Title: Understanding the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner Introduction: In the District of Columbia, the Limited Partnership Agreement (PA) serves as a legally binding document outlining the roles, responsibilities, and obligations between a Limited Liability Company (LLC) and a Limited Partner within a limited partnership structure. This agreement is crucial in establishing the rights and responsibilities of the LLC, as the general partner, and the limited partner(s). Let's dive deeper into this arrangement, discussing its key components, common types, and how it governs business operations in the District of Columbia. Key Components of a District of Columbia Limited Partnership Agreement: 1. Identification of Parties Involved: The PA must identify both the LLC, acting as the general partner, and the limited partner(s) involved in the partnership. This ensures clarity regarding the roles and responsibilities of each entity. 2. Capital Contributions and Profit Distribution: The agreement outlines the capital contributions made by the limited partner(s) and the allocation of profits among the partners. This section specifies how profits and losses will be distributed and provides a framework for financial management. 3. Management Structure: The PA details the decision-making authority and management structure, defining the powers and limitations of both the general partner (LLC) and the limited partner(s). It addresses matters such as partner meetings, voting rights, and decision-making processes. 4. Limited Liability Protection: As the name suggests, a limited partner typically enjoys limited liability, shielding their personal assets from the partnership's obligations. The PA must outline the extent to which limited liability protection will be provided. Types of District of Columbia Limited Partnership Agreements: 1. General Partnership: In this type of PA, the limited partner(s) have no management authority and are not involved in the day-to-day operations or decision-making processes. The general partner (LLC) assumes full responsibility for managing the partnership. 2. Limited Liability Partnership (LLP): In this variant, both the LLC and the limited partner(s) possess management authority, sharing decision-making responsibilities according to their agreed-upon terms. This type offers enhanced liability protection, limiting the personal liability of all involved parties. 3. Limited Liability Limited Partnership (LL LP): This agreement combines elements of both a limited partnership and a limited liability partnership. The LL LP extends limited liability protection to all partners, including the general partner (LLC). It offers a higher level of personal asset protection while allowing all partners to participate in the management of the partnership. Conclusion: The District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner is a crucial document that establishes the business relationship between an LLC and a limited partner(s). By covering aspects such as capital contributions, profit distribution, management, and liability protection, this agreement ensures clear expectations and provides a framework for successful partnership operations. Understanding the different types of Pas, such as the general partnership, limited liability partnership, and limited liability limited partnership, further enables businesses to choose a structure that aligns with their objectives and mitigates potential risks within the legal framework of the District of Columbia.

District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out District Of Columbia Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Finding the appropriate legal document template can be challenging.

Undoubtedly, numerous formats are accessible online, but how do you acquire the valid form you need.

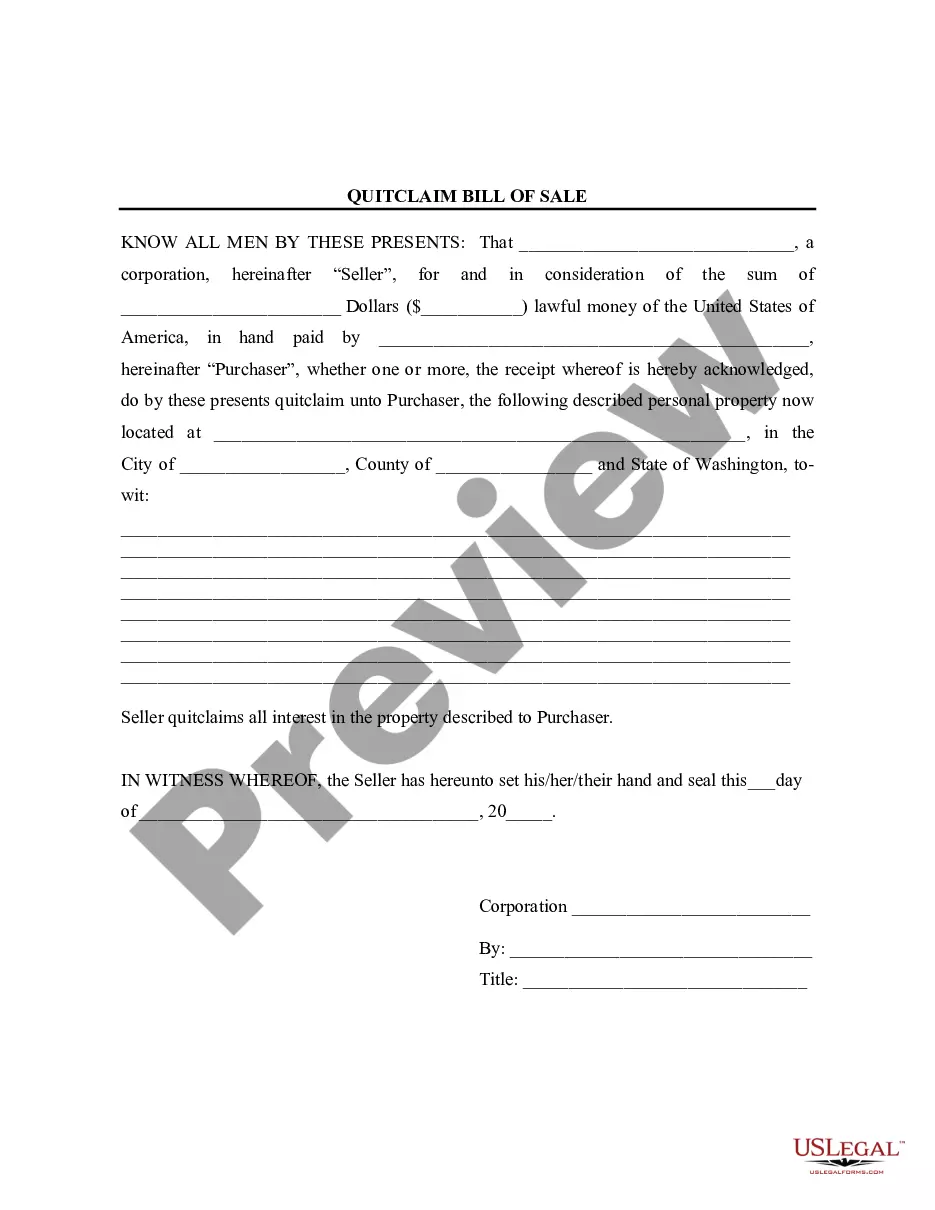

Use the US Legal Forms website. This platform offers a multitude of templates, including the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner, suitable for both business and personal needs.

You can preview the form using the Review button and check the form details to confirm this is the right one for you.

- All of the documents are verified by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Download button to access the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Utilize your account to review the legal documents you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

The LLP agreement between the partners specifies the terms under which they operate together under the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner. This document includes details about profit sharing, decision-making processes, and liability limitations. It's essential for fostering mutual understanding and trust among partners. With uslegalforms, you can easily access customizable agreements that suit your partnership arrangement.

The District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner outlines the responsibilities and obligations of each party involved. This agreement serves to protect the interests of the limited partners while clarifying the management roles of the LLC. By establishing a clear framework, the agreement helps prevent potential conflicts and ensures smooth operations. Using uslegalforms can simplify the drafting process, providing templates tailored to your specific needs.

General partnerships involve partners who share management responsibilities and have personal liability for business debts. Limited partnerships include general partners and limited partners, where the latter have restricted input and limited liability. Limited liability partnerships provide all partners with limited liability and equal management rights. Understanding these differences is crucial, and the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner can help clarify these distinctions.

Yes, a limited liability partnership is a type of partnership, but it offers specific advantages like limited liability for all partners. This means that personal assets are typically protected from business liabilities. When forming an LLP, referencing the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner ensures compliance with local laws.

In a limited liability partnership (LLP), all partners generally enjoy limited liability protection. This distinguishes it from general partnerships, where partners have personal liability for business debts. The structure defined in the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner offers legal clarity on this protection.

Limited partnerships, or LPs, indeed require partnership agreements. These agreements detail the relationship between the general and limited partners, defining management duties and profit distribution. To ensure compliance and clarity, consider utilizing the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner as a resource.

Yes, limited partnerships must have a partnership agreement to outline roles, responsibilities, and contributions of partners. This agreement is crucial as it governs how profits and losses are shared and helps prevent disputes among partners. The District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner provides a solid framework for creating this important document.

Yes, a Limited Liability Partnership (LLP) can have another LLP as a partner. This structure can offer additional liability protection and flexibility in management. It's essential to reference the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner for specific guidelines on partnership arrangements.

A limited company is a legal entity separate from its owners, providing them with limited liability, while a limited partnership is an arrangement where at least one partner has unlimited liability while others have limited liability. In a limited partnership, the general partner manages the business, whereas in a limited company, shareholders benefit from limited liability protection. The District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner outlines these distinctions clearly.

No, an LP, or limited partnership, is different from a general partnership. In an LP, there are both general partners, who manage the business, and limited partners, who invest but do not actively manage it. This structure allows for limited liability for limited partners, which is a key feature of the District of Columbia Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

Interesting Questions

More info

Realism Constitution View Constitution Supreme Court Code Federal Rules Appellate Procedure Feudalism Federal Rules View Appellate Procedure View Federal Rules.