A District of Columbia letter agreement between a known imposter and a victim is a legal document that outlines the terms and conditions for working out a repayment plan. This agreement is designed to address cases where an imposter has committed fraud or identity theft, causing financial harm to the victim residing in the District of Columbia. By entering into this agreement, both parties aim to find a mutually satisfactory resolution for repayment. Keywords: District of Columbia, letter agreement, known imposter, victim, repayment plan, fraud, identity theft, financial harm, legal document, resolution. Different types of District of Columbia letter agreements between known imposters and victims to work out repayment plans may include: 1. District of Columbia Letter Agreement for Fraudulent Credit Card Usage: This type of agreement is drafted when an imposter fraudulently uses the victim's credit card information and the parties wish to work out a plan for repayment of the unauthorized charges. 2. District of Columbia Letter Agreement for Identity Theft-related Loan Repayment: In instances where an imposter has fraudulently acquired a loan using the victim's identity, this agreement outlines a repayment plan between the imposter and the victim to address the unauthorized debt. 3. District of Columbia Letter Agreement for Resolution of Financial Impersonation: Financial impersonation is a broader term encompassing various fraudulent activities committed by imposters using the victim's identity for personal financial gain. This agreement type aims to establish a repayment plan to address the financial harm caused by the imposter's actions. 4. District of Columbia Letter Agreement for Resolution of Tax Fraud: When an imposter has fraudulently filed taxes using the victim's identity, this agreement outlines a repayment plan to address any tax liabilities incurred as a result. 5. District of Columbia Letter Agreement for Resolution of Mortgage Fraud: In cases where an imposter has fraudulently obtained a mortgage loan using the victim's identity, this agreement details a repayment plan to address the unauthorized mortgage debt. Each type of District of Columbia letter agreement serves to address specific circumstances related to imposter fraud and identity theft, all with the goal of reaching a resolution for the victim's financial losses.

District of Columbia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out District Of Columbia Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

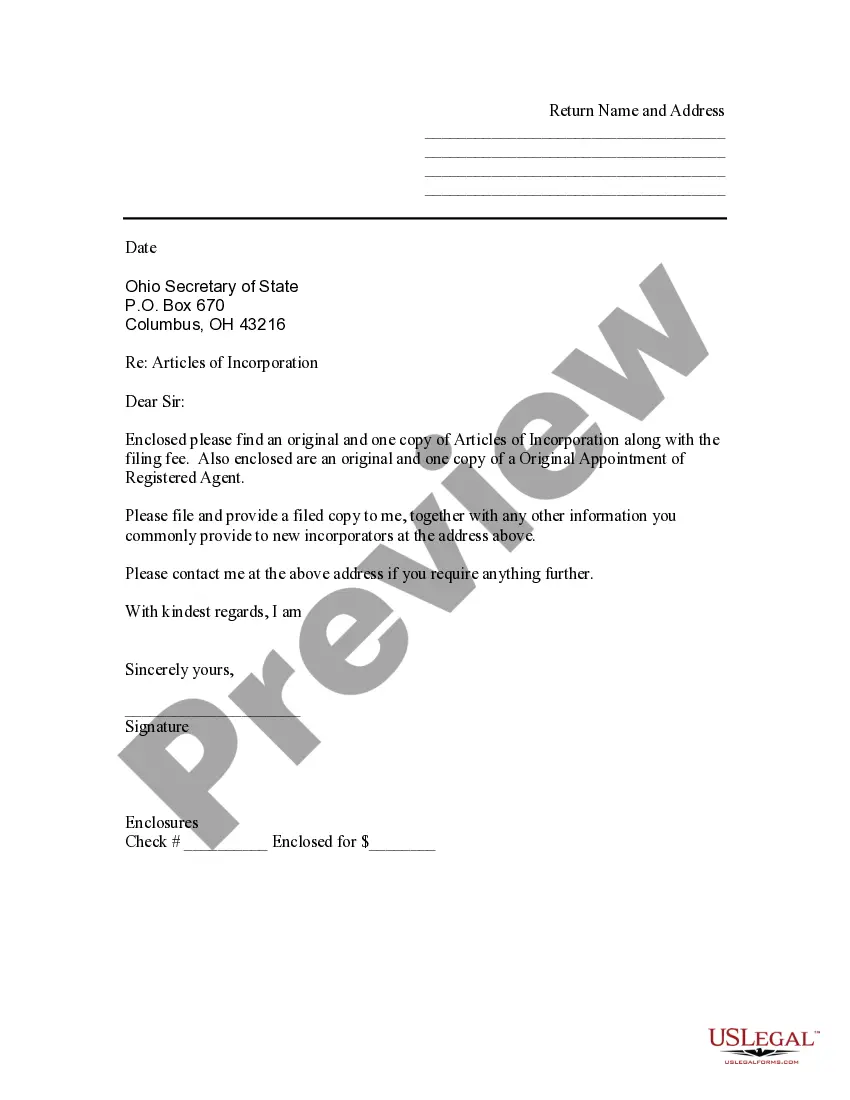

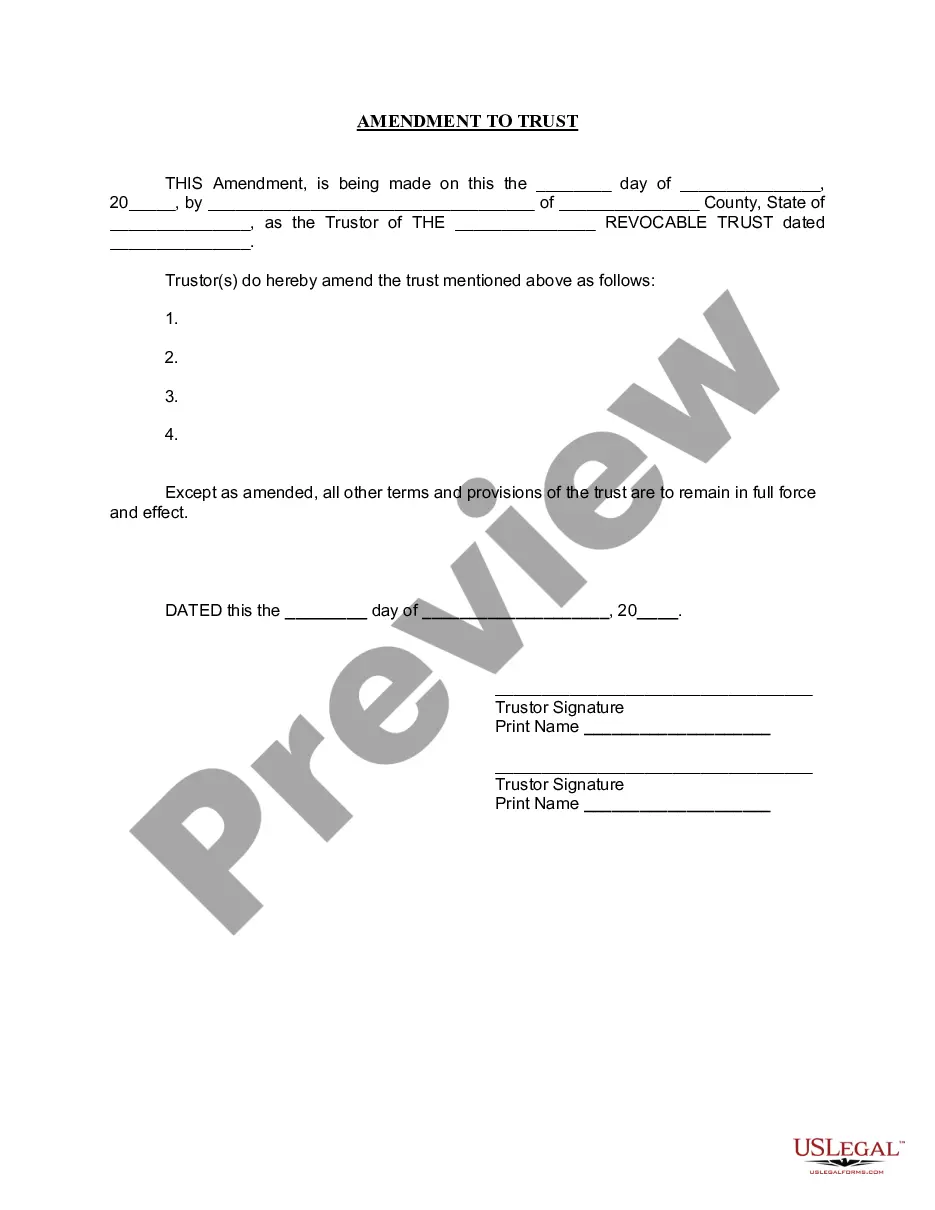

Are you in the placement in which you will need papers for both company or personal reasons almost every time? There are tons of authorized papers themes available on the Internet, but finding types you can rely on is not easy. US Legal Forms gives 1000s of develop themes, such as the District of Columbia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, that are published to meet federal and state needs.

Should you be previously acquainted with US Legal Forms website and also have an account, just log in. After that, you can acquire the District of Columbia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan template.

Unless you have an account and wish to start using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is to the right metropolis/state.

- Use the Preview button to examine the form.

- Look at the outline to ensure that you have selected the appropriate develop.

- If the develop is not what you`re trying to find, make use of the Lookup area to find the develop that fits your needs and needs.

- Whenever you get the right develop, click on Buy now.

- Select the costs program you desire, fill in the required details to create your account, and purchase an order utilizing your PayPal or credit card.

- Pick a convenient document structure and acquire your version.

Get each of the papers themes you possess purchased in the My Forms menu. You can aquire a extra version of District of Columbia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan anytime, if needed. Just click on the needed develop to acquire or print the papers template.

Use US Legal Forms, one of the most extensive selection of authorized forms, to save lots of time and stay away from faults. The service gives professionally created authorized papers themes that you can use for a variety of reasons. Create an account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

If you have reason to believe someone has applied for unemployment benefits using your information, report it immediately to UI. Use the methods on the Report Unemployment Fraud page to request a fraud investigation. After reporting the fraud to UI, follow the instructions under If You're a Victim of Identity Fraud.

Contact ODJFS immediately. If you do not have access to the internet, you can call ODJFS at 877-644-6562; please note wait times may be long. Once you've successfully filed your report, ODJFS will send a confirmation email, investigate the claim and issue a correction to the IRS if fraud is determined.

If you believe that your information has been used to fraudulently file an unemployment insurance (UI) claim, please complete a Request for Investigation of Unemployment Insurance Fraud form and return it: by email to ui.fraud@maryland.gov; mail to Benefit Payment Control, Room 206, 1100 North Eutaw Street, Baltimore, ...

A: To be eligible for Unemployment Insurance benefits, an individual must meet the following wage requirements: ? Wages must be reported in at least two quarters of the base period; ? At least $1,300 in wages must be reported in one quarter of the base period; ? At least $1,950 in wages must be reported for the entire ...

For District of Columbia Residents: Out-of-State residents can visit Report Unemployment Identity Theft | U.S. Department of Labor to contact their local office. Reporting of Identity Theft and Obtaining a police report: You have the right to obtain any police report filed in the United States regarding this incident.