The District of Columbia Charitable Remainder Inter Vivos Annuity Trust, also known as D.C. CAT, is a legal and financial tool designed to provide individuals with a way to support charitable causes while also receiving certain financial benefits during their lifetime. This type of trust can be beneficial for those who are willing to make a charitable donation but also want to retain an income stream from their assets. Key features of the District of Columbia Charitable Remainder Inter Vivos Annuity Trust include: 1. Charitable Intent: The primary purpose of this trust is to support charitable organizations and causes. The creator of the trust, known as the donor, designates one or more charitable organizations as the beneficiary to receive the trust's assets upon its termination. 2. Lifetime Income: One of the main advantages of a Charitable Remainder Inter Vivos Annuity Trust is that it provides the donor with a guaranteed income stream for life or for a specified term. The donor can decide the amount of income to be paid annually, which is typically a fixed percentage of the initial contribution. 3. Tax Benefits: By establishing a D.C. CAT, the donor may receive certain tax benefits. The donor can claim an income tax deduction for the present value of the charitable gift made to the trust, which can potentially reduce their overall tax liability. 4. Asset Protection: Assets placed in a Charitable Remainder Inter Vivos Annuity Trust are protected from creditors and can be shielded from estate taxes, enabling the donor to preserve their wealth for themselves and their chosen charitable organizations. Different types of Charitable Remainder Inter Vivos Annuity Trusts that may exist within the District of Columbia might include variations based on the specific terms and conditions set by the donor. These might include determining the length of the annuity period, specifying the charitable beneficiary or beneficiaries, or any additional provisions unique to the trust. Overall, the District of Columbia Charitable Remainder Inter Vivos Annuity Trust provides an effective strategy for individuals to leave a lasting impact on their community by supporting charitable causes while enjoying certain financial benefits during their lifetime.

District of Columbia Charitable Remainder Inter Vivos Annuity Trust

Description

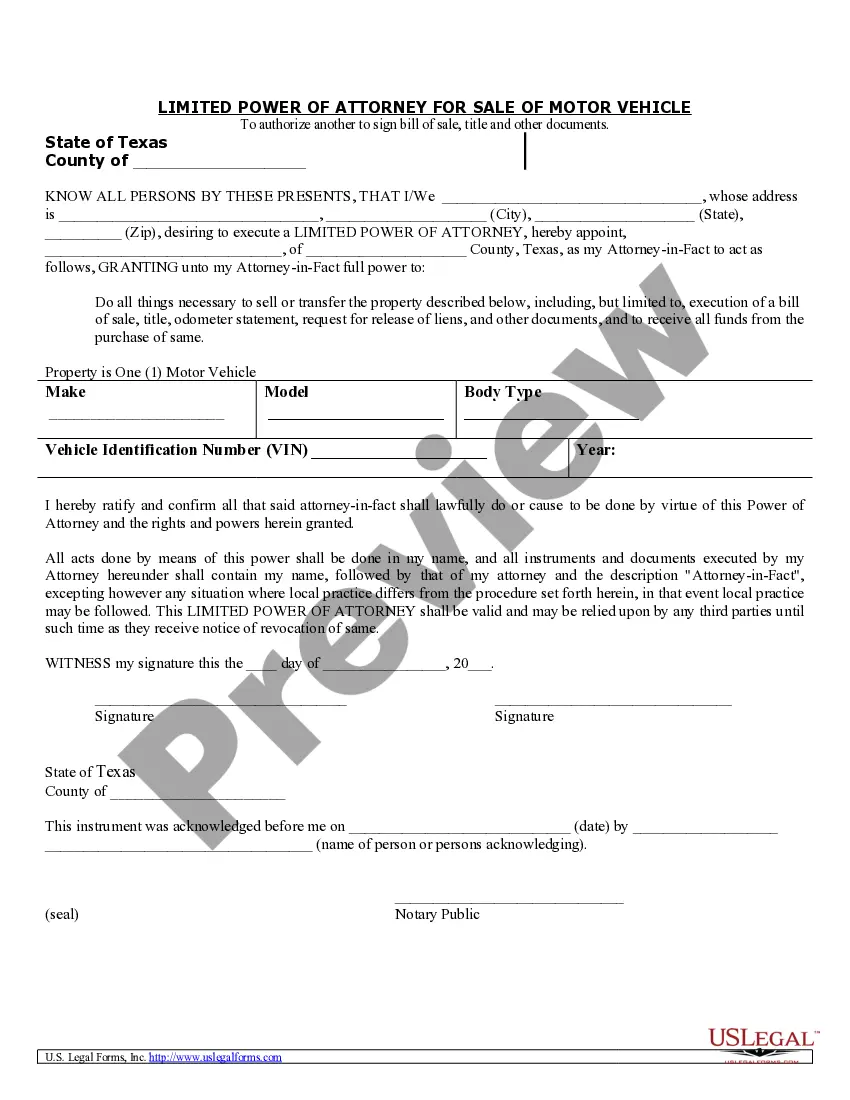

How to fill out District Of Columbia Charitable Remainder Inter Vivos Annuity Trust?

Are you currently in a placement that you will need documents for both organization or personal functions nearly every working day? There are a variety of authorized file templates available on the Internet, but getting ones you can depend on isn`t straightforward. US Legal Forms gives thousands of type templates, much like the District of Columbia Charitable Remainder Inter Vivos Annuity Trust, which are composed in order to meet federal and state requirements.

Should you be previously informed about US Legal Forms web site and have a merchant account, merely log in. Next, you may download the District of Columbia Charitable Remainder Inter Vivos Annuity Trust format.

Should you not provide an accounts and need to begin to use US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for the correct area/county.

- Use the Review key to analyze the form.

- Read the description to actually have selected the correct type.

- In case the type isn`t what you are searching for, make use of the Search area to discover the type that suits you and requirements.

- When you discover the correct type, click Get now.

- Opt for the rates strategy you need, fill out the specified information to generate your account, and buy the order utilizing your PayPal or bank card.

- Select a handy file file format and download your copy.

Get all of the file templates you have purchased in the My Forms food list. You can obtain a extra copy of District of Columbia Charitable Remainder Inter Vivos Annuity Trust any time, if needed. Just select the necessary type to download or print out the file format.

Use US Legal Forms, by far the most substantial selection of authorized forms, in order to save time as well as prevent errors. The support gives professionally produced authorized file templates that can be used for an array of functions. Make a merchant account on US Legal Forms and commence creating your life easier.