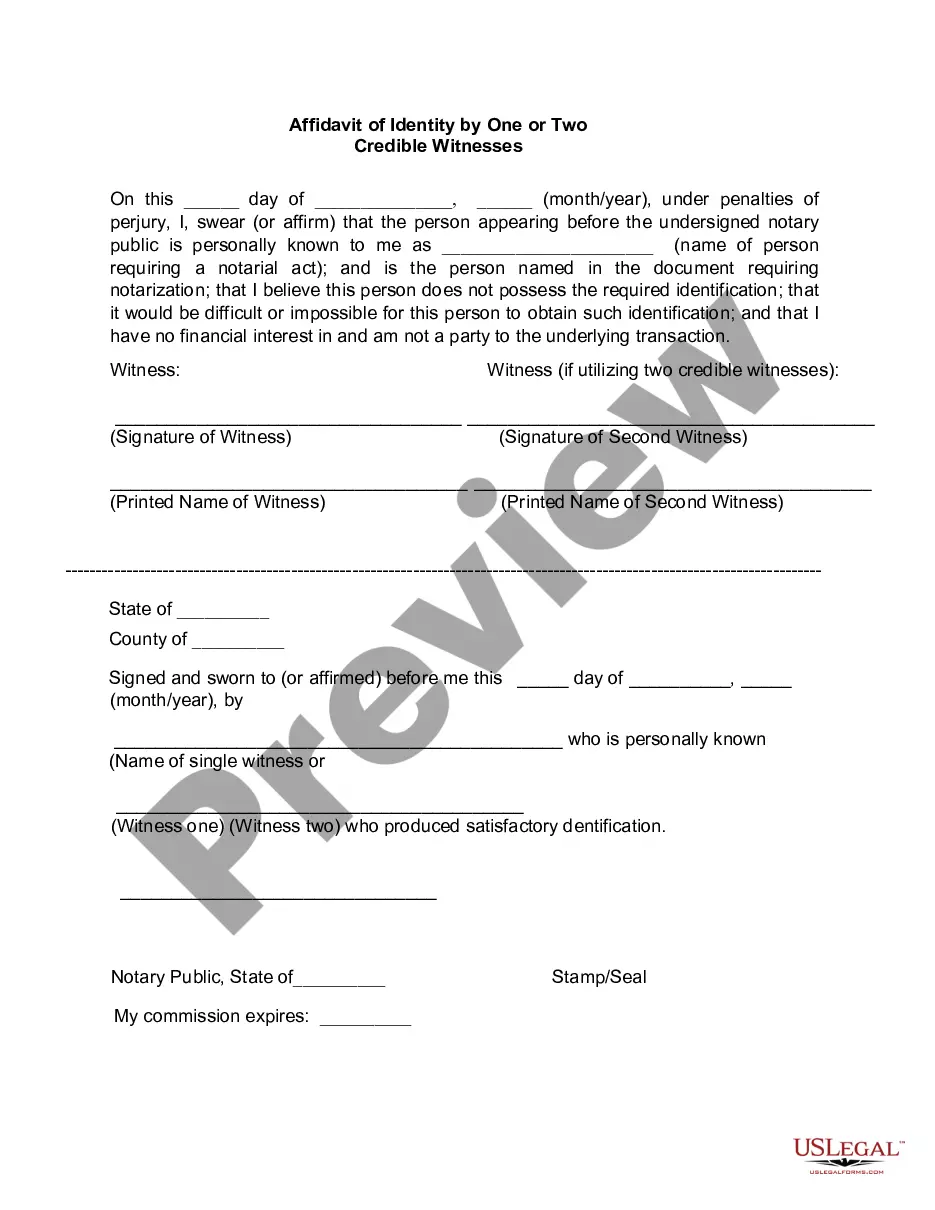

How to fill out Minutes For Partnership?

If you want to be thorough, download, or print legally recognized document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site's straightforward and efficient search tool to find the documents you need.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the District of Columbia Minutes for Partnership with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- Use US Legal Forms to acquire the District of Columbia Minutes for Partnership in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the District of Columbia Minutes for Partnership.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other types of your legal document template.

- Step 4. Once you have found the form you need, select the Get now button. Choose your pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the District of Columbia Minutes for Partnership.

Form popularity

FAQ

Yes, partnerships do have minutes, and maintaining them is essential for effective governance. District of Columbia Minutes for Partnership serve to document important discussions and decisions made during meetings. These minutes help ensure transparency among partners and provide a clear reference for future discussions. Utilizing tools from US Legal Forms can simplify the process of creating and managing these minutes, making compliance easier for all involved.

To open a bank account for a partnership firm, you’ll need to gather identification for all partners and provide a copy of the District of Columbia Minutes for Partnership. These documents confirm the partnership's legal structure and allow the bank to properly set up the account. Contact your chosen bank beforehand to learn about specific requirements and documentation.

Washington, D.C. requires partnerships to file an annual partnership tax return. This return includes essential information regarding income and expenses that the partnership generated during the tax year. Be sure to keep accurate records and include the District of Columbia Minutes for Partnership to verify your partnership's structure.

Yes, partnerships operating in the District of Columbia must file an annual tax return. This return details the partnership's income, deductions, and credits for the year. Understanding these tax obligations is essential for compliance and protecting your investment.

To open a partnership account, you need to register your partnership with the appropriate DC authorities and provide essential documents such as the District of Columbia Minutes for Partnership. Additionally, you will need identification and any other relevant paperwork that demonstrates the partnership's legitimacy. Make sure to have all required information ready to avoid delays.

To properly book partnership income, you should maintain accurate records of all income and expenses related to your partnership activities. Utilizing accounting software can aid in tracking this information effectively. Don’t forget to include the District of Columbia Minutes for Partnership in your financial records as they may impact your reports.

The District of Columbia does accept federal extensions for partnerships. If you file for a federal extension, you automatically receive an extension for DC, provided you meet the requirements. However, you must still file the required forms and the District of Columbia Minutes for Partnership in a timely manner.

Yes, the District of Columbia imposes a franchise tax on partnerships based on their gross receipts. It’s important to understand how this tax may impact your partnership's financial planning. Ensure compliance by consulting the District of Columbia Minutes for Partnership as part of your tax strategy.

To create a partnership account in DC, you should choose a unique partnership name and complete the registration forms provided by the Department of Consumer and Regulatory Affairs. Additionally, you’ll need the District of Columbia Minutes for Partnership to serve as a formal record of your partnership's establishment. Once these steps are completed, you can legally operate your partnership.

Yes, the District of Columbia requires a non-resident tax return if you earn income sourced from DC. Filing this return helps you comply with tax regulations, even if you do not reside in the city. It’s crucial to be informed about your obligations related to the District of Columbia Minutes for Partnership.