The District of Columbia Contract between a General Agent of an Insurance Company and an Independent Agent is a legal agreement that establishes the relationship between the two parties involved in the insurance business. This contract outlines the specific terms and conditions that govern the activities and responsibilities of both the general agent and the independent agent. Keywords: District of Columbia Contract, General Agent, Insurance Company, Independent Agent. This type of contract is crucial in the insurance industry as it clarifies the roles and expectations of each party, ensuring a smooth and mutually beneficial partnership. The District of Columbia Contract between a General Agent of an Insurance Company and an Independent Agent can vary based on specific factors, such as the insurance company involved, the type of insurance products being sold, and the agreed scope of work. Different types of District of Columbia Contracts between General Agents of Insurance Companies and Independent Agents can include: 1. Non-Exclusive Agent Agreement: This type of contract permits the general agent to work with multiple independent agents simultaneously, allowing them to represent multiple insurance companies. It provides flexibility for both parties and allows the independent agent to have a diversified product portfolio, increasing their potential earnings. 2. Exclusive Agent Agreement: In contrast to the non-exclusive agreement, this type of contract restricts the independent agent from working with other insurance companies. It grants the general agent exclusivity in representing their insurance products, ensuring undivided loyalty from the independent agent. This agreement is often used when certain insurance products require specialized knowledge or when the general agent provides a higher level of support and resources to the independent agent. 3. Commission-Based Agreement: This agreement primarily focuses on the compensation structure between the general agent and the independent agent. It outlines the commission rates, payment terms, and any additional payment incentives or bonuses. This type of contract is important to ensure clarity and fairness in the compensation process, promoting motivation and performance from the independent agent. 4. Termination Agreement: This type of contract governs the termination process between the general agent and the independent agent. It specifies the conditions under which either party can terminate the agreement, the notice period required, and any potential financial implications. This agreement protects the interests of both parties and provides a clear roadmap for the termination process. In summary, the District of Columbia Contract between a General Agent of an Insurance Company and an Independent Agent is a vital legal document that establishes the working relationship between the two parties. It clarifies their roles, responsibilities, compensation, and termination procedures. Understanding and adhering to this contract ensures a productive and successful partnership in the insurance business.

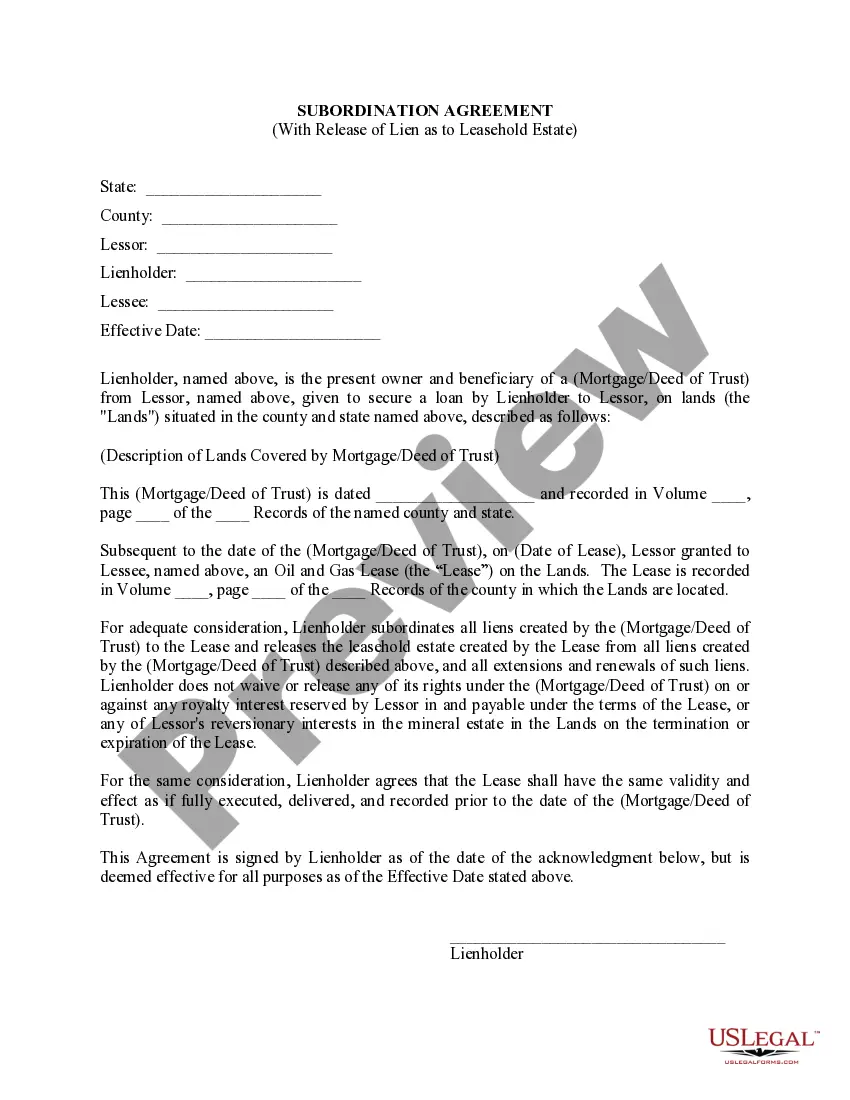

District of Columbia Contract between General Agent of Insurance Company and Independent Agent

Description

How to fill out District Of Columbia Contract Between General Agent Of Insurance Company And Independent Agent?

Finding the right legal record web template might be a struggle. Needless to say, there are a variety of themes available online, but how would you find the legal develop you need? Use the US Legal Forms website. The support delivers thousands of themes, like the District of Columbia Contract between General Agent of Insurance Company and Independent Agent, which you can use for business and private requires. Every one of the forms are inspected by experts and satisfy state and federal requirements.

If you are currently registered, log in to the profile and click on the Acquire switch to find the District of Columbia Contract between General Agent of Insurance Company and Independent Agent. Utilize your profile to appear through the legal forms you may have acquired formerly. Check out the My Forms tab of the profile and acquire another copy from the record you need.

If you are a brand new customer of US Legal Forms, here are straightforward directions so that you can comply with:

- First, ensure you have chosen the right develop for the town/state. It is possible to check out the shape while using Preview switch and read the shape description to make certain it is the right one for you.

- In case the develop does not satisfy your needs, take advantage of the Seach area to get the correct develop.

- Once you are certain that the shape is proper, select the Purchase now switch to find the develop.

- Choose the prices plan you need and enter the needed details. Build your profile and pay money for the order utilizing your PayPal profile or Visa or Mastercard.

- Choose the document structure and acquire the legal record web template to the system.

- Total, revise and produce and signal the obtained District of Columbia Contract between General Agent of Insurance Company and Independent Agent.

US Legal Forms will be the largest collection of legal forms where you can find various record themes. Use the company to acquire expertly-produced files that comply with state requirements.