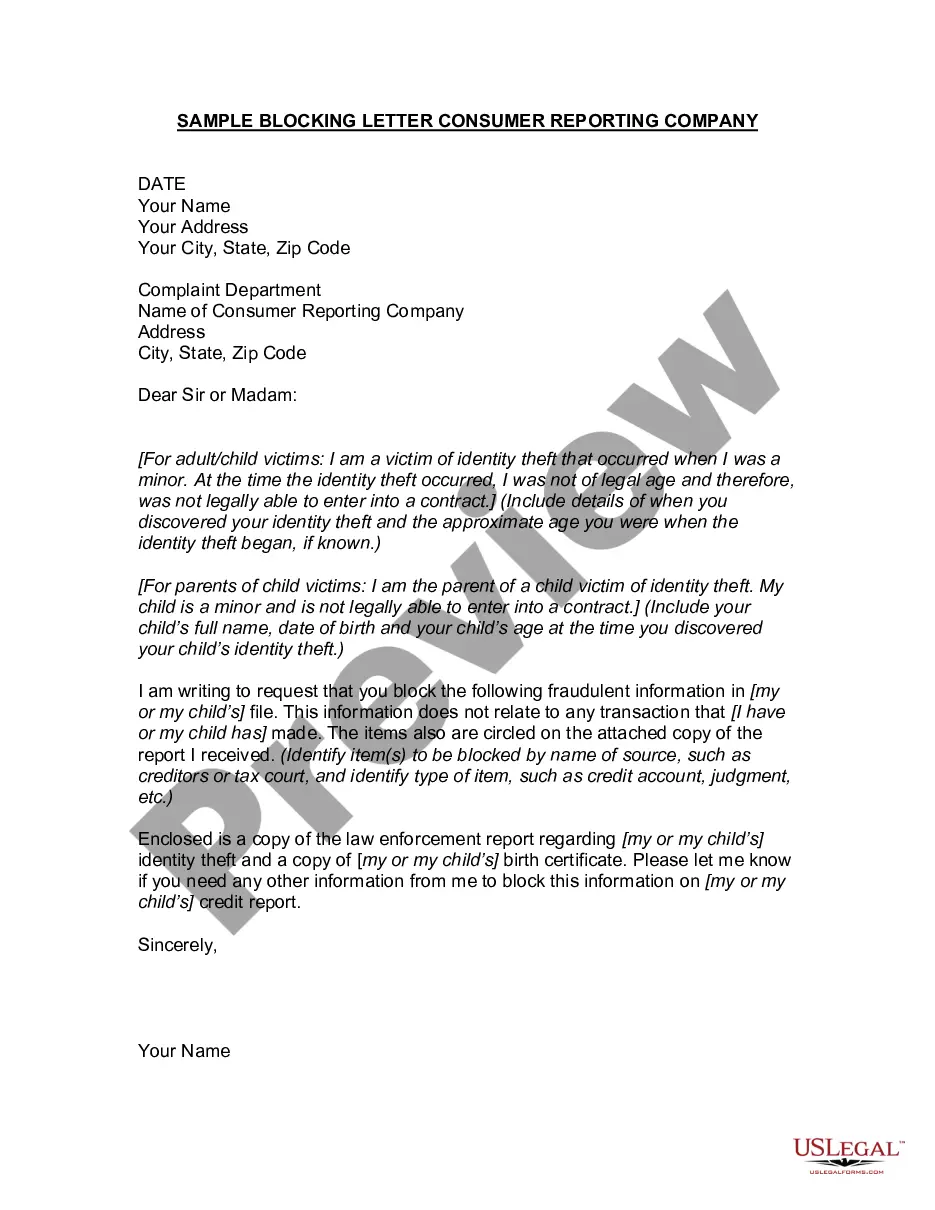

District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor Introduction: In the District of Columbia, it is crucial to have a comprehensive understanding of the process and necessary steps to take when dealing with identity theft of a minor. One of the vital aspects of addressing this issue is to write a detailed letter to the credit reporting company or bureau to inform them about the identity theft and its impact on the minor's financial well-being. This article will provide a thorough description of the District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor, highlighting its key elements and different variations. Key Elements of a District of Columbia Letter to Credit Reporting Company or Bureau: 1. Salutation: Begin the letter with a proper salutation, addressing the recipient by their full name or appropriate department. 2. Identity Theft Report: Include a reference to the identity theft report filed with law enforcement agencies in the District of Columbia. Indicate the case or report number, date of filing, and any relevant contact information for the investigating officer. 3. Identification Details: Clearly state the minor's full name, date of birth, and Social Security Number (SSN). Additionally, providing the minor's current address and previous addresses can assist in verifying the legitimacy of the identity theft. 4. Description of Identity Theft: Give a detailed account of how the minor's identity was stolen, including when and where it occurred. Mention any suspicious activities, such as unauthorized credit applications or fraudulent charges, along with supporting evidence like bank statements or credit reports. 5. Request for Investigation: Specifically request the credit reporting company or bureau to conduct a thorough investigation into the identity theft claim. Emphasize the urgency of the situation, stressing the potential long-term consequences for the minor's financial future. 6. Supporting Documents: Enclose photocopies of relevant documents such as the minor's birth certificate, Social Security card, and any official identification. Attach copies of the ID theft report, law enforcement correspondence, and supporting financial statements or credit reports. 7. Fraud Alert and Credit Freeze: Advise the credit reporting company or bureau to place a fraud alert on the minor's credit file. Consider requesting a credit freeze, which will restrict access to the minor's credit report and prevent new accounts from being opened without explicit permission. 8. Follow-Up Contact Information: Provide contact details where the credit reporting company or bureau can reach the minor or their legal guardian regarding the investigation. Include a preferred phone number, email address, and mailing address. Different Types of District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor: 1. Initial Identity Theft Letter: Used for reporting the initial incident of identity theft and requesting an investigation. This type of letter serves as the primary communication to inform the credit reporting company or bureau about the fraudulent activity. 2. Follow-Up Letter: If there has been no response or inadequate action taken by the credit reporting company or bureau, sending a follow-up letter is necessary. This letter reiterates the initial request, expresses concerns, and emphasizes the legal implications if the matter is not adequately addressed. 3. Dispute Letter: In cases where the credit reporting company or bureau fails to correct inaccuracies or remove fraudulent accounts resulting from the identity theft, a dispute letter can be sent. This letter lays out the specific errors on the credit report and requests their prompt resolution. Conclusion: Writing a detailed District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor is a crucial step in combating identity theft and safeguarding the minor's financial future. By including relevant information, supporting documents, and maintaining open communication with the credit reporting company or bureau, you can assert the rights of the minor and ensure proactive action is taken to address the identity theft.

District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor

Description

How to fill out Letter To Credit Reporting Company Or Bureau Regarding Identity Theft Of Minor?

Are you within a place that you require paperwork for both company or individual purposes virtually every day? There are a lot of legitimate record templates accessible on the Internet, but locating kinds you can trust is not straightforward. US Legal Forms provides a large number of develop templates, such as the District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor, which can be published in order to meet state and federal demands.

Should you be previously acquainted with US Legal Forms internet site and have a free account, just log in. Next, you are able to obtain the District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor template.

Should you not offer an account and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for the proper area/region.

- Use the Preview switch to examine the shape.

- See the description to ensure that you have chosen the proper develop.

- If the develop is not what you are looking for, take advantage of the Research field to obtain the develop that meets your requirements and demands.

- Whenever you get the proper develop, simply click Purchase now.

- Opt for the pricing strategy you would like, submit the required info to generate your money, and pay for the transaction utilizing your PayPal or charge card.

- Decide on a convenient document formatting and obtain your duplicate.

Get all of the record templates you might have purchased in the My Forms menus. You can get a more duplicate of District of Columbia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor any time, if needed. Just select the essential develop to obtain or print out the record template.

Use US Legal Forms, probably the most substantial collection of legitimate types, to save some time and prevent errors. The assistance provides professionally made legitimate record templates that can be used for a selection of purposes. Produce a free account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful ? when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

Each of the three major credit reporting agencies (Equifax, Experian and TransUnion) offers consumers the ability to place a ?security freeze,? or deny access to, their credit reports. A security freeze means that your credit file cannot be shared with potential creditors.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

In the District of Columbia, the Financial and Cyber Crimes Unit of the Metropolitan Police Department (?MPD?) handles identity theft complaints. You should file a complaint with MPD and ask for a police report. MPD can be contacted as follows: Via telephone at 202-727-4159.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

How To Know if Someone Stole Your Identity Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

An Identity Theft Affidavit is a document used by victims of identity theft to prove to businesses that their personal information was used to open a fraudulent account.