District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Shareholder Agreement To Sell Stock To Other Shareholder?

You can spend hours online looking for the legal document format that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can obtain or print the District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder from my services.

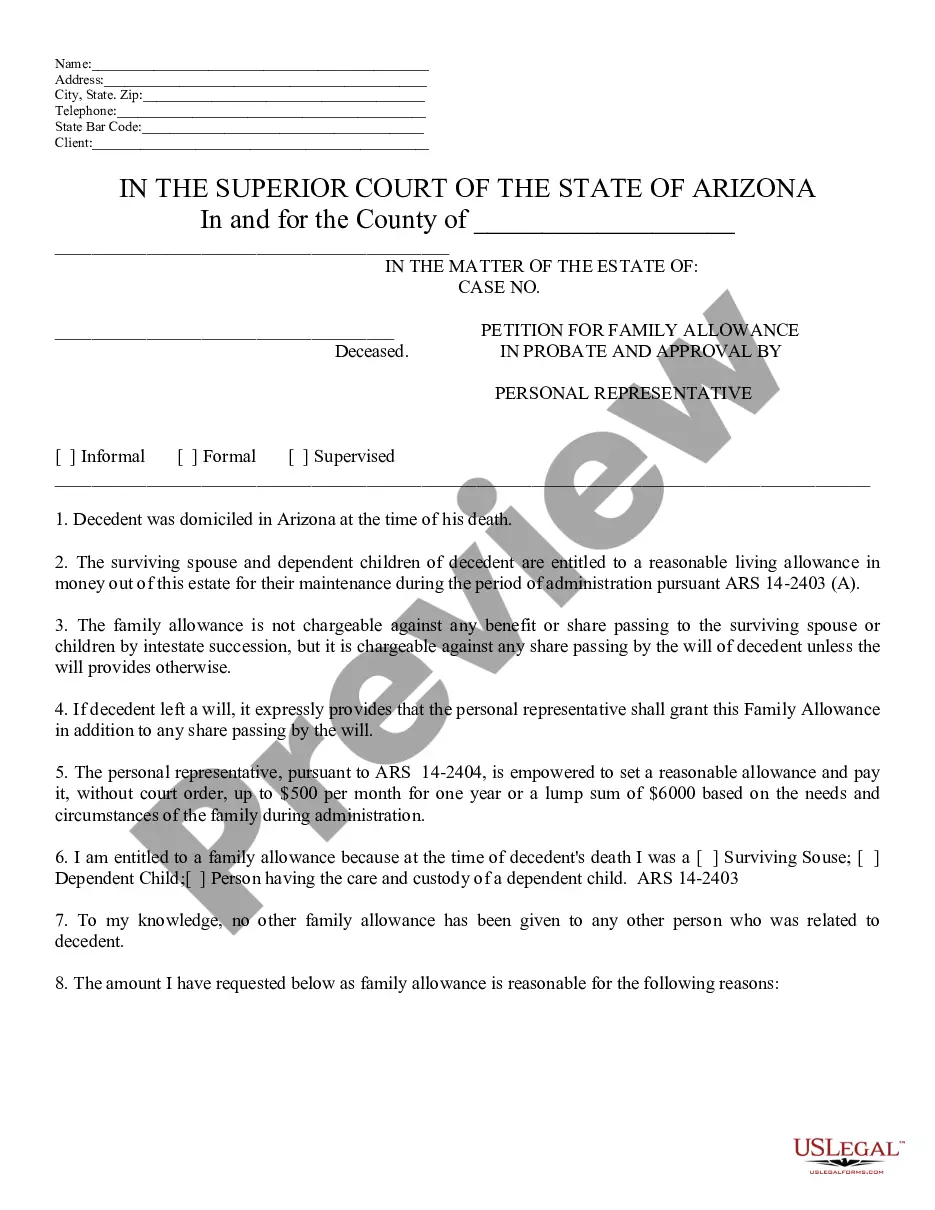

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Acquire button.

- After that, you are able to complete, modify, print, or sign the District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Check the document outline to confirm you have chosen the right form.

Form popularity

FAQ

To transfer shares to another shareholder, you should follow the guidelines established in the District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder. Communicate clearly with the other shareholder regarding the intent to transfer shares, and ensure you comply with any restrictions or requirements in your agreement. Documentation is crucial; a formal transfer document may be needed to finalize the process. US Legal Forms can provide you with the necessary templates to facilitate a smooth transfer.

Creating a District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder involves several important steps. First, you should outline the terms and conditions regarding the sale of shares, including the methods for valuation and payment. Next, it's essential to clarify the rights and responsibilities of each shareholder, along with any restrictions on the sale. You may consider using a platform like US Legal Forms for templates and guidance to simplify the process.

In the District of Columbia, a shareholder agreement does not generally need to be notarized to be enforceable. However, having the agreement notarized can provide an additional layer of verification and may enhance its credibility. It's always advisable to keep records of all agreements you enter into, including those related to the sale of stock between shareholders. Platforms like uSlegalforms can guide you in creating a compliant District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder.

Creating a shareholder agreement involves drafting a document that outlines the rights and responsibilities of shareholders. Start by gathering input from all shareholders to ensure their needs and concerns are addressed. Once you have drafted the agreement, it is wise to consult with a legal professional to ensure compliance with local laws in the District of Columbia. The uSlegalforms platform offers helpful resources to create a solid District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder.

Yes, shareholders can sometimes compel another shareholder to sell, depending on the conditions outlined in the shareholder agreement. Typically, this right is included to protect the interests of all shareholders in situations such as a shareholder’s departure or an ownership dispute. Therefore, it's essential to have a well-defined District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder that specifies these conditions clearly.

To write a shareholder agreement, start by defining the key terms and the structure of your business. Include clauses that address decision-making procedures, the process for selling stock, and any restrictions on transfers. Make sure the agreement complies with District of Columbia laws, particularly regarding shareholder rights and obligations. Utilizing the uSlegalforms platform can simplify this process, offering you a clear template for a District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder.

Yes, you can write your own shareholders agreement. However, it is essential to ensure that it meets the legal requirements of the District of Columbia. A well-crafted agreement will protect your interests, outline shareholder rights, and clarify processes regarding the sale of stock to other shareholders. If you need assistance, consider using the uSlegalforms platform, which provides templates tailored for the District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder.

Acquiring a District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder can be done through legal resources or platforms like uslegalforms. These services provide templates and guidance, making it easier to customize an agreement that fits your needs. Consulting with legal professionals can ensure you cover all necessary aspects for your shareholder agreement.

To sell shares to other shareholders, refer to your District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder for the prescribed process. You will typically present the offer to your fellow shareholders and follow any outlined steps for approval. Understanding these procedures aids in a smooth transaction and maintains harmony within the company.

Establishing a District of Columbia Shareholder Agreement to Sell Stock to Other Shareholder begins with defining the terms of share ownership and transfer. Engage all shareholders to discuss their expectations and documented provisions. Platforms like uslegalforms can help you draft and finalize a legally sound agreement that caters to your unique business situation.