District of Columbia Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out Director's Fees - Resolution Form - Corporate Resolutions?

If you aim to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Order now button. Choose your preferred payment plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct jurisdiction/country.

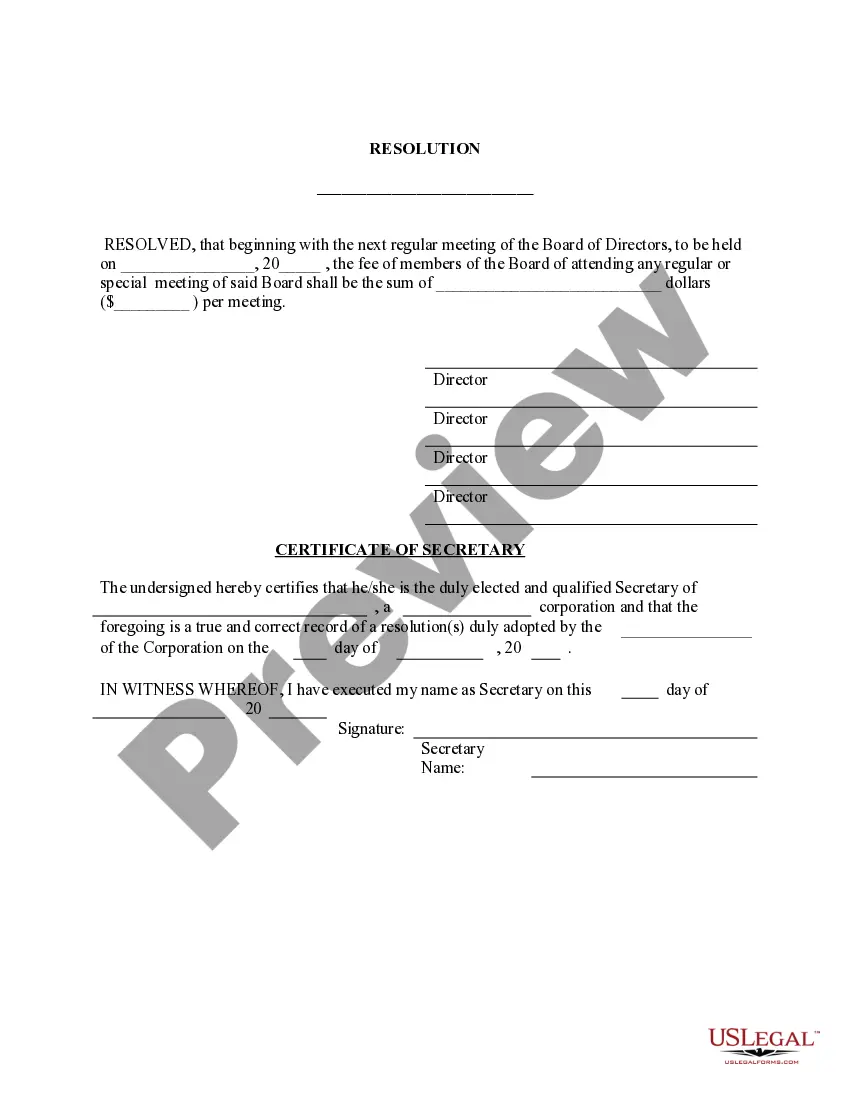

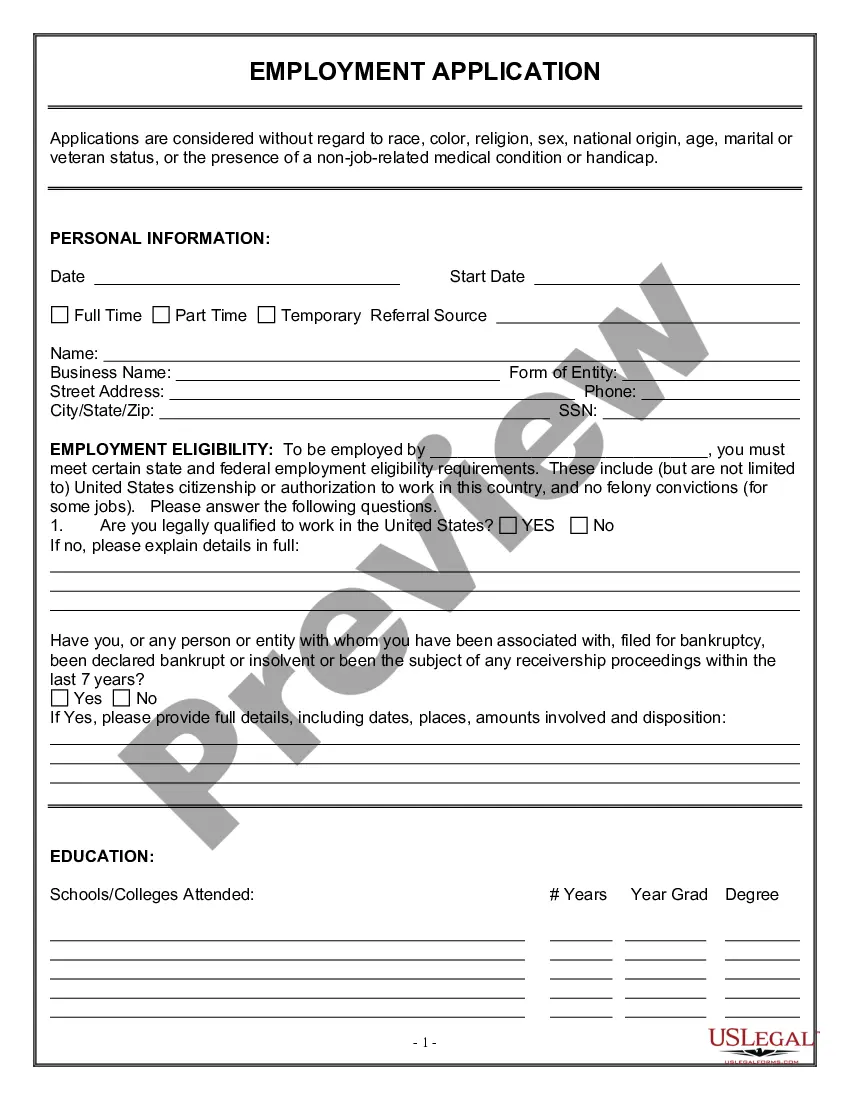

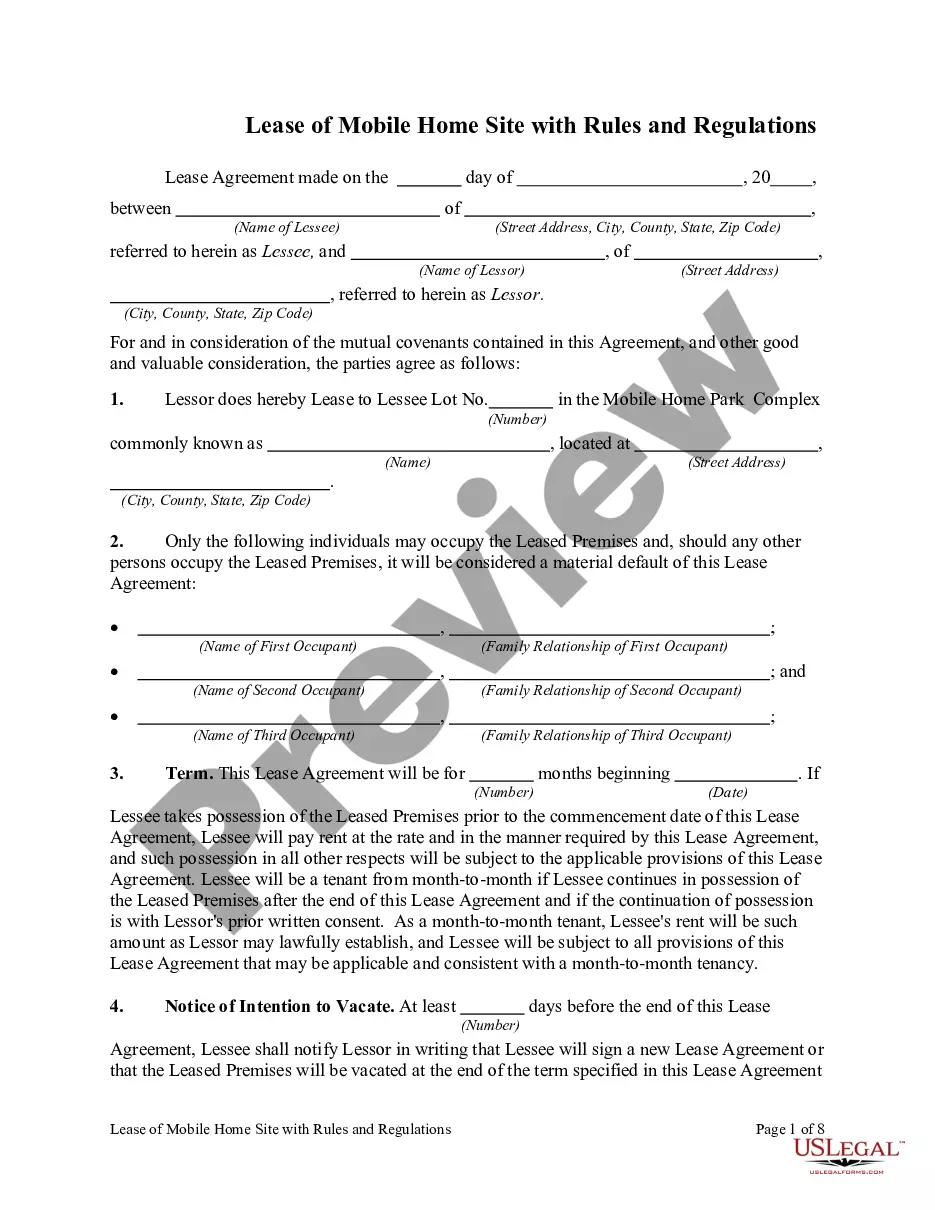

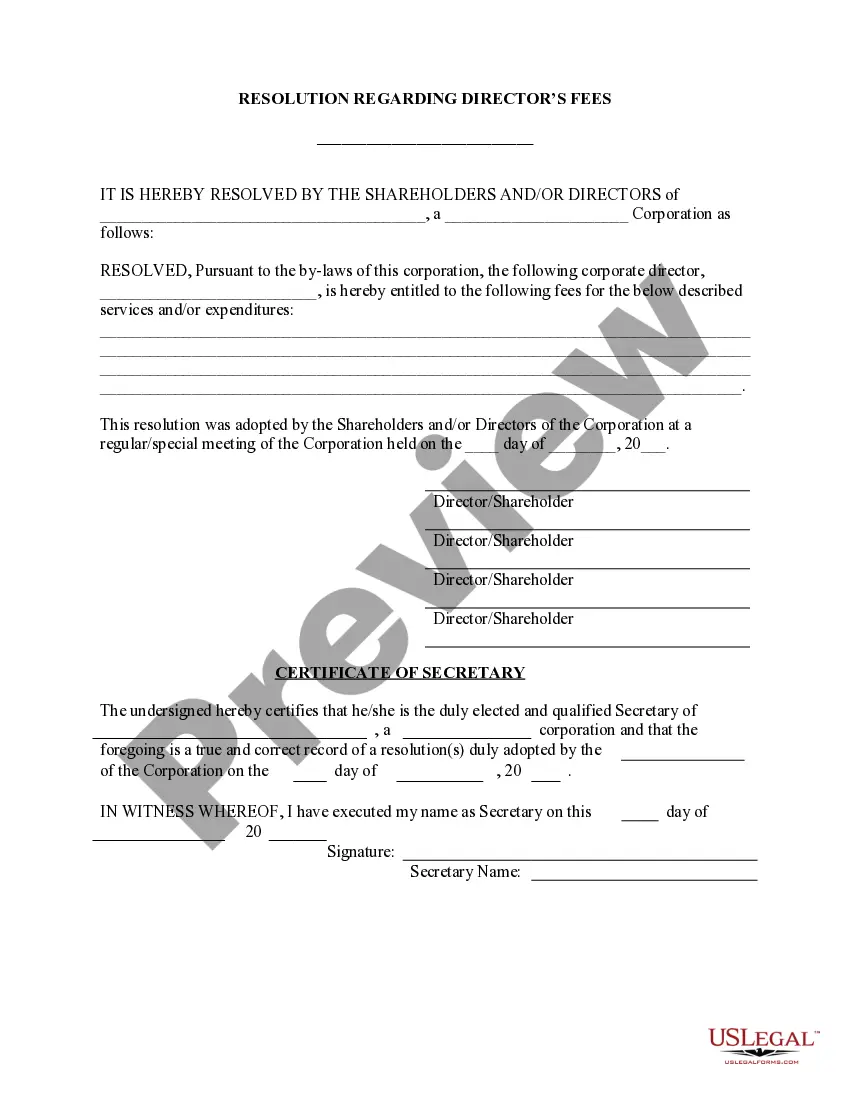

- Step 2. Use the Preview option to view the form’s content. Make sure to review the details.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The resolution of a document refers to the level of detail and clarity that the content presents. It can also indicate the outcomes agreed upon in the document, ensuring that all stakeholders understand the direction and decisions made. A well-drafted resolution enhances organizational effectiveness and governance. With tools like the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions, you can ensure clarity and precision in documenting these vital decisions.

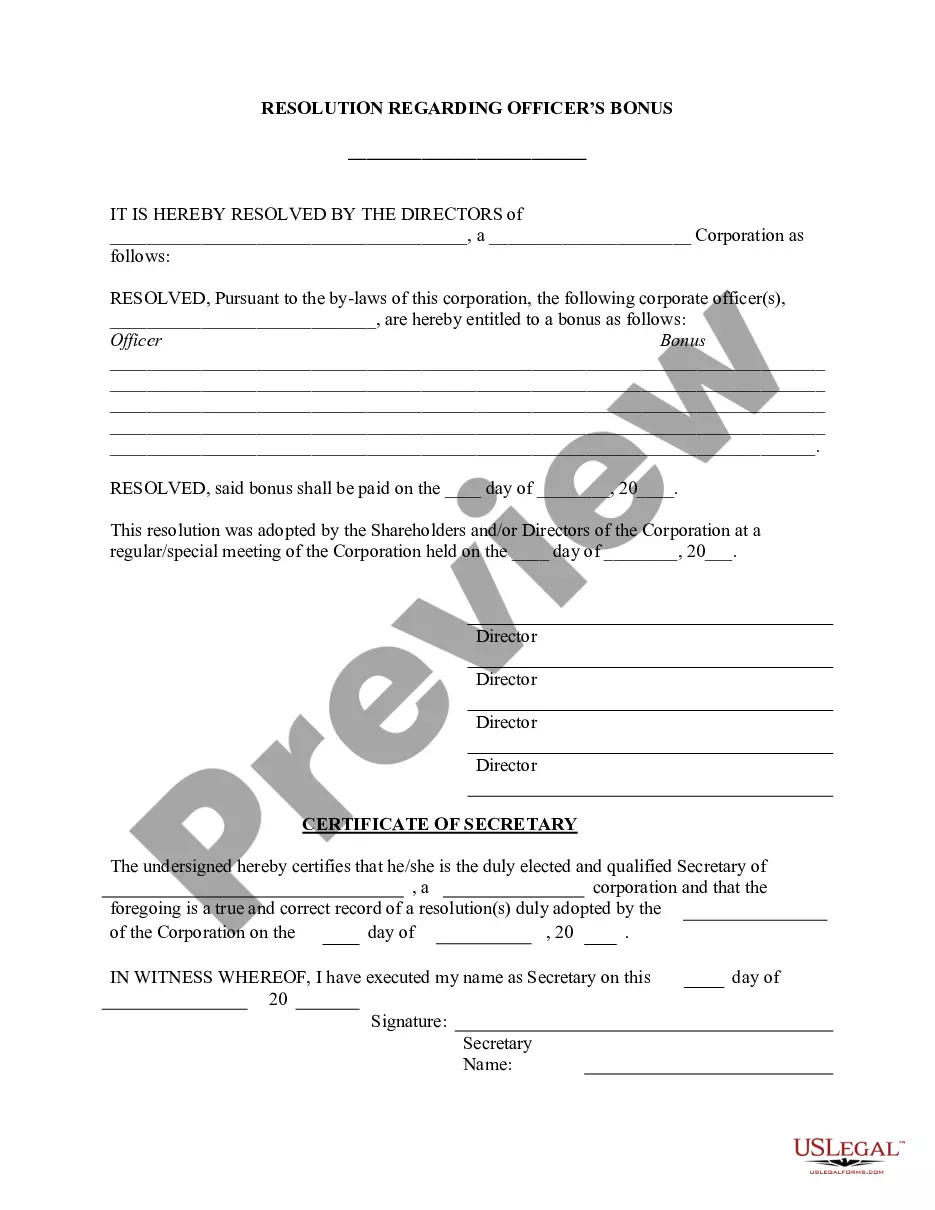

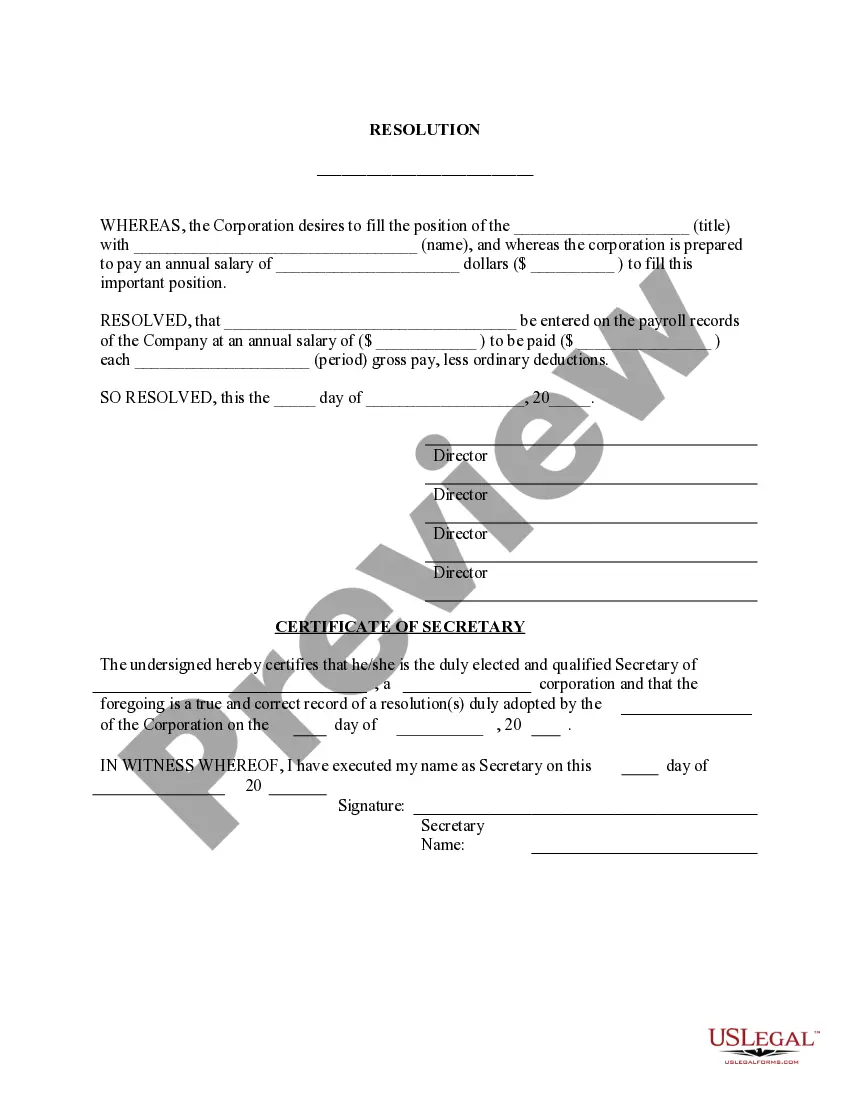

A director resolution refers to a formal decision or action taken by a company's board of directors regarding its operations or governance. Such resolutions may pertain to various matters, including financial decisions, policies, or changes in management. This type of resolution helps in holding directors accountable and maintaining clear records of their actions. In relation to the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions, it specifically addresses compensation decisions.

Creating a corporate resolution involves several steps: identifying the decision to be made, gathering the board members, and then drafting the resolution text. Include pertinent details such as the reasons for the decision, names of those involved, and the voting process. It's helpful to use templates like the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions for consistency and compliance. This ensures the resolution meets all legal requirements.

In a document, a resolution refers to a formal decision made by a governing body, such as a board of directors. It articulates the agreed-upon actions or policies that need to be implemented. Resolutions serve as a legal record, ensuring that the organization's direction is clear and agreed upon. The District of Columbia Director's Fees - Resolution Form - Corporate Resolutions embodies this principle by documenting specific decisions about director compensation.

To document a resolution, first, write down the specific decision being made by the board of directors. Include details like the date, names of directors present, and the vote results. This formalization provides clarity on what actions were taken and ensures transparency. Utilizing a standard format, such as the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions, can simplify this process.

The resolution of directors document is an official record that reflects the decisions made by a company's board of directors. It helps in ensuring that important decisions are documented formally and can be referred to in the future. This document is essential for maintaining compliance with corporate governance. In the context of District of Columbia Director's Fees - Resolution Form - Corporate Resolutions, it acts as proof of approved actions regarding director's fees.

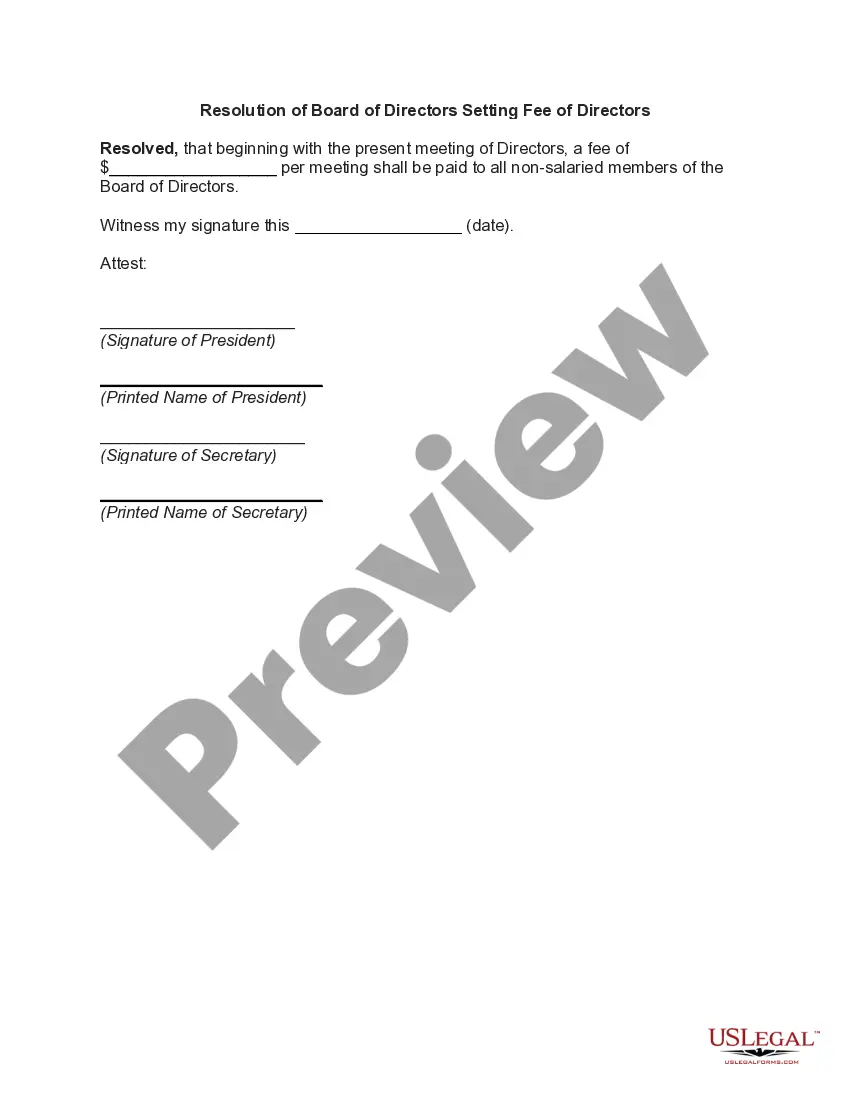

Directors typically pass resolutions through meetings or written consent, depending on the circumstances and rules of the organization. For meeting resolutions, discussions occur, followed by a vote. If the resolution passes, it should be documented in the minutes. Using the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions helps formalize this process and ensures that all aspects of the resolution are clear and legally binding.

When formatting a resolution, start with a clear title that reflects the purpose of the resolution, such as the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions. Follow with the introductory statement, followed by the resolved clauses, and conclude with the signatures of the directors. It’s essential to be precise and to include all necessary details that outline the resolution’s intent. Utilizing a template can simplify this process significantly.

Directors can indeed pass written resolutions in accordance with the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions. This allows for decisions to be made without the need for a formal meeting, which can save time and streamline decision-making. However, it is essential that all directors have the opportunity to review and agree to the written resolution. A properly structured format aids in clarity and adherence to legal requirements.

Yes, directors can pass a special resolution under the guidelines set forth in the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions. This type of resolution usually requires a higher threshold of approval compared to regular resolutions. It is important for directors to follow the appropriate procedures for passage and documentation. Using a well-prepared resolution form can help ensure compliance.